In a world in which screens are the norm however, the attraction of tangible printed items hasn't gone away. Whether it's for educational purposes for creative projects, simply adding an individual touch to your home, printables for free are now an essential source. Through this post, we'll take a dive in the world of "Income Tax Exemption For Nps Tier 1," exploring the benefits of them, where you can find them, and how they can add value to various aspects of your life.

Get Latest Income Tax Exemption For Nps Tier 1 Below

Income Tax Exemption For Nps Tier 1

Income Tax Exemption For Nps Tier 1 -

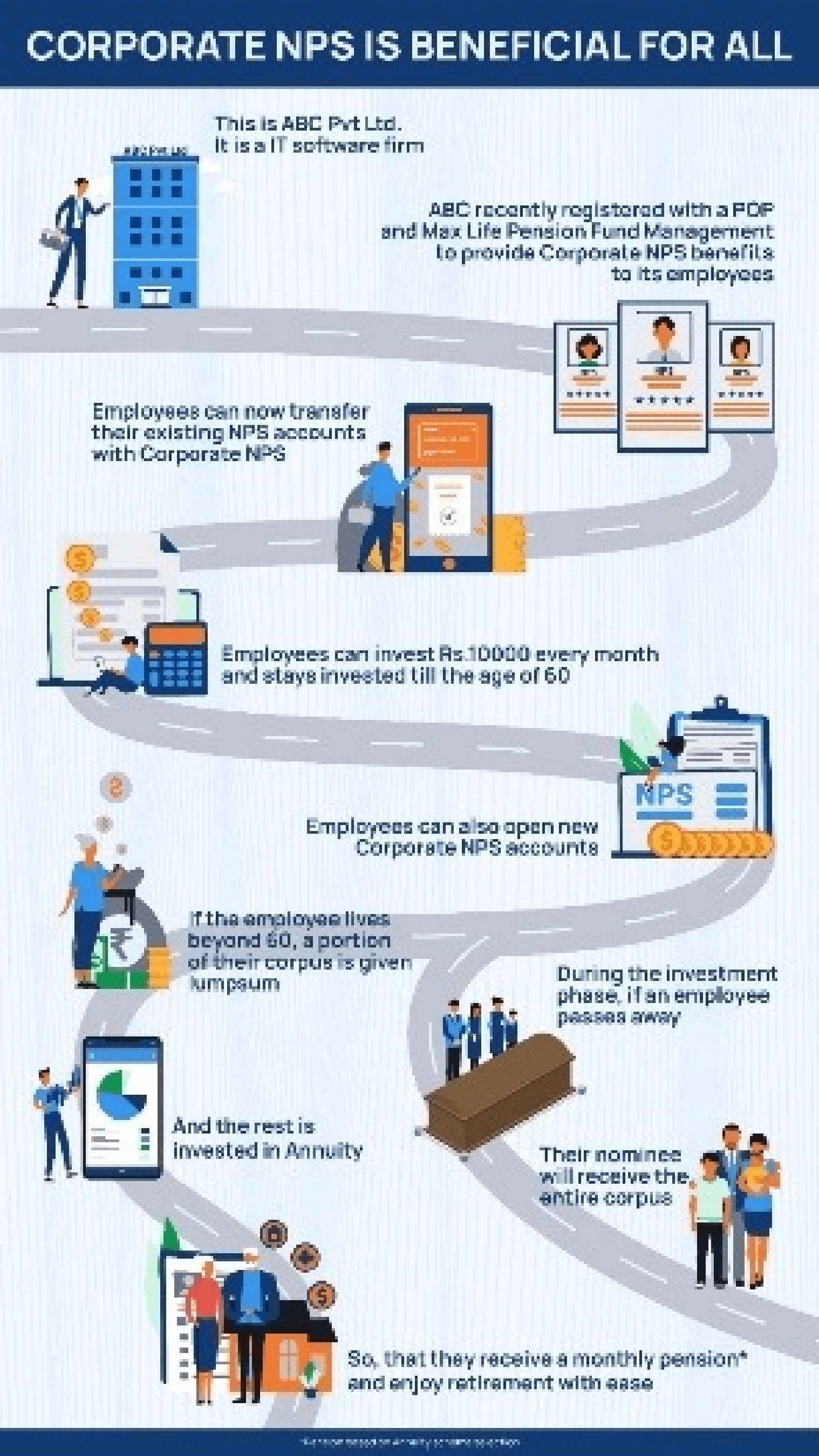

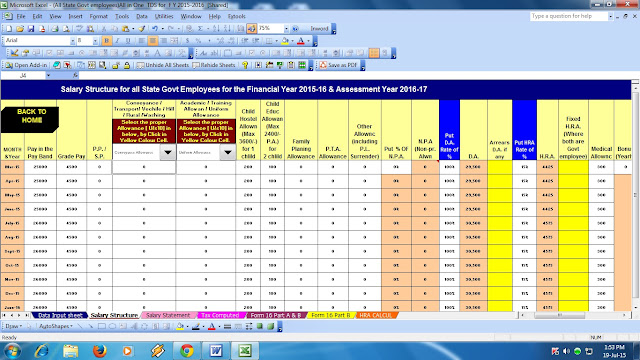

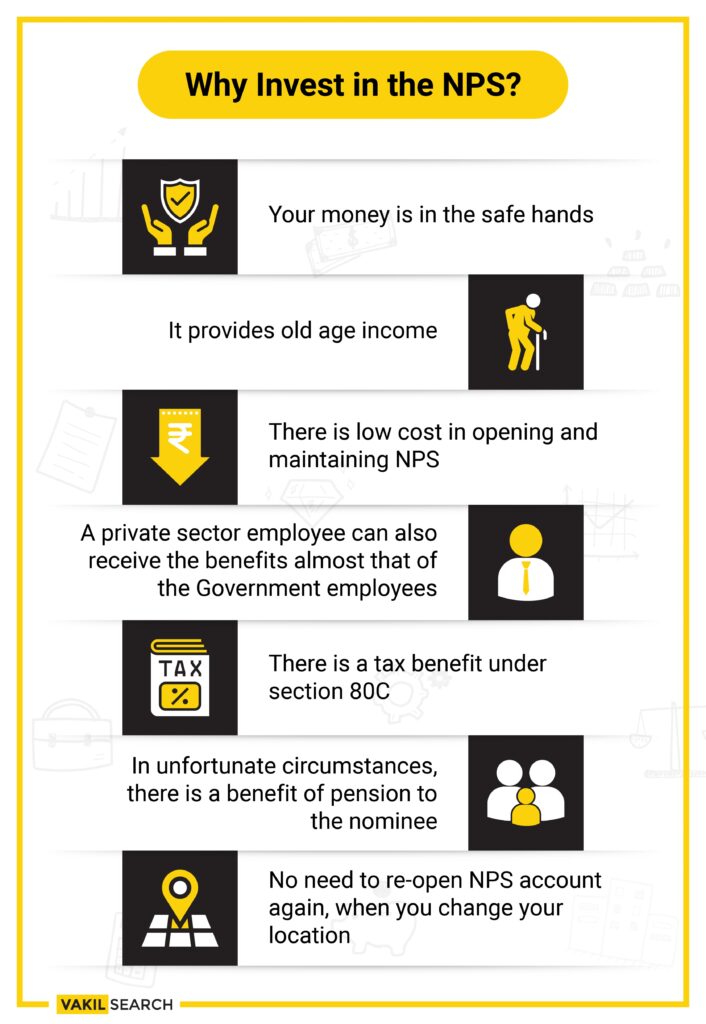

NPS Tier I Account NPS Tier II Account Status Default Voluntary Withdrawals As per the rules regulations Permitted Tax exemption Up to Rs 2 lakh p a Under 80C and 80CCD 1 5 lakh for government employees Other employees None Minimum NPS contribution for opening an account Rs 500 Rs 1 000 Minimum NPS contribution Rs

NPS Tier 1 Vs NPS Tier 2 Which One Should You Choose Under Section 80CCD 1 Tier 1 investors may receive a tax exemption for an additional investment of up to Rs 50 000 Premature withdrawals and the purchase of

Income Tax Exemption For Nps Tier 1 cover a large range of downloadable, printable content that can be downloaded from the internet at no cost. They are available in a variety of designs, including worksheets templates, coloring pages and many more. The beauty of Income Tax Exemption For Nps Tier 1 is their flexibility and accessibility.

More of Income Tax Exemption For Nps Tier 1

Additional Tax Saving On 50000 Should You Invest In NPS Tier 1 For

Additional Tax Saving On 50000 Should You Invest In NPS Tier 1 For

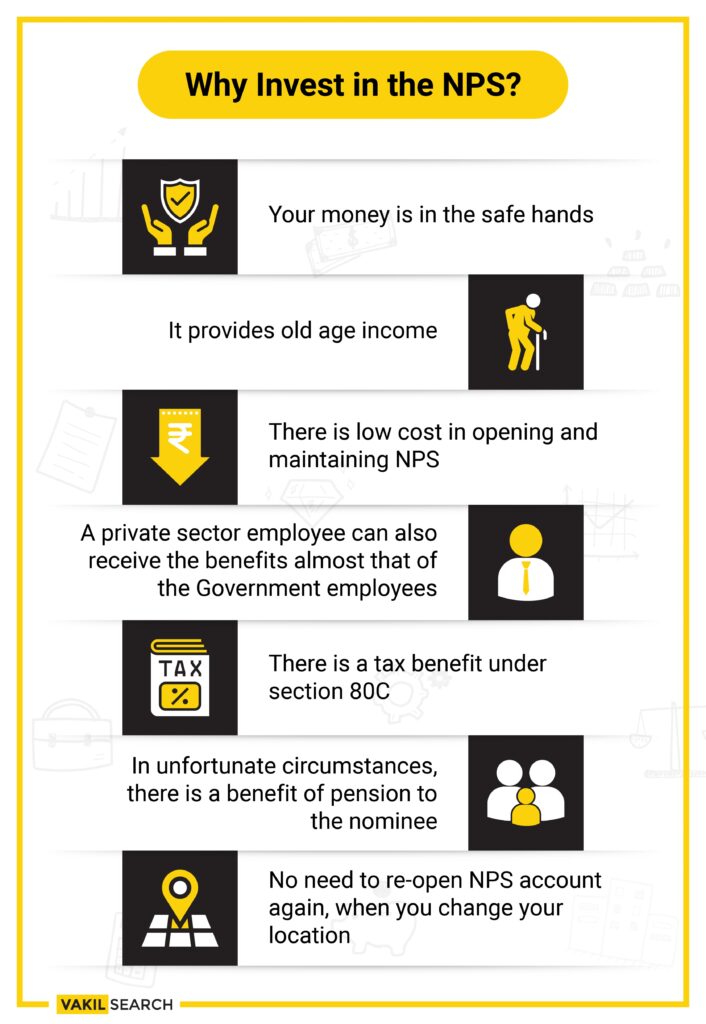

Features and Benefits Tax Benefits under NPS Tax benefits to employees on Self Contribution Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling of Rs 1 50 lakh under Sec 80 CCE

1 What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD 1 of Income Tax Act up to 10 of salary Basic DA

Income Tax Exemption For Nps Tier 1 have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Flexible: This allows you to modify printables to fit your particular needs whether it's making invitations for your guests, organizing your schedule or decorating your home.

-

Educational value: These Income Tax Exemption For Nps Tier 1 are designed to appeal to students of all ages, which makes them a great aid for parents as well as educators.

-

Simple: You have instant access a plethora of designs and templates saves time and effort.

Where to Find more Income Tax Exemption For Nps Tier 1

Nps Solutions

Nps Solutions

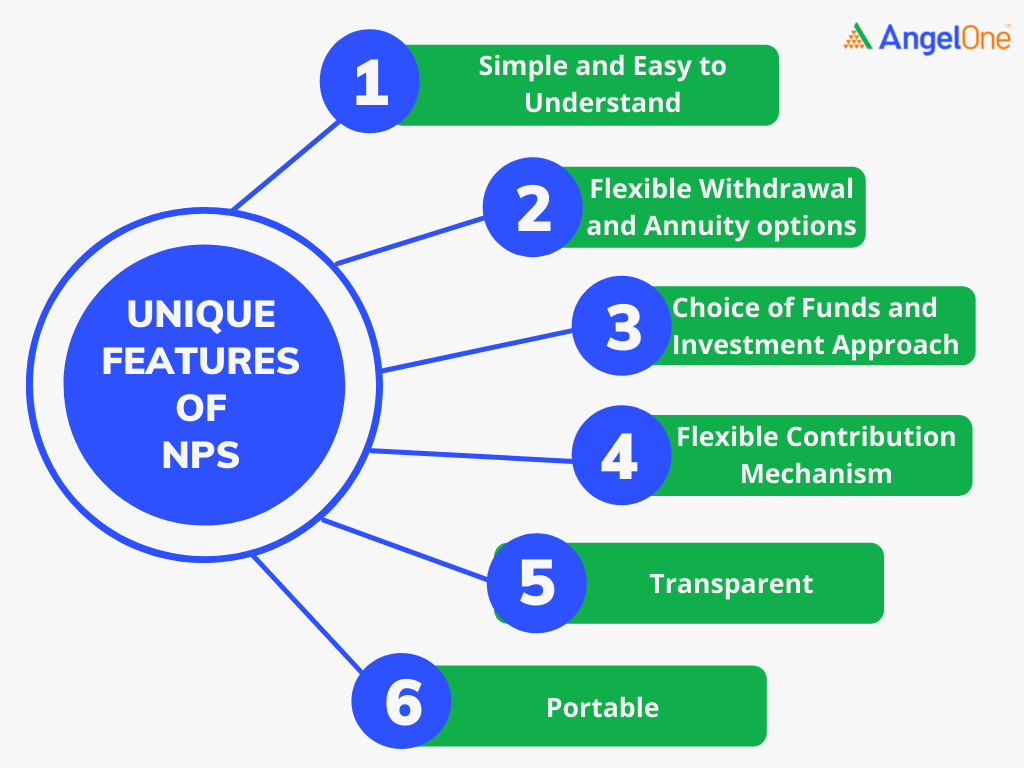

Tier 1 is a long term retirement account with tax benefits and limited withdrawals while Tier 2 is a more flexible short term savings option that allows easier access to your funds making it suitable for various financial goals Read this article below to get more information about both NPS account types Tier 1 and Tier 2 NPS Tier 1

Employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80 CCD 2 of the Income Tax Act 14 of salary for central government employees and 10 for others This rebate is over and above the limit prescribed under Section 80 C

Now that we've piqued your interest in Income Tax Exemption For Nps Tier 1 and other printables, let's discover where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Income Tax Exemption For Nps Tier 1 for various applications.

- Explore categories such as decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free or flashcards as well as learning materials.

- The perfect resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs covered cover a wide range of interests, that range from DIY projects to planning a party.

Maximizing Income Tax Exemption For Nps Tier 1

Here are some innovative ways to make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Exemption For Nps Tier 1 are a treasure trove filled with creative and practical information for a variety of needs and desires. Their access and versatility makes they a beneficial addition to your professional and personal life. Explore the many options of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes, they are! You can print and download these free resources for no cost.

-

Are there any free printing templates for commercial purposes?

- It is contingent on the specific conditions of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Do you have any copyright concerns when using Income Tax Exemption For Nps Tier 1?

- Certain printables might have limitations on use. Be sure to review these terms and conditions as set out by the designer.

-

How can I print Income Tax Exemption For Nps Tier 1?

- Print them at home with printing equipment or visit the local print shop for more high-quality prints.

-

What program do I require to open Income Tax Exemption For Nps Tier 1?

- A majority of printed materials are in PDF format. These is open with no cost software such as Adobe Reader.

NPS Tax Benefits How To Avail NPS Income Tax Benefits

National Pension Scheme NPS Scheme NPS Tier 1 And Tier 2 NPS Tax

Check more sample of Income Tax Exemption For Nps Tier 1 below

NPS Tier II Account Income Tax Benefits Certiom Consultants

NPS Scheme Basics Features Rules And Top NPS Schemes

Additional Income Tax Exemption Under Section 80 CCD 1 For

NPS Invest Rs 5000 Per Month Get Rs 2 Lakh Monthly Pension From THIS

NPS Tax Exemption Important News Way To Get Tax Exemption On Employer

Nps Contribution By Employee Werohmedia

https://cleartax.in/s/nps-tier-1-vs-nps-tier-2

NPS Tier 1 Vs NPS Tier 2 Which One Should You Choose Under Section 80CCD 1 Tier 1 investors may receive a tax exemption for an additional investment of up to Rs 50 000 Premature withdrawals and the purchase of

https://www.etmoney.com/learn/nps/nps-tax-benefit

Tier I investments are eligible for NPS deductions or NPS tax saving benefits under Section 80 CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Income Tax Act 1961 NPS Tier 1 tax benefits are as follows

NPS Tier 1 Vs NPS Tier 2 Which One Should You Choose Under Section 80CCD 1 Tier 1 investors may receive a tax exemption for an additional investment of up to Rs 50 000 Premature withdrawals and the purchase of

Tier I investments are eligible for NPS deductions or NPS tax saving benefits under Section 80 CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Income Tax Act 1961 NPS Tier 1 tax benefits are as follows

NPS Invest Rs 5000 Per Month Get Rs 2 Lakh Monthly Pension From THIS

NPS Scheme Basics Features Rules And Top NPS Schemes

NPS Tax Exemption Important News Way To Get Tax Exemption On Employer

Nps Contribution By Employee Werohmedia

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

Know The Difference Between Tier 1 And Tier 2 NPS

Know The Difference Between Tier 1 And Tier 2 NPS

NPS Tax Benefits Compare Apply Loans Credit Cards In India