In this digital age, where screens have become the dominant feature of our lives The appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education such as creative projects or simply adding a personal touch to your space, Hra Tax Deduction Section are now a useful source. Through this post, we'll dive in the world of "Hra Tax Deduction Section," exploring their purpose, where they can be found, and how they can add value to various aspects of your life.

Get Latest Hra Tax Deduction Section Below

Hra Tax Deduction Section

Hra Tax Deduction Section -

House rent allowance HRA is received by the salaried class A deduction is permissible under Section 10 13A of the Income Tax Act in accordance with Rule 2A of the Income Tax Rules You can claim exemption on your HRA under the Income Tax Act if you stay in a rented house and get a HRA from your employer

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

Hra Tax Deduction Section provide a diverse range of printable, free content that can be downloaded from the internet at no cost. They are available in numerous styles, from worksheets to templates, coloring pages, and much more. The great thing about Hra Tax Deduction Section lies in their versatility and accessibility.

More of Hra Tax Deduction Section

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

Section 80GG of Income Tax Act Deductions in Respect of Rent Paid Conditions Eligibility Updated on Mar 14th 2024 5 min read Usually HRA forms part of your salary and you can claim a deduction for HRA

HRA is paid as a part of the salary to meet accommodation expenses Learn how to save tax by claiming HRA exemption and their rules

Hra Tax Deduction Section have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Personalization The Customization feature lets you tailor the design to meet your needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Use: The free educational worksheets cater to learners from all ages, making them an essential device for teachers and parents.

-

Accessibility: Quick access to various designs and templates, which saves time as well as effort.

Where to Find more Hra Tax Deduction Section

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Income Tax Department Tax Tools House rent allowance calculator As amended upto Finance Act 2023 HOUSE RENT ALLOWANCE Basic salary DA forming part of salary Commission as of turnover achieved by

Depending on the city the HRA House Rent Allowance varies You can deduct up to 50 of your HRA from your taxes if you live in a metropolis like Mumbai Delhi Chennai or Kolkata If you live anywhere else you

Since we've got your interest in Hra Tax Deduction Section We'll take a look around to see where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in Hra Tax Deduction Section for different purposes.

- Explore categories such as decorations for the home, education and the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- The blogs covered cover a wide spectrum of interests, all the way from DIY projects to party planning.

Maximizing Hra Tax Deduction Section

Here are some creative ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print worksheets that are free to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Hra Tax Deduction Section are a treasure trove of practical and innovative resources that cater to various needs and interests. Their accessibility and flexibility make these printables a useful addition to your professional and personal life. Explore the plethora of Hra Tax Deduction Section and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes they are! You can print and download these resources at no cost.

-

Can I use free templates for commercial use?

- It's based on the rules of usage. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Are there any copyright issues with Hra Tax Deduction Section?

- Some printables may come with restrictions in their usage. You should read the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home using an printer, or go to an in-store print shop to get premium prints.

-

What software do I require to view printables at no cost?

- Most PDF-based printables are available in PDF format, which is open with no cost software like Adobe Reader.

How To Show HRA Not Accounted By The Employer In ITR

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

Check more sample of Hra Tax Deduction Section below

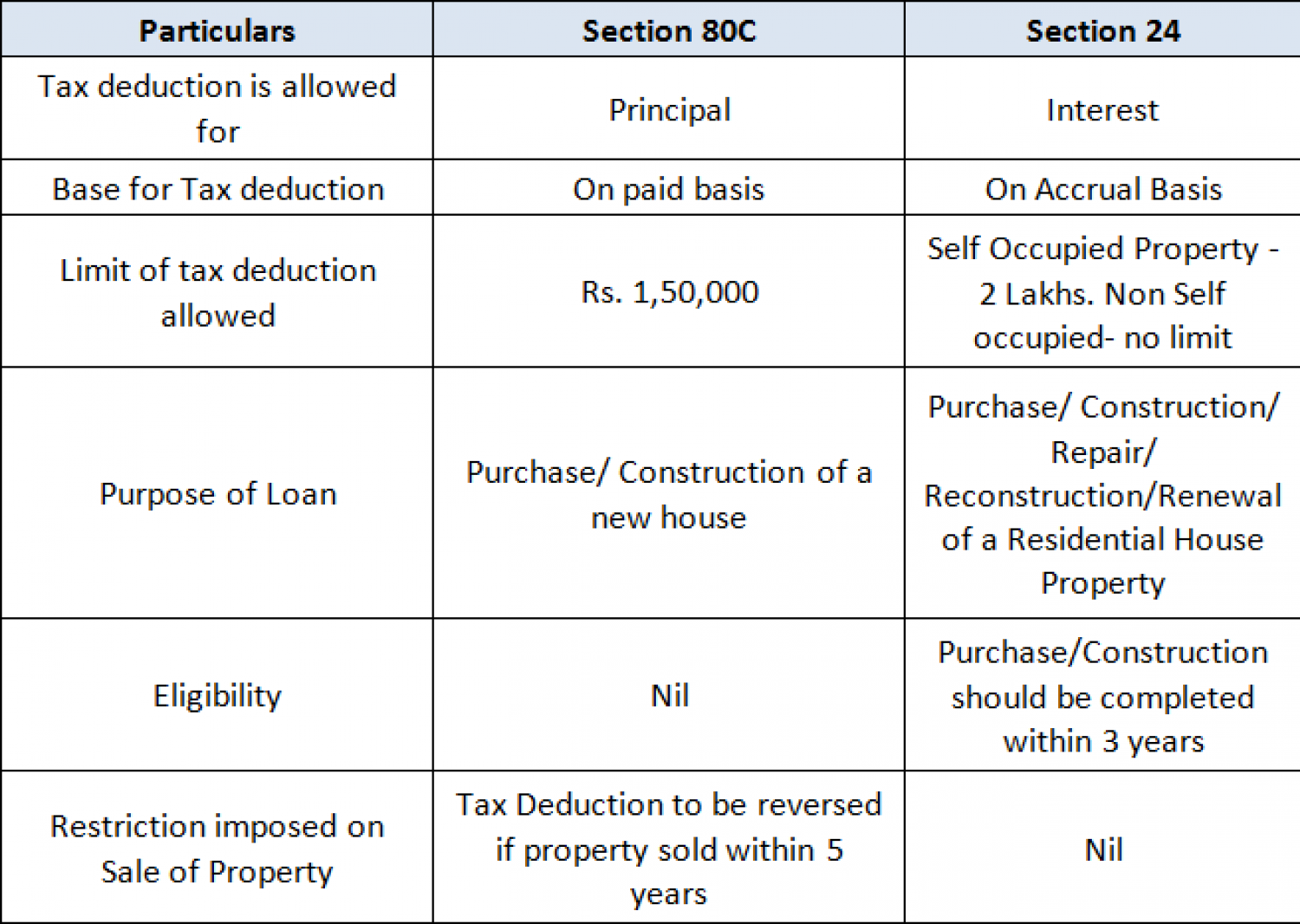

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

Income Tax Savings HRA

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

HRA Tax Exemption Calculator House Rent Deduction In Income Tax

https:// taxguru.in /income-tax/house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

https:// tax2win.in /guide/hra-house-rent-allowance

House Rent Allowance HRA or is a commonly used term in the realm of personal finance and employment benefits It refers to an allowance provided by employers to their employees to help them meet their housing expenses Understanding the intricacies of HRA is crucial for both employees and employers to maximize its benefits

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

House Rent Allowance HRA or is a commonly used term in the realm of personal finance and employment benefits It refers to an allowance provided by employers to their employees to help them meet their housing expenses Understanding the intricacies of HRA is crucial for both employees and employers to maximize its benefits

Income Tax Savings HRA

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

HRA Tax Exemption Calculator House Rent Deduction In Income Tax

HRA Exemption Calculator In Excel House Rent Allowance Calculation

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech