In this age of electronic devices, where screens dominate our lives, the charm of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons or creative projects, or just adding an extra personal touch to your home, printables for free are a great source. The following article is a dive into the world "Income Tax Housing Loan Interest Exemption Limit," exploring their purpose, where they are available, and how they can add value to various aspects of your lives.

Get Latest Income Tax Housing Loan Interest Exemption Limit Below

Income Tax Housing Loan Interest Exemption Limit

Income Tax Housing Loan Interest Exemption Limit -

The home loan taken should be up to Rs 35 lakhs Section 80EE provides a deduction only for the interest portion of a house loan The house loan must be sanctioned by a Housing Finance organization or a

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Income Tax Housing Loan Interest Exemption Limit encompass a wide assortment of printable, downloadable materials that are accessible online for free cost. They are available in a variety of forms, like worksheets templates, coloring pages, and much more. The attraction of printables that are free is their flexibility and accessibility.

More of Income Tax Housing Loan Interest Exemption Limit

What Is A Portfolio Interest Exemption EPGD Business Law

What Is A Portfolio Interest Exemption EPGD Business Law

This is within the overall limit of Rs 1 50 000 of Section 80C Therefore as a family you will be able to take a larger tax benefit against the interest paid on the home

Section 24 provides for deduction for interest on a home loan of up to Rs 2 00 000 in a financial year The assessee can claim a deduction up to Rs 2 lakh while computing his her total taxable income under the

Income Tax Housing Loan Interest Exemption Limit have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization The Customization feature lets you tailor the templates to meet your individual needs in designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value Education-related printables at no charge offer a wide range of educational content for learners of all ages. This makes the perfect tool for parents and teachers.

-

Accessibility: Access to a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Income Tax Housing Loan Interest Exemption Limit

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax rebate for senior citizens Rs 2

As mentioned under the newly inserted section 80EEA of the Income Tax Act the government has extended the limit of deduction up to Rs 1 50 000 applicable to

Now that we've ignited your interest in Income Tax Housing Loan Interest Exemption Limit, let's explore where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection with Income Tax Housing Loan Interest Exemption Limit for all reasons.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- The perfect resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a broad selection of subjects, ranging from DIY projects to planning a party.

Maximizing Income Tax Housing Loan Interest Exemption Limit

Here are some creative ways that you can make use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print out free worksheets and activities for teaching at-home and in class.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Housing Loan Interest Exemption Limit are an abundance of innovative and useful resources that cater to various needs and interest. Their accessibility and flexibility make them a fantastic addition to each day life. Explore the wide world of Income Tax Housing Loan Interest Exemption Limit today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Housing Loan Interest Exemption Limit truly for free?

- Yes you can! You can print and download these documents for free.

-

Can I utilize free printing templates for commercial purposes?

- It depends on the specific rules of usage. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright concerns when using Income Tax Housing Loan Interest Exemption Limit?

- Some printables could have limitations concerning their use. Be sure to review the terms of service and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home using a printer or visit a print shop in your area for premium prints.

-

What program will I need to access printables at no cost?

- A majority of printed materials are in the format PDF. This is open with no cost software like Adobe Reader.

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Tax Benefits On Home Loan Know More At Taxhelpdesk

Check more sample of Income Tax Housing Loan Interest Exemption Limit below

Living In NV PlaneSense

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

National Interest Exemption Vs National Interest Waiver

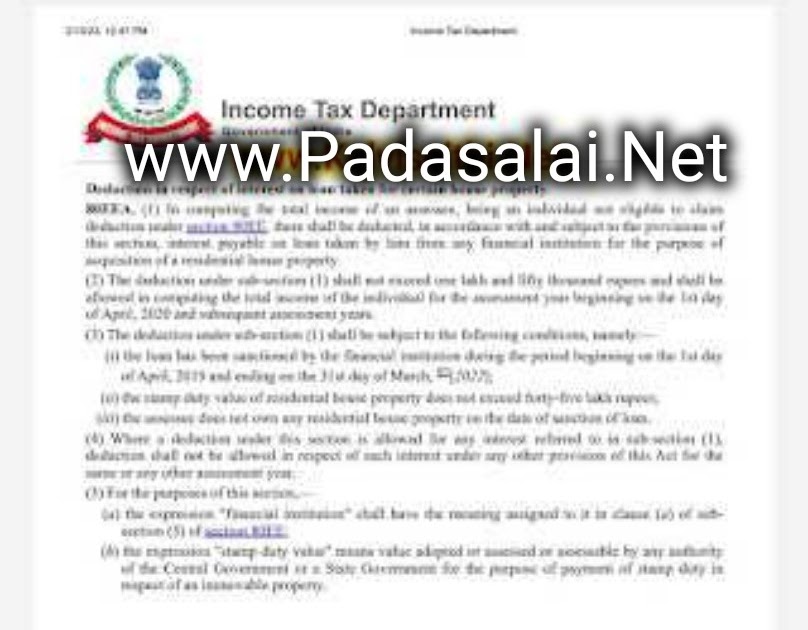

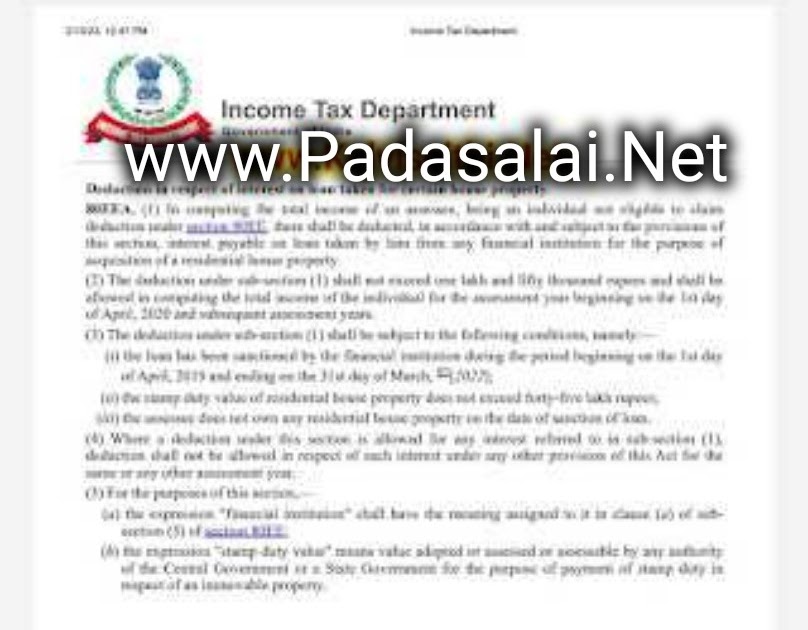

INCOME TAX HOUSING LOAN Rs 1 50 000 80 EEA

Build India February 2012

https://www. paisabazaar.com /home-loan/home-loan-tax-benefits

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

https:// taxguru.in /income-tax/section-80ee-income...

The loan amount should not exceed Rs 35 lakh The value of the residential property should not exceed Rs 50 lakh The loan should be sanctioned

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

The loan amount should not exceed Rs 35 lakh The value of the residential property should not exceed Rs 50 lakh The loan should be sanctioned

National Interest Exemption Vs National Interest Waiver

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

INCOME TAX HOUSING LOAN Rs 1 50 000 80 EEA

Build India February 2012

Lok Sabha Election Result Now That They Have Got The Votes They

The New Section 163 j Interest Limits And The Portfolio Interest Exemption

The New Section 163 j Interest Limits And The Portfolio Interest Exemption

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint