In this digital age, where screens dominate our lives, the charm of tangible printed materials hasn't faded away. If it's to aid in education and creative work, or simply adding a personal touch to your area, Income Tax Exemption For Gpf have become an invaluable source. With this guide, you'll dive into the world "Income Tax Exemption For Gpf," exploring what they are, where to locate them, and what they can do to improve different aspects of your lives.

Get Latest Income Tax Exemption For Gpf Below

Income Tax Exemption For Gpf

Income Tax Exemption For Gpf -

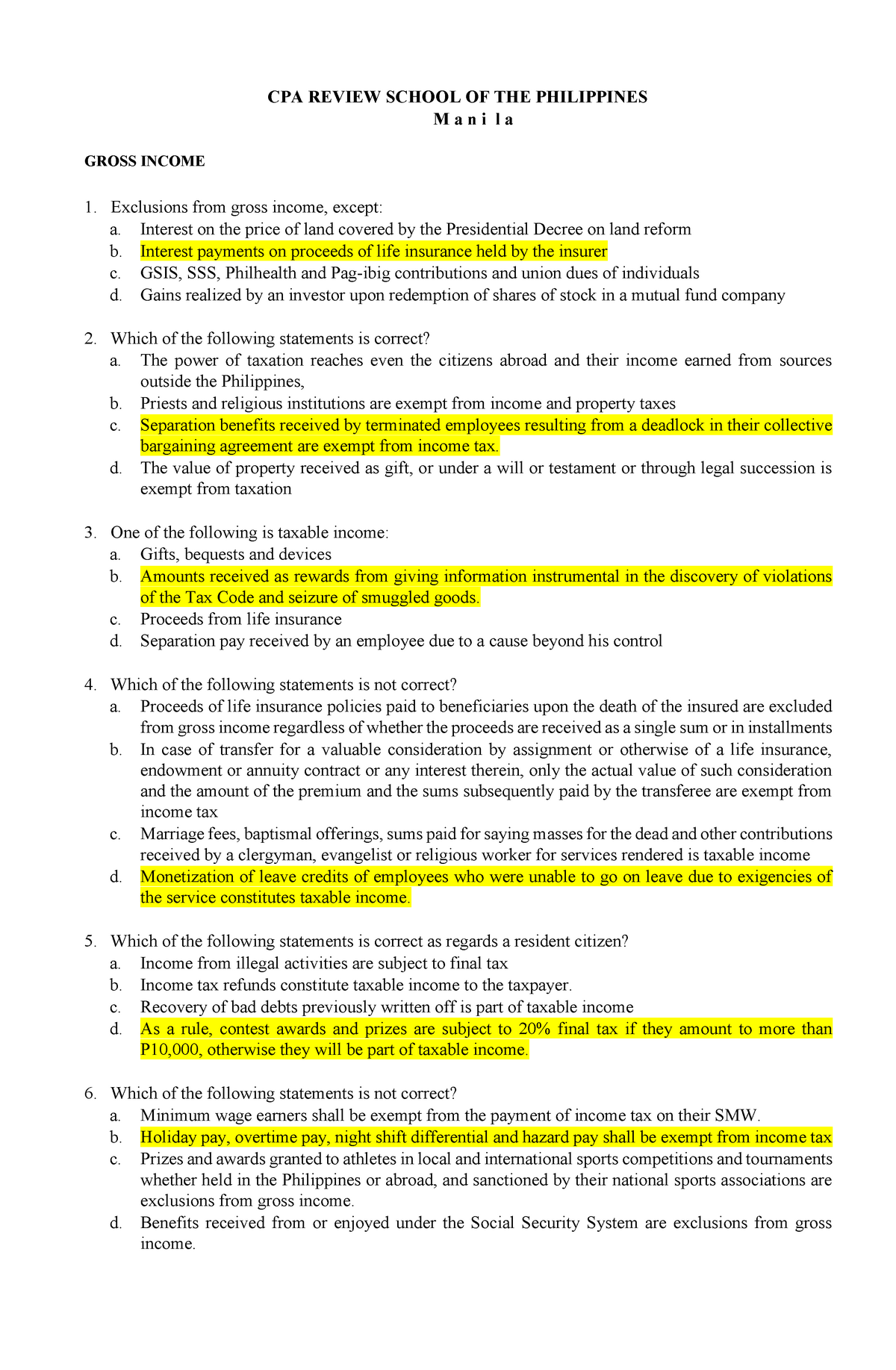

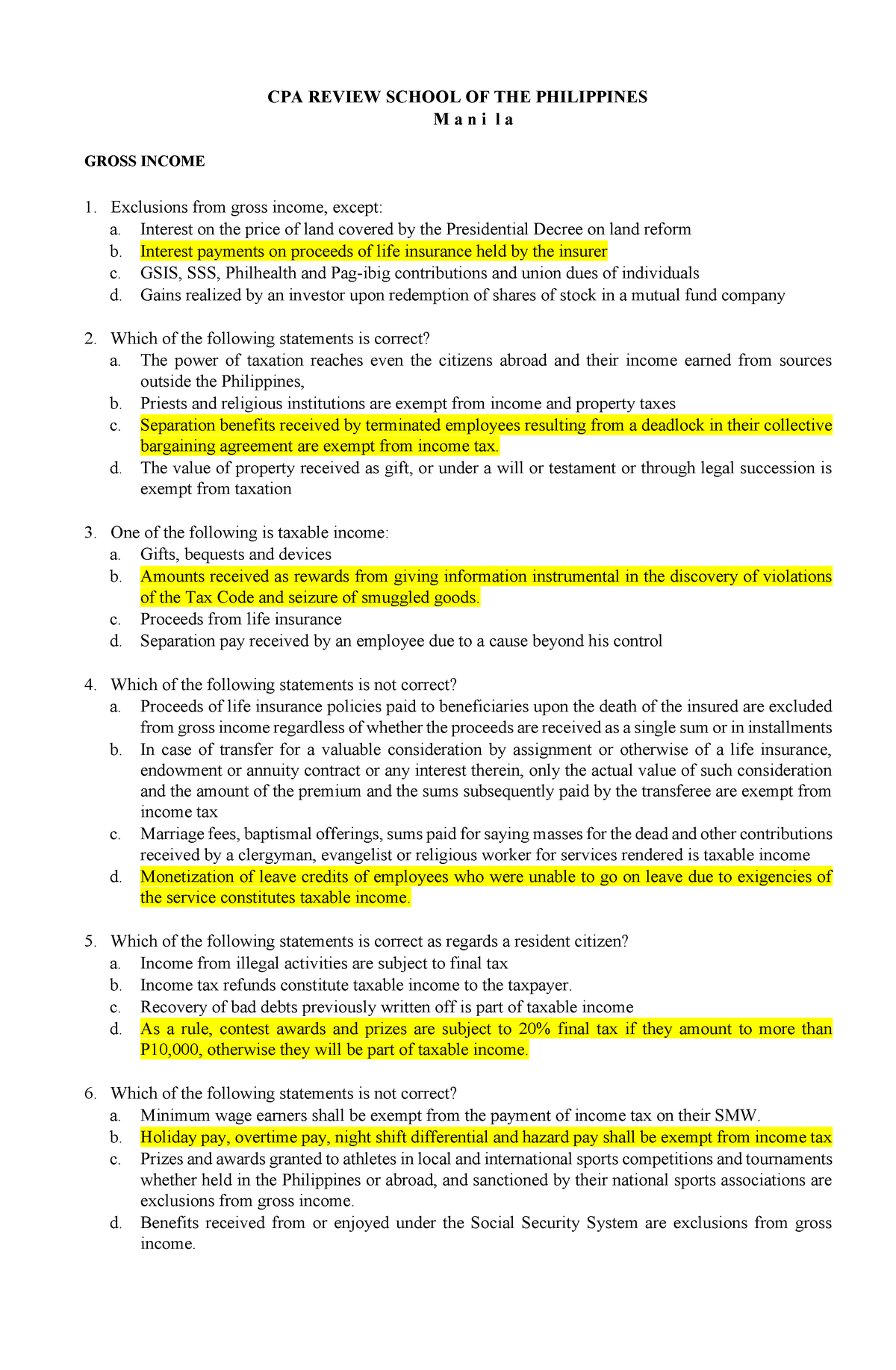

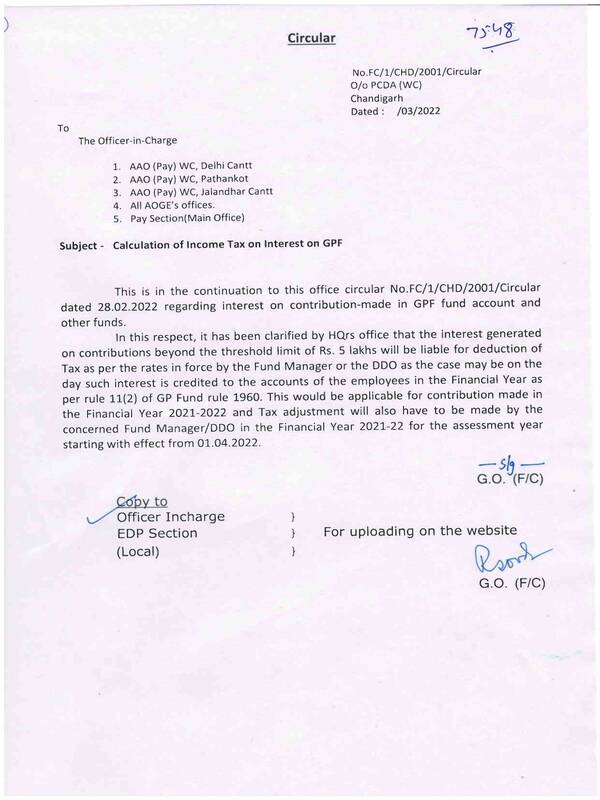

Income Tax Exemption Limit on GPF and all provident funds increased to Rs 5 Lakh Notification issued Earlier exemption limit was fixed at Rs 2 5 lakh Contribution to GPF and other provident funds over and above Rs 5 Lakh will attract income tax

After rationalization of provident fund announced in budget 2021 the Central Board of Direct Taxes CBDT has inserted rule 9D of Income Tax Rules 1962 in FY22 Under this rule each EPFO

Printables for free cover a broad array of printable content that can be downloaded from the internet at no cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and many more. The attraction of printables that are free is their flexibility and accessibility.

More of Income Tax Exemption For Gpf

Income Tax Rules For General Provident Fund GPF 2022 Academy Tax4wealth

Income Tax Rules For General Provident Fund GPF 2022 Academy Tax4wealth

New Income Tax Rule at The GPF The CBDT has notified that corporations want to preserve separate PF accounts One of the accounts can be for taxable contributions at the same time as the opposite can be for non taxable contributions beginning 1st April 2021

Taxable accounts are those for which tax on EPF interest is applicable since the contributions exceed the thresholds limits EPF contributions exceed Rs 2 5 lakh and employer s contributions to PF account exceed Rs 7 5 lakh

Income Tax Exemption For Gpf have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

customization: There is the possibility of tailoring the templates to meet your individual needs for invitations, whether that's creating them planning your schedule or decorating your home.

-

Educational Value: Printables for education that are free can be used by students from all ages, making them a valuable instrument for parents and teachers.

-

Affordability: The instant accessibility to numerous designs and templates is time-saving and saves effort.

Where to Find more Income Tax Exemption For Gpf

50 Income Tax Exemption For High Earners In Cyprus

50 Income Tax Exemption For High Earners In Cyprus

The Finance Ministry said that tax on interest pertaining to contribution towards Employees Provident Fund EPF or General Provident Fund GPF exceeding 2 5 lakh will not be retrospective

Come April 1 2022 the interest earned on the general provident fund balance will not remain exempted from tax Union Finance Minister Nirmala Sitharaman had in her Budget 2021 speech proposed taxability of interest on general provident fund GPF in case the amount exceeds the threshold limit

Since we've got your curiosity about Income Tax Exemption For Gpf we'll explore the places you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Income Tax Exemption For Gpf to suit a variety of goals.

- Explore categories such as the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets with flashcards and other teaching tools.

- The perfect resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- These blogs cover a wide selection of subjects, from DIY projects to party planning.

Maximizing Income Tax Exemption For Gpf

Here are some creative ways create the maximum value use of Income Tax Exemption For Gpf:

1. Home Decor

- Print and frame beautiful art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print worksheets that are free to reinforce learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Exemption For Gpf are an abundance of creative and practical resources designed to meet a range of needs and interests. Their accessibility and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the many options of Income Tax Exemption For Gpf now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Exemption For Gpf really cost-free?

- Yes you can! You can download and print these tools for free.

-

Do I have the right to use free printouts for commercial usage?

- It's determined by the specific usage guidelines. Always check the creator's guidelines before using any printables on commercial projects.

-

Are there any copyright problems with Income Tax Exemption For Gpf?

- Some printables may have restrictions in their usage. Make sure you read the terms of service and conditions provided by the creator.

-

How do I print Income Tax Exemption For Gpf?

- Print them at home with the printer, or go to an area print shop for more high-quality prints.

-

What software do I need to run printables free of charge?

- Most printables come in PDF format. These is open with no cost software, such as Adobe Reader.

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

NJ Division Of Taxation Income Tax Exemption For Veterans Income

Check more sample of Income Tax Exemption For Gpf below

We Got 12A Exemption Registration Under Income Tax

Income Tax Exemption For Veterans PSA YouTube

We Got 12A Exemption Registration Under Income Tax

Income Tax Slab For The A Y 2024 25

Checklist Of Income Tax Exemption For Start Up

House Of Representatives Files Bill Of Tax Exemption For Senior

https://www.livemint.com/money/personal-finance/...

After rationalization of provident fund announced in budget 2021 the Central Board of Direct Taxes CBDT has inserted rule 9D of Income Tax Rules 1962 in FY22 Under this rule each EPFO

https://cleartax.in/s/tax-on-pf-provident-fund

Various types of provident funds like GPF Recognised Provident Fund Unrecognised PF and PPF have different tax implications EPF contributions vary based on salary with rates like 12 employee contribution

After rationalization of provident fund announced in budget 2021 the Central Board of Direct Taxes CBDT has inserted rule 9D of Income Tax Rules 1962 in FY22 Under this rule each EPFO

Various types of provident funds like GPF Recognised Provident Fund Unrecognised PF and PPF have different tax implications EPF contributions vary based on salary with rates like 12 employee contribution

Income Tax Slab For The A Y 2024 25

Income Tax Exemption For Veterans PSA YouTube

Checklist Of Income Tax Exemption For Start Up

House Of Representatives Files Bill Of Tax Exemption For Senior

Income Generated On The General Provident Fund GPF By Both Government

Life Insurance Income Tax Exemption IndiaFilings

Life Insurance Income Tax Exemption IndiaFilings

Calculation Of Income Tax On Interest On GPF Central Government Staff