In this age of technology, where screens rule our lives but the value of tangible printed objects isn't diminished. In the case of educational materials project ideas, artistic or just adding an extra personal touch to your space, How To Claim Eis Tax Relief For Previous Year are now an essential resource. For this piece, we'll take a dive through the vast world of "How To Claim Eis Tax Relief For Previous Year," exploring the benefits of them, where to get them, as well as how they can add value to various aspects of your daily life.

Get Latest How To Claim Eis Tax Relief For Previous Year Below

How To Claim Eis Tax Relief For Previous Year

How To Claim Eis Tax Relief For Previous Year -

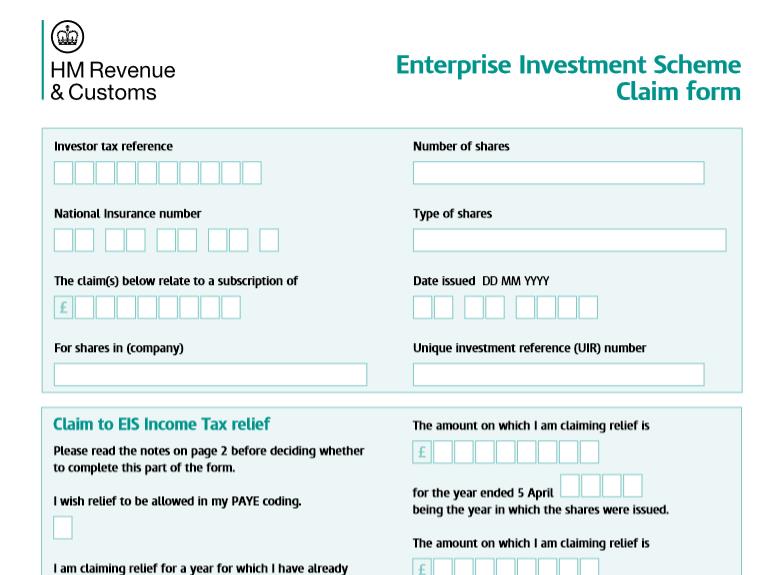

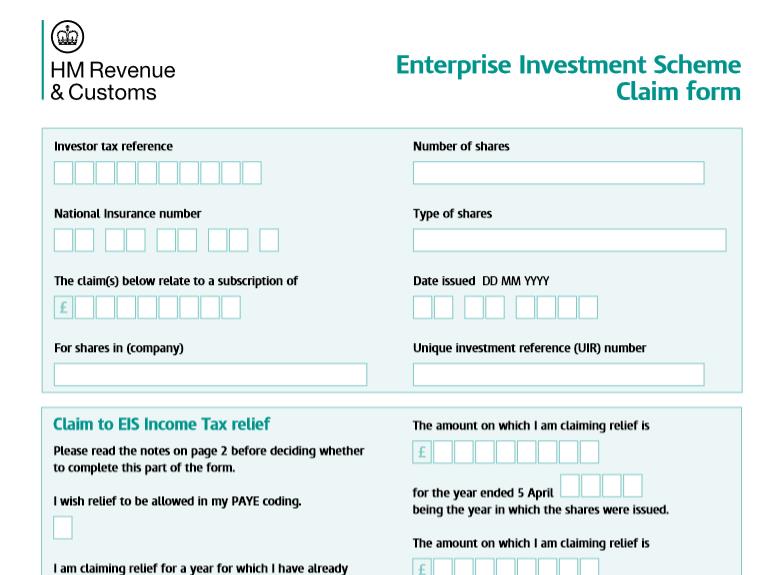

The maximum is 1 million If you have already received some relief during the year by a change in PAYE code or reduction in payment on account include this amount However if an amount is being claimed from

1 The circumstances in which you can claim the relief If you ve received a form EIS3 or EIS5 for any investment you made in shares issued during the year ended 5 April 2022 or in some

The How To Claim Eis Tax Relief For Previous Year are a huge range of downloadable, printable resources available online for download at no cost. These resources come in many styles, from worksheets to templates, coloring pages, and much more. One of the advantages of How To Claim Eis Tax Relief For Previous Year is their versatility and accessibility.

More of How To Claim Eis Tax Relief For Previous Year

How To File Your EIS And SEIS Claims TrendScout UK

How To File Your EIS And SEIS Claims TrendScout UK

The key thing to bear in mind if you re looking to claim these reliefs separately e g if the gain you d like to defer is in the current tax year but you d like to claim income tax relief for the previous tax year is that you retain a copy of your EIS form and certificate

Carry back applying tax relief to a previous year Reduction or elimination of Inheritance Tax on eligible EIS shares held for two years Two options for EIS investment There are two options for investing with EIS Either you can invest directly in an EIS qualifying company or you can invest in an EIS fund

The How To Claim Eis Tax Relief For Previous Year have gained huge popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: The Customization feature lets you tailor printables to fit your particular needs whether you're designing invitations planning your schedule or decorating your home.

-

Educational Value: Education-related printables at no charge offer a wide range of educational content for learners of all ages, which makes them a valuable tool for parents and educators.

-

Easy to use: Access to various designs and templates reduces time and effort.

Where to Find more How To Claim Eis Tax Relief For Previous Year

8 Things You Didn t Know About SEIS EIS Tax Relief By Anthony Rose

8 Things You Didn t Know About SEIS EIS Tax Relief By Anthony Rose

Investors with capital gains made up to three years before or one year after an EIS investment is made can claim deferral relief against those gains at up to 24 for gains on residential property and up to 20 on other

Benefits There are a number of potential tax reliefs associated with EIS Income Tax relief Individuals who subscribe for shares in an EIS qualifying company will receive tax relief of 30 on the cost of the shares which is offset against the individual s Income Tax liability for the year in which the investment was made

If we've already piqued your curiosity about How To Claim Eis Tax Relief For Previous Year We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of needs.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs are a vast range of topics, starting from DIY projects to party planning.

Maximizing How To Claim Eis Tax Relief For Previous Year

Here are some innovative ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

How To Claim Eis Tax Relief For Previous Year are an abundance with useful and creative ideas catering to different needs and desires. Their accessibility and versatility make them a valuable addition to both professional and personal lives. Explore the vast collection of How To Claim Eis Tax Relief For Previous Year now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes, they are! You can download and print these items for free.

-

Can I make use of free printables in commercial projects?

- It is contingent on the specific rules of usage. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may have restrictions in their usage. Be sure to check the conditions and terms of use provided by the designer.

-

How can I print How To Claim Eis Tax Relief For Previous Year?

- Print them at home using either a printer or go to a local print shop to purchase premium prints.

-

What software do I need to run printables free of charge?

- The majority of PDF documents are provided in PDF format. These is open with no cost programs like Adobe Reader.

How Do I Claim An EIS Loss Relief On My Taxes KBC

How To Claim Eis Client Is Claiming Eis Relief And Has Given Me Form

Check more sample of How To Claim Eis Tax Relief For Previous Year below

EIS Tax Relief EIS Scheme Explained

.jpg)

Your Guide To EIS The Enterprise Investment Scheme

EIS Tax Relief Maximizing Savings And Minimizing Taxes YouTube

Here s How To Claim EIS Tax Reliefs This Tax Year

Claiming EIS Tax Relief For Investors Sleek

Our Guide To EIS Tax Relief TrendScout UK

https://www.gov.uk/government/publications/...

1 The circumstances in which you can claim the relief If you ve received a form EIS3 or EIS5 for any investment you made in shares issued during the year ended 5 April 2022 or in some

https://community.hmrc.gov.uk/customerforums/sa/68...

You would only be able to include an EIS claim in your 22 23 tax return for that tax year If your claim is for tax relief on an investment of over 33333 then this claim will

1 The circumstances in which you can claim the relief If you ve received a form EIS3 or EIS5 for any investment you made in shares issued during the year ended 5 April 2022 or in some

You would only be able to include an EIS claim in your 22 23 tax return for that tax year If your claim is for tax relief on an investment of over 33333 then this claim will

Here s How To Claim EIS Tax Reliefs This Tax Year

Your Guide To EIS The Enterprise Investment Scheme

Claiming EIS Tax Relief For Investors Sleek

Our Guide To EIS Tax Relief TrendScout UK

How To Claim EIS Sep 24 2021 Johor Bahru JB Malaysia Taman

What Is EIS Tax Relief Envestors

What Is EIS Tax Relief Envestors

Firglas Ltd EIS Single Company Investment Opportunity Commercial