In this age of technology, in which screens are the norm, the charm of tangible printed products hasn't decreased. Be it for educational use, creative projects, or simply adding personal touches to your space, Income Tax Exemption Investments are now an essential source. In this article, we'll dive into the sphere of "Income Tax Exemption Investments," exploring their purpose, where to find them, and how they can be used to enhance different aspects of your daily life.

Get Latest Income Tax Exemption Investments Below

Income Tax Exemption Investments

Income Tax Exemption Investments -

Roths are tax exempt accounts Contributions are made with after tax dollars so there s no immediate tax deduction However the account grows tax free and future distributions are free

Below are seven important tax efficient investments you can incorporate in your portfolio 1 Municipal Bonds Municipal bonds or muni bonds for short are bonds issued by local governments that are used to fund various projects such as improving roads or building schools

Printables for free include a vast assortment of printable documents that can be downloaded online at no cost. These resources come in many forms, like worksheets templates, coloring pages and more. The beauty of Income Tax Exemption Investments is in their versatility and accessibility.

More of Income Tax Exemption Investments

We Got 12A Exemption Registration Under Income Tax

We Got 12A Exemption Registration Under Income Tax

Investments that aren t tax efficient are better off in tax deferred or tax exempt accounts Tax advantaged accounts like IRAs and 401 k s have annual contribution limits Why Is

Tax exempt investments are financial instruments that generate income or returns that are not subject to federal state or local taxes These types of investments are designed to encourage investors to allocate their resources to sectors that serve a public purpose such as infrastructure development or education

The Income Tax Exemption Investments have gained huge popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Individualization They can make the design to meet your needs be it designing invitations and schedules, or decorating your home.

-

Educational value: Printables for education that are free can be used by students from all ages, making these printables a powerful tool for teachers and parents.

-

Accessibility: You have instant access a variety of designs and templates is time-saving and saves effort.

Where to Find more Income Tax Exemption Investments

Get More Tax Exemptions For Income Tax In Malaysia IMoney

Get More Tax Exemptions For Income Tax In Malaysia IMoney

The tax exempt sector includes bonds notes leases bond funds mutual funds trusts and life insurance among other investment vehicles Government municipal bond issuers offer a guarantee

1 Public Provident Fund PPF Under Section 80C individuals can reduce their taxable income by investing in the Public Provident Fund PPF This scheme falls under the exempt exempt exempt EEE category

Now that we've piqued your interest in printables for free Let's take a look at where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Income Tax Exemption Investments for various goals.

- Explore categories such as the home, decor, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a wide array of topics, ranging everything from DIY projects to party planning.

Maximizing Income Tax Exemption Investments

Here are some creative ways to make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home and in class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Exemption Investments are a treasure trove of practical and imaginative resources for a variety of needs and passions. Their availability and versatility make them a wonderful addition to both professional and personal life. Explore the plethora of Income Tax Exemption Investments today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Exemption Investments really gratis?

- Yes they are! You can print and download these documents for free.

-

Can I use the free printables for commercial use?

- It's contingent upon the specific conditions of use. Always check the creator's guidelines before using their printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables could be restricted in use. Check the terms and conditions set forth by the author.

-

How can I print printables for free?

- You can print them at home with any printer or head to an area print shop for more high-quality prints.

-

What software do I require to view printables free of charge?

- The majority are printed with PDF formats, which can be opened using free software like Adobe Reader.

Great Dyke Investments Granted Tax Exemption Nehanda Radio

Malaysia Issues Tax Exemption For Foreign Sourced Income

Check more sample of Income Tax Exemption Investments below

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

We Got 12A Exemption Registration Under Income Tax

Income Tax Exemption Limit May Get Doubled To Rs 2 Lacs

Tax Exemption On Foreign Source Income To Spur Investments CTIM New

Bill To Approve Income Tax Exemption For Foreign Investments Drummond

The Fixed Income Investment Instrument Selection Strategy India

https://smartasset.com/investing/tax-free-investments

Below are seven important tax efficient investments you can incorporate in your portfolio 1 Municipal Bonds Municipal bonds or muni bonds for short are bonds issued by local governments that are used to fund various projects such as improving roads or building schools

https://cleartax.in/s/income-tax-savings

The government offers income tax exemptions on direct taxes charged on your whole pay to alleviate this burden We will discuss some avenues to help you save taxes under the old and new tax regimes Tax Saving Deductions And Exemptions Under The New Tax Regime Under the new tax regime only limited tax deductions are available for taxpayers

Below are seven important tax efficient investments you can incorporate in your portfolio 1 Municipal Bonds Municipal bonds or muni bonds for short are bonds issued by local governments that are used to fund various projects such as improving roads or building schools

The government offers income tax exemptions on direct taxes charged on your whole pay to alleviate this burden We will discuss some avenues to help you save taxes under the old and new tax regimes Tax Saving Deductions And Exemptions Under The New Tax Regime Under the new tax regime only limited tax deductions are available for taxpayers

Tax Exemption On Foreign Source Income To Spur Investments CTIM New

We Got 12A Exemption Registration Under Income Tax

Bill To Approve Income Tax Exemption For Foreign Investments Drummond

The Fixed Income Investment Instrument Selection Strategy India

Life Insurance Income Tax Exemption IndiaFilings

Key Bermuda Payroll Tax Updates From The Government s Budget Statement

Key Bermuda Payroll Tax Updates From The Government s Budget Statement

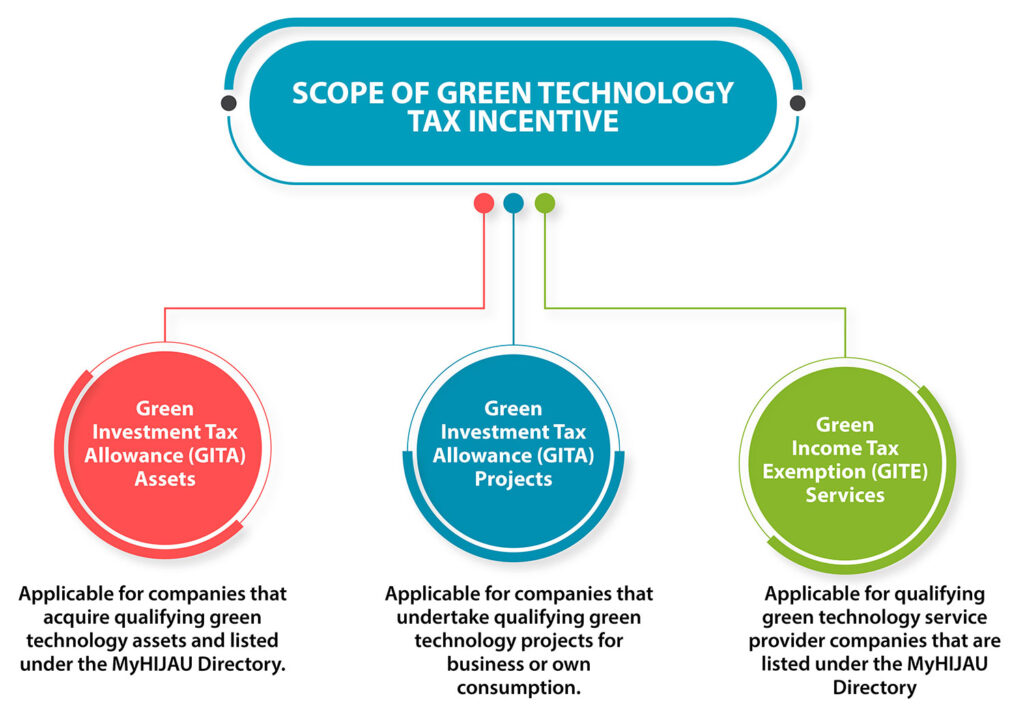

Green Investment Tax Allowance GITA Green Income Tax Exemption