In a world where screens have become the dominant feature of our lives yet the appeal of tangible, printed materials hasn't diminished. If it's to aid in education, creative projects, or simply adding an individual touch to your area, Income Tax Exemption For Home Loan 2022 23 can be an excellent resource. In this article, we'll dive into the world of "Income Tax Exemption For Home Loan 2022 23," exploring the benefits of them, where to get them, as well as the ways that they can benefit different aspects of your daily life.

Get Latest Income Tax Exemption For Home Loan 2022 23 Below

Income Tax Exemption For Home Loan 2022 23

Income Tax Exemption For Home Loan 2022 23 -

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Note that home loan borrowers opting for new tax regime cannot claim deductions under Sections 80C or 24 b

New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special benefit announced

Printables for free include a vast assortment of printable, downloadable items that are available online at no cost. These printables come in different designs, including worksheets templates, coloring pages and much more. The great thing about Income Tax Exemption For Home Loan 2022 23 is in their versatility and accessibility.

More of Income Tax Exemption For Home Loan 2022 23

Georgia Sales Tax Exemption Form St 5 ExemptForm

Georgia Sales Tax Exemption Form St 5 ExemptForm

As per the new income tax rule starting April 2023 no new home loans sanctioned in FY23 24 will be eligible to claim the tax benefits under section 80 EEA Sections of the Income Tax Act for tax rebate on home loan Here are some key sections of the Income Tax Act in India that provide tax benefits on home loans

Home loan tax benefits include deductions on principal interest payments under sections 80C 24 b of Income Tax Act reducing overall tax liability for owners

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

customization: There is the possibility of tailoring the design to meet your needs be it designing invitations to organize your schedule or even decorating your home.

-

Educational value: Printing educational materials for no cost are designed to appeal to students of all ages, making them an invaluable source for educators and parents.

-

Easy to use: The instant accessibility to the vast array of design and templates saves time and effort.

Where to Find more Income Tax Exemption For Home Loan 2022 23

We Got 12A Exemption Registration Under Income Tax

We Got 12A Exemption Registration Under Income Tax

The Government of India provides Home Loan tax benefits under the Income Tax Act of 1961 So if you are already servicing a Home Loan or planning to borrow in the future it is vital to be aware of all the Home Loan tax benefits as it will significantly reduce your tax outgo and help you save more

Tax Benefits on Home Loan FY 2022 23 Income Tax Act Tax exemption Section 80C Upto Rs 1 5 lakhs on principal repayment Section 24 b Upto Rs 2 lakh on interest payment Section 80EE Additional benefit of upto Rs 50 000 on interest payment for first time homebuyers

In the event that we've stirred your interest in printables for free Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Income Tax Exemption For Home Loan 2022 23 for various reasons.

- Explore categories such as design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free as well as flashcards and other learning materials.

- Great for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs covered cover a wide range of topics, from DIY projects to planning a party.

Maximizing Income Tax Exemption For Home Loan 2022 23

Here are some innovative ways of making the most use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Exemption For Home Loan 2022 23 are a treasure trove of practical and innovative resources for a variety of needs and passions. Their availability and versatility make them a wonderful addition to both professional and personal lives. Explore the vast array of Income Tax Exemption For Home Loan 2022 23 today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes, they are! You can print and download these free resources for no cost.

-

Are there any free printables for commercial uses?

- It's determined by the specific conditions of use. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables might have limitations regarding usage. Always read the terms and condition of use as provided by the designer.

-

How can I print Income Tax Exemption For Home Loan 2022 23?

- You can print them at home using an printer, or go to a local print shop for top quality prints.

-

What software do I require to view Income Tax Exemption For Home Loan 2022 23?

- The majority of PDF documents are provided in the format of PDF, which can be opened using free software, such as Adobe Reader.

50 Income Tax Exemption For High Earners In Cyprus

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

Check more sample of Income Tax Exemption For Home Loan 2022 23 below

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

We Got 12A Exemption Registration Under Income Tax

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

Income Tax Exemption For Home Buyers No Tax On Making New House

Zenman1550 On Twitter RT Safelanding Herschel Walker Georgia

Income Tax Calculation Example 2 For Salary Employees 2023 24

https://www.livemint.com/money/personal-finance/...

New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special benefit announced

https://www.livemint.com/money/personal-finance/...

How to claim income tax benefits on home loans in FY23 4 min read 20 Mar 2023 06 18 PM IST Vipul Das A Home Loan is a financial source for your dream come true along with making a

New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special benefit announced

How to claim income tax benefits on home loans in FY23 4 min read 20 Mar 2023 06 18 PM IST Vipul Das A Home Loan is a financial source for your dream come true along with making a

Income Tax Exemption For Home Buyers No Tax On Making New House

We Got 12A Exemption Registration Under Income Tax

Zenman1550 On Twitter RT Safelanding Herschel Walker Georgia

Income Tax Calculation Example 2 For Salary Employees 2023 24

Life Insurance Income Tax Exemption IndiaFilings

Herschel Walker Georgia Senate Candidate Gets Tax Exemption For Home

Herschel Walker Georgia Senate Candidate Gets Tax Exemption For Home

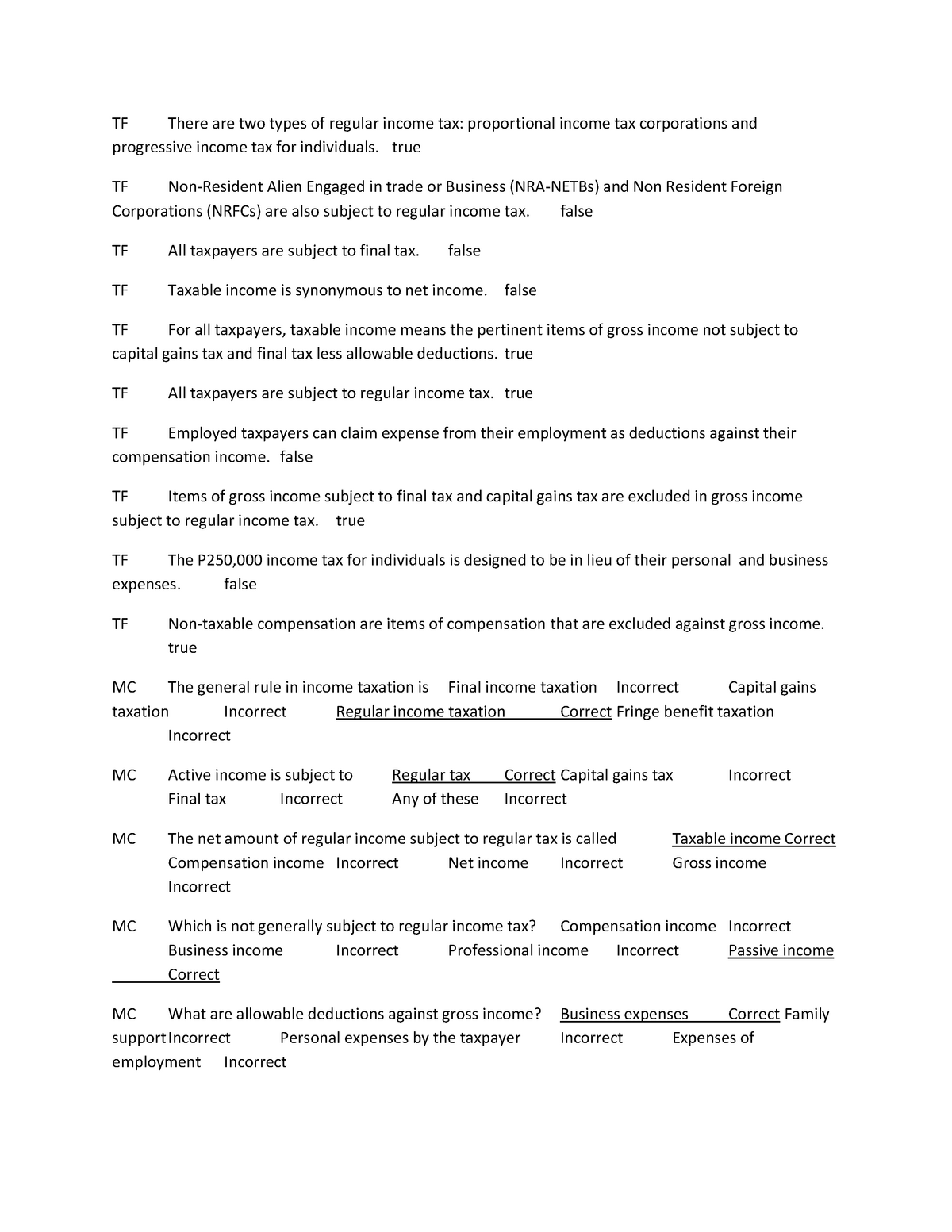

Introduction Of Income Taxation TF There Are Two Types Of Regular