In this age of electronic devices, where screens dominate our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. Be it for educational use and creative work, or just adding the personal touch to your space, Income Tax Credit Meaning have become an invaluable source. This article will take a dive deeper into "Income Tax Credit Meaning," exploring the different types of printables, where they are, and what they can do to improve different aspects of your lives.

Get Latest Income Tax Credit Meaning Below

Income Tax Credit Meaning

Income Tax Credit Meaning -

Free tax preparation help Choose a tax professional Find out what you need to bring to your preparer EITC Central has tools and information for IRS partners community organizations employers government agencies and offices and tax preparers Page Last Reviewed or Updated 20 Sep 2023

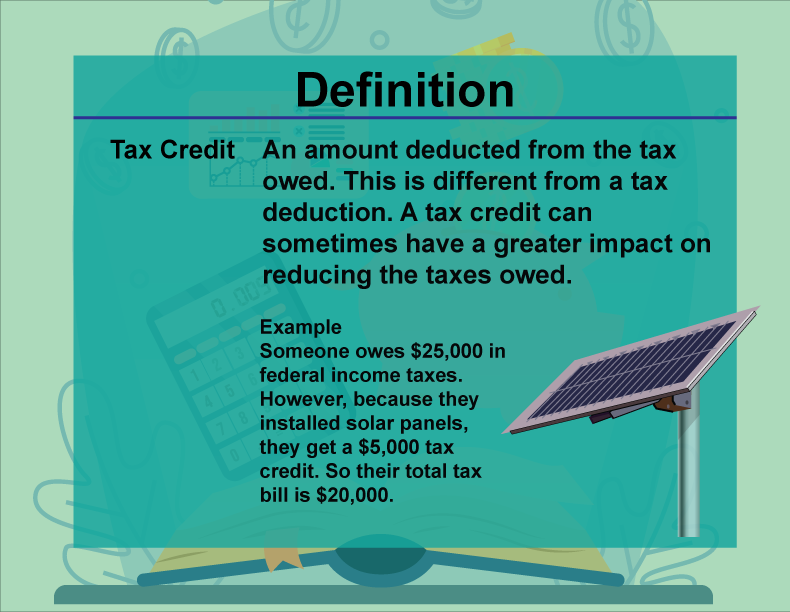

Glossary Videos Resources Podcast Principles Courses Search Tax Credit A tax credit is a provision that reduces a taxpayer s final tax bill dollar for dollar A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayer s tax bill directly What Types of Credits Are There

Income Tax Credit Meaning include a broad range of printable, free documents that can be downloaded online at no cost. These printables come in different types, like worksheets, coloring pages, templates and much more. The benefit of Income Tax Credit Meaning is in their versatility and accessibility.

More of Income Tax Credit Meaning

Definition Financial Literacy Tax Credit Media4Math

Definition Financial Literacy Tax Credit Media4Math

TurboTax Tax Calculators Tips Tax Tips Guides Videos Tax Deductions and Credits What Are Tax Credits Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 January 12 2024 1 50 PM

A tax credit is an amount of money given by the IRS that reduces your tax bill on a dollar for dollar basis Alyssa Powell Insider Affiliate links for the products on this page are from

Income Tax Credit Meaning have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Flexible: You can tailor printed materials to meet your requirements such as designing invitations planning your schedule or even decorating your home.

-

Education Value Educational printables that can be downloaded for free cater to learners from all ages, making these printables a powerful device for teachers and parents.

-

Easy to use: Access to numerous designs and templates, which saves time as well as effort.

Where to Find more Income Tax Credit Meaning

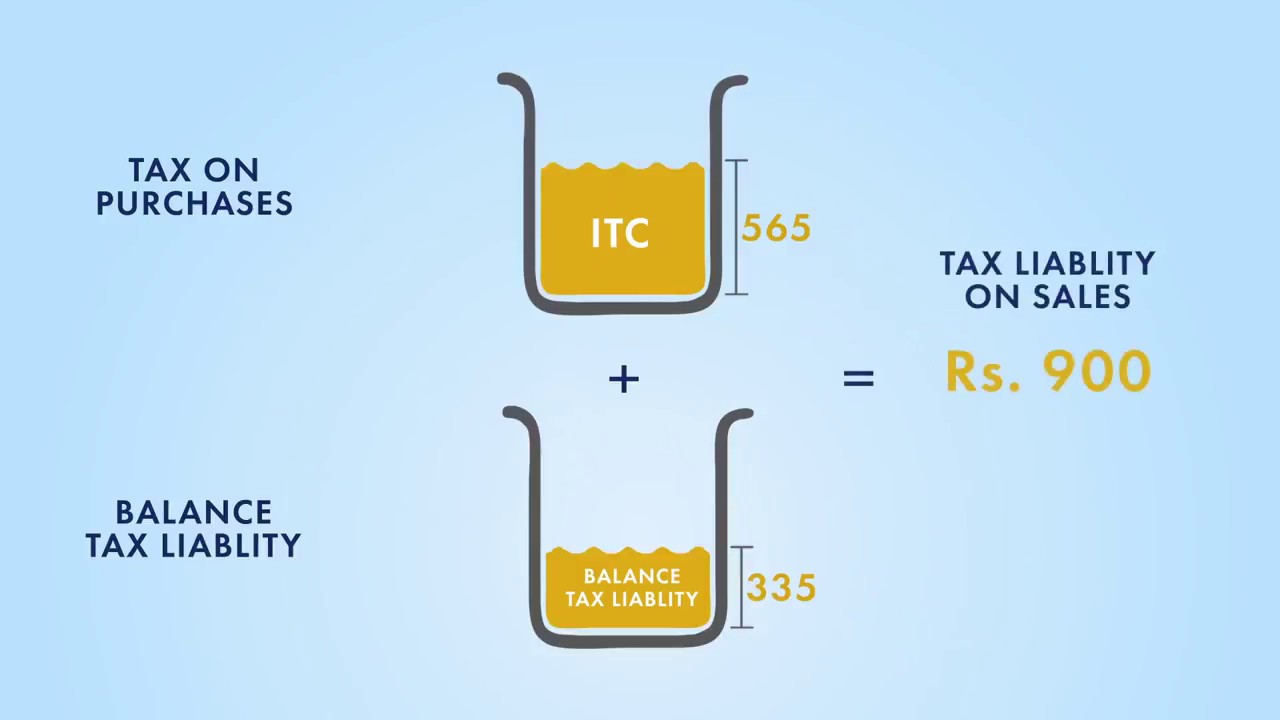

What Is Input Tax Credit Under GST System

What Is Input Tax Credit Under GST System

More information Tax credits for individuals What they mean and how they can help refunds Deductions for individuals What they mean and the difference between standard and itemized deductions Subscribe to IRS Tax

Individual Income Tax 6 7 Individual Taxes Q What are tax credits and how do they differ from tax deductions A Credits reduce taxes directly and do not depend on tax rates Deductions reduce taxable income their value thus depends on the taxpayer s marginal tax rate which rises with income Tax Credits

Since we've got your interest in Income Tax Credit Meaning and other printables, let's discover where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of needs.

- Explore categories like decorating your home, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets including flashcards, learning materials.

- Ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- These blogs cover a wide spectrum of interests, that range from DIY projects to party planning.

Maximizing Income Tax Credit Meaning

Here are some inventive ways for you to get the best of Income Tax Credit Meaning:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use free printable worksheets to enhance learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Credit Meaning are a treasure trove of innovative and useful resources for a variety of needs and pursuits. Their accessibility and flexibility make them an invaluable addition to both personal and professional life. Explore the vast world of Income Tax Credit Meaning to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes they are! You can print and download these materials for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It depends on the specific rules of usage. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright rights issues with Income Tax Credit Meaning?

- Certain printables might have limitations concerning their use. Check these terms and conditions as set out by the designer.

-

How do I print Income Tax Credit Meaning?

- You can print them at home using an printer, or go to the local print shops for better quality prints.

-

What program do I require to open printables for free?

- The majority are printed in PDF format. These can be opened using free software like Adobe Reader.

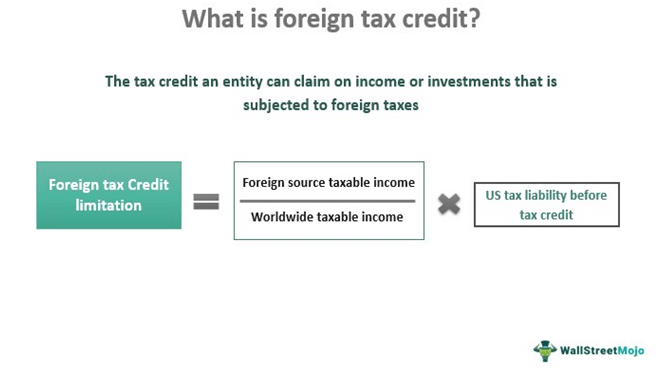

Foreign Tax Credit Meaning Example Limitation Carryover

What Is Input Credit ITC Under GST

Check more sample of Income Tax Credit Meaning below

Input Tax Credit Meaning Conditions To Avail Documents Required

California Earned Income Tax Credit Worksheet Part Iii Line 6 Worksheet

Foreign Tax Credit Income Tax Rules IndiaFilings

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

Two Types Of Tax Credit Types Of Taxes Tax Credits Accounting Services

Deferred Tax Liability Meaning Calculation Example

https://taxfoundation.org/taxedu/glossary/tax-credit

Glossary Videos Resources Podcast Principles Courses Search Tax Credit A tax credit is a provision that reduces a taxpayer s final tax bill dollar for dollar A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayer s tax bill directly What Types of Credits Are There

https://www.irs.gov/newsroom/tax-credits-for...

Native Americans Veterans Self employed Without a qualifying child Recently divorced unemployed or experienced other changes to their marital financial or parental status Below the filing requirement with earnings Not proficient in English Living in rural areas Receiving certain disability pensions or have children with disabilities

Glossary Videos Resources Podcast Principles Courses Search Tax Credit A tax credit is a provision that reduces a taxpayer s final tax bill dollar for dollar A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayer s tax bill directly What Types of Credits Are There

Native Americans Veterans Self employed Without a qualifying child Recently divorced unemployed or experienced other changes to their marital financial or parental status Below the filing requirement with earnings Not proficient in English Living in rural areas Receiving certain disability pensions or have children with disabilities

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

California Earned Income Tax Credit Worksheet Part Iii Line 6 Worksheet

Two Types Of Tax Credit Types Of Taxes Tax Credits Accounting Services

Deferred Tax Liability Meaning Calculation Example

How GST Input Tax Credit Works YouTube

What Is The Difference Between A Tax Credit And Tax Deduction

What Is The Difference Between A Tax Credit And Tax Deduction

ITR Related Provisions Overall Accounting