In a world when screens dominate our lives however, the attraction of tangible printed materials hasn't faded away. Whether it's for educational purposes for creative projects, simply to add some personal flair to your space, Income Protection Benefits Tax Return are now a vital resource. With this guide, you'll dive through the vast world of "Income Protection Benefits Tax Return," exploring what they are, how to find them and the ways that they can benefit different aspects of your daily life.

Get Latest Income Protection Benefits Tax Return Below

Income Protection Benefits Tax Return

Income Protection Benefits Tax Return -

Income protection insurance provides up to 70 of your regular income in monthly payments if you become ill or injured and the premiums you pay are tax deductible This means you can protect future you against a number of risks to your income while also enjoying tax benefits along the way

Only the premiums you pay to protect your income salary and wages are deductible This is known as income protection or continuing salary cover If you receive a payment to replace your salary and wages under an income protection policy you must include it in your tax return

Income Protection Benefits Tax Return provide a diverse collection of printable material that is available online at no cost. These printables come in different formats, such as worksheets, coloring pages, templates and many more. The attraction of printables that are free is their versatility and accessibility.

More of Income Protection Benefits Tax Return

Benefits Of Income Protection Yes ie Blog

Benefits Of Income Protection Yes ie Blog

Aug 21 2023 Fact checked Income protection payments are taxed in Australia in the same way that your income is taxed But there are several differences you need to be aware of It all depends

Tax on income protection payouts As its name suggests income protection or salary continuance benefits protect the income that you earn each month if you get sick or injured and cannot work or cannot work in the same capacity

The Income Protection Benefits Tax Return have gained huge popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Flexible: There is the possibility of tailoring the design to meet your needs when it comes to designing invitations planning your schedule or decorating your home.

-

Educational Value: The free educational worksheets provide for students of all ages. This makes them an invaluable aid for parents as well as educators.

-

It's easy: You have instant access a variety of designs and templates helps save time and effort.

Where to Find more Income Protection Benefits Tax Return

Get Essentials For Personal Tax Return Benefits Jazonandthedead

Get Essentials For Personal Tax Return Benefits Jazonandthedead

How to claim income protection tax deductions You may claim a tax deduction on your income protection premiums where the benefits paid replace lost income when you complete your tax return for the financial year You may like to obtain advice from a registered tax agent if you need help with this especially if your insurance is bundled

Income protection sickness and accident insurance premiums You can claim the cost of any premiums you paid for insurance against the loss of your income You must include any payment you received under the policy for loss of your income at items 1 2 or 24 on your tax return

After we've peaked your interest in Income Protection Benefits Tax Return Let's see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of goals.

- Explore categories such as decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs are a vast selection of subjects, that includes DIY projects to party planning.

Maximizing Income Protection Benefits Tax Return

Here are some fresh ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Income Protection Benefits Tax Return are a treasure trove of creative and practical resources that satisfy a wide range of requirements and hobbies. Their availability and versatility make them a fantastic addition to each day life. Explore the world of Income Protection Benefits Tax Return right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes, they are! You can download and print these documents for free.

-

Can I download free printables for commercial use?

- It is contingent on the specific terms of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may contain restrictions on use. Be sure to check the terms and conditions set forth by the creator.

-

How do I print printables for free?

- Print them at home with printing equipment or visit an area print shop for the highest quality prints.

-

What software do I need in order to open Income Protection Benefits Tax Return?

- Most PDF-based printables are available in PDF format, which can be opened with free software, such as Adobe Reader.

Time To Talk Fringe Benefits Tax FBT The Financial Foreman

Start A Business Who What Where When How And Why Starting A

Check more sample of Income Protection Benefits Tax Return below

Amending Fringe Benefits Tax Return And Updated Exemptions Articles

Completing Your 2015 Fringe Benefits Tax Return

What Are The Benefits Of Filing Your Income Tax Return Regularly

The Right Amount Of Insurance Sente Mortgage

Benefits Of Filing Income Tax Return In India Bonsmartway

5 Tips To Secure The Best Insurance Coverage Bit Rebels

https://www.ato.gov.au/.../income-protection-insurance

Only the premiums you pay to protect your income salary and wages are deductible This is known as income protection or continuing salary cover If you receive a payment to replace your salary and wages under an income protection policy you must include it in your tax return

https://moneytothemasses.com/quick-savings/...

1 minute summary If you personally pay for your Income Protection insurance premiums then your Income Protection benefits will not be taxed however the maximum benefit is usually limited to around 65 of your gross earnings ensuring it doesn t pay more than your usual earnings

Only the premiums you pay to protect your income salary and wages are deductible This is known as income protection or continuing salary cover If you receive a payment to replace your salary and wages under an income protection policy you must include it in your tax return

1 minute summary If you personally pay for your Income Protection insurance premiums then your Income Protection benefits will not be taxed however the maximum benefit is usually limited to around 65 of your gross earnings ensuring it doesn t pay more than your usual earnings

The Right Amount Of Insurance Sente Mortgage

Completing Your 2015 Fringe Benefits Tax Return

Benefits Of Filing Income Tax Return In India Bonsmartway

5 Tips To Secure The Best Insurance Coverage Bit Rebels

Road To A Successful Fringe Benefits Tax FBT Return In Australia

File Income Tax Return How To E File Your Income Tax Return Online

File Income Tax Return How To E File Your Income Tax Return Online

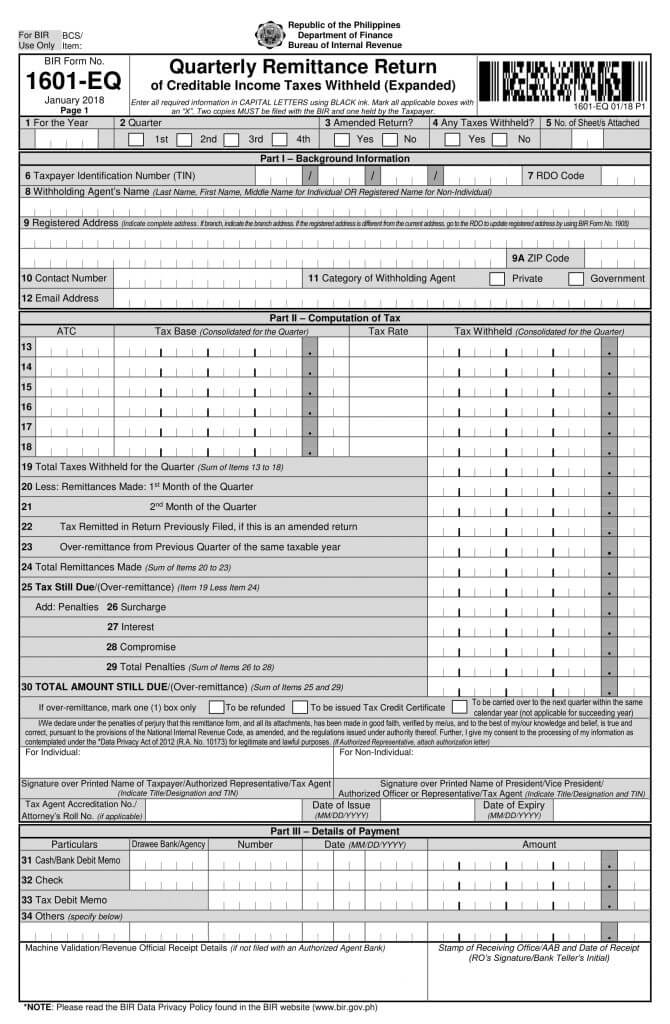

Monthly Withholding Tax Table 2019 Elcho Table