In a world when screens dominate our lives yet the appeal of tangible printed items hasn't gone away. No matter whether it's for educational uses and creative work, or simply adding some personal flair to your home, printables for free have become a valuable resource. We'll take a dive deep into the realm of "Income Tax Exemption Under Section 10 14," exploring the different types of printables, where to find them and ways they can help you improve many aspects of your daily life.

Get Latest Income Tax Exemption Under Section 10 14 Below

Income Tax Exemption Under Section 10 14

Income Tax Exemption Under Section 10 14 -

Section 10 14 read with Rule 2BB provides for transport allowance exemption The amount of exemption is as follows Changes by Finance Act 2018 From the financial

Section 10 14 of the Income Tax Act provides exemptions towards allowances and benefits granted to the employees to meet

Income Tax Exemption Under Section 10 14 encompass a wide assortment of printable materials available online at no cost. These resources come in many forms, like worksheets templates, coloring pages, and much more. The beauty of Income Tax Exemption Under Section 10 14 is their versatility and accessibility.

More of Income Tax Exemption Under Section 10 14

How To Claim HRA Allowance House Rent Allowance Exemption

How To Claim HRA Allowance House Rent Allowance Exemption

Section 10 14 i of the Income Tax Act provides for the exemption of certain allowances and perquisites from the computation of an individual s taxable income This section aims to provide relief to

According to Section 10 14 ii of the Income Tax Act and Rule 2BB of the Income Tax Rules salaried individuals can claim conveyance allowance exemption of

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Modifications: They can make printing templates to your own specific requirements whether you're designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Impact: Printables for education that are free can be used by students of all ages, making them a useful aid for parents as well as educators.

-

It's easy: The instant accessibility to a plethora of designs and templates, which saves time as well as effort.

Where to Find more Income Tax Exemption Under Section 10 14

How To Get Tax Exemption Under Section 10 10D Canara HSBC Life

How To Get Tax Exemption Under Section 10 10D Canara HSBC Life

Section 10 14 of the Income Tax Act Section 10 14 of the Income Tax Act provides an exemption for certain allowances an employee receives The allowances

As per the Income Tax Act of 1961 section 10 14 rule 2BB discusses the taxation of professional pursuit allowance According to this clause the allowance an

After we've peaked your interest in Income Tax Exemption Under Section 10 14 We'll take a look around to see where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Income Tax Exemption Under Section 10 14 to suit a variety of needs.

- Explore categories such as decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- These blogs cover a broad variety of topics, ranging from DIY projects to planning a party.

Maximizing Income Tax Exemption Under Section 10 14

Here are some fresh ways of making the most use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free for teaching at-home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Exemption Under Section 10 14 are an abundance with useful and creative ideas catering to different needs and interests. Their accessibility and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the plethora of Income Tax Exemption Under Section 10 14 right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes you can! You can print and download these tools for free.

-

Does it allow me to use free printouts for commercial usage?

- It's dependent on the particular usage guidelines. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues in Income Tax Exemption Under Section 10 14?

- Some printables may have restrictions regarding their use. Be sure to check the terms and conditions provided by the author.

-

How can I print Income Tax Exemption Under Section 10 14?

- Print them at home with any printer or head to any local print store for better quality prints.

-

What software do I need in order to open Income Tax Exemption Under Section 10 14?

- A majority of printed materials are in the format PDF. This can be opened using free software such as Adobe Reader.

How To Calculate Tax Deduction From Salary Malaysia Printable Forms

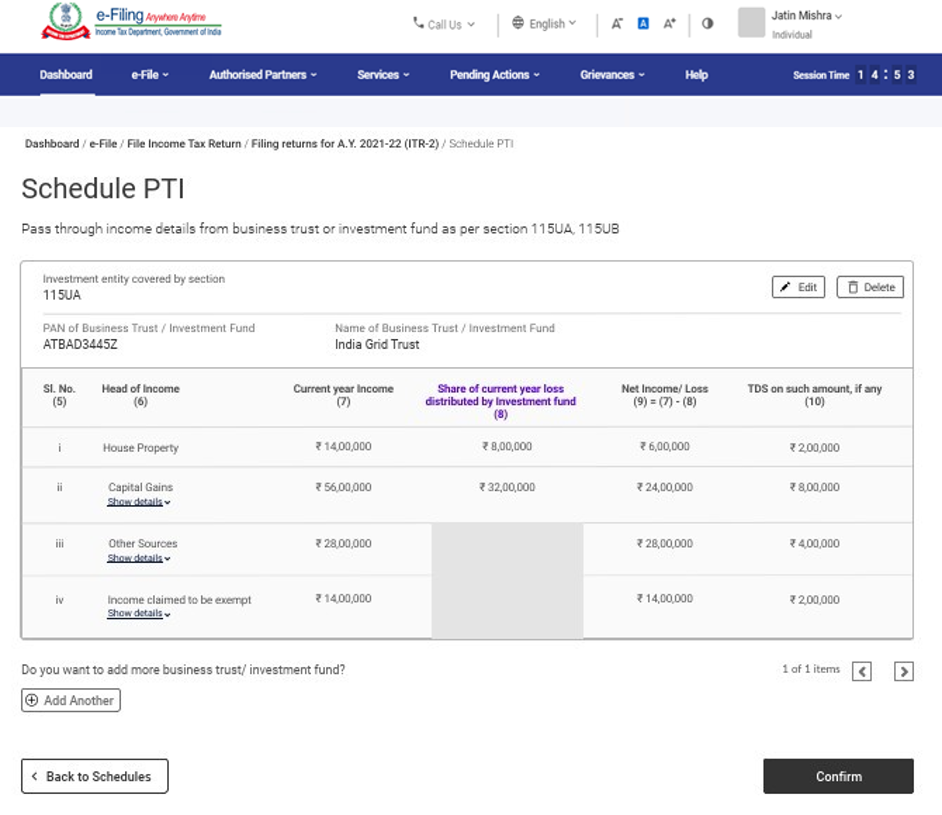

2 Income Tax Department

Check more sample of Income Tax Exemption Under Section 10 14 below

Foreign Employment Income Tax Exemption SARS Guidance For South

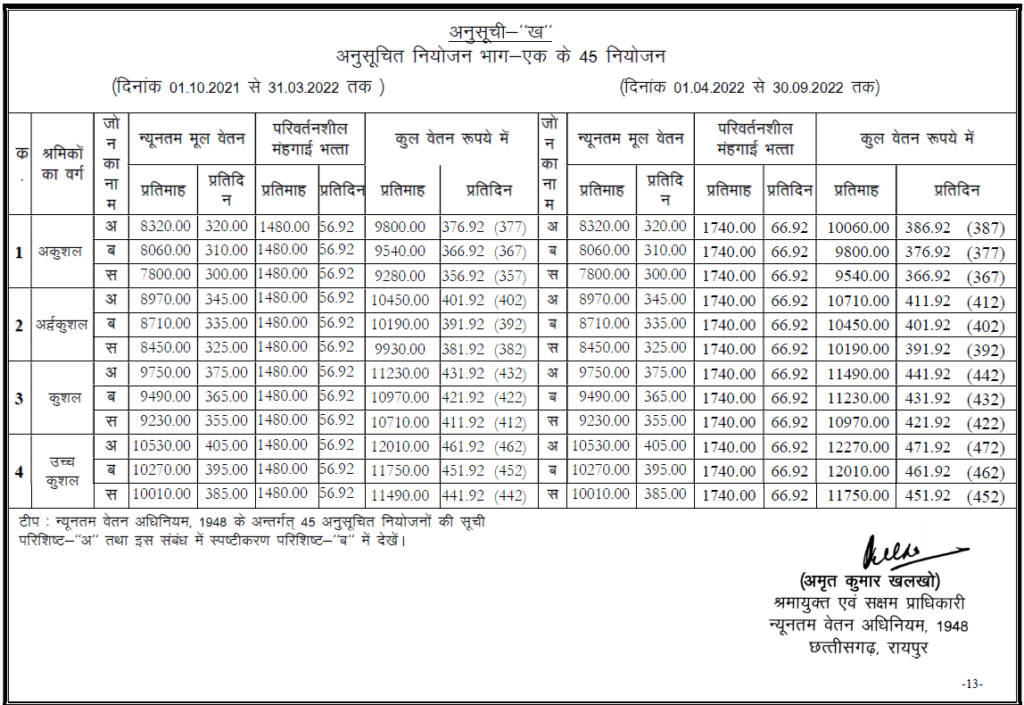

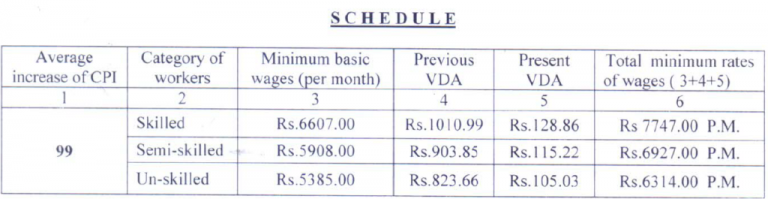

Minimum Wages Of Tripura From 1st Oct 2021 To 31st Mar 2022 Shop

CBDT Notifies RERA Eligible For Income Tax Exemption

Income Tax Calculation Example 2 For Salary Employees 2023 24

CBDT Notifies Canada based Pension Fund 2589555 Ontario Limited For

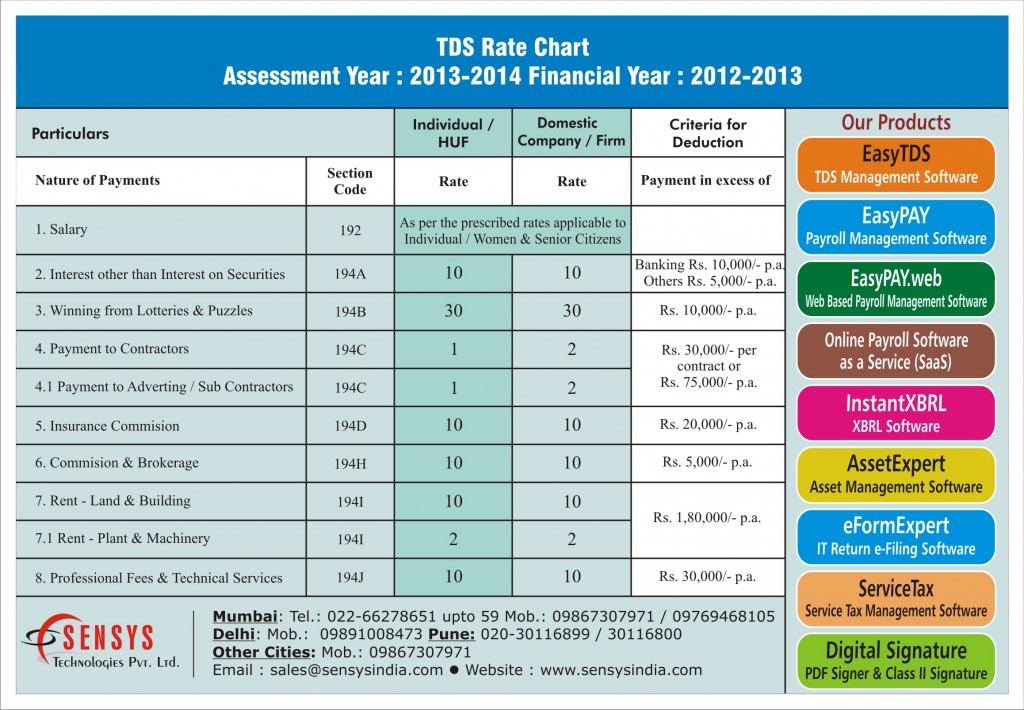

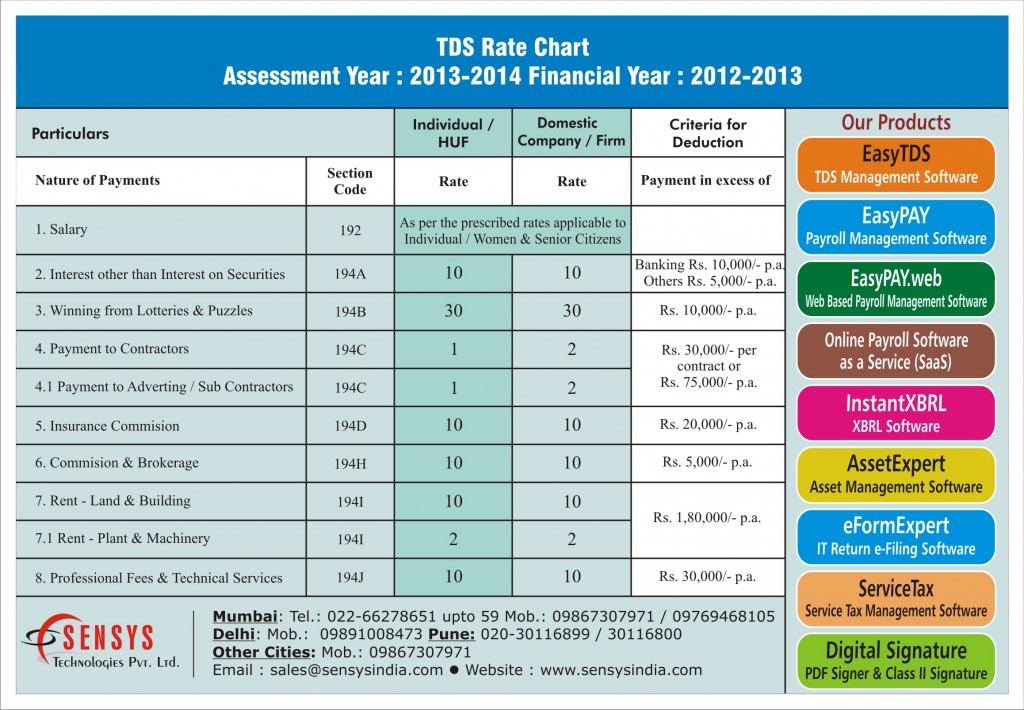

TDS Rate Chart AY 2013 2014 Sensys Blog

https://taxguru.in/income-tax/income-t…

Section 10 14 of the Income Tax Act provides exemptions towards allowances and benefits granted to the employees to meet

https://margcompusoft.com/m/section-1…

Section 10 14 of the Income Tax Act 1961 deals with the taxability of various allowances and benefits that are paid by an employer to his employees This section specifies the conditions under

Section 10 14 of the Income Tax Act provides exemptions towards allowances and benefits granted to the employees to meet

Section 10 14 of the Income Tax Act 1961 deals with the taxability of various allowances and benefits that are paid by an employer to his employees This section specifies the conditions under

Income Tax Calculation Example 2 For Salary Employees 2023 24

Minimum Wages Of Tripura From 1st Oct 2021 To 31st Mar 2022 Shop

CBDT Notifies Canada based Pension Fund 2589555 Ontario Limited For

TDS Rate Chart AY 2013 2014 Sensys Blog

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

CBDT Notifies Qatar based Sovereign Wealth Fund INQ Holding LLC For

CBDT Notifies Qatar based Sovereign Wealth Fund INQ Holding LLC For

Income Tax Exemption U s 10 23C iiiac Allowable When 50 Of Total