In this age of technology, when screens dominate our lives The appeal of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons or creative projects, or simply adding a personal touch to your home, printables for free are a great resource. Here, we'll take a dive deeper into "Income Tax Exemption Limit," exploring what they are, where to get them, as well as how they can enrich various aspects of your daily life.

Get Latest Income Tax Exemption Limit Below

Income Tax Exemption Limit

Income Tax Exemption Limit -

Clarifying the misconception No tax exemption of Rs 7 00 000 under New Tax Regime for FY 2022 23 Understand the correct slabs deductions and tax implications for the financial year

Depending on your age filing status and dependents for the 2023 tax year the gross income threshold for filing taxes is between 12 950 and 28 700 If you have self employment income you re required to report

Printables for free include a vast selection of printable and downloadable resources available online for download at no cost. These resources come in many designs, including worksheets coloring pages, templates and many more. One of the advantages of Income Tax Exemption Limit is their versatility and accessibility.

More of Income Tax Exemption Limit

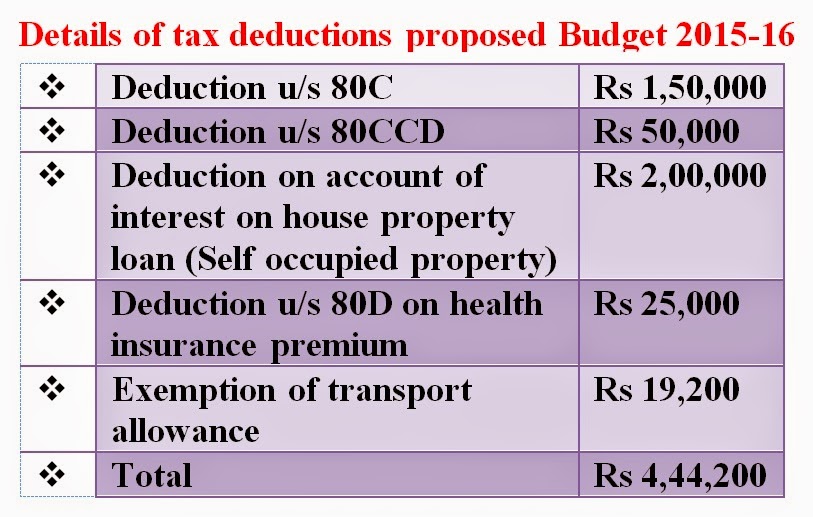

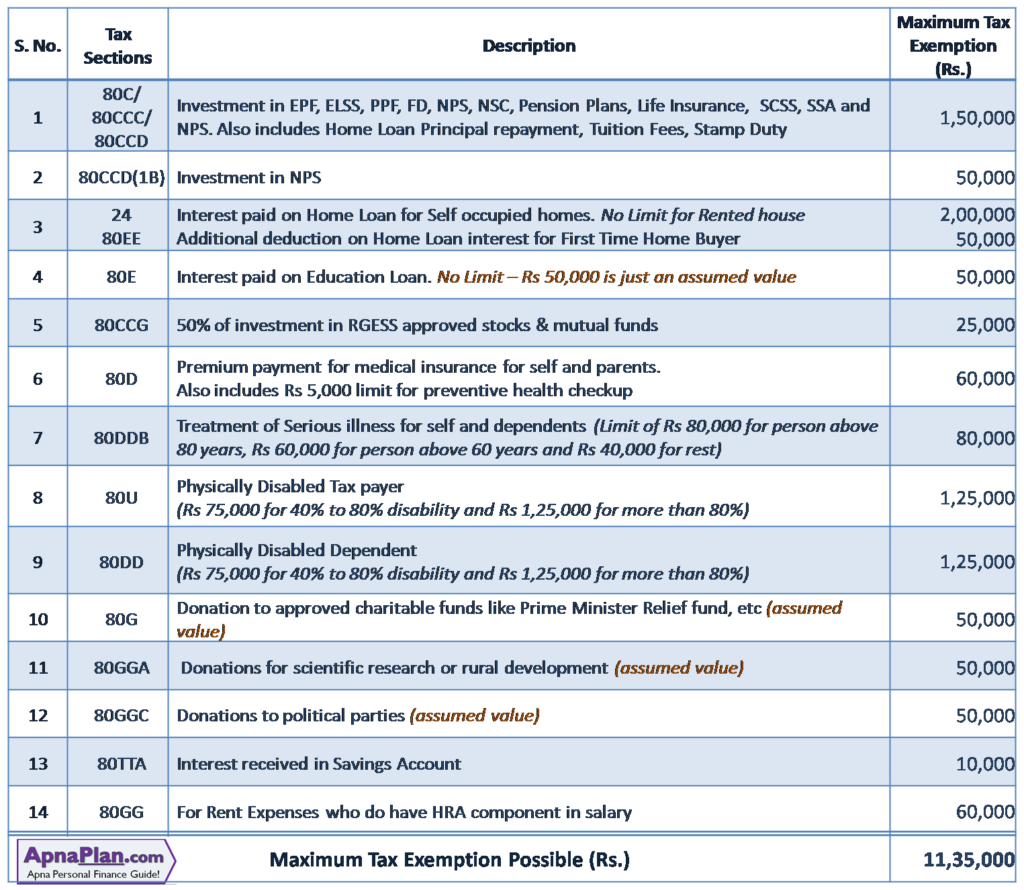

Maximum Income Tax You Can Save For FY 2016 17

Maximum Income Tax You Can Save For FY 2016 17

Income Tax Deductions Exemptions under Sections 80C 80D 80DDB for FY 2023 24 2024 25 Income tax deductions and exemptions for FY 2023 24 include benefits

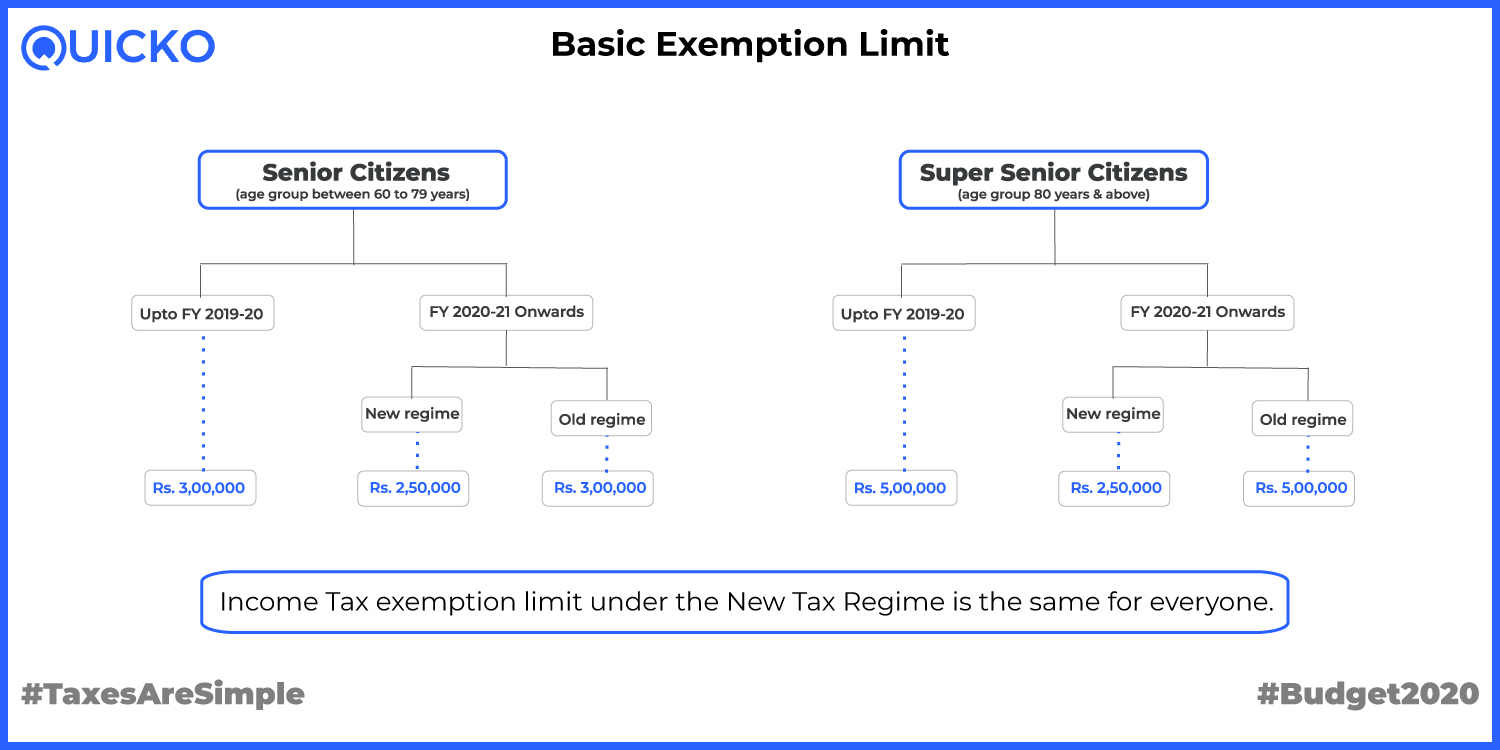

Updated on 05 Mar 2024 11 50 AM In India the income tax slabs used to be structured in a progressive manner where the tax rates increase as the income level rises Senior

Income Tax Exemption Limit have gained a lot of recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Individualization Your HTML0 customization options allow you to customize the design to meet your needs whether you're designing invitations planning your schedule or decorating your home.

-

Educational Use: These Income Tax Exemption Limit offer a wide range of educational content for learners from all ages, making these printables a powerful instrument for parents and teachers.

-

Accessibility: Access to the vast array of design and templates reduces time and effort.

Where to Find more Income Tax Exemption Limit

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

An income tax exemption is available for certain individuals aged 65 years or over These individuals are only liable to income tax if their income is above a specified limit For

According to Dr Suresh Surana founder RSM India This Supreme Court judgement upheld the taxation of interest free or concessional loans given by banks to

If we've already piqued your interest in Income Tax Exemption Limit Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Income Tax Exemption Limit to suit a variety of needs.

- Explore categories like decorating your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing, flashcards, and learning materials.

- It is ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- These blogs cover a broad selection of subjects, everything from DIY projects to party planning.

Maximizing Income Tax Exemption Limit

Here are some innovative ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Utilize free printable worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Exemption Limit are an abundance with useful and creative ideas that meet a variety of needs and passions. Their accessibility and versatility make them a wonderful addition to both personal and professional life. Explore the world of Income Tax Exemption Limit to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes, they are! You can print and download these resources at no cost.

-

Are there any free printables for commercial uses?

- It's based on the rules of usage. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables might have limitations on usage. Make sure to read the terms of service and conditions provided by the author.

-

How do I print printables for free?

- Print them at home using either a printer or go to any local print store for superior prints.

-

What program will I need to access printables at no cost?

- The majority of printables are in the format of PDF, which is open with no cost programs like Adobe Reader.

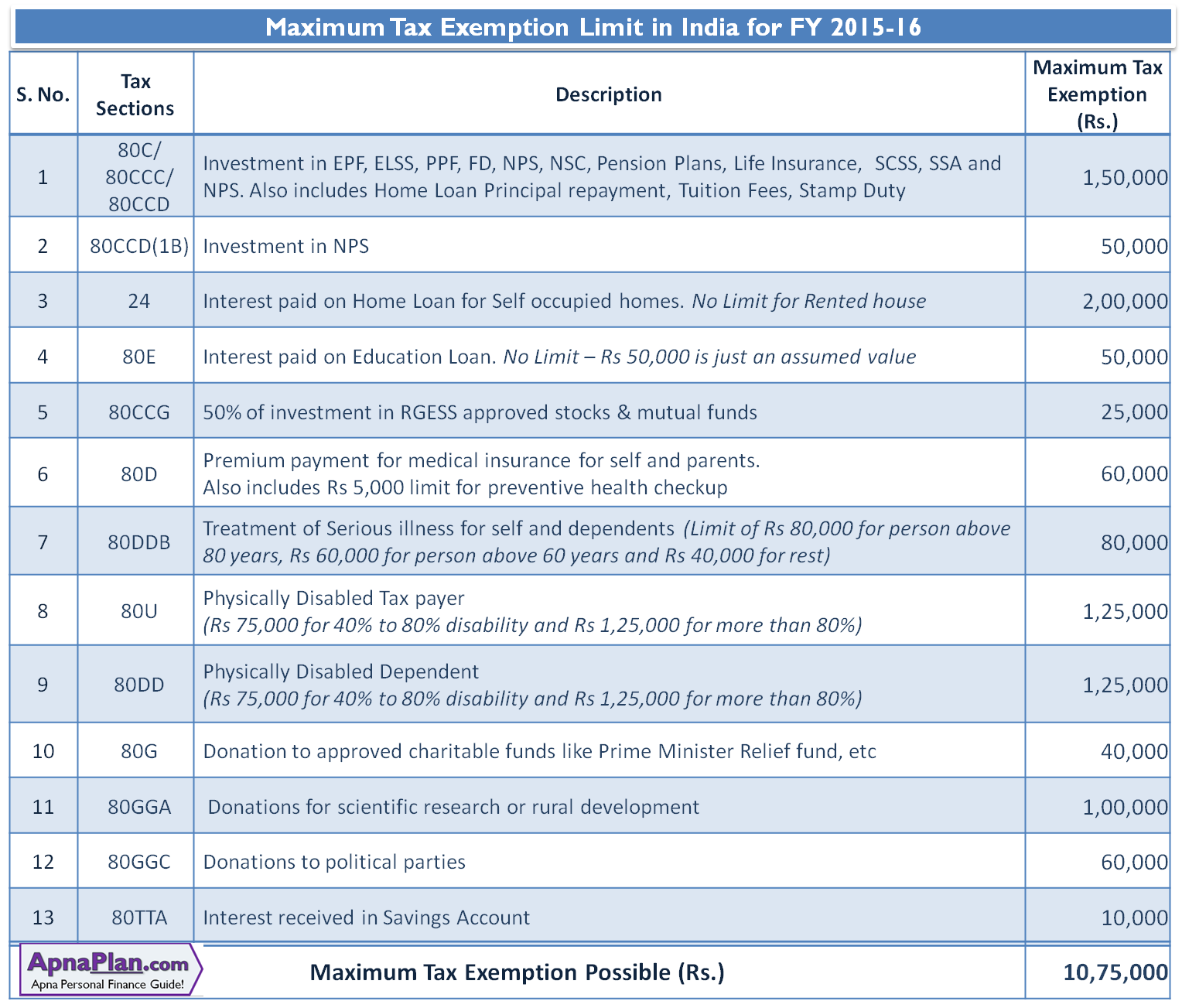

Maximum Income Tax You Can Save For FY 2015 16

Difference Old Tax Regime Vs New Tax Regime Learn By Quicko

Check more sample of Income Tax Exemption Limit below

New Tax Regime Vs Old Tax Regime Which Is Better Yadnya Investment

Budget 2019 Income Tax Exemption Limit Likely To Be Increased To Rs 5 Lakh

New Income Tax Slab 2019 20 Income Tax Income Tax Exemption

Income Tax Exemption Limit Likely To Be Enhanced In Budget

NIFR Seeks Income Tax Exemption Limit Be Raised To 6 Lakh In Budget

Interim Budget 2019 Income Tax Exemption Limit Hiked To Rs 5 Lakh

https://www.freshbooks.com/hub/taxes/…

Depending on your age filing status and dependents for the 2023 tax year the gross income threshold for filing taxes is between 12 950 and 28 700 If you have self employment income you re required to report

https://www.etmoney.com/learn/nps/nps …

In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means

Depending on your age filing status and dependents for the 2023 tax year the gross income threshold for filing taxes is between 12 950 and 28 700 If you have self employment income you re required to report

In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means

Income Tax Exemption Limit Likely To Be Enhanced In Budget

Budget 2019 Income Tax Exemption Limit Likely To Be Increased To Rs 5 Lakh

NIFR Seeks Income Tax Exemption Limit Be Raised To 6 Lakh In Budget

Interim Budget 2019 Income Tax Exemption Limit Hiked To Rs 5 Lakh

Income Tax Exemption Limit To Be Raised By 5 Lakh YouTube

Income Tax Exemption Limit Likely To Be Enhanced To Rs 5 Lakh Flipboard

Income Tax Exemption Limit Likely To Be Enhanced To Rs 5 Lakh Flipboard

Income Tax Exemption Limit Good News For Taxpayers Up To 5 Lakh Can