In this age of electronic devices, where screens rule our lives and the appeal of physical printed material hasn't diminished. For educational purposes project ideas, artistic or just adding an element of personalization to your home, printables for free have proven to be a valuable source. This article will take a dive deeper into "Hra Deduction In Itr," exploring what they are, where they can be found, and the ways that they can benefit different aspects of your daily life.

Get Latest Hra Deduction In Itr Below

Hra Deduction In Itr

Hra Deduction In Itr -

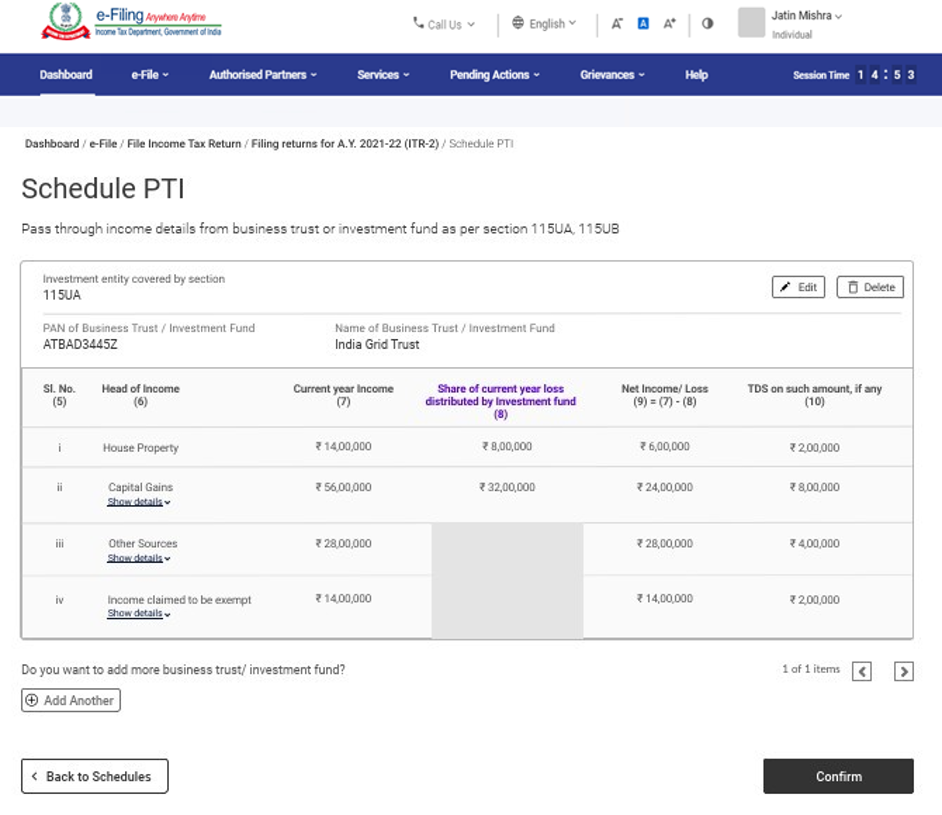

Contents What is HRA House Rent Allowance Eligibility Criteria to Claim Tax Deductions On HRA How much HRA exemption is available under the income tax act How to Calculate HRA Exemption Documents Required to Claim HRA Tax Exemption How to Claim HRA Exemption at the Time of Filing ITR

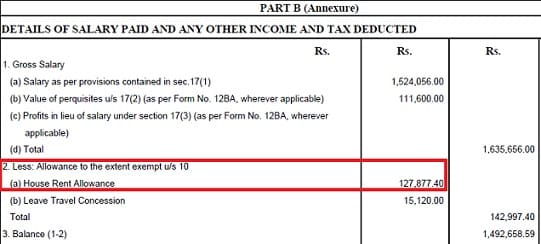

While filing your return you will have to deduct the tax exempt HRA amount from the Gross salary Salary as per provision under section 17 Make sure to provide the correct details including the correct tax exempt amount of HRA in your ITR otherwise the income tax department may ask you to submit documents for proof of the HRA

Hra Deduction In Itr cover a large collection of printable materials online, at no cost. These printables come in different forms, like worksheets templates, coloring pages and more. The great thing about Hra Deduction In Itr is their versatility and accessibility.

More of Hra Deduction In Itr

How To Show HRA Not Accounted By The Employer In ITR

How To Show HRA Not Accounted By The Employer In ITR

What is House Rent Allowance HRA House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation expenses Salaried individuals who live in rental premises can claim exemption of House Rent Allowance u s 10 13A

Learn about House Rent Allowance HRA exemptions and how they affect tax savings Understand the rules calculations and potential benefits for salaried employees

Hra Deduction In Itr have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Flexible: This allows you to modify printed materials to meet your requirements be it designing invitations making your schedule, or even decorating your house.

-

Education Value Printing educational materials for no cost provide for students from all ages, making the perfect instrument for parents and teachers.

-

Convenience: Instant access to a plethora of designs and templates saves time and effort.

Where to Find more Hra Deduction In Itr

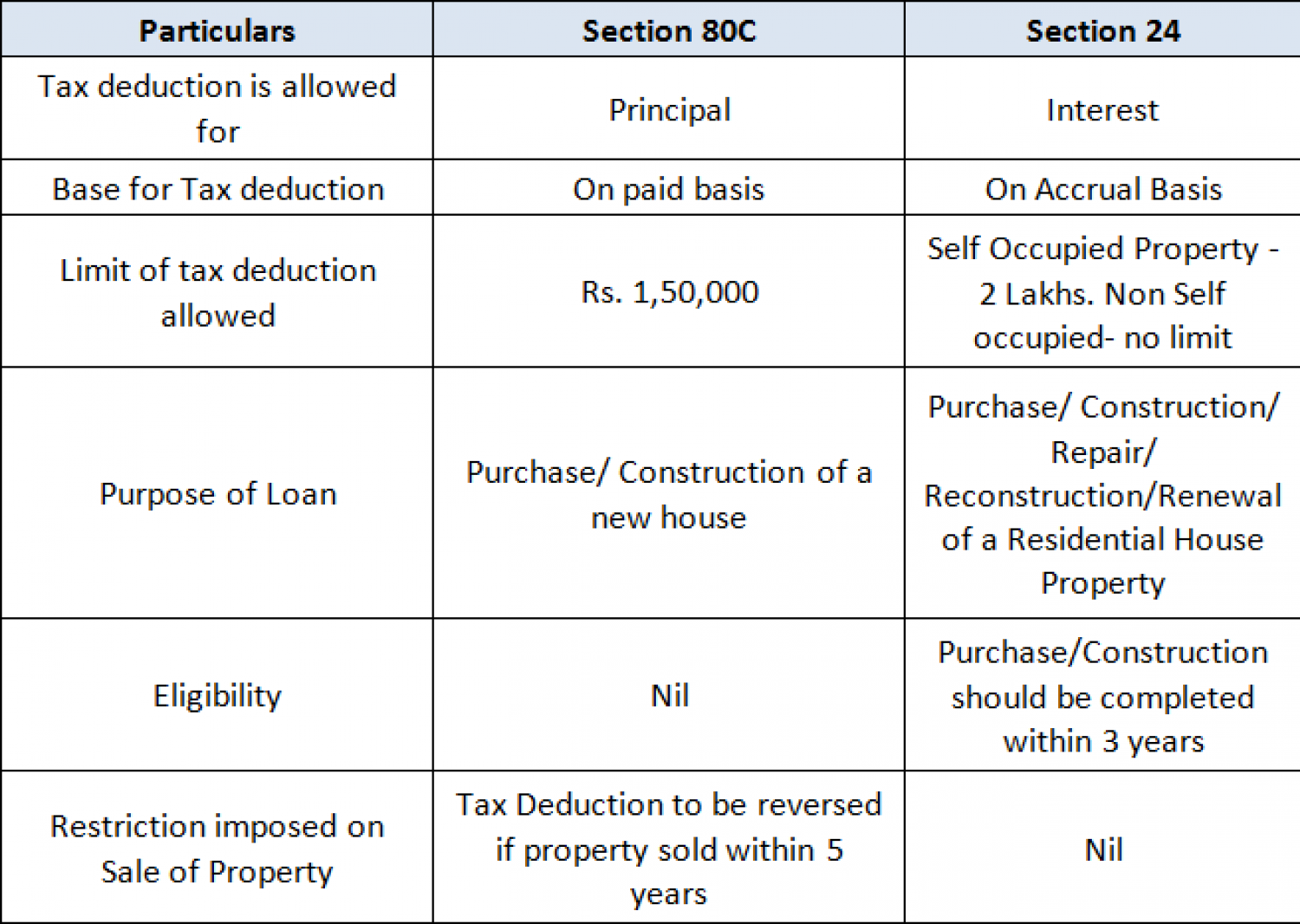

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

Discover the eligibility criteria necessary documents and key considerations to ensure a smooth and successful HRA claim in your ITR Maximize your tax benefits with this valuable resource on claiming HRA in your income tax return

If you don t receive HRA you can now claim upto Rs 60 000 deduction under Section 80GG Click here to calculate your tax as per Budget 2024 If you receive HRA you can use this calculator

If we've already piqued your curiosity about Hra Deduction In Itr Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Hra Deduction In Itr to suit a variety of objectives.

- Explore categories such as decorating your home, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- These blogs cover a broad array of topics, ranging everything from DIY projects to planning a party.

Maximizing Hra Deduction In Itr

Here are some unique ways of making the most of Hra Deduction In Itr:

1. Home Decor

- Print and frame beautiful artwork, quotes, or festive decorations to decorate your living areas.

2. Education

- Print free worksheets to build your knowledge at home also in the classes.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Hra Deduction In Itr are a treasure trove of practical and innovative resources that can meet the needs of a variety of people and hobbies. Their accessibility and flexibility make them a great addition to both personal and professional life. Explore the many options of Hra Deduction In Itr and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes you can! You can download and print these documents for free.

-

Are there any free printables for commercial uses?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may come with restrictions on usage. Always read the terms and conditions offered by the designer.

-

How can I print Hra Deduction In Itr?

- Print them at home with a printer or visit any local print store for more high-quality prints.

-

What software must I use to open printables at no cost?

- The majority of printed documents are in PDF format. These is open with no cost software like Adobe Reader.

ITR Filing How To Claim HRA Exemption India Today

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Check more sample of Hra Deduction In Itr below

Claim Home Loan Tax Benefits HRA Together For ITR Filing Telangana Today

HRA Calculation Income Tax 2023 HRA Exemption For Salaried Employee

HRA Exemption Calculator In Excel House Rent Allowance Calculation

Income Tax Savings HRA

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

Itr What Is Deduction In

https://blog.saginfotech.com/claim-hra-filing-income-tax-return

While filing your return you will have to deduct the tax exempt HRA amount from the Gross salary Salary as per provision under section 17 Make sure to provide the correct details including the correct tax exempt amount of HRA in your ITR otherwise the income tax department may ask you to submit documents for proof of the HRA

https://taxguru.in/income-tax/house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

While filing your return you will have to deduct the tax exempt HRA amount from the Gross salary Salary as per provision under section 17 Make sure to provide the correct details including the correct tax exempt amount of HRA in your ITR otherwise the income tax department may ask you to submit documents for proof of the HRA

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

Income Tax Savings HRA

HRA Calculation Income Tax 2023 HRA Exemption For Salaried Employee

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

Itr What Is Deduction In

2 Income Tax Department

Mediclaim For Independent Parents Can You Claim Deduction In ITR

Mediclaim For Independent Parents Can You Claim Deduction In ITR

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving