Today, where screens dominate our lives however, the attraction of tangible, printed materials hasn't diminished. For educational purposes, creative projects, or simply adding some personal flair to your space, Income Tax Deduction For Charitable Donations are now a vital source. This article will take a dive into the world of "Income Tax Deduction For Charitable Donations," exploring the benefits of them, where to find them, and how they can be used to enhance different aspects of your life.

Get Latest Income Tax Deduction For Charitable Donations Below

Income Tax Deduction For Charitable Donations

Income Tax Deduction For Charitable Donations -

Introduction This publication explains how individuals claim a deduction for charitable contributions It discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct

The charitable contributions deduction reduces taxable income by allowing individual taxpayers and businesses to deduct contributions of cash and property to qualified charitable

Printables for free include a vast selection of printable and downloadable materials online, at no cost. These printables come in different types, such as worksheets coloring pages, templates and much more. The great thing about Income Tax Deduction For Charitable Donations is in their versatility and accessibility.

More of Income Tax Deduction For Charitable Donations

Charitable Giving Take Advantage Of The Tax Deduction

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

Charitable contributions must be claimed as itemized deductions on Schedule A of IRS Form 1040 The 60 AGI ceiling on charitable cash contributions to qualified charities applies for tax

Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A Form 1040 For non cash contributions greater than 500 the IRS requires Form 8283 to be

Income Tax Deduction For Charitable Donations have garnered immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

The ability to customize: Your HTML0 customization options allow you to customize printing templates to your own specific requirements be it designing invitations to organize your schedule or decorating your home.

-

Educational Impact: Educational printables that can be downloaded for free can be used by students of all ages, making them an essential resource for educators and parents.

-

Convenience: instant access various designs and templates helps save time and effort.

Where to Find more Income Tax Deduction For Charitable Donations

Charitable Donations Tax Deduction Limit 2021

Charitable Donations Tax Deduction Limit 2021

If donating to a charity is part of your tax plan here are a couple of tips so you can maximize your tax deductible donation before year end Featured Partner Offers Federal Filing Fee

When you donate money or property to a qualified nonprofit organization you can deduct the value of your donation up to IRS limits from your taxable income when filing your income tax return as long as you itemize deductions The IRS provides guidelines on which organizations qualify for tax deductible contributions

We've now piqued your interest in Income Tax Deduction For Charitable Donations We'll take a look around to see where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Income Tax Deduction For Charitable Donations suitable for many objectives.

- Explore categories such as furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- The blogs are a vast array of topics, ranging everything from DIY projects to planning a party.

Maximizing Income Tax Deduction For Charitable Donations

Here are some fresh ways to make the most use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Deduction For Charitable Donations are a treasure trove with useful and creative ideas that can meet the needs of a variety of people and preferences. Their availability and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the vast world of Income Tax Deduction For Charitable Donations now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes they are! You can download and print these documents for free.

-

Can I download free printables for commercial use?

- It's dependent on the particular rules of usage. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables could have limitations on use. Make sure you read these terms and conditions as set out by the creator.

-

How do I print printables for free?

- Print them at home using a printer or visit the local print shop for top quality prints.

-

What program is required to open printables that are free?

- Most PDF-based printables are available in the format PDF. This can be opened with free software such as Adobe Reader.

How Much Do You Need To Donate For Tax Deduction

How To Get A 300 IRS Tax Deduction For Charitable Donations Money

Check more sample of Income Tax Deduction For Charitable Donations below

Charitable Donations Of Appreciated Real Estate How The Tax Code

Charitable Deductions For 2020

Section 80G Of IT Act Tax Deduction On Donations To Charity

13 Tips For Making Your Charitable Donation Tax Deductible Giving Compass

Charitable Contributions Deduction Liberalized For 2021 Corporate Tax

Special IRS Charitable Donations 300 Tax Deduction PPSC A CPA Firm

https://www.investopedia.com/terms/c/charitable...

The charitable contributions deduction reduces taxable income by allowing individual taxpayers and businesses to deduct contributions of cash and property to qualified charitable

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg?w=186)

https://www.nerdwallet.com/article/taxes/tax...

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes

The charitable contributions deduction reduces taxable income by allowing individual taxpayers and businesses to deduct contributions of cash and property to qualified charitable

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes

13 Tips For Making Your Charitable Donation Tax Deductible Giving Compass

Charitable Deductions For 2020

Charitable Contributions Deduction Liberalized For 2021 Corporate Tax

Special IRS Charitable Donations 300 Tax Deduction PPSC A CPA Firm

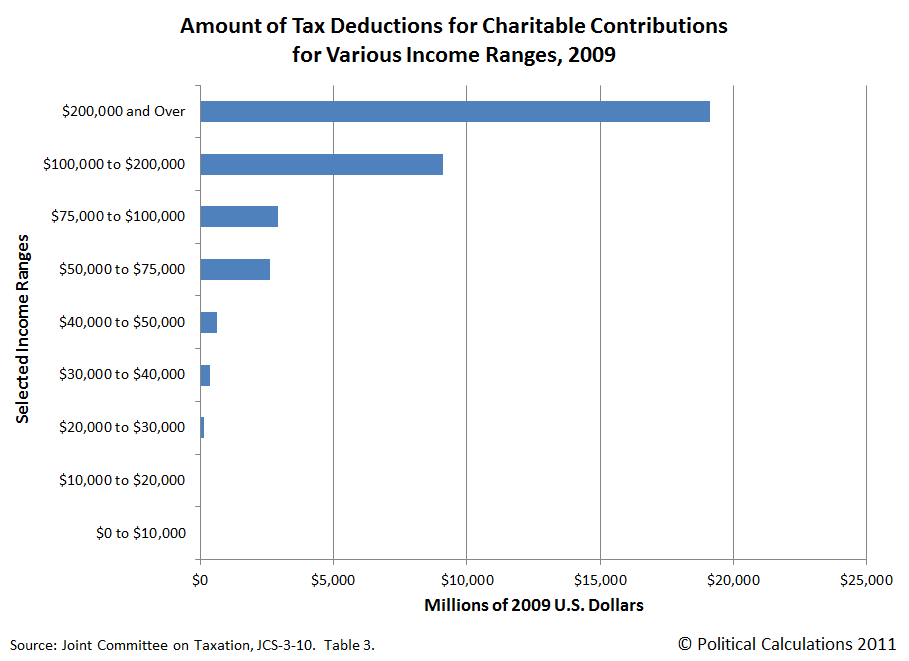

Political Calculations Tax Deductions For Charity By Income Level

How To Legally Claim A Tax Deduction For Charitable Giving From Your

How To Legally Claim A Tax Deduction For Charitable Giving From Your

Tax Deduction For Charitable Contributions AIO Financial YouTube