In this age of technology, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects hasn't waned. In the case of educational materials or creative projects, or just adding an element of personalization to your home, printables for free have become an invaluable resource. With this guide, you'll dive through the vast world of "How To Claim Water Heater Tax Credit," exploring the benefits of them, where to find them and what they can do to improve different aspects of your lives.

Get Latest How To Claim Water Heater Tax Credit Below

How To Claim Water Heater Tax Credit

How To Claim Water Heater Tax Credit -

By further improving your home s envelope with new ENERGY STAR certified exterior doors and a heat pump water heater you can claim up to 600 or 30 of the product cost for upgrading your windows in one taxable year

Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

How To Claim Water Heater Tax Credit encompass a wide assortment of printable materials that are accessible online for free cost. They come in many types, like worksheets, templates, coloring pages, and many more. The appeal of printables for free is in their variety and accessibility.

More of How To Claim Water Heater Tax Credit

About The 2023 Wood And Pellet Home Heater Tax Credit Higgins Energy

About The 2023 Wood And Pellet Home Heater Tax Credit Higgins Energy

Qualified Clean Energy Property How to Claim the Credit Related Resources How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home

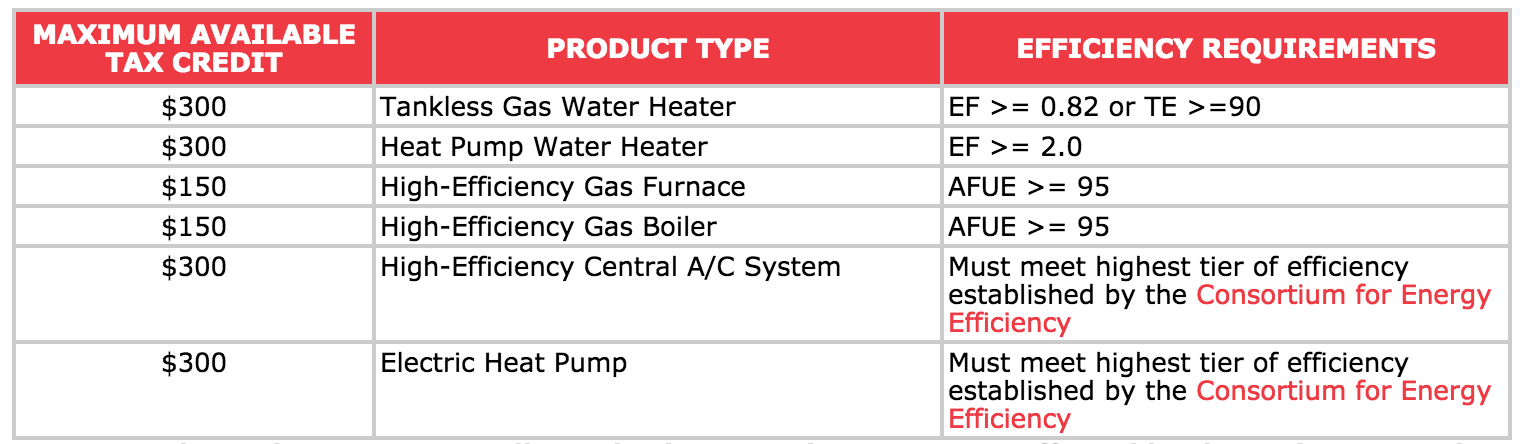

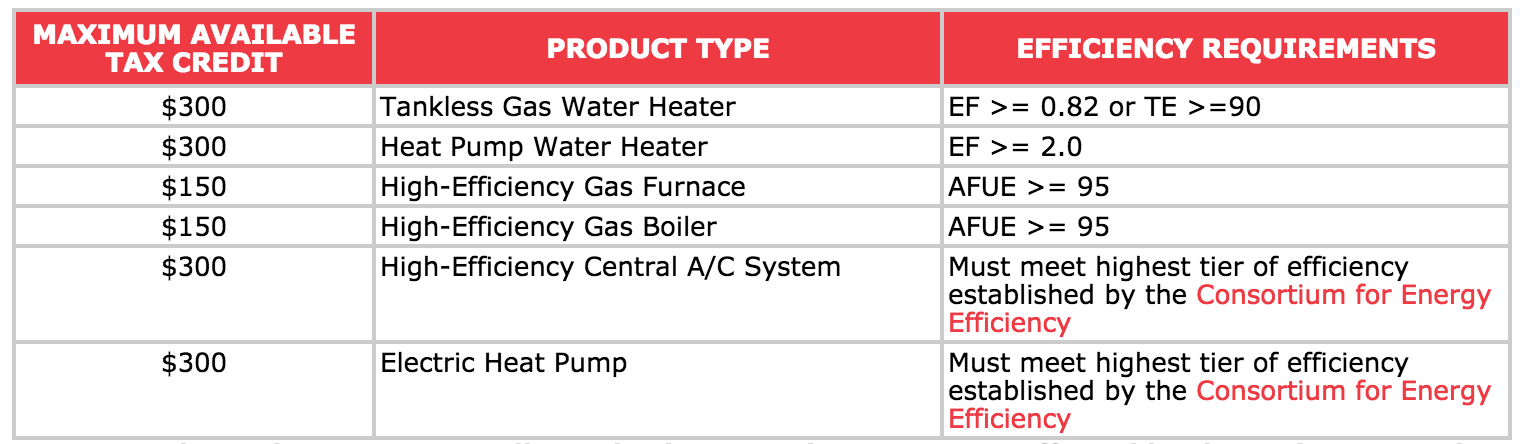

The following criteria must be met in order to receive a tax credit of 300 Uniform Energy Factor UEF 0 82 OR a thermal efficiency of at least 90 According to energystar gov m ost ENERGY STAR certified water heaters meet the requirements of this tax credit How Do I Apply File IRS Form 5695 with your tax return

How To Claim Water Heater Tax Credit have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

customization: Your HTML0 customization options allow you to customize the design to meet your needs whether you're designing invitations and schedules, or even decorating your house.

-

Educational Impact: Free educational printables provide for students of all ages. This makes them a valuable aid for parents as well as educators.

-

Simple: The instant accessibility to various designs and templates can save you time and energy.

Where to Find more How To Claim Water Heater Tax Credit

Bradford HVAC Installation Maintenance And Repair Furnace AC Heating

Bradford HVAC Installation Maintenance And Repair Furnace AC Heating

In addition to the 1 200 credit limit above a separate aggregate yearly credit limit of 2 000 applies to electric or natural gas heat pump water heaters electric or natural gas heat pumps and biomass stoves and biomass boilers

The 300 credit can also be claimed for water heaters including gas oil and propane units with an energy factor of 0 82 or more or a thermal efficiency of at least 90 percent Home Improvements That Qualify Your home s envelope includes the outer walls windows doors and other openings

We hope we've stimulated your curiosity about How To Claim Water Heater Tax Credit Let's find out where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of How To Claim Water Heater Tax Credit for various goals.

- Explore categories such as design, home decor, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets with flashcards and other teaching materials.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- These blogs cover a broad range of topics, ranging from DIY projects to planning a party.

Maximizing How To Claim Water Heater Tax Credit

Here are some fresh ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to aid in learning at your home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

How To Claim Water Heater Tax Credit are a treasure trove of innovative and useful resources that meet a variety of needs and needs and. Their accessibility and versatility make them a fantastic addition to any professional or personal life. Explore the vast array of How To Claim Water Heater Tax Credit now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are How To Claim Water Heater Tax Credit truly free?

- Yes they are! You can print and download these tools for free.

-

Can I make use of free printouts for commercial usage?

- It's determined by the specific usage guidelines. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues in How To Claim Water Heater Tax Credit?

- Some printables may come with restrictions in use. Be sure to check the terms and regulations provided by the author.

-

How do I print printables for free?

- Print them at home with any printer or head to an in-store print shop to get top quality prints.

-

What software must I use to open printables at no cost?

- Most printables come with PDF formats, which can be opened with free software like Adobe Reader.

What Does Water Do To Our Bodies WaterProAdvice

Questions To Ask When Having Your Furnace Installed Heatingontario ca

Check more sample of How To Claim Water Heater Tax Credit below

Pellet Heater Tax Credit Doctor Flue MI OH

HVAC Tax Credit For 2014 Improvements

Upfront Pricing On Tankless Water Heater Tune Up Peterman Brothers

HVAC Mississauga Commercial Residential Installation And Repair

Heat Pump Energy Tax Credit PumpRebate

Service Area Peterman Brothers Heating Cooling And Plumbing

www.irs.gov/credits-deductions/home-energy-tax-credits

Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

www.energystar.gov/about/federal-tax...

How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695 Print Version PDF YOU CAN CLAIM 30 of project cost 600 maximum amount credited What products are eligible Gas storage water heaters

Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695 Print Version PDF YOU CAN CLAIM 30 of project cost 600 maximum amount credited What products are eligible Gas storage water heaters

HVAC Mississauga Commercial Residential Installation And Repair

HVAC Tax Credit For 2014 Improvements

Heat Pump Energy Tax Credit PumpRebate

Service Area Peterman Brothers Heating Cooling And Plumbing

Radiant Floor Heating System Heating Ontario HVAC Company

Federal Rebate For Tankless Water Heater 2022 WaterRebate

Federal Rebate For Tankless Water Heater 2022 WaterRebate

9 Types Of Air Conditioners For Various Spaces Residential Commercial