In the digital age, in which screens are the norm however, the attraction of tangible printed objects hasn't waned. In the case of educational materials, creative projects, or simply adding the personal touch to your space, Income Tax Exemption For Disability Pension have proven to be a valuable source. Through this post, we'll dive into the world of "Income Tax Exemption For Disability Pension," exploring the different types of printables, where they are, and how they can be used to enhance different aspects of your daily life.

Get Latest Income Tax Exemption For Disability Pension Below

Income Tax Exemption For Disability Pension

Income Tax Exemption For Disability Pension -

Verkko How to get a tax free government pension or benefit if you have a disability or care for someone with a disability Income tax is not paid on certain tax free government

Verkko Disability Pensions If you retired on disability you must include in income any disability pension you receive under a plan that is paid for by your employer You

Income Tax Exemption For Disability Pension offer a wide collection of printable material that is available online at no cost. These materials come in a variety of forms, including worksheets, coloring pages, templates and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Income Tax Exemption For Disability Pension

KRA Tax Exemption For Imports And Income Explained Persons With

KRA Tax Exemption For Imports And Income Explained Persons With

Verkko 20 kes 228 k 2023 nbsp 0183 32 A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim

Verkko Disability pension payments Section 641 ITEPA 2003 Specified disability pensions and awards are exempt from Income Tax They are paid tax free whether the

Income Tax Exemption For Disability Pension have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Personalization You can tailor the templates to meet your individual needs in designing invitations making your schedule, or decorating your home.

-

Educational Impact: Printing educational materials for no cost offer a wide range of educational content for learners of all ages. This makes these printables a powerful aid for parents as well as educators.

-

Accessibility: Fast access the vast array of design and templates will save you time and effort.

Where to Find more Income Tax Exemption For Disability Pension

Section 80U Tax Deductions For Disabled Individuals Tax2win

Section 80U Tax Deductions For Disabled Individuals Tax2win

Verkko 15 elok 2022 nbsp 0183 32 The Income Tax Law provides an opportunity to any taxpayer under section 119 2 b to claim the refund of TDS exemption deduction or any other

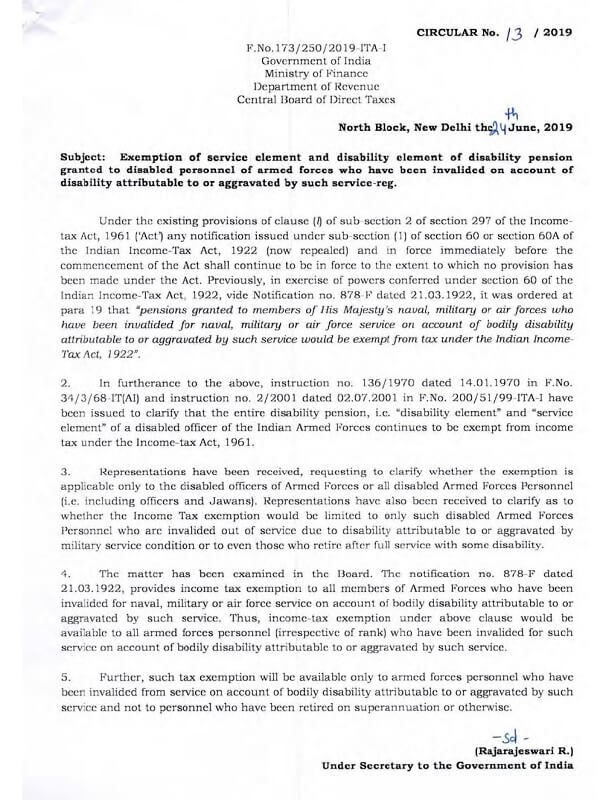

Verkko 24 hein 228 k 2023 nbsp 0183 32 The matter has been re examined in the Board and it has been decided to reiterate that the entire disability pension i e disability element and service

We hope we've stimulated your interest in Income Tax Exemption For Disability Pension, let's explore where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection in Income Tax Exemption For Disability Pension for different objectives.

- Explore categories such as design, home decor, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- Ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs covered cover a wide range of topics, everything from DIY projects to planning a party.

Maximizing Income Tax Exemption For Disability Pension

Here are some creative ways how you could make the most use of Income Tax Exemption For Disability Pension:

1. Home Decor

- Print and frame gorgeous art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Income Tax Exemption For Disability Pension are a treasure trove of creative and practical resources that satisfy a wide range of requirements and interests. Their accessibility and flexibility make them an invaluable addition to the professional and personal lives of both. Explore the many options of Income Tax Exemption For Disability Pension now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes, they are! You can print and download these resources at no cost.

-

Do I have the right to use free printables for commercial purposes?

- It's based on the usage guidelines. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may contain restrictions regarding their use. Make sure to read the terms and condition of use as provided by the author.

-

How can I print printables for free?

- You can print them at home with any printer or head to a local print shop to purchase top quality prints.

-

What program is required to open Income Tax Exemption For Disability Pension?

- Most printables come in the PDF format, and can be opened with free programs like Adobe Reader.

IT Circular 13 2019 Exemption Of Service Element And Disability

How To Calculate Exemption On Pension Income

Check more sample of Income Tax Exemption For Disability Pension below

CBDT Circular On Exemption Of Disability Pension For Armed Forces Personnel

Income Profession Tax Benefits For Disabled Handicapped Persons

CBDT Notifies Income Tax Exemption To Pension Funds Of Various Entities

Currently Income Up To Rs 3 00 000 Is Only Exempt In The Hands Of

Australia s Disability Support Pension System Explained 2022

Disability Pension For Military Personnel Taxable Unless Forced Out Of

https://www.irs.gov/publications/p907

Verkko Disability Pensions If you retired on disability you must include in income any disability pension you receive under a plan that is paid for by your employer You

https://www.nolo.com/legal-encyclopedia/are-disability-pensions...

Verkko You do not have to pay income tax on certain military and government disability pensions VA Disability Benefits You need not pay income tax on disability

Verkko Disability Pensions If you retired on disability you must include in income any disability pension you receive under a plan that is paid for by your employer You

Verkko You do not have to pay income tax on certain military and government disability pensions VA Disability Benefits You need not pay income tax on disability

Currently Income Up To Rs 3 00 000 Is Only Exempt In The Hands Of

Income Profession Tax Benefits For Disabled Handicapped Persons

Australia s Disability Support Pension System Explained 2022

Disability Pension For Military Personnel Taxable Unless Forced Out Of

Income Tax Rules For Senior Citizens Income Tax Exemption For Senior

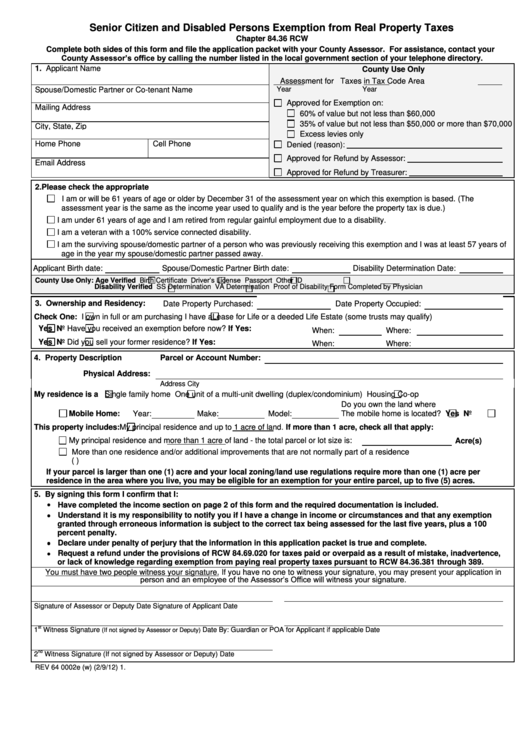

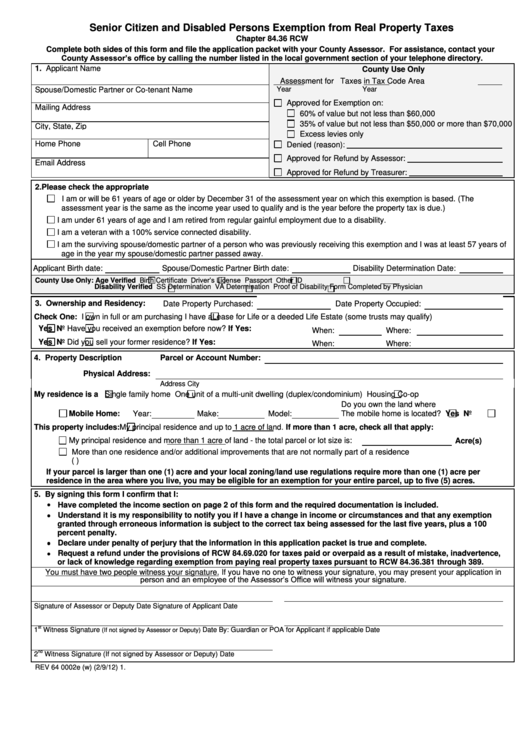

Fillable Form Rev 64 0002e Senior Citizen And Disabled Persons

Fillable Form Rev 64 0002e Senior Citizen And Disabled Persons

Disability Support Pension What Is It And How To Get It Homage