In a world in which screens are the norm and the appeal of physical printed products hasn't decreased. For educational purposes and creative work, or simply adding an element of personalization to your area, Hydro Tax Credit Ontario are now an essential resource. We'll dive deep into the realm of "Hydro Tax Credit Ontario," exploring what they are, where they are available, and how they can improve various aspects of your daily life.

Get Latest Hydro Tax Credit Ontario Below

Hydro Tax Credit Ontario

Hydro Tax Credit Ontario -

What is the Ontario energy and property tax credit OEPTC The OEPTC is designed to help low to moderate income Ontario residents with the sales tax on energy and with property taxes The annual entitlement is usually divided by 12 and issued monthly as part of the Ontario trillium benefit OTB payment see first three bullets of the note

The Government of Ontario has a number of credits available to help low to moderate income Ontario residents with the sales tax on energy and property taxes and Northern Ontario residents with the higher energy costs of living in the north

Hydro Tax Credit Ontario include a broad collection of printable materials available online at no cost. The resources are offered in a variety forms, like worksheets coloring pages, templates and much more. The benefit of Hydro Tax Credit Ontario is their flexibility and accessibility.

More of Hydro Tax Credit Ontario

Canadian Film Tax Credit Logo Compilation YouTube

Canadian Film Tax Credit Logo Compilation YouTube

The Ontario Trillium Benefit combines the following three credits to help pay for energy costs as well as sales and property tax Northern Ontario Energy Credit Ontario Energy and Property Tax Credit Ontario Sales Tax Credit You need to be eligible for at least one of the three credits to receive the benefit Northern Ontario Energy Credit

Before March 1 2024 a household of two with an income after tax of 38 500 would qualify for a 40 monthly on bill credit before and after March 1 2024 How to Apply To apply or to find out if you qualify visit OntarioElectricitySupport ca or call 1 855 831 8151 You will need the following information to apply

Hydro Tax Credit Ontario have gained a lot of popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Modifications: Your HTML0 customization options allow you to customize printing templates to your own specific requirements for invitations, whether that's creating them as well as organizing your calendar, or even decorating your house.

-

Educational Value: Printables for education that are free can be used by students of all ages. This makes them an invaluable resource for educators and parents.

-

An easy way to access HTML0: Quick access to a plethora of designs and templates reduces time and effort.

Where to Find more Hydro Tax Credit Ontario

TTT The Ontario Staycation Tax Credit The Mad Accountant

TTT The Ontario Staycation Tax Credit The Mad Accountant

Step 1 Occupancy cost Multiply your rent paid in Ontario for 2021 by 20 Add your property tax paid in Ontario for 2021 Add 25 00 if you lived in a student residence This is your occupancy cost Step 2 Energy component Multiply the amount paid for a public or non profit long term care home in Ontario for 2021 by 20

The Ontario Electricity Support Program OESP provides monthly on bill credits for lower income customers to help reduce their electricity bills Depending on your combined household income and the number of residents in your home you could be eligible to receive a credit from 35 to 113 off each electricity bill

Since we've got your interest in printables for free Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of reasons.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs are a vast selection of subjects, including DIY projects to planning a party.

Maximizing Hydro Tax Credit Ontario

Here are some innovative ways in order to maximize the use use of Hydro Tax Credit Ontario:

1. Home Decor

- Print and frame beautiful artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets for teaching at-home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Hydro Tax Credit Ontario are an abundance of innovative and useful resources that cater to various needs and preferences. Their access and versatility makes them an invaluable addition to each day life. Explore the endless world of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes you can! You can print and download these free resources for no cost.

-

Do I have the right to use free printables in commercial projects?

- It's all dependent on the rules of usage. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables might have limitations on their use. Make sure to read the terms and conditions set forth by the author.

-

How do I print Hydro Tax Credit Ontario?

- Print them at home with an printer, or go to the local print shops for top quality prints.

-

What program do I need to open printables for free?

- Most printables come in PDF format, which is open with no cost software like Adobe Reader.

With The Participation Of Canada The Canadian Film Of Video Production

Work From Home Tax Credit Ontario

Check more sample of Hydro Tax Credit Ontario below

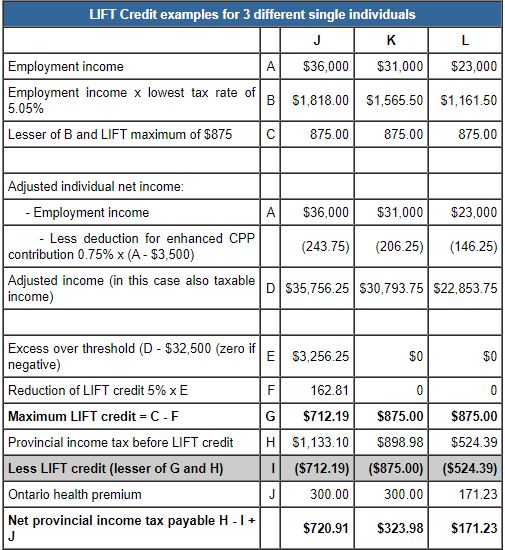

TaxTips ca Ontario Non Refundable LIFT Credit

Does The Government Help First Time Home Buyers KnowYourGovernment

Funding Opportunities Various Funding On A National Provincial And

Total Drama All Stars End Credits Episodes 1 3 YouTube

Consumer Rights Groups Want To Abolish Hydro Taxes In Quebec MTL Blog

First Time Home Buyer Tax Credit Ontario 2016

/https://www.thestar.com/content/dam/thestar/opinion/editorials/2016/11/14/ontario-takes-a-positive-but-modest-step-on-house-prices-editorial/realestate.jpg)

https://www.hydroone.com/.../residential/financial-assistance/tax-credit

The Government of Ontario has a number of credits available to help low to moderate income Ontario residents with the sales tax on energy and property taxes and Northern Ontario residents with the higher energy costs of living in the north

https://www.oeb.ca/consumer-information-and...

The amount of the credit depends on 2 factors How many people live in the home The combined annual household after tax income For example a home with 4 people and an annual income of 65 000 will receive an on bill credit of 40 each month This chart shows the different credit amounts OESP credit amounts

The Government of Ontario has a number of credits available to help low to moderate income Ontario residents with the sales tax on energy and property taxes and Northern Ontario residents with the higher energy costs of living in the north

The amount of the credit depends on 2 factors How many people live in the home The combined annual household after tax income For example a home with 4 people and an annual income of 65 000 will receive an on bill credit of 40 each month This chart shows the different credit amounts OESP credit amounts

Total Drama All Stars End Credits Episodes 1 3 YouTube

Does The Government Help First Time Home Buyers KnowYourGovernment

Consumer Rights Groups Want To Abolish Hydro Taxes In Quebec MTL Blog

/https://www.thestar.com/content/dam/thestar/opinion/editorials/2016/11/14/ontario-takes-a-positive-but-modest-step-on-house-prices-editorial/realestate.jpg)

First Time Home Buyer Tax Credit Ontario 2016

Consumer Rights Groups Want To Abolish Hydro Taxes In Quebec MTL Blog

Ontario Interactive Digital Media Tax Credit Interactive Ontario

Ontario Interactive Digital Media Tax Credit Interactive Ontario

Ontario Film And Television Tax Credits Credits Variants Logo