In this age of technology, where screens have become the dominant feature of our lives however, the attraction of tangible printed objects hasn't waned. No matter whether it's for educational uses for creative projects, simply adding personal touches to your area, Income Tax Exemption Under Section 80dd are a great resource. In this article, we'll dive into the world "Income Tax Exemption Under Section 80dd," exploring their purpose, where to find them and ways they can help you improve many aspects of your life.

Get Latest Income Tax Exemption Under Section 80dd Below

Income Tax Exemption Under Section 80dd

Income Tax Exemption Under Section 80dd -

Understanding who can claim 80DD Deduction under the Income Tax Act

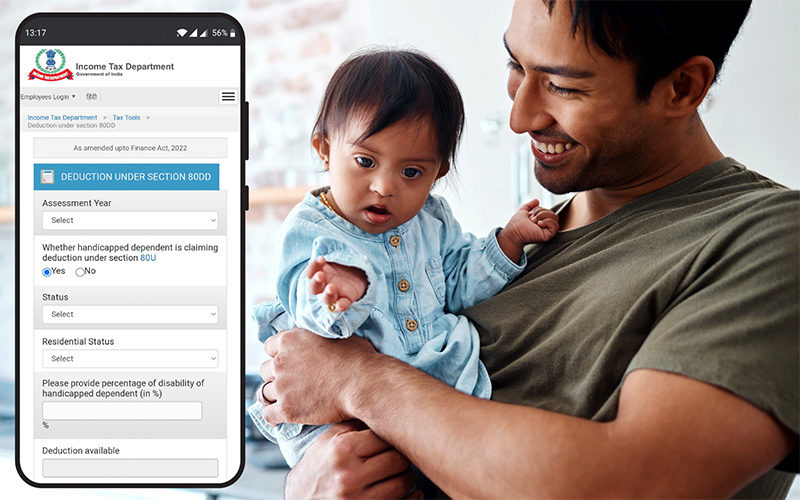

Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical maintenance of a dependant who is a person with a major disability

Income Tax Exemption Under Section 80dd provide a diverse assortment of printable, downloadable material that is available online at no cost. They come in many forms, including worksheets, templates, coloring pages, and many more. The beauty of Income Tax Exemption Under Section 80dd is their flexibility and accessibility.

More of Income Tax Exemption Under Section 80dd

Section 80U Tax Deductions For Disabled Individuals Tax2win

Section 80U Tax Deductions For Disabled Individuals Tax2win

The following are the expenses that are exempted for income tax under section 80DD Any expenses incurred for medical treatment which includes nursing training as well as rehabilitation of dependent that is disabled

Section 80DD Deductions Deduction in respect of Medical treatment maintenance of Handicapped dependent relative any member in your family is suffering from a disability is dependent on you then you can claim deduction of expenditure on such person u s 80DD An individual as well as HUF is eligible for this deduction

Income Tax Exemption Under Section 80dd have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Individualization They can make designs to suit your personal needs whether it's making invitations, organizing your schedule, or even decorating your home.

-

Educational Benefits: Free educational printables cater to learners from all ages, making them an essential source for educators and parents.

-

Convenience: You have instant access various designs and templates can save you time and energy.

Where to Find more Income Tax Exemption Under Section 80dd

Preventive Check Up 80d Wkcn

Preventive Check Up 80d Wkcn

Section 80DD of the Income Tax Act provides tax deductions to family members taking care of disabled dependent members of the family It outlines a flat out tax deduction regardless of their income level The deductions under this section include exemptions for expenses borne for medical treatments and deposited amounts under a scheme

To provide relief to the family members the Income Tax Act provides a tax deduction under section 80DD INDEX What are the Conditions to Claim Section 80DD Deduction Which Medical Authority is eligible to issue the certificate Who are covered under dependents What is the 80DD deduction Limit Which disabilities are covered

We hope we've stimulated your interest in Income Tax Exemption Under Section 80dd, let's explore where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety with Income Tax Exemption Under Section 80dd for all goals.

- Explore categories like decoration for your home, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets with flashcards and other teaching materials.

- Ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a wide variety of topics, that includes DIY projects to party planning.

Maximizing Income Tax Exemption Under Section 80dd

Here are some unique ways in order to maximize the use of Income Tax Exemption Under Section 80dd:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print out free worksheets and activities to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Income Tax Exemption Under Section 80dd are an abundance of practical and imaginative resources that meet a variety of needs and interests. Their access and versatility makes them a valuable addition to both professional and personal life. Explore the vast array of Income Tax Exemption Under Section 80dd to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes, they are! You can download and print the resources for free.

-

Can I use free printables for commercial use?

- It depends on the specific rules of usage. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright issues when you download Income Tax Exemption Under Section 80dd?

- Certain printables could be restricted in their usage. Be sure to check the terms and conditions set forth by the designer.

-

How can I print Income Tax Exemption Under Section 80dd?

- You can print them at home using your printer or visit an area print shop for high-quality prints.

-

What program do I need to open printables at no cost?

- Most PDF-based printables are available in the format PDF. This can be opened with free software, such as Adobe Reader.

Claim Deduction Under Section 80DD Learn By Quicko

Get Involved Updates Kowanj

Check more sample of Income Tax Exemption Under Section 80dd below

Anything To Everything Income Tax Guide For Individuals Including

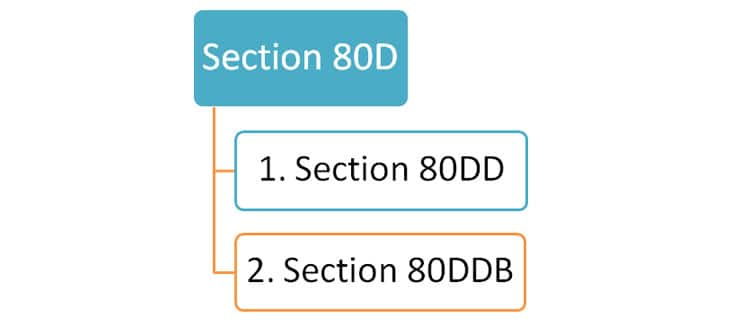

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Tax Deduction Under Section 80DD Of Income Tax Eligibility Criteria

80DD FORM PDF

SBI Foundation Organ Donation About MOHAN Foundation

Income Tax Deductions 1 Section 80D 80DD 80DDB 80E 80G 80GG 80U 80CCD1B

https://tax2win.in/guide/section-80dd

Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical maintenance of a dependant who is a person with a major disability

https://taxguru.in/income-tax/deduction-section-80dd-income-tax-act.html

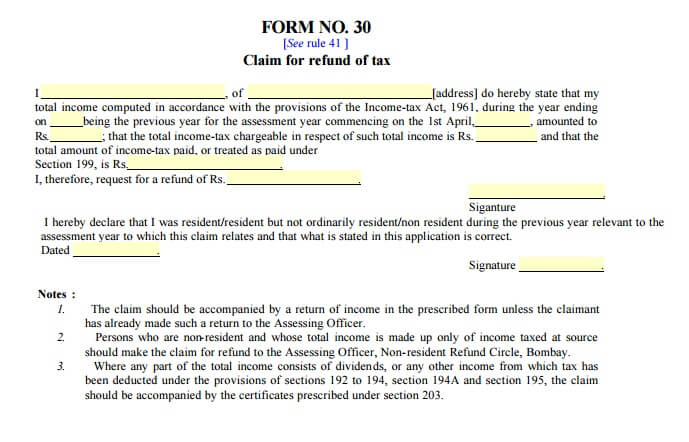

Deduction under section 80DD of the Income Tax Act covers the amount paid towards the medical expenditure of a dependant with a specific disability It also covers the amount of insurance premium paid towards specific insurance plans

Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical maintenance of a dependant who is a person with a major disability

Deduction under section 80DD of the Income Tax Act covers the amount paid towards the medical expenditure of a dependant with a specific disability It also covers the amount of insurance premium paid towards specific insurance plans

80DD FORM PDF

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

SBI Foundation Organ Donation About MOHAN Foundation

Income Tax Deductions 1 Section 80D 80DD 80DDB 80E 80G 80GG 80U 80CCD1B

Income Tax Deduction Income Tax Standard Deduction 2019 2020

Tax Exemption On Life Insurance Policy Under Section 10 10D Plan

Tax Exemption On Life Insurance Policy Under Section 10 10D Plan

Income Tax Rates For Fy 2021 22 How To Choose Between Old Regime And