In this age of electronic devices, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. Be it for educational use project ideas, artistic or simply to add a personal touch to your home, printables for free are now an essential resource. In this article, we'll dive into the sphere of "Hra Exemption In Income Tax Filing," exploring their purpose, where to locate them, and the ways that they can benefit different aspects of your lives.

Get Latest Hra Exemption In Income Tax Filing Below

Hra Exemption In Income Tax Filing

Hra Exemption In Income Tax Filing -

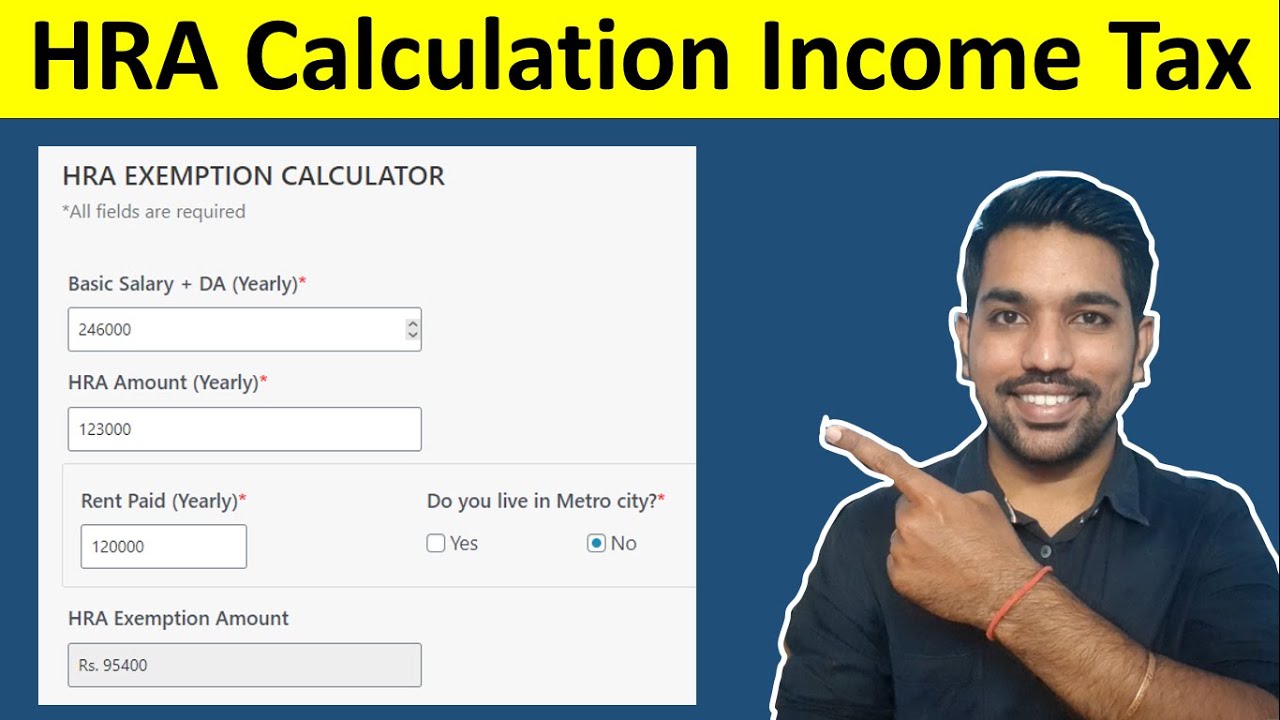

Salaried individuals who live in a rented house can claim this exemption and bring down their taxes HRA can be fully or partially exempt from tax Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

Hra Exemption In Income Tax Filing encompass a wide selection of printable and downloadable materials available online at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages, and much more. The great thing about Hra Exemption In Income Tax Filing is their flexibility and accessibility.

More of Hra Exemption In Income Tax Filing

How To Claim HRA Allowance House Rent Allowance Exemption

How To Claim HRA Allowance House Rent Allowance Exemption

House rent allowance calculator Income Tax Department Tax Tools House rent allowance calculator As amended upto Finance Act 2023 HOUSE RENT ALLOWANCE Basic salary DA forming part of salary Commission as of turnover achieved by the employee HRA Received Rent Paid Tick if residing in metro city Tick

If the employer provides a Home Rent Allowance HRA as part of the monthly salary an individual will not be eligible to claim a deduction under this section Section 80GG deduction is applicable to salaried and self employed professionals

Hra Exemption In Income Tax Filing have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Individualization The Customization feature lets you tailor the templates to meet your individual needs for invitations, whether that's creating them making your schedule, or even decorating your home.

-

Educational Value: The free educational worksheets are designed to appeal to students of all ages. This makes them a great aid for parents as well as educators.

-

It's easy: immediate access numerous designs and templates reduces time and effort.

Where to Find more Hra Exemption In Income Tax Filing

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

What is House Rent Allowance HRA Exemption Rules and Calculation Can a taxpayer claim both deductions on Home Loan HRA What if you don t receive HRA FAQs What is House Rent Allowance HRA House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation

Do note that salaried employees earning HRA up to Rs 3 000 per month are exempt from the production of rent receipts However we highly recommend you to keep those for your own record This has been laid down in the CBDT circular no 8 2013 dated 10th October 2013 as well as in 20 2015 dated 2nd December 2015

Since we've got your curiosity about Hra Exemption In Income Tax Filing Let's see where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection and Hra Exemption In Income Tax Filing for a variety needs.

- Explore categories such as furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free with flashcards and other teaching materials.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- These blogs cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Hra Exemption In Income Tax Filing

Here are some unique ways for you to get the best use of Hra Exemption In Income Tax Filing:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings and birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Hra Exemption In Income Tax Filing are a treasure trove of creative and practical resources designed to meet a range of needs and passions. Their access and versatility makes them a fantastic addition to both professional and personal lives. Explore the vast collection of Hra Exemption In Income Tax Filing and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes you can! You can download and print these items for free.

-

Can I utilize free printing templates for commercial purposes?

- It depends on the specific terms of use. Always verify the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright issues with Hra Exemption In Income Tax Filing?

- Certain printables might have limitations in their usage. Be sure to review the terms of service and conditions provided by the creator.

-

How can I print printables for free?

- Print them at home with either a printer at home or in the local print shops for higher quality prints.

-

What software will I need to access printables for free?

- The majority of printables are in the PDF format, and can be opened with free software like Adobe Reader.

How To Show HRA Not Accounted By The Employer In ITR

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Check more sample of Hra Exemption In Income Tax Filing below

HRA Calculation In Income Tax House Rent Allowance Calculator

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

Income Tax Savings HRA

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech

HRA What Is House Rent Allowance HRA Exemption Deduction Taxwink

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

https://taxguru.in/income-tax/house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

https://tax2win.in/guide/hra-house-rent-allowance

Salaried individuals who live in a rented house can claim tax exemption on HRA under Section 10 13A of the Income Tax Act HRA is subject to full or partial tax deductions An employee has to submit Form 12BB to the employer to claim the exemptions like HRA LTA etc and Income Tax deductions under Chapter VI A

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

Salaried individuals who live in a rented house can claim tax exemption on HRA under Section 10 13A of the Income Tax Act HRA is subject to full or partial tax deductions An employee has to submit Form 12BB to the employer to claim the exemptions like HRA LTA etc and Income Tax deductions under Chapter VI A

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

HRA What Is House Rent Allowance HRA Exemption Deduction Taxwink

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

HRA Exemption In Income Tax Section 80GG Section 10 13A YouTube

How To Calculate HRA Exemption Income Tax YouTube

How To Calculate HRA Exemption Income Tax YouTube

HRA Exemption Calculator For Income Tax Benefits Calculation And