In this digital age, with screens dominating our lives, the charm of tangible printed materials hasn't faded away. Whatever the reason, whether for education as well as creative projects or simply to add an individual touch to the home, printables for free are now an essential source. For this piece, we'll take a dive in the world of "Income Tax Exemption Under Section 10 10aa," exploring the different types of printables, where to locate them, and how they can improve various aspects of your life.

What Are Income Tax Exemption Under Section 10 10aa?

The Income Tax Exemption Under Section 10 10aa are a huge selection of printable and downloadable materials online, at no cost. The resources are offered in a variety forms, like worksheets coloring pages, templates and more. The attraction of printables that are free lies in their versatility as well as accessibility.

Income Tax Exemption Under Section 10 10aa

Income Tax Exemption Under Section 10 10aa

Income Tax Exemption Under Section 10 10aa -

[desc-5]

[desc-1]

How To Claim HRA Allowance House Rent Allowance Exemption

How To Claim HRA Allowance House Rent Allowance Exemption

[desc-4]

[desc-6]

Leave Encashment Income Tax Section 10 10AA Leave Encashment

Leave Encashment Income Tax Section 10 10AA Leave Encashment

[desc-9]

[desc-7]

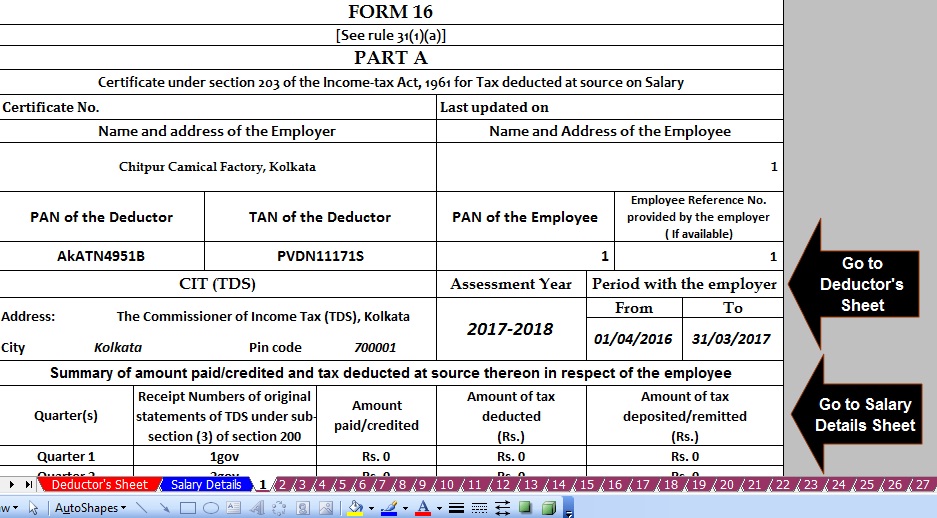

Leave Salary Exemption U s 10 10AA In Income Tax Automatic Master Of

Leave Encashment Section 10 10AA For Computing Salary Income

CBDT Increased The Exemption Limit Of Rs 25 Lakh For Leave Encashment

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Income Tax Calculation Example 2 For Salary Employees 2023 24

CBDT Notifies Canada based Pension Fund 2589555 Ontario Limited For

CBDT Notifies Canada based Pension Fund 2589555 Ontario Limited For

Income Tax Exemption U s 10 23C iiiac Allowable When 50 Of Total