In the digital age, when screens dominate our lives but the value of tangible printed items hasn't gone away. If it's to aid in education, creative projects, or just adding an extra personal touch to your space, How To Claim Rebate On House Rent Paid have proven to be a valuable resource. The following article is a take a dive through the vast world of "How To Claim Rebate On House Rent Paid," exploring their purpose, where they are, and how they can enrich various aspects of your life.

Get Latest How To Claim Rebate On House Rent Paid Below

How To Claim Rebate On House Rent Paid

How To Claim Rebate On House Rent Paid -

Hence check the Salary Slip to see if there is any House Rent Allowance component in the salary break up If not a taxpayer can claim a deduction for rent paid under section 80GG So a deduction can be claimed from total income if The taxpayer has paid the House rent There is no House Rent Allowance component in the salary structure

1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961 Stay in Rented Accommodation Not living in a self owned Rent paid exceeds 10 of

How To Claim Rebate On House Rent Paid include a broad assortment of printable content that can be downloaded from the internet at no cost. They come in many styles, from worksheets to templates, coloring pages and much more. The appeal of printables for free is in their versatility and accessibility.

More of How To Claim Rebate On House Rent Paid

Older Disabled Residents Can File For Property Tax Rent Rebate Program

Older Disabled Residents Can File For Property Tax Rent Rebate Program

Since house rent allowance or HRA is almost always an integral part of a company s salary structure knowing the nitty gritty of HRA calculation and HRA exemption is crucial for tax savings purposes HRA exemption Conditions for claiming HRA rebate under Section 10 13A HRA exemption limit HRA calculation

The benefit is allowed as a deduction from one s total income However the deduction is restricted to 25 of the total income or excess of rent actually paid over 10 of the total income Moreover the maximum deduction that can be claimed in a year is Rs 60 000 and Rs 5 000 per month This 10 deduction is not based on the period for which

How To Claim Rebate On House Rent Paid have gained a lot of popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Individualization The Customization feature lets you tailor designs to suit your personal needs be it designing invitations, organizing your schedule, or even decorating your house.

-

Educational Benefits: The free educational worksheets cater to learners of all ages. This makes these printables a powerful aid for parents as well as educators.

-

The convenience of instant access the vast array of design and templates reduces time and effort.

Where to Find more How To Claim Rebate On House Rent Paid

Income Tax Return Filing To Linking Aadhaar With UAN These 4 Financial

Income Tax Return Filing To Linking Aadhaar With UAN These 4 Financial

Calculation of the HRA that can be claimed from the salary 1 Actual rent paid annually minus 10 of annual basic salary 15 000 x 12 50 400 1 29 600 2 Actual HRA given by the

Documents required to claim HRA tax exemption HRA exemptions can be availed only on submission of rent receipts and the rent agreement with the house owner to the employer According to tax experts it is mandatory to have both rent agreement and rent receipts from landlord to claim the HRA tax exemption

In the event that we've stirred your interest in printables for free, let's explore where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of How To Claim Rebate On House Rent Paid suitable for many purposes.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets or flashcards as well as learning tools.

- Ideal for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- These blogs cover a wide spectrum of interests, from DIY projects to party planning.

Maximizing How To Claim Rebate On House Rent Paid

Here are some new ways how you could make the most use of How To Claim Rebate On House Rent Paid:

1. Home Decor

- Print and frame stunning images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

How To Claim Rebate On House Rent Paid are a treasure trove of creative and practical resources catering to different needs and interests. Their accessibility and flexibility make these printables a useful addition to the professional and personal lives of both. Explore the vast world of How To Claim Rebate On House Rent Paid right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are How To Claim Rebate On House Rent Paid really for free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I use free templates for commercial use?

- It's based on the usage guidelines. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables may be subject to restrictions regarding usage. Make sure you read these terms and conditions as set out by the author.

-

How do I print How To Claim Rebate On House Rent Paid?

- Print them at home with the printer, or go to the local print shop for the highest quality prints.

-

What program must I use to open printables at no cost?

- The majority of printed documents are in the format PDF. This is open with no cost software like Adobe Reader.

Application Deadline Extended To Dec 31 For Property Tax Rent Rebate

Pennsylvanians Can Now File Property Tax Rent Rebate Program

Check more sample of How To Claim Rebate On House Rent Paid below

Do You Have A Soakaway How To Claim A Surface Water Drainage Rebate On

Pa Renters Rebate Status RentersRebate

How To File My Renters Rebate RentersRebate

Know Income Tax Rebate On House Rent Income

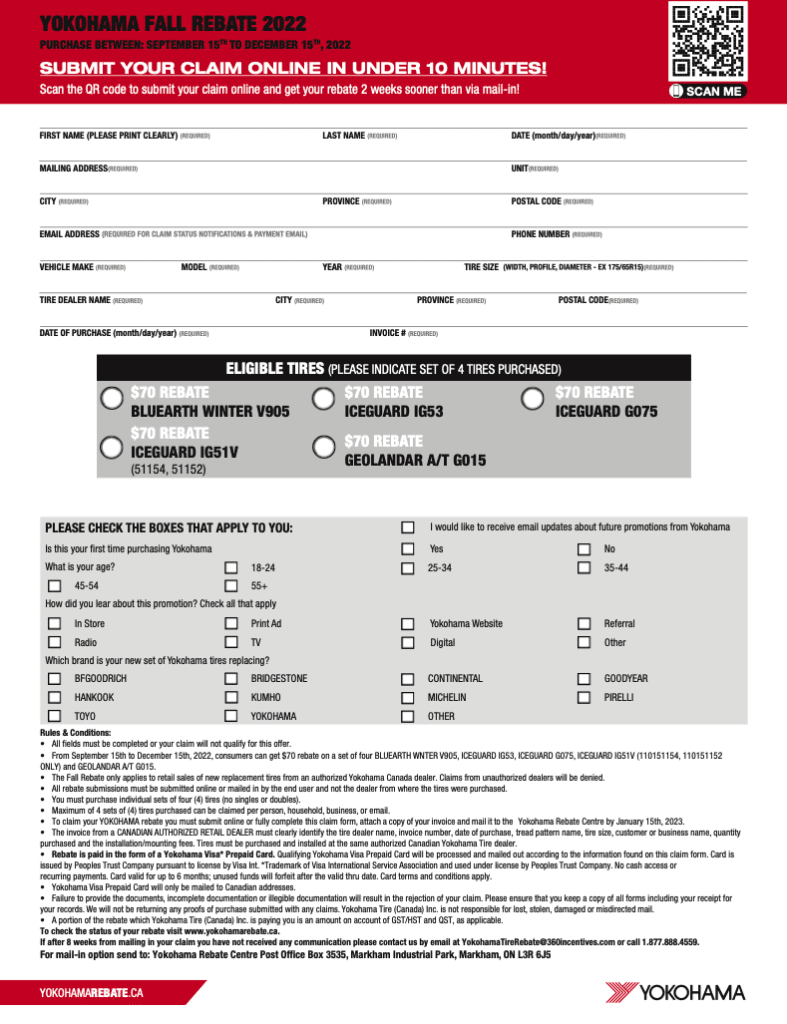

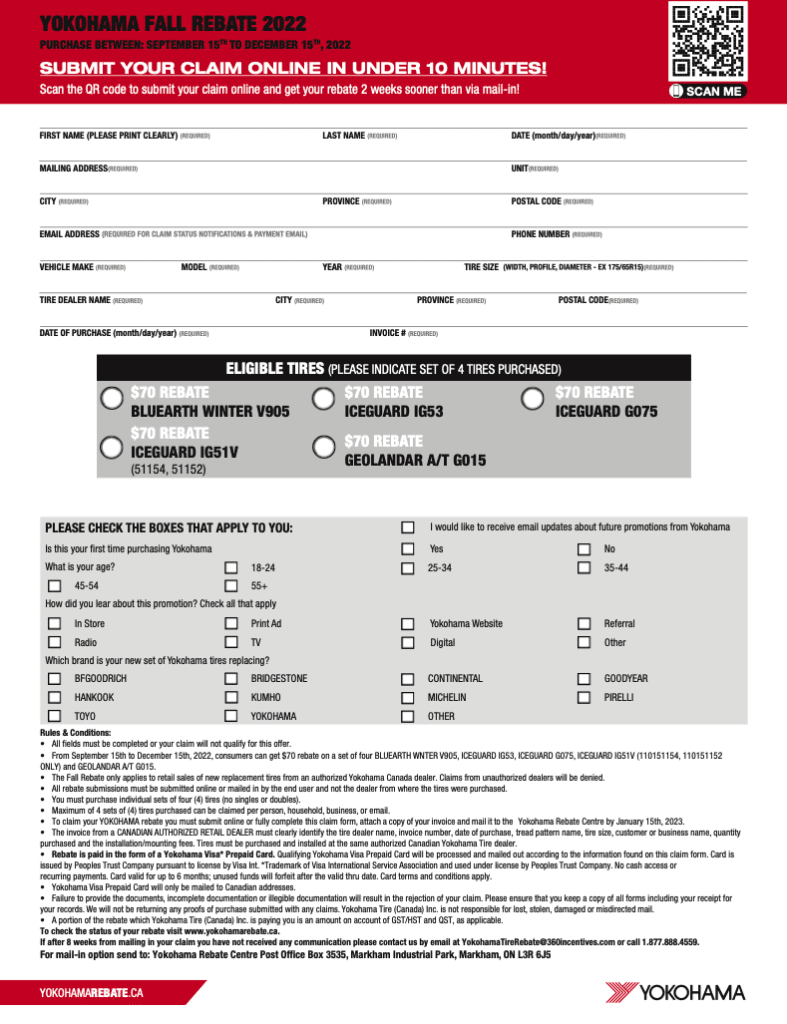

Yokohama Tire Rebate Form 2023 Printable Rebate Form

Here Is How To Claim Rebate Under Section 87A Of Income tax Act

https://taxguru.in/income-tax/house-rent-allowance...

1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961 Stay in Rented Accommodation Not living in a self owned Rent paid exceeds 10 of

https://cleartax.in/s/claim-deduction-under-section-80gg-for-rent-paid

Yes you can claim Section 80GG benefit under old tax regime when the property is in your father s name and you are paying rent to him You must enter into a rental agreement with your father and submit Form 10BA to claim the benefit

1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961 Stay in Rented Accommodation Not living in a self owned Rent paid exceeds 10 of

Yes you can claim Section 80GG benefit under old tax regime when the property is in your father s name and you are paying rent to him You must enter into a rental agreement with your father and submit Form 10BA to claim the benefit

Know Income Tax Rebate On House Rent Income

Pa Renters Rebate Status RentersRebate

Yokohama Tire Rebate Form 2023 Printable Rebate Form

Here Is How To Claim Rebate Under Section 87A Of Income tax Act

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

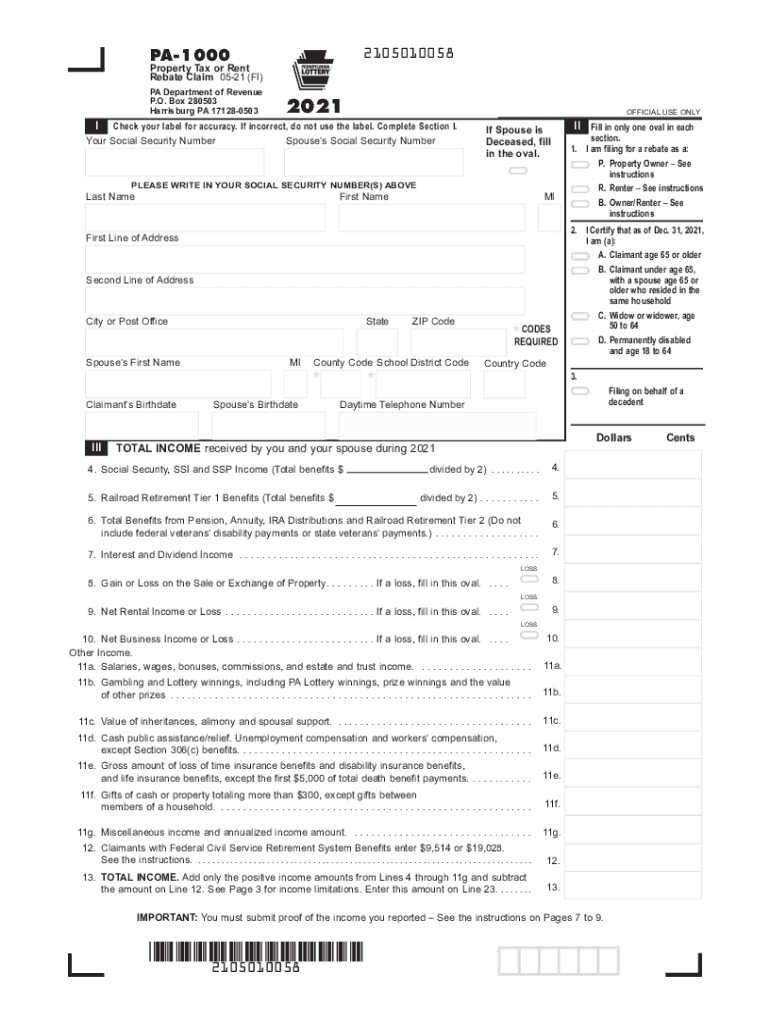

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

How To Get Full Rebate On HRA In Income Tax