In the age of digital, when screens dominate our lives however, the attraction of tangible printed products hasn't decreased. Be it for educational use project ideas, artistic or just adding an element of personalization to your space, Income Tax Exemption Education Loan Under Section 80e have become an invaluable resource. With this guide, you'll dive into the sphere of "Income Tax Exemption Education Loan Under Section 80e," exploring the benefits of them, where they can be found, and the ways that they can benefit different aspects of your life.

Get Latest Income Tax Exemption Education Loan Under Section 80e Below

Income Tax Exemption Education Loan Under Section 80e

Income Tax Exemption Education Loan Under Section 80e -

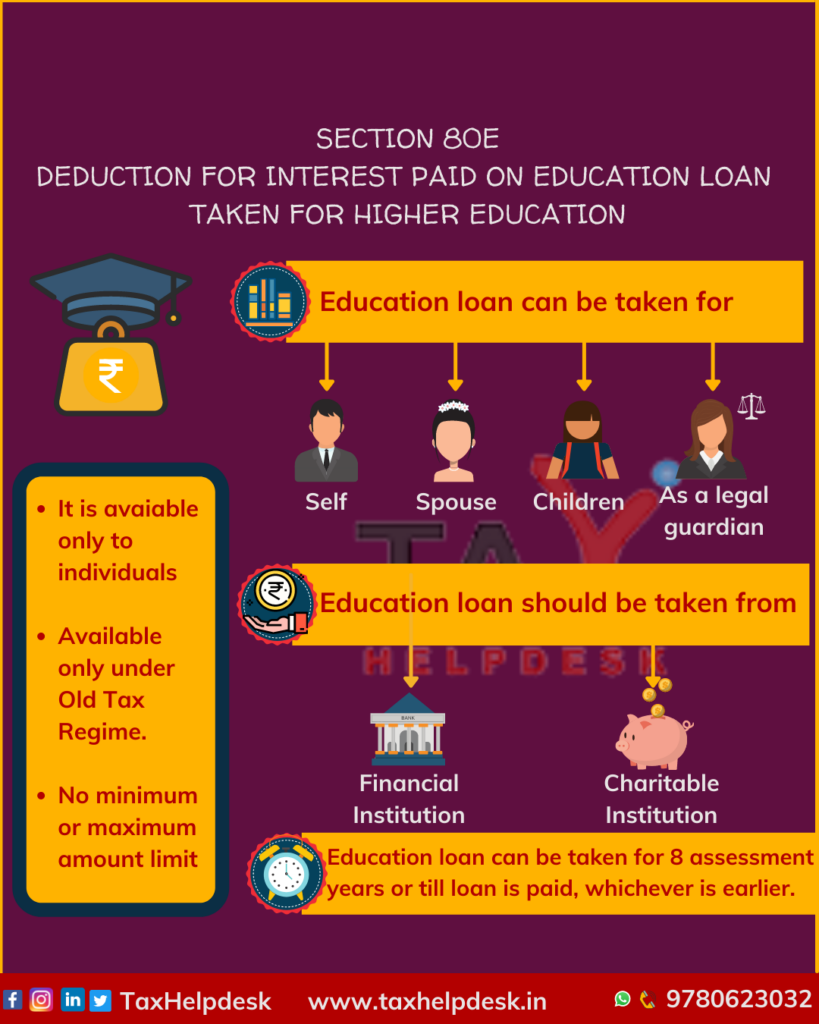

The provisions of Section 80E of the Income Tax Act 1961 specifically cater to educational loans This section offers deductions that apply to the interest component of these loans Moreover these deductions can only be claimed by individuals once repayment for a said loan has started

Contents What is section 80E of income tax Who can claim tax benefits on interest paid on an education loan What is the

Income Tax Exemption Education Loan Under Section 80e include a broad variety of printable, downloadable materials online, at no cost. These resources come in various designs, including worksheets templates, coloring pages, and much more. The benefit of Income Tax Exemption Education Loan Under Section 80e lies in their versatility and accessibility.

More of Income Tax Exemption Education Loan Under Section 80e

Education Loan Jharkhand Student Guruji Credit Card Scheme 2023 Apply

Education Loan Jharkhand Student Guruji Credit Card Scheme 2023 Apply

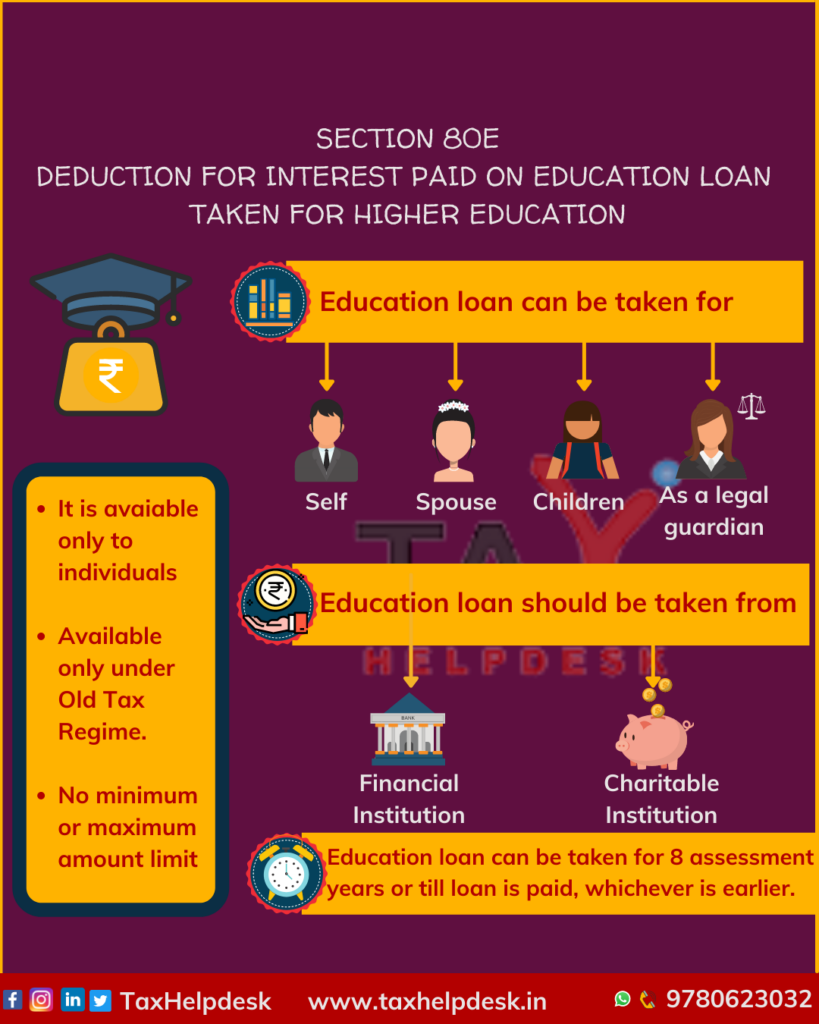

Section 80E Deduction for educational loan available only to Individual not to HUF or other type of Assessee 2 Deduction amount under Section 80E The amount of interest paid is eligible for deduction and moreover there is no cap on the amount to be deducted You can deduct the entire interest amount from your taxable income

Section 80E provides deduction towards interest paid on educational loan taken for the higher education of either the assessee himself or for the higher education of the spouse or the children 2 What is the maximum limit under Section 80E There is no maximum limit under section 80E

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Modifications: It is possible to tailor printed materials to meet your requirements be it designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational value: Educational printables that can be downloaded for free can be used by students of all ages, which makes them an invaluable resource for educators and parents.

-

The convenience of You have instant access a plethora of designs and templates is time-saving and saves effort.

Where to Find more Income Tax Exemption Education Loan Under Section 80e

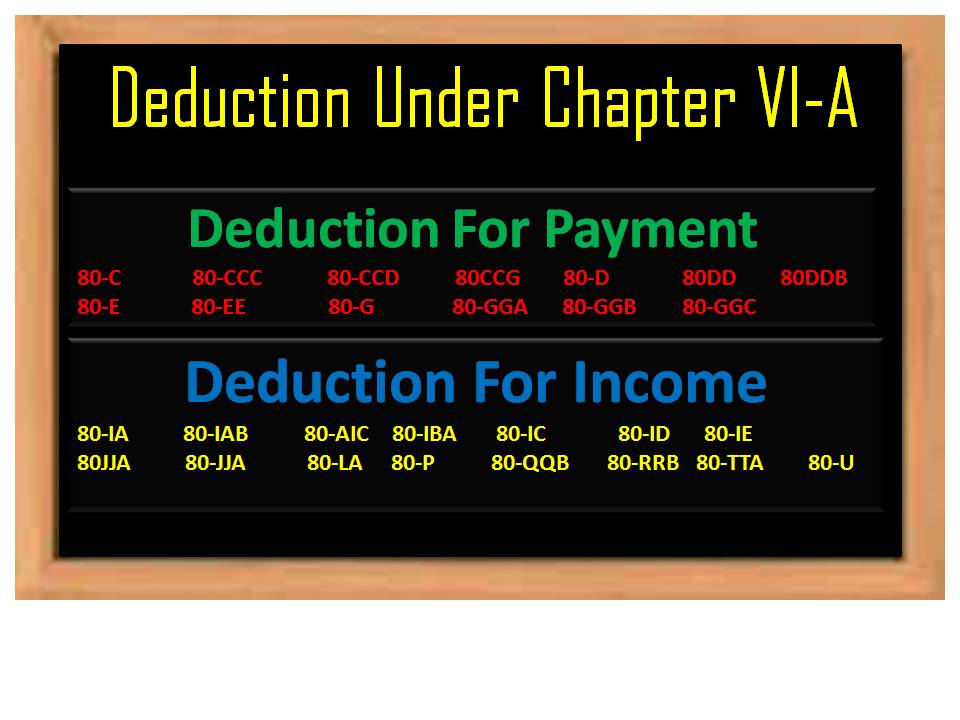

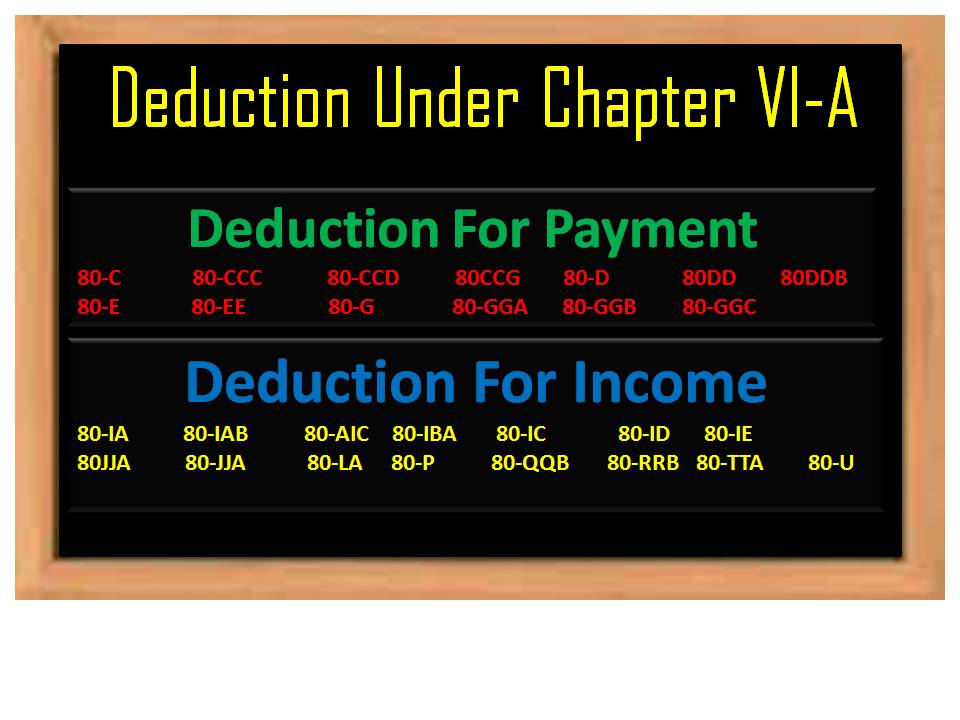

Deduction Under Chapter 6A Of Income Tax Act Loan Deduction Under

Deduction Under Chapter 6A Of Income Tax Act Loan Deduction Under

Section 80E of the Income Tax Act 1961 is a provision designed to provide relief to individuals repaying education loans This section allows for the deduction of the entire interest paid on the loan from the total taxable income providing significant financial relief to taxpayers

Section 80E of the Income Tax Act is a tax saving provision that provides tax deductions to individuals who have taken education loans to pursue their higher studies Hence the 80E deduction has the dual benefit of helping pay for education while saving money on taxes

Now that we've ignited your interest in printables for free, let's explore where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of purposes.

- Explore categories like design, home decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- The blogs are a vast spectrum of interests, everything from DIY projects to planning a party.

Maximizing Income Tax Exemption Education Loan Under Section 80e

Here are some fresh ways to make the most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Exemption Education Loan Under Section 80e are a treasure trove of creative and practical resources that can meet the needs of a variety of people and desires. Their accessibility and versatility make them a great addition to your professional and personal life. Explore the many options of Income Tax Exemption Education Loan Under Section 80e today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I make use of free printables in commercial projects?

- It is contingent on the specific rules of usage. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables might have limitations regarding usage. You should read the terms and conditions offered by the designer.

-

How do I print Income Tax Exemption Education Loan Under Section 80e?

- You can print them at home using an printer, or go to a print shop in your area for premium prints.

-

What software do I need to run printables for free?

- The majority of printables are as PDF files, which is open with no cost programs like Adobe Reader.

Education Loan Interest Benefit In Income Tax L Section 80E I L

Section 80E Benefits Of Eduction Loan Interest On Education Loan

Check more sample of Income Tax Exemption Education Loan Under Section 80e below

Deduction Under Section 80E Interest Paid On Higher Education

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

Understanding Section 80E And Its Importance For Education Loan

Australian National University Kaaiser Australian Education

Deduction Under Section 80E Interest Paid On Higher Education

80E Tax

https://tax2win.in/guide/sec-80e-deducti…

Contents What is section 80E of income tax Who can claim tax benefits on interest paid on an education loan What is the

https://www.etmoney.com/learn/income-tax/education...

Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is available for a maximum of 8 years or till the interest is repaid whichever is earlier

Contents What is section 80E of income tax Who can claim tax benefits on interest paid on an education loan What is the

Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is available for a maximum of 8 years or till the interest is repaid whichever is earlier

Australian National University Kaaiser Australian Education

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

Deduction Under Section 80E Interest Paid On Higher Education

80E Tax

HDFC Credila Education Loan Student Loan For Higher Education

Deduction Under Chapter VI A Tax Planning With Tax Savings

Deduction Under Chapter VI A Tax Planning With Tax Savings

Tax Exemption 80G Certificate