In the digital age, in which screens are the norm The appeal of tangible printed materials hasn't faded away. For educational purposes for creative projects, simply adding the personal touch to your home, printables for free can be an excellent source. The following article is a take a dive into the world "Income Tax Deduction On Home Loan Interest 80eea," exploring what they are, where they can be found, and ways they can help you improve many aspects of your life.

Get Latest Income Tax Deduction On Home Loan Interest 80eea Below

Income Tax Deduction On Home Loan Interest 80eea

Income Tax Deduction On Home Loan Interest 80eea -

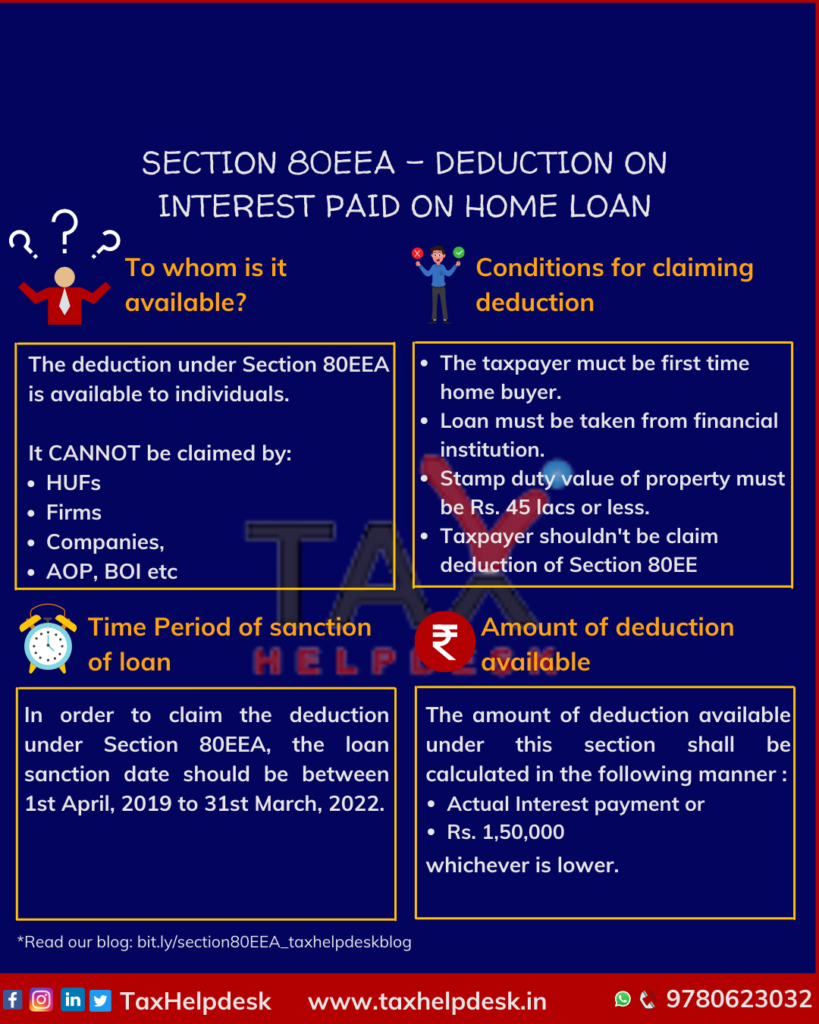

Section 80EE and Section 80EEA provide valuable income tax deductions on home loan interest payments By understanding the eligibility criteria claiming procedures and maximum deduction amounts individuals can optimize their tax savings

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is up to Rs 50 000 per financial year Taxpayers can claim 80EE if they had serviced a home loan between 1 April 2016 to 31 March 2017

Income Tax Deduction On Home Loan Interest 80eea provide a diverse collection of printable materials available online at no cost. These resources come in various forms, like worksheets templates, coloring pages and much more. The beauty of Income Tax Deduction On Home Loan Interest 80eea is in their variety and accessibility.

More of Income Tax Deduction On Home Loan Interest 80eea

Income Tax Deduction Of Rs 5 Lakh On Home Loan Interest 2022 Budget

Income Tax Deduction Of Rs 5 Lakh On Home Loan Interest 2022 Budget

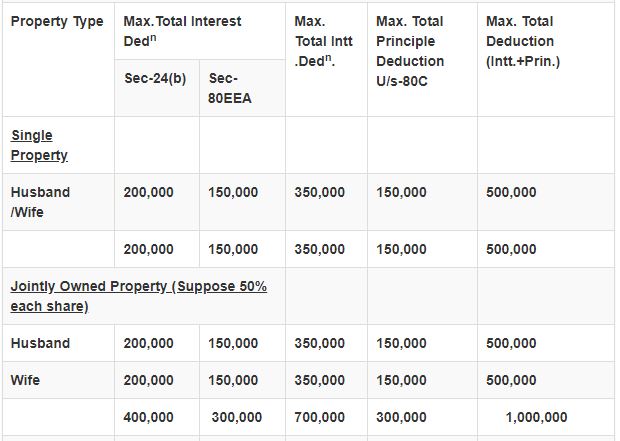

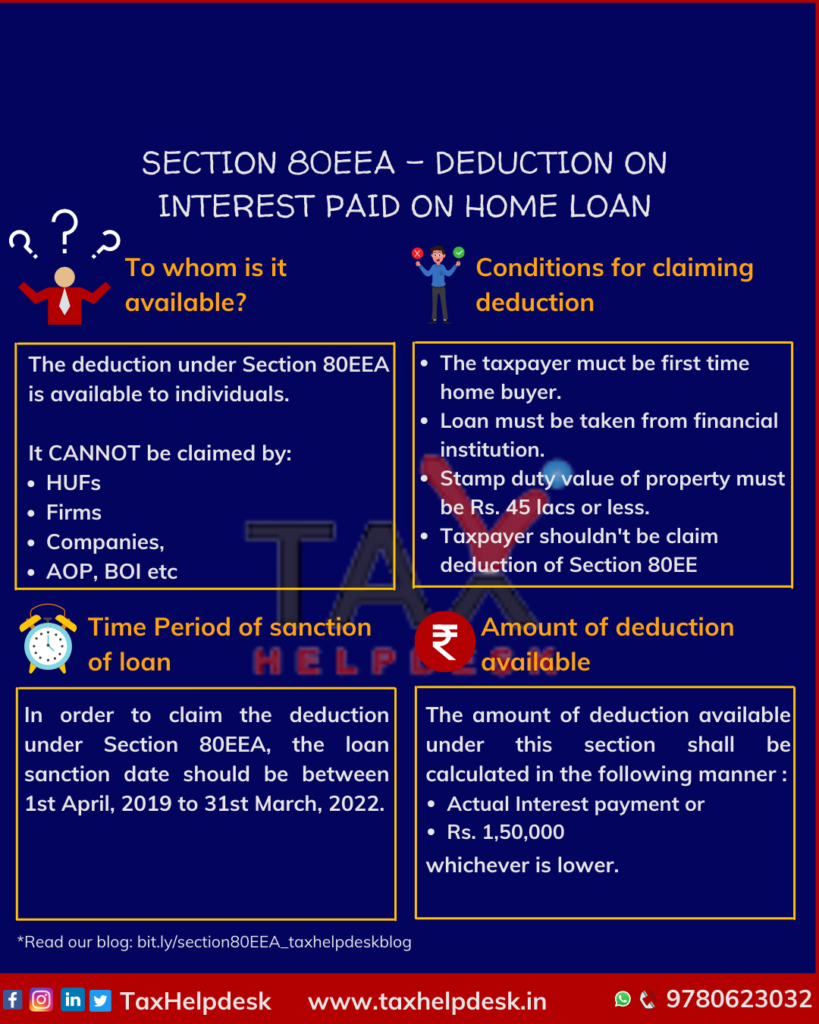

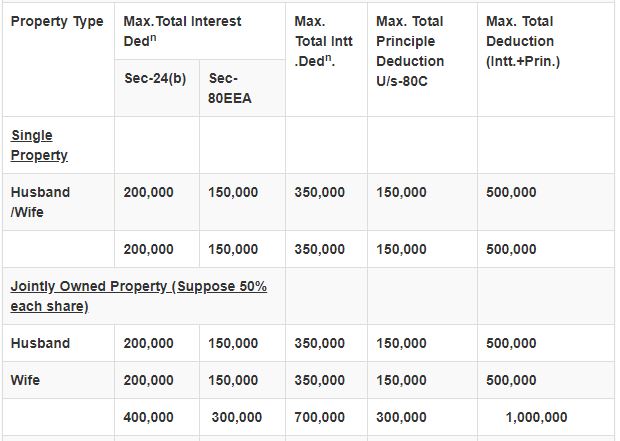

The Indian Income Tax Act provides a tax deduction of up to Rs 1 5 lakhs per financial year for interest paid on home loans taken for purchasing or constructing an affordable house This deduction is available under Section 80EEA of the Income Tax Act and is in addition to the existing tax benefits available under Section 80C and Section 24

This announcement brought the introduction of section 80EEA which allows a tax benefit of additional deduction on home loan interest from FY 2019 20 onwards for first time home buyers Under Section 80EEA deduction can be claimed on payment of interest on a Loan sanctioned between 01 04 2019 to 31 03 2022

Income Tax Deduction On Home Loan Interest 80eea have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization: There is the possibility of tailoring the templates to meet your individual needs whether you're designing invitations as well as organizing your calendar, or even decorating your house.

-

Education Value Education-related printables at no charge can be used by students of all ages. This makes them a useful source for educators and parents.

-

Easy to use: Instant access to the vast array of design and templates saves time and effort.

Where to Find more Income Tax Deduction On Home Loan Interest 80eea

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh tax deductions on home loan interest payment Benefits of this provision are applicable only only housing loans sanctioned between between 1 April 2019 and 31 March 2022

Amount Limit This deduction is up to Rs 50 000 per financial year of the interest component of your Home Loan This deduction is over the 2 Lakh limit that comes under Section 24 of the Income Tax Act Eligibility This deduction is only available to individuals Entities like companies HUF or AOP cannot claim the benefits under Section 80EE

After we've peaked your interest in printables for free Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Income Tax Deduction On Home Loan Interest 80eea suitable for many motives.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- The blogs covered cover a wide array of topics, ranging including DIY projects to party planning.

Maximizing Income Tax Deduction On Home Loan Interest 80eea

Here are some new ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Utilize free printable worksheets to enhance learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Deduction On Home Loan Interest 80eea are an abundance of fun and practical tools designed to meet a range of needs and needs and. Their availability and versatility make they a beneficial addition to both professional and personal lives. Explore the wide world of Income Tax Deduction On Home Loan Interest 80eea today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes they are! You can print and download these tools for free.

-

Can I download free printouts for commercial usage?

- It's dependent on the particular terms of use. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues when you download Income Tax Deduction On Home Loan Interest 80eea?

- Certain printables could be restricted in their usage. Be sure to read the terms and regulations provided by the author.

-

How can I print Income Tax Deduction On Home Loan Interest 80eea?

- Print them at home using either a printer at home or in a local print shop for more high-quality prints.

-

What software do I require to open printables at no cost?

- The majority of printed documents are in the format PDF. This is open with no cost software like Adobe Reader.

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Under construction House How To Claim Tax Deduction On Home Loan

Check more sample of Income Tax Deduction On Home Loan Interest 80eea below

Section 80EEA Deduction Of Housing Loan Interest Home Loan Interest

Section 80EEA Claim Deduction For The Interest Paid On Housing Loan

Section 80EEA All You Need To Know About Deduction For Interest Paid

Section 80EE Of Income Tax Act Deduction On Home Loan

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is up to Rs 50 000 per financial year Taxpayers can claim 80EE if they had serviced a home loan between 1 April 2016 to 31 March 2017

https://tax2win.in/guide/section-80eea-deduction-for-affordable-housing

Discover Section 80EEA of the Income Tax Act which provides deductions for interest paid on a home loan Explore the eligibility criteria maximum deduction limits and conditions for claiming this tax benefit

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is up to Rs 50 000 per financial year Taxpayers can claim 80EE if they had serviced a home loan between 1 April 2016 to 31 March 2017

Discover Section 80EEA of the Income Tax Act which provides deductions for interest paid on a home loan Explore the eligibility criteria maximum deduction limits and conditions for claiming this tax benefit

Section 80EE Of Income Tax Act Deduction On Home Loan

Section 80EEA Claim Deduction For The Interest Paid On Housing Loan

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

REVISED HOME LOAN BENEFITS U S 80EEA Deduction On Interest For Housing

Stamp Duty Exemption 2019 Warren Churchill

Stamp Duty Exemption 2019 Warren Churchill

Section 80EE Income Tax Deduction On Home Loan Interest