Today, in which screens are the norm however, the attraction of tangible printed objects hasn't waned. No matter whether it's for educational uses as well as creative projects or simply adding a personal touch to your home, printables for free have proven to be a valuable source. For this piece, we'll dive deep into the realm of "Income Tax On Insurance Claim Received," exploring what they are, where to get them, as well as how they can improve various aspects of your life.

Get Latest Income Tax On Insurance Claim Received Below

Income Tax On Insurance Claim Received

Income Tax On Insurance Claim Received -

Generally speaking moneys that businesses collect from their insurance companies after filing a claim are not considered taxable income particularly if the amount you receive is 5 000 or less However there is a chance that you will have to pay taxes on the moneys you collect from your insurance claim depending on the specific

Updated Mar 8 2023 Money you receive as part of an insurance claim or settlement is typically not taxed The IRS only levies taxes on income which is money or payment received that results in you having more wealth than you did before

Income Tax On Insurance Claim Received include a broad range of printable, free materials online, at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and much more. The value of Income Tax On Insurance Claim Received lies in their versatility as well as accessibility.

More of Income Tax On Insurance Claim Received

Accounting For Insurance Claim destruction Of Asset Manager Forum

Accounting For Insurance Claim destruction Of Asset Manager Forum

Your insurance claim income is probably not taxable If there s nothing to indicate what the payment is for it s likely that it s meant to cover medical expenses and pain and suffering If this is the case you don t have to include the amount in your income

Generally if you re paying premiums yourself such as for homeowners insurance and auto insurance then your insurance benefits are not a taxable event says Adam Sherman CEO of Firstrust

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Personalization They can make printables to fit your particular needs such as designing invitations planning your schedule or decorating your home.

-

Educational Value The free educational worksheets cater to learners of all ages, which makes them an essential aid for parents as well as educators.

-

Accessibility: Instant access to the vast array of design and templates reduces time and effort.

Where to Find more Income Tax On Insurance Claim Received

Insurance Claim Received Journal Entry CArunway

Insurance Claim Received Journal Entry CArunway

Insurance claim checks are not taxable Insurance claim checks aim to compensate you for a loss and return you to where you were financially before the loss As a result insurance claim checks as a general rule are not subject to taxation

According to Budget 2023 if you purchase any life insurance plans other than ULIP on or after April 1 2023 and the aggregate premium exceeds INR 5 00 000 in a fiscal year the money received on maturity will be taxable Section 10 10D will not provide an exemption to anyone What does Section 194D say

Now that we've piqued your interest in printables for free, let's explore where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Income Tax On Insurance Claim Received to suit a variety of needs.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets with flashcards and other teaching tools.

- Perfect for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- The blogs are a vast variety of topics, that includes DIY projects to planning a party.

Maximizing Income Tax On Insurance Claim Received

Here are some ideas for you to get the best use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax On Insurance Claim Received are a treasure trove with useful and creative ideas that satisfy a wide range of requirements and desires. Their accessibility and versatility make these printables a useful addition to the professional and personal lives of both. Explore the world of Income Tax On Insurance Claim Received to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually are they free?

- Yes you can! You can print and download these documents for free.

-

Are there any free printouts for commercial usage?

- It is contingent on the specific terms of use. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright concerns when using Income Tax On Insurance Claim Received?

- Some printables may have restrictions in use. You should read the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home using either a printer at home or in any local print store for high-quality prints.

-

What software do I require to view printables that are free?

- Most printables come in PDF format, which is open with no cost software like Adobe Reader.

Cheque Received Journal Entry CArunway

UAE Corporate Tax On Insurance Business Crowe UAE

Check more sample of Income Tax On Insurance Claim Received below

Journal Entry For An Insurance Claim En Intipanime

Barnet Arrest As Man In 30s Stabbed To Death In Whetstone Flipboard

Asiento De Diario Por P rdida De Bienes activos Asegurados Barcelona

Peter Nelson Marketing The 7 Most Common Sales Objections By

GST Implications On Insurance Claim Received On Loss Of Stock Or

Do I Have To Pay Tax On Insurance Maturity Proceeds The Economic Times

https://www.valuepenguin.com/insurance-settlements-taxable

Updated Mar 8 2023 Money you receive as part of an insurance claim or settlement is typically not taxed The IRS only levies taxes on income which is money or payment received that results in you having more wealth than you did before

https://www2.deloitte.com/nz/en/pages/tax-alerts/...

At a broad level the tax principles for insurance receipts or similar compensation are relatively straightforward and should generally follow matching principles Insurance for Business Interruption aka lost profits should be taxable in the period of interruption it relates to

Updated Mar 8 2023 Money you receive as part of an insurance claim or settlement is typically not taxed The IRS only levies taxes on income which is money or payment received that results in you having more wealth than you did before

At a broad level the tax principles for insurance receipts or similar compensation are relatively straightforward and should generally follow matching principles Insurance for Business Interruption aka lost profits should be taxable in the period of interruption it relates to

Peter Nelson Marketing The 7 Most Common Sales Objections By

Barnet Arrest As Man In 30s Stabbed To Death In Whetstone Flipboard

GST Implications On Insurance Claim Received On Loss Of Stock Or

Do I Have To Pay Tax On Insurance Maturity Proceeds The Economic Times

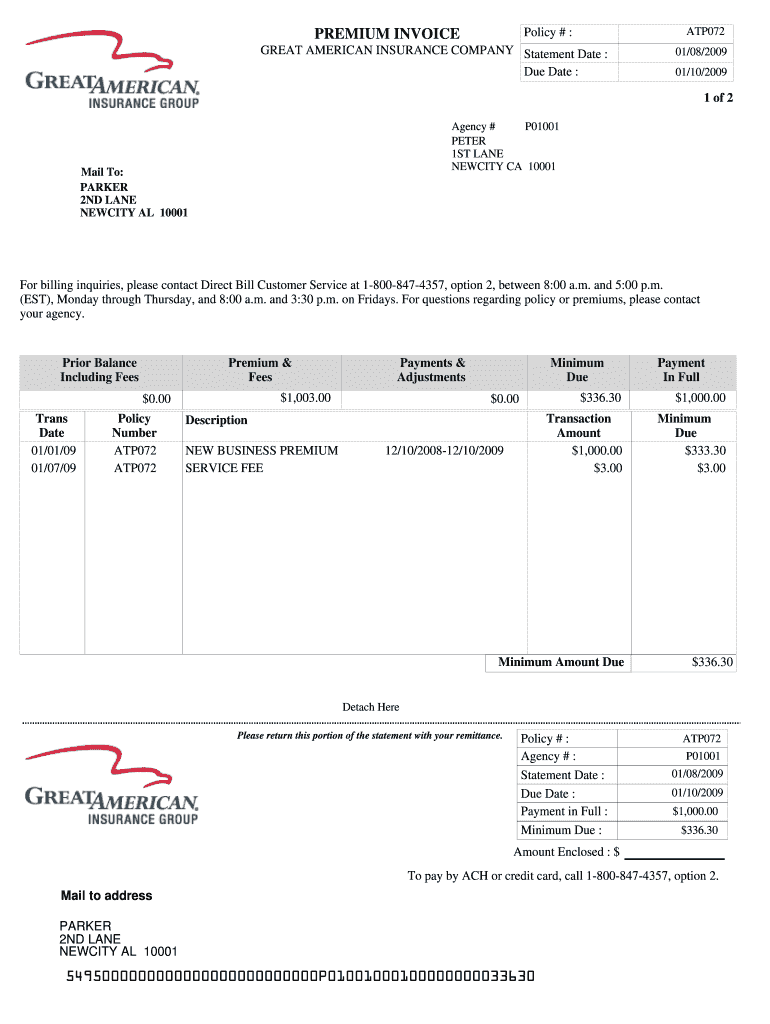

Insurance Invoice Template Fill Online Printable Fillable Blank

Tax Benefits Under Section 80D Health Insurance Policies Health

Tax Benefits Under Section 80D Health Insurance Policies Health

Income Tax Slabs Gambaran