In the age of digital, with screens dominating our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons, creative projects, or simply to add personal touches to your space, Income Tax Deduction For Medical Treatment Of Spouse have proven to be a valuable source. With this guide, you'll take a dive into the world of "Income Tax Deduction For Medical Treatment Of Spouse," exploring what they are, where you can find them, and the ways that they can benefit different aspects of your lives.

Get Latest Income Tax Deduction For Medical Treatment Of Spouse Below

Income Tax Deduction For Medical Treatment Of Spouse

Income Tax Deduction For Medical Treatment Of Spouse -

Section 80DDB provides for a deduction to Individuals and HUFs for medical expenses incurred for treatment of specified diseases or ailments and should be deducted from the Gross Total Income while

A complete medical examination for tax relief purposes refers to a thorough examination as defined by the MMC For this medical expense you can claim up to

Income Tax Deduction For Medical Treatment Of Spouse include a broad array of printable items that are available online at no cost. These materials come in a variety of designs, including worksheets coloring pages, templates and more. One of the advantages of Income Tax Deduction For Medical Treatment Of Spouse lies in their versatility as well as accessibility.

More of Income Tax Deduction For Medical Treatment Of Spouse

Income Tax Deduction For Medical Expenses IndiaFilings

Income Tax Deduction For Medical Expenses IndiaFilings

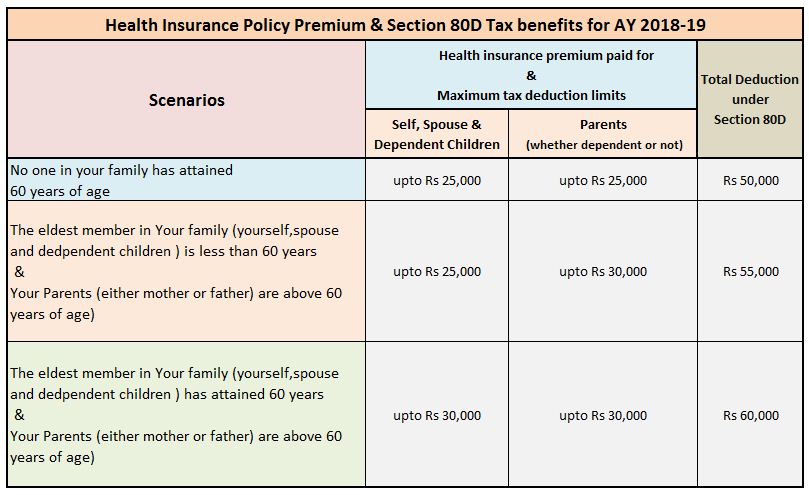

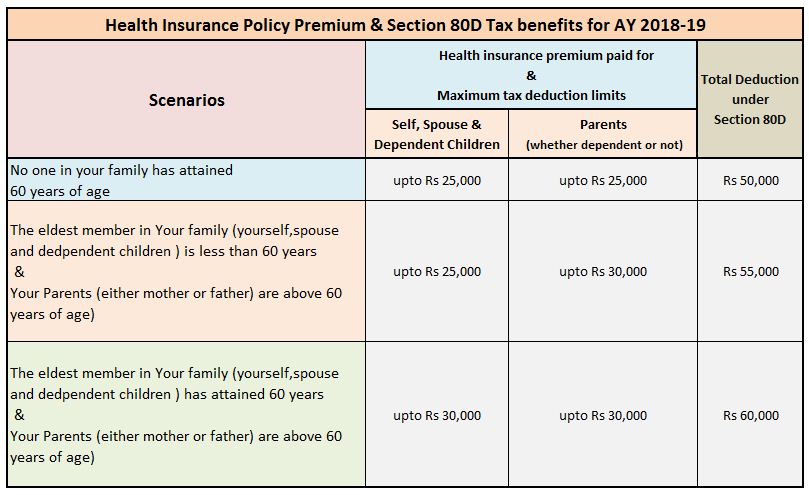

Tax Deduction The Income Tax Act provides a tax deduction under Section 80D for expenses incurred on preventive health check ups Taxpayers can claim up to 5 000 per financial year for

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat

Income Tax Deduction For Medical Treatment Of Spouse have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization: They can make printing templates to your own specific requirements be it designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Use: Printables for education that are free are designed to appeal to students of all ages, making these printables a powerful source for educators and parents.

-

Accessibility: Access to a plethora of designs and templates reduces time and effort.

Where to Find more Income Tax Deduction For Medical Treatment Of Spouse

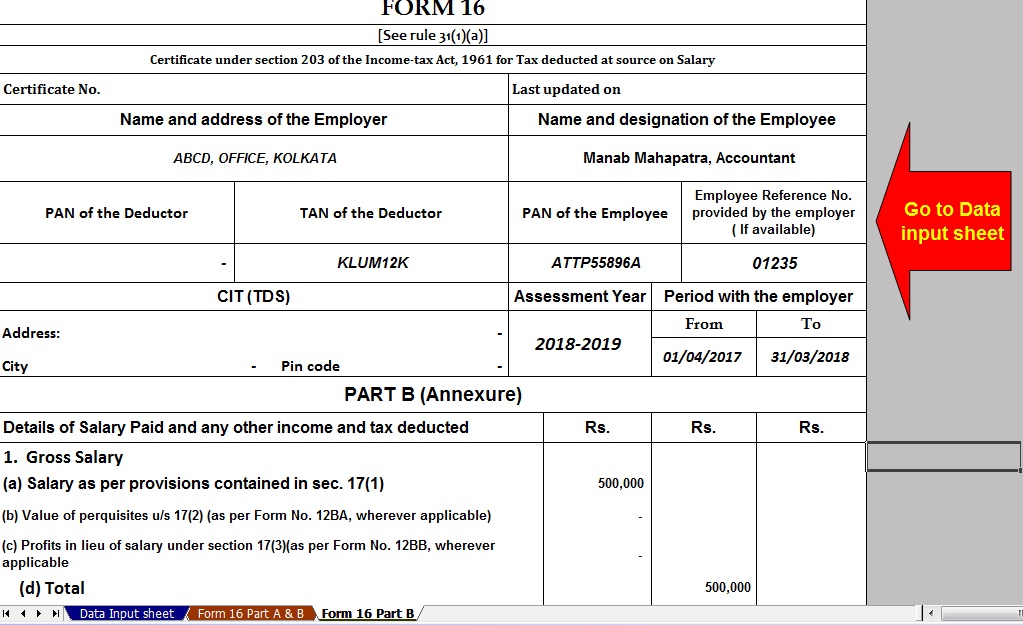

Income Tax Deduction For Medical Treatment With Automated TDS On

Income Tax Deduction For Medical Treatment With Automated TDS On

Section 80D of the IT Act allows a deduction of up to 5 000 in respect of payment made towards preventive health check up of self spouse dependent children

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental

Now that we've piqued your interest in Income Tax Deduction For Medical Treatment Of Spouse Let's take a look at where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Income Tax Deduction For Medical Treatment Of Spouse designed for a variety applications.

- Explore categories such as decoration for your home, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- These blogs cover a broad range of interests, that range from DIY projects to planning a party.

Maximizing Income Tax Deduction For Medical Treatment Of Spouse

Here are some new ways that you can make use use of Income Tax Deduction For Medical Treatment Of Spouse:

1. Home Decor

- Print and frame beautiful artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use free printable worksheets for teaching at-home and in class.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Deduction For Medical Treatment Of Spouse are a treasure trove of fun and practical tools that satisfy a wide range of requirements and desires. Their accessibility and versatility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the wide world of Income Tax Deduction For Medical Treatment Of Spouse right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes you can! You can download and print these documents for free.

-

Can I make use of free printables to make commercial products?

- It's contingent upon the specific terms of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using Income Tax Deduction For Medical Treatment Of Spouse?

- Certain printables might have limitations concerning their use. Be sure to check the terms and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home with your printer or visit an in-store print shop to get top quality prints.

-

What program do I need to open printables at no cost?

- The majority are printed in the format PDF. This is open with no cost software like Adobe Reader.

Income Tax Deduction For Medical Treatment IndiaFilings

Understanding 80DDB Deduction For Medical Treatment

Check more sample of Income Tax Deduction For Medical Treatment Of Spouse below

How To Calculate Adjusted Gross Income Accounting Education

Qualified Business Income Deduction And The Self Employed The CPA Journal

Medical Expense Deduction How To Claim A Tax Deduction For Medical

Income Tax Deductions List Deductions On Section 80C 80CCC 80CCD

4 Types Of Provident Fund And Tax Treatment Of Provident Fund

Claim Income Tax Deduction For Medical Treatment Of Specified Diseases

https://www.imoney.my/articles/what-can-claim-tax-relief-medical

A complete medical examination for tax relief purposes refers to a thorough examination as defined by the MMC For this medical expense you can claim up to

https://tax2win.in/guide/section-80ddb

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s

A complete medical examination for tax relief purposes refers to a thorough examination as defined by the MMC For this medical expense you can claim up to

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s

Income Tax Deductions List Deductions On Section 80C 80CCC 80CCD

Qualified Business Income Deduction And The Self Employed The CPA Journal

4 Types Of Provident Fund And Tax Treatment Of Provident Fund

Claim Income Tax Deduction For Medical Treatment Of Specified Diseases

Finance Bill 2022 Provides For Separate Income Tax Deduction For Covid

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Section 80D Deductions For Medical Health Insurance For Fy 2021 22