In this day and age where screens dominate our lives but the value of tangible printed materials isn't diminishing. No matter whether it's for educational uses such as creative projects or simply to add personal touches to your space, Income Tax Exemption On 2nd Home Loan have become a valuable source. We'll dive deep into the realm of "Income Tax Exemption On 2nd Home Loan," exploring what they are, how you can find them, and what they can do to improve different aspects of your lives.

Get Latest Income Tax Exemption On 2nd Home Loan Below

Income Tax Exemption On 2nd Home Loan

Income Tax Exemption On 2nd Home Loan -

The tax benefit on a second home loan governed by the Income Tax Act under Sections 80C and 24 can significantly impact your financial planning Whether your second home is a rental property or a personal retreat affects these benefits adding layers of complexity to the decision

The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C

Income Tax Exemption On 2nd Home Loan include a broad variety of printable, downloadable documents that can be downloaded online at no cost. They are available in a variety of kinds, including worksheets coloring pages, templates and more. The great thing about Income Tax Exemption On 2nd Home Loan lies in their versatility as well as accessibility.

More of Income Tax Exemption On 2nd Home Loan

Tax Implications On A Second Home Loan A Must Read 50 Plus Finance

Tax Implications On A Second Home Loan A Must Read 50 Plus Finance

Under the income tax laws there are no restrictions on the number of houses for which you can claim the tax benefits for home loan Whether you have one home loan or more the deduction allowable

Tax benefits on second home loans under construction will be available for five years 20 of the interest that must be paid during the pre construction phase will be eligible for deductions Additionally a sum similar to 30 of the

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

customization: You can tailor the templates to meet your individual needs when it comes to designing invitations planning your schedule or decorating your home.

-

Educational Value: Printables for education that are free can be used by students of all ages, making them an invaluable tool for parents and educators.

-

Accessibility: Fast access an array of designs and templates cuts down on time and efforts.

Where to Find more Income Tax Exemption On 2nd Home Loan

Income Tax Malaysia 2022 Deadline Extension Latest News Update

Income Tax Malaysia 2022 Deadline Extension Latest News Update

The income tax benefits in respect of interest on home loans for self occupied house property ies as well as for repayment of principal repayment are available only if you opt for the old

Tax benefits on second Home Loan You can get the above tax benefits if you take a second home loan to buy another property however the aggregate amount of deductions is subject to the respective caps mentioned above As per the Union Budget of 2019 the Government has provided further incentives for investing in a house property

In the event that we've stirred your interest in Income Tax Exemption On 2nd Home Loan, let's explore where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Income Tax Exemption On 2nd Home Loan suitable for many motives.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets as well as flashcards and other learning tools.

- It is ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs are a vast range of topics, from DIY projects to party planning.

Maximizing Income Tax Exemption On 2nd Home Loan

Here are some innovative ways that you can make use of Income Tax Exemption On 2nd Home Loan:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Exemption On 2nd Home Loan are a treasure trove of practical and innovative resources that cater to various needs and preferences. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the vast world of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes they are! You can print and download these tools for free.

-

Can I use the free templates for commercial use?

- It's based on specific conditions of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables may be subject to restrictions regarding their use. Be sure to review the terms and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home using an printer, or go to an in-store print shop to get top quality prints.

-

What software do I need to open Income Tax Exemption On 2nd Home Loan?

- The majority of printables are in the format PDF. This is open with no cost software like Adobe Reader.

No Income Tax Exemption On Loan Interest From 2023

Income Tax Exemption On Gratuity Income Castuff

Check more sample of Income Tax Exemption On 2nd Home Loan below

Real Estate ReLakhs

2nd Home Loan Rochester Hills MI 2nd Home Loan Experts Michigan

CBDT Notifies Income Tax Exemption On California Public Employees

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

Gratuity Under Income Tax Act All You Need To Know

Income Tax Exemption On Interest Of Education Loan YouTube

https://cleartax.in/s/home-loan-tax-benefits

The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C

https://taxguru.in/income-tax/income-tax-benefits...

1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000 per month The approximate home loan interest for this flat is Rs 2 00 000 What maximum tax exemption can I get in above case

The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C

1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000 per month The approximate home loan interest for this flat is Rs 2 00 000 What maximum tax exemption can I get in above case

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

2nd Home Loan Rochester Hills MI 2nd Home Loan Experts Michigan

Gratuity Under Income Tax Act All You Need To Know

Income Tax Exemption On Interest Of Education Loan YouTube

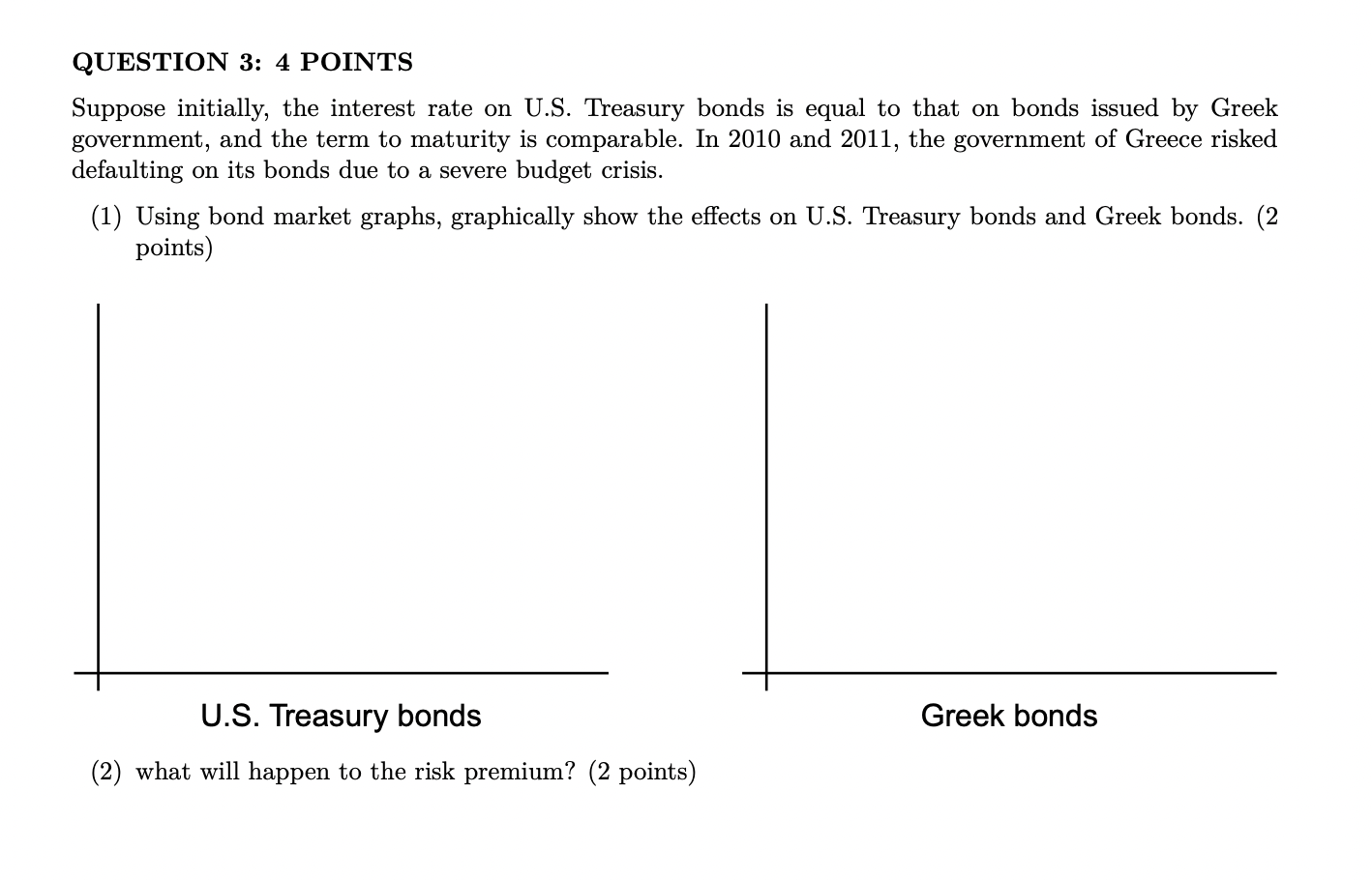

Solved QUESTION 2 4 POINTS Suppose The Income Tax Exemption Chegg

Tax Benefits On Second Home Loan Tax Exemption On 2nd Home Loan PNB

Tax Benefits On Second Home Loan Tax Exemption On 2nd Home Loan PNB

Income Tax Exemption On Electric Vehicle Deduction On Electric Vehicle