In the age of digital, where screens dominate our lives it's no wonder that the appeal of tangible printed material hasn't diminished. Whether it's for educational purposes in creative or artistic projects, or simply to add an individual touch to your home, printables for free can be an excellent source. The following article is a dive in the world of "Income Tax Deduction For Assessment Year 2023 24," exploring their purpose, where to find them and how they can be used to enhance different aspects of your lives.

Get Latest Income Tax Deduction For Assessment Year 2023 24 Below

Income Tax Deduction For Assessment Year 2023 24

Income Tax Deduction For Assessment Year 2023 24 -

Income upto Rs 7 lakhs will be tax free from F Y 2023 24 In Budget 2023 rebate under new regime has been increased to Rs 7 00 000 Therefore income upto Rs 7 00 000 will be tax free from FY 2023 24 AY 2024 25 This is due to tax rebate under section of 87A of the Income Tax Act A tax rebate reduces the tax amount

Income Tax Deductions List Deductions on Section 80C 80CCC 80CCD 80D FY 2023 24 AY 2024 25 Updated on 14 May 2024 04 23 PM deduction under chapter vi a chapter vi a deductions deductions under sec

Printables for free cover a broad collection of printable documents that can be downloaded online at no cost. These printables come in different styles, from worksheets to templates, coloring pages and much more. The great thing about Income Tax Deduction For Assessment Year 2023 24 is their versatility and accessibility.

More of Income Tax Deduction For Assessment Year 2023 24

Malaysia Personal Income Tax Relief 2022

Malaysia Personal Income Tax Relief 2022

This article summarizes Income Tax Rates Surcharge Health Education Cess Special rates and rebate relief applicable to various categories of Persons viz Individuals Resident Non Resident HUF Firms LLP Companies Co operative Society Local Authority AOP BOI artificial juridical persons for income liable to tax in the

This article aims to provide a comprehensive guide on the income tax rates applicable for the Assessment Years 2023 24 and 2024 25 It covers tax rates for various categories such as individuals both resident and non resident senior and super senior citizens HUFs and different types of firms and companies

Income Tax Deduction For Assessment Year 2023 24 have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

The ability to customize: You can tailor printables to your specific needs be it designing invitations to organize your schedule or decorating your home.

-

Educational Impact: Printables for education that are free can be used by students of all ages, making the perfect tool for parents and teachers.

-

Simple: instant access many designs and templates helps save time and effort.

Where to Find more Income Tax Deduction For Assessment Year 2023 24

INCOME TAX DEDUCTION FROM SALARIES DURING THE FINANCIAL YEAR 2015 16

INCOME TAX DEDUCTION FROM SALARIES DURING THE FINANCIAL YEAR 2015 16

The new tax regime introduced in Budget 2023 offers lower tax rates but does not allow most of the deductions and exemptions available under the old tax regime Here are the income tax slabs for individuals under the new tax regime for FY 2023 24 AY 2024 25 Up to Rs 3 00 000 NIL Rs 300 001 to Rs 6 00 000 5 Tax Rebate u s 87A

Income Tax Deduction Allowed in the new income tax regime A Y 2024 25 as per Budget 2023 A new and optional income tax regime was announced in the Union Budget 2023 Under this new regime the income tax slab rates have been reduce d significantly However denomination slab fees

In the event that we've stirred your interest in Income Tax Deduction For Assessment Year 2023 24 we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Income Tax Deduction For Assessment Year 2023 24 designed for a variety goals.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets along with flashcards, as well as other learning materials.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- The blogs are a vast array of topics, ranging including DIY projects to planning a party.

Maximizing Income Tax Deduction For Assessment Year 2023 24

Here are some unique ways that you can make use use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home also in the classes.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Deduction For Assessment Year 2023 24 are a treasure trove of practical and imaginative resources for a variety of needs and preferences. Their availability and versatility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the many options of Income Tax Deduction For Assessment Year 2023 24 and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes you can! You can print and download these files for free.

-

Can I download free printables for commercial uses?

- It's dependent on the particular terms of use. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Are there any copyright issues when you download Income Tax Deduction For Assessment Year 2023 24?

- Certain printables could be restricted on use. Make sure you read the conditions and terms of use provided by the designer.

-

How can I print printables for free?

- You can print them at home with an printer, or go to any local print store for superior prints.

-

What software do I require to view Income Tax Deduction For Assessment Year 2023 24?

- Most printables come in PDF format. They is open with no cost software like Adobe Reader.

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Income Tax Calculator FY 2022 23 AY 2023 24 Excel Download FinCalC

Check more sample of Income Tax Deduction For Assessment Year 2023 24 below

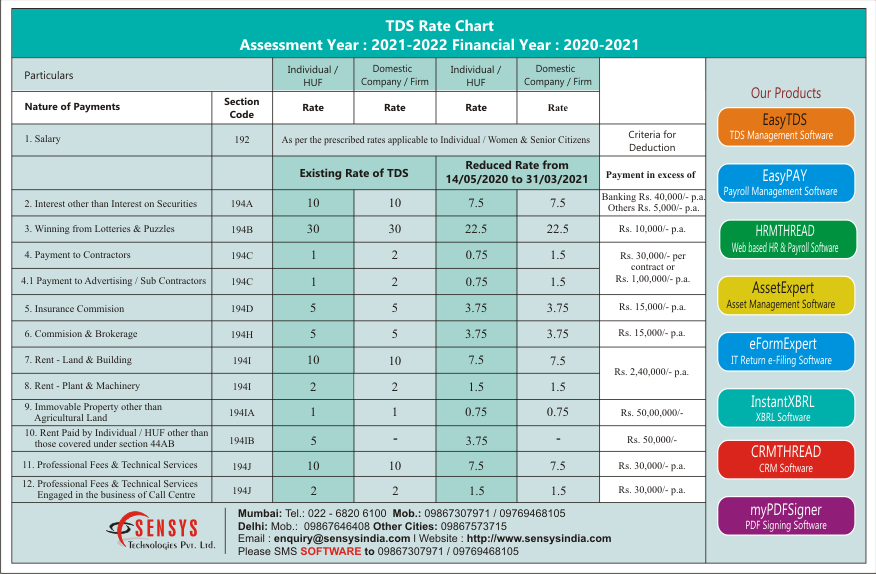

TDS Rate Chart FY 2020 2021 AY 2021 2022 Sensys Blog

Simulador De Taxes 2023 Irs Forms IMAGESEE

Business Tax Deduction Worksheet

Income Tax Rates For Fy 2021 22 How To Choose Between Old Regime And

Income Tax Assessment Form 2021 22 Pdf In Hindi TAX

Printable Itemized Deductions Worksheet

https://tax2win.in/guide/deductions

Income Tax Deductions List Deductions on Section 80C 80CCC 80CCD 80D FY 2023 24 AY 2024 25 Updated on 14 May 2024 04 23 PM deduction under chapter vi a chapter vi a deductions deductions under sec

https://cleartax.in/s/income-tax-slabs

For example the current previous year is from 1st April 2023 to 31st March 2024 i e FY 2023 24 The corresponding assessment year is 1st April 2024 to 31st March 2025 i e AY 2024 25

Income Tax Deductions List Deductions on Section 80C 80CCC 80CCD 80D FY 2023 24 AY 2024 25 Updated on 14 May 2024 04 23 PM deduction under chapter vi a chapter vi a deductions deductions under sec

For example the current previous year is from 1st April 2023 to 31st March 2024 i e FY 2023 24 The corresponding assessment year is 1st April 2024 to 31st March 2025 i e AY 2024 25

Income Tax Rates For Fy 2021 22 How To Choose Between Old Regime And

Simulador De Taxes 2023 Irs Forms IMAGESEE

Income Tax Assessment Form 2021 22 Pdf In Hindi TAX

Printable Itemized Deductions Worksheet

Union Budget 2023 Impact Of Income Tax On Salary Deduction With

Standard Deduction 2020 Self Employed Standard Deduction 2021

Standard Deduction 2020 Self Employed Standard Deduction 2021

A Singaporean s Guide How To Claim Income Tax Deduction For Work