In this digital age, where screens rule our lives, the charm of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons for creative projects, just adding an element of personalization to your space, How To Deduct Hra From Income Tax are now an essential resource. With this guide, you'll dive through the vast world of "How To Deduct Hra From Income Tax," exploring their purpose, where to find them and what they can do to improve different aspects of your life.

Get Latest How To Deduct Hra From Income Tax Below

How To Deduct Hra From Income Tax

How To Deduct Hra From Income Tax -

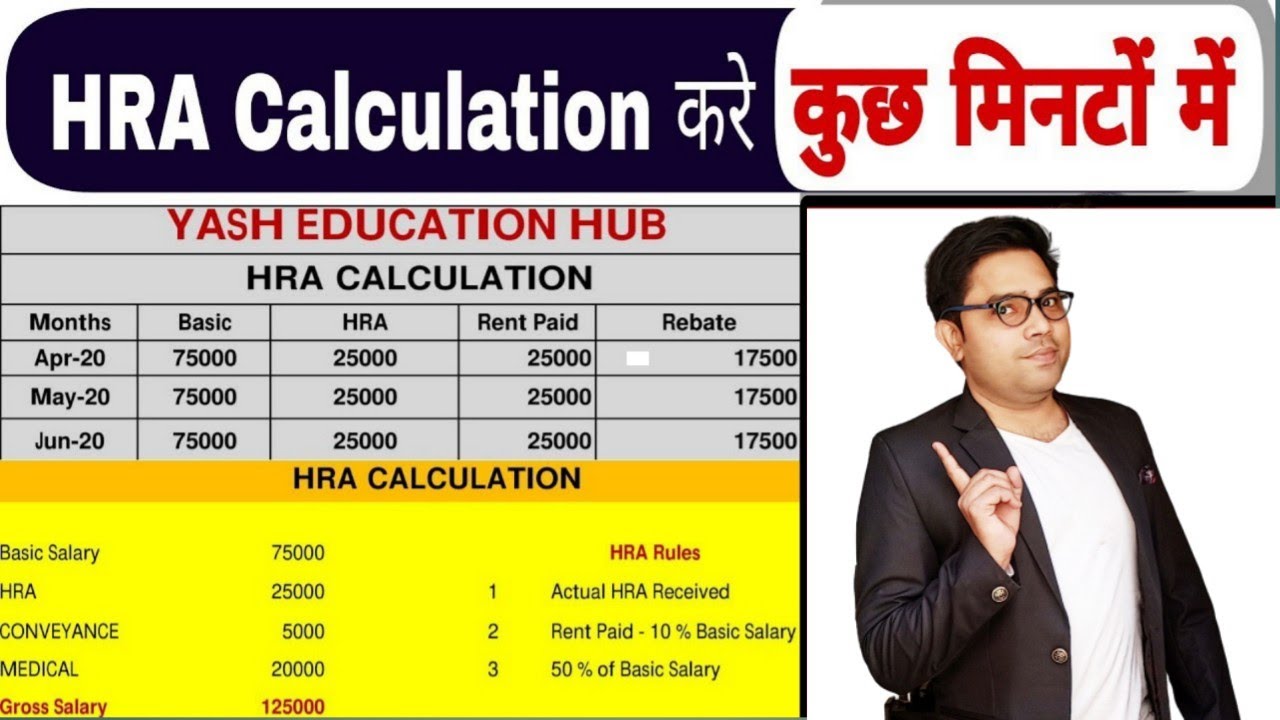

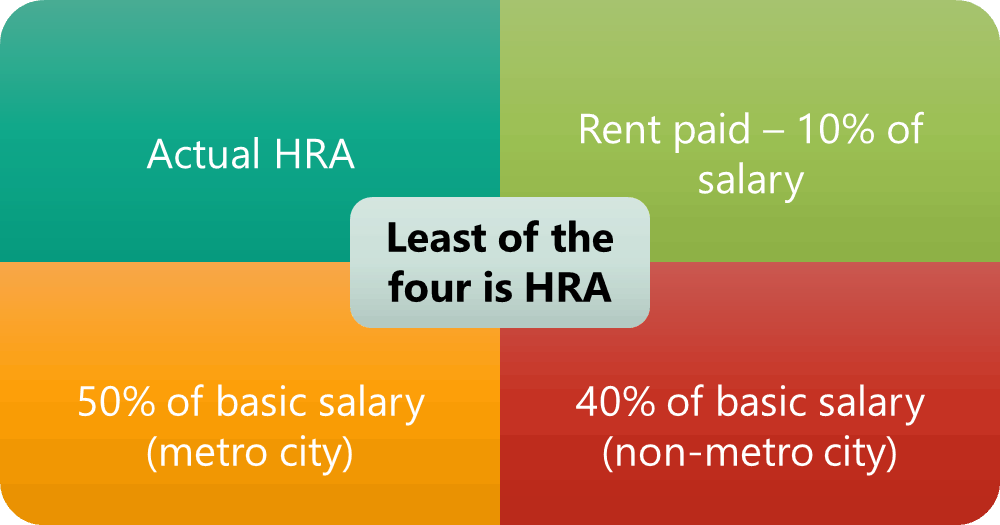

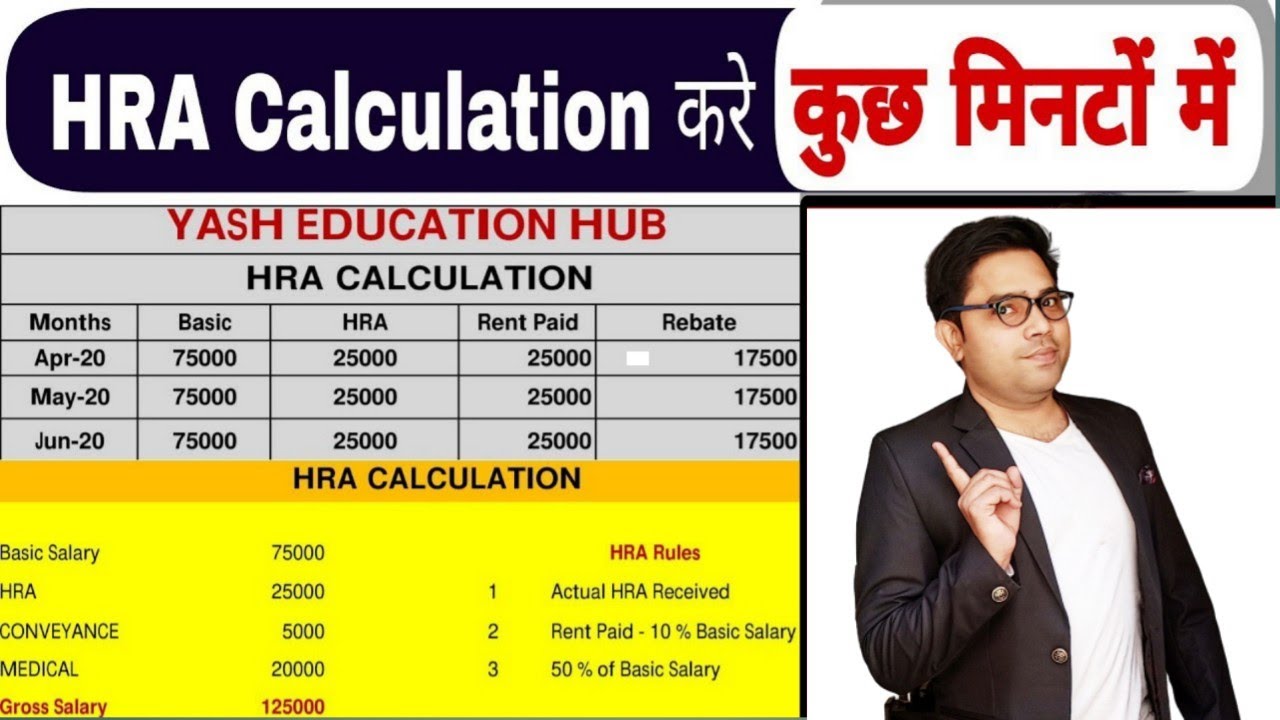

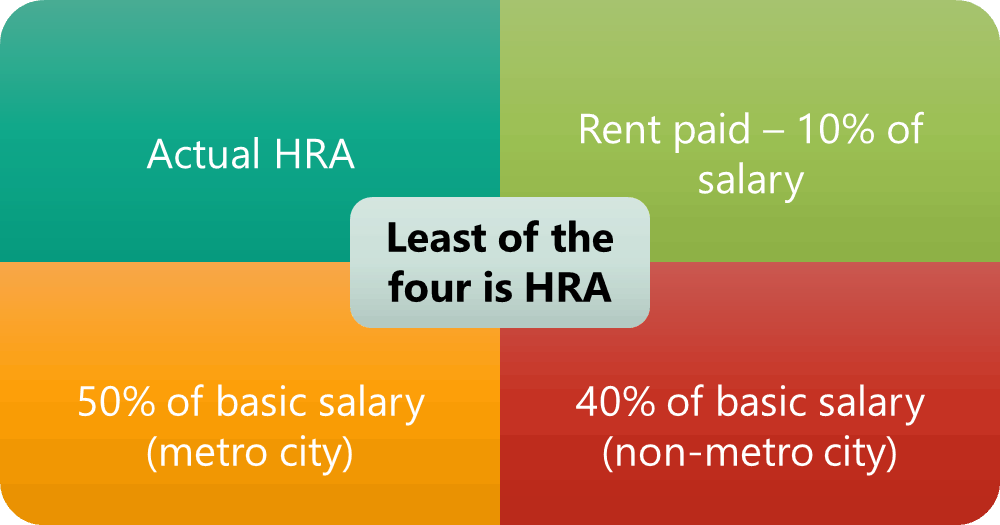

HRA calculation involves determining the amount exempt from income tax The amount of tax deduction that can be claimed over HRA is the lowest of the following Actual rent paid minus 10 of salary HRA received from employer City specific limit 50 of basic salary for those living in metro cities like Mumbai or Chennai

In this article you will learn how to do the HRA calculation how much HRA can be claimed the eligibility for the tax deductions and use the HRA exemption calculator to evaluate your taxable income

How To Deduct Hra From Income Tax include a broad selection of printable and downloadable materials online, at no cost. These resources come in many kinds, including worksheets coloring pages, templates and much more. The attraction of printables that are free is in their variety and accessibility.

More of How To Deduct Hra From Income Tax

The Deductions You Can Claim Hra Tax Vrogue

The Deductions You Can Claim Hra Tax Vrogue

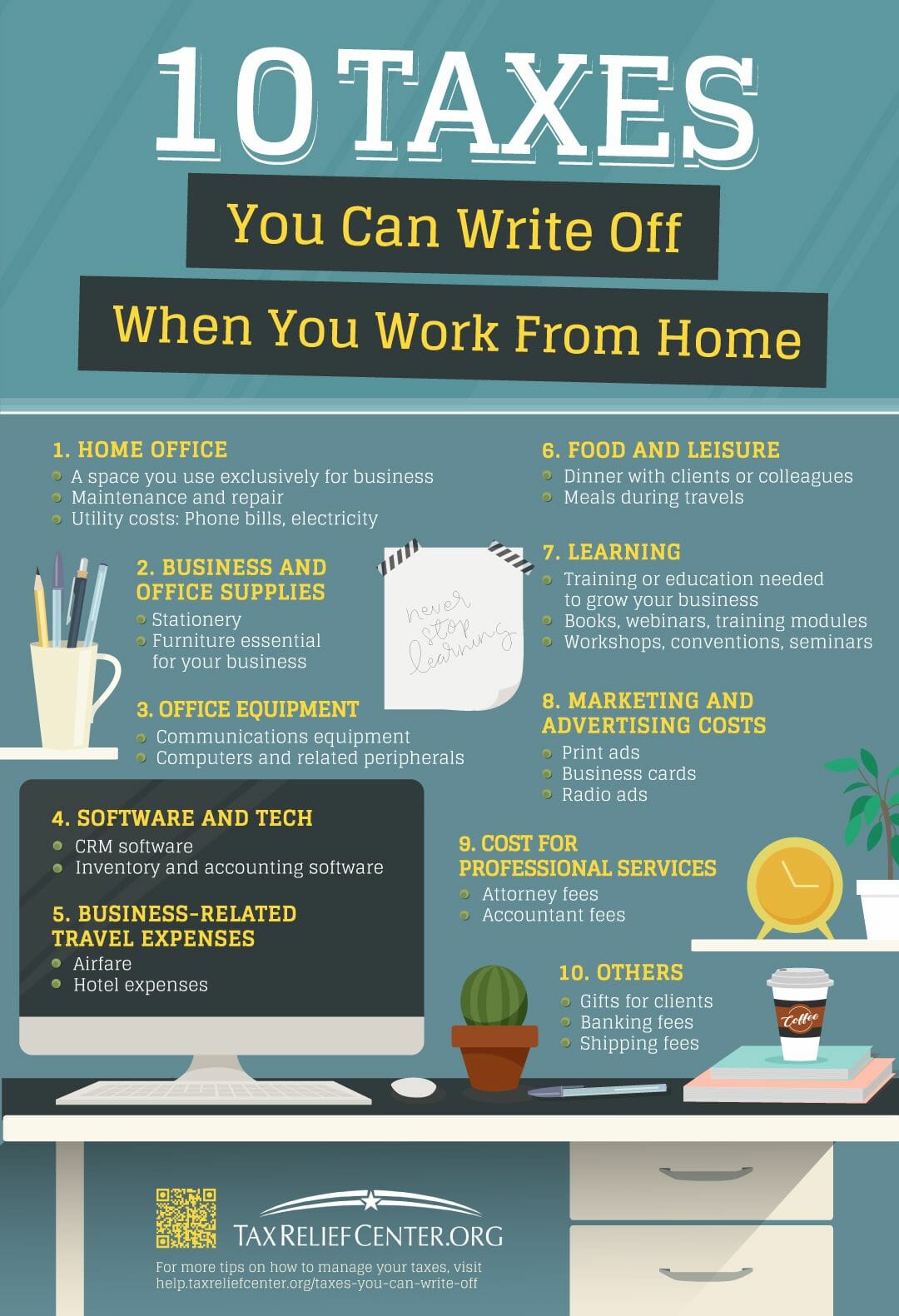

Tax on employment and entertainment allowance will also be allowed as a deduction from the salary income Employment tax is deducted from your salary by your employer and then it is deposited to the state government

Depending on the city the HRA House Rent Allowance varies You can deduct up to 50 of your HRA from your taxes if you live in a metropolis like Mumbai Delhi Chennai or Kolkata If you live anywhere else you can deduct up to 40 of your HRA

How To Deduct Hra From Income Tax have gained a lot of popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization: There is the possibility of tailoring printing templates to your own specific requirements, whether it's designing invitations planning your schedule or decorating your home.

-

Educational Value: The free educational worksheets can be used by students of all ages. This makes them an essential resource for educators and parents.

-

The convenience of The instant accessibility to a plethora of designs and templates reduces time and effort.

Where to Find more How To Deduct Hra From Income Tax

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

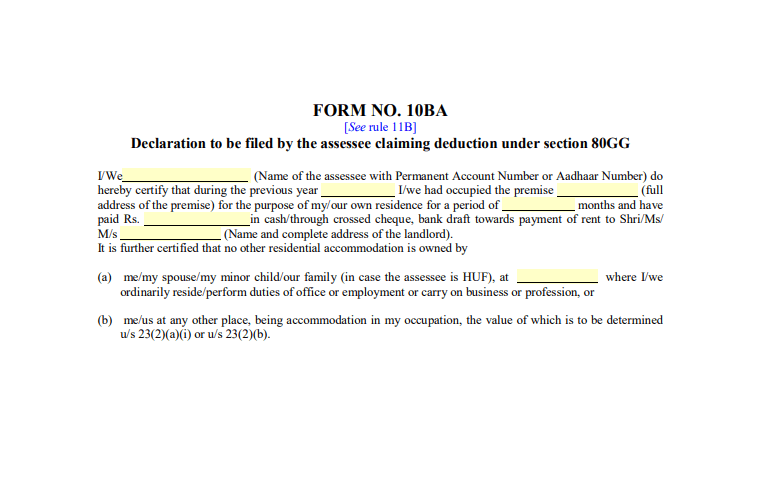

How to Claim Deduction Under Section 80GG How to Avail Tax Benefits on your Home Loan as well as HRA What to Do If we Do not Receive HRA Penalties for false claim Frequently Asked Questions on House Rent Allowance What is HRA in salary

HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a house You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable

If we've already piqued your curiosity about How To Deduct Hra From Income Tax We'll take a look around to see where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection in How To Deduct Hra From Income Tax for different needs.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- The perfect resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- The blogs are a vast range of topics, from DIY projects to planning a party.

Maximizing How To Deduct Hra From Income Tax

Here are some fresh ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

How To Deduct Hra From Income Tax are an abundance of useful and creative resources which cater to a wide range of needs and preferences. Their accessibility and versatility make them an essential part of each day life. Explore the vast world of How To Deduct Hra From Income Tax today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes you can! You can download and print these resources at no cost.

-

Are there any free templates for commercial use?

- It's contingent upon the specific terms of use. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Are there any copyright violations with How To Deduct Hra From Income Tax?

- Certain printables may be subject to restrictions regarding their use. Make sure you read the terms and conditions offered by the author.

-

How can I print printables for free?

- You can print them at home with an printer, or go to a local print shop to purchase top quality prints.

-

What program will I need to access How To Deduct Hra From Income Tax?

- Most PDF-based printables are available in the PDF format, and can be opened using free software like Adobe Reader.

HRA Exemption Calculator In Excel House Rent Allowance Calculation

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

Check more sample of How To Deduct Hra From Income Tax below

How To Get Full Rebate On HRA In Income Tax

HRA Calculation In Salary HRA Calculation In Excel HRA Calculation

Deduction In Respect Of Rent Paid Sec 80GG Eligibility Calculation

How To Deduct Your Car And Rent On Your Tax Return YouTube

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

House Rent Allowance HRA Lenvica HRMS

https://www.omnicalculator.com/finance/hra-exemption

In this article you will learn how to do the HRA calculation how much HRA can be claimed the eligibility for the tax deductions and use the HRA exemption calculator to evaluate your taxable income

https://cleartax.in/s/hra-house-rent-allowance

House Rent Allowance HRA is a key part of a salaried individual s compensation package This article explains HRA its tax exemption and calculation Individuals can avail HRA exemption under Section 10 13A of the Income Tax Act Self employed individuals can use Section 80GG for tax deductions on rented accommodation

In this article you will learn how to do the HRA calculation how much HRA can be claimed the eligibility for the tax deductions and use the HRA exemption calculator to evaluate your taxable income

House Rent Allowance HRA is a key part of a salaried individual s compensation package This article explains HRA its tax exemption and calculation Individuals can avail HRA exemption under Section 10 13A of the Income Tax Act Self employed individuals can use Section 80GG for tax deductions on rented accommodation

How To Deduct Your Car And Rent On Your Tax Return YouTube

HRA Calculation In Salary HRA Calculation In Excel HRA Calculation

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

House Rent Allowance HRA Lenvica HRMS

How To Calculate HRA Exemption For Income Tax Step by Step

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Mortgage

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Mortgage

How To Calculate Salary With Benefits