In this digital age, where screens dominate our lives, the charm of tangible printed objects isn't diminished. Be it for educational use as well as creative projects or simply adding some personal flair to your area, Hra Rebate Rules have become an invaluable resource. For this piece, we'll dive into the world of "Hra Rebate Rules," exploring the benefits of them, where to find them, and how they can add value to various aspects of your life.

Get Latest Hra Rebate Rules Below

Hra Rebate Rules

Hra Rebate Rules -

HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a house You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable

1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961 Stay in Rented Accommodation Not living in a self owned Rent

Hra Rebate Rules encompass a wide range of printable, free materials online, at no cost. They are available in numerous types, such as worksheets templates, coloring pages, and more. The attraction of printables that are free is their versatility and accessibility.

More of Hra Rebate Rules

Air Source Heat Pump Rebate Rules 2022 2000 AirRebate

Air Source Heat Pump Rebate Rules 2022 2000 AirRebate

House rent allowance HRA tax benefit is available only to salaried individuals who are planning to opt for old tax regime Further this tax benefit can be claimed only if they have the HRA component as part of their salary structure and is staying in a rented accommodation

1 Actual House Rent Allowance HRA received from your employer 2 Actual house rent paid by you minus 10 of your basic salary 3 50 of your basic salary if you live in a metro or 40 of your basic salary if you live in a non metro This minimum of above is allowed as income tax exemption on house

Hra Rebate Rules have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Personalization They can make the templates to meet your individual needs such as designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Impact: These Hra Rebate Rules offer a wide range of educational content for learners of all ages. This makes them a vital resource for educators and parents.

-

Convenience: You have instant access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Hra Rebate Rules

Micro Rebate Rules

Micro Rebate Rules

Updated on 06 Feb 2024 12 40 PM HRA is a commonly used term in the realm of personal finance and employment benefits It refers to an allowance provided by employers to their employees to help them meet their housing expenses Understanding the intricacies of HRA is crucial for both employees and employers

HRA or the House Rent Allowance is one of the sub components of the employee s salary for which deductions are fully or partially taxable under Section 10 13A of the Income Tax Act The HRA calculation depends on the following factors The salary of the employee The actual rent paid by the employee

Now that we've piqued your interest in Hra Rebate Rules, let's explore where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of purposes.

- Explore categories such as furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free as well as flashcards and other learning materials.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- These blogs cover a wide selection of subjects, ranging from DIY projects to planning a party.

Maximizing Hra Rebate Rules

Here are some fresh ways of making the most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Hra Rebate Rules are an abundance of practical and imaginative resources which cater to a wide range of needs and desires. Their accessibility and versatility make they a beneficial addition to each day life. Explore the vast array of Hra Rebate Rules and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes, they are! You can download and print these documents for free.

-

Are there any free printables for commercial use?

- It's dependent on the particular usage guidelines. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables may be subject to restrictions on usage. You should read the terms and conditions set forth by the author.

-

How do I print Hra Rebate Rules?

- You can print them at home with either a printer at home or in a local print shop for high-quality prints.

-

What program must I use to open printables that are free?

- Most printables come with PDF formats, which can be opened with free programs like Adobe Reader.

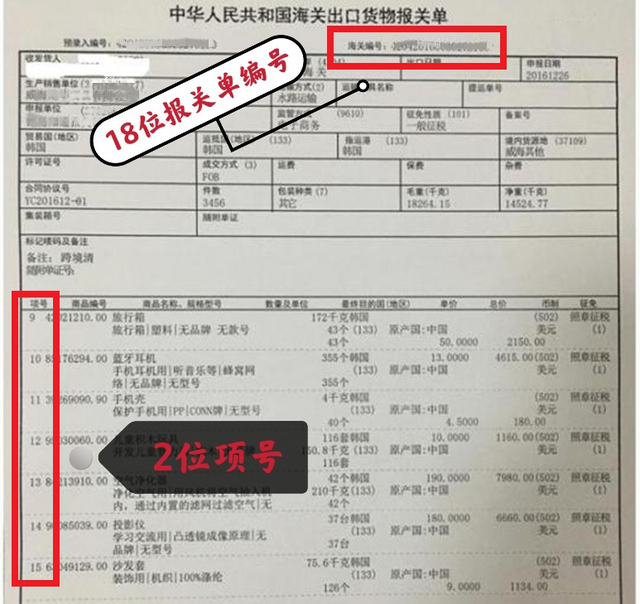

Changes In The New System Of Export Tax Rebate Rules For Compiling

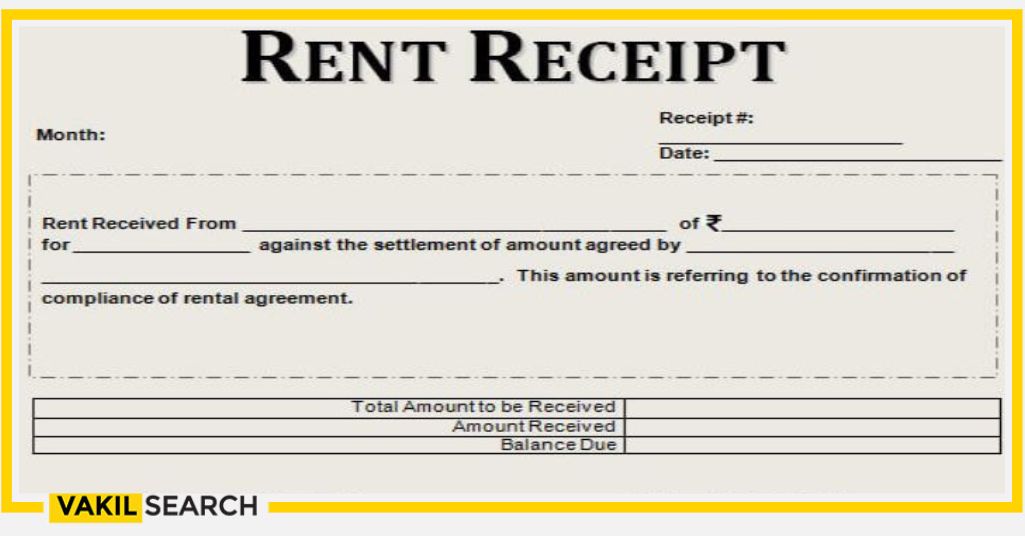

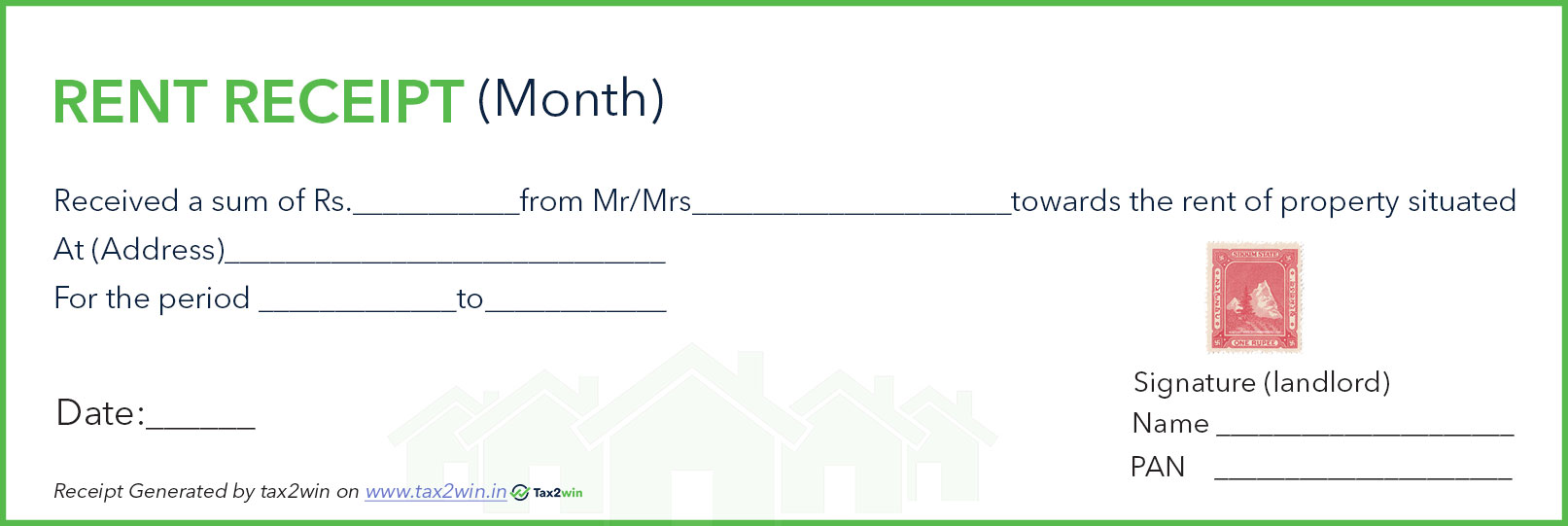

Rent Receipt Format A Complete Guideline

Check more sample of Hra Rebate Rules below

Rent Receipt Format Bangalore Invoice Template

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

Cross Product Rebates

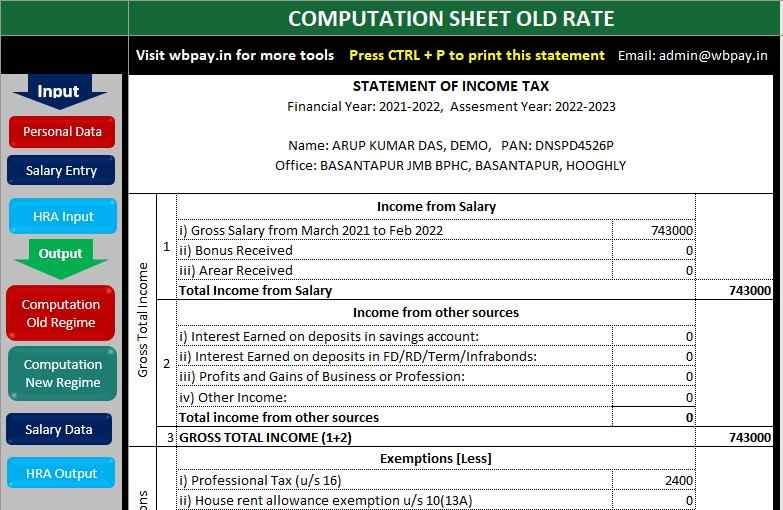

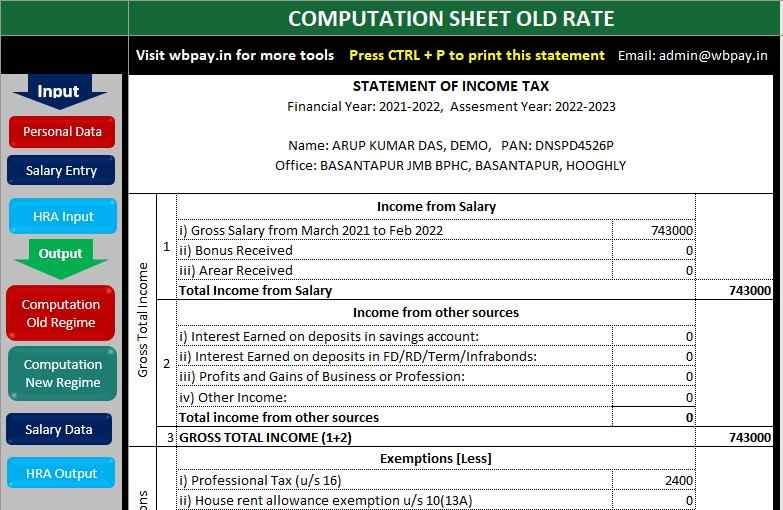

All In One Income Tax Calculator For FY 2021 22 Old New

REBATE RULES AND REGULATIONS Toyo Tires Canada

Hra Exemption Calculator Archives Rajasthan Government Employees

https://taxguru.in/income-tax/house-rent-allowance...

1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961 Stay in Rented Accommodation Not living in a self owned Rent

https://www.hdfcbank.com/personal/resources/...

Exemption limit A big question among salaried professionals is what is the exemption limit on HRA The exemption on your HRA benefit is the minimum of The actual HRA received rent paid annually reduced by 10 of salary 50 of your basic salary if you live in a metro city and 40 of your basic salary if you live in a

1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961 Stay in Rented Accommodation Not living in a self owned Rent

Exemption limit A big question among salaried professionals is what is the exemption limit on HRA The exemption on your HRA benefit is the minimum of The actual HRA received rent paid annually reduced by 10 of salary 50 of your basic salary if you live in a metro city and 40 of your basic salary if you live in a

All In One Income Tax Calculator For FY 2021 22 Old New

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

REBATE RULES AND REGULATIONS Toyo Tires Canada

Hra Exemption Calculator Archives Rajasthan Government Employees

HRA Calculation Taxability Hindi Video House Rent Allowance Tax

How To Get Full Rebate On HRA In Income Tax

How To Get Full Rebate On HRA In Income Tax

Ivey Floats Tax Rebate Rules Out permanent Structural Change