Today, in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. If it's to aid in education project ideas, artistic or simply to add an extra personal touch to your area, How Much Vat Refund In Uk have proven to be a valuable source. With this guide, you'll dive deeper into "How Much Vat Refund In Uk," exploring their purpose, where they can be found, and how they can enhance various aspects of your lives.

Get Latest How Much Vat Refund In Uk Below

How Much Vat Refund In Uk

How Much Vat Refund In Uk -

Value added tax VAT is a 20 sales tax charged on most goods in the UK Visitors from outside the EU were eligible for tax free shopping until January 2021 Tax free sales at airports ports and Eurostar stations ended as of 1 January 2021

Currently the standard VAT rate is 20 that means 20 is the amount added to the price in purchases and the amount that can be reclaimed by those that are eligible to apply The current 20 rate came in to effect on 4th January 2011

How Much Vat Refund In Uk cover a large assortment of printable, downloadable documents that can be downloaded online at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages and many more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of How Much Vat Refund In Uk

Claiming VAT Refunds In The European Union FastVAT 2023

Claiming VAT Refunds In The European Union FastVAT 2023

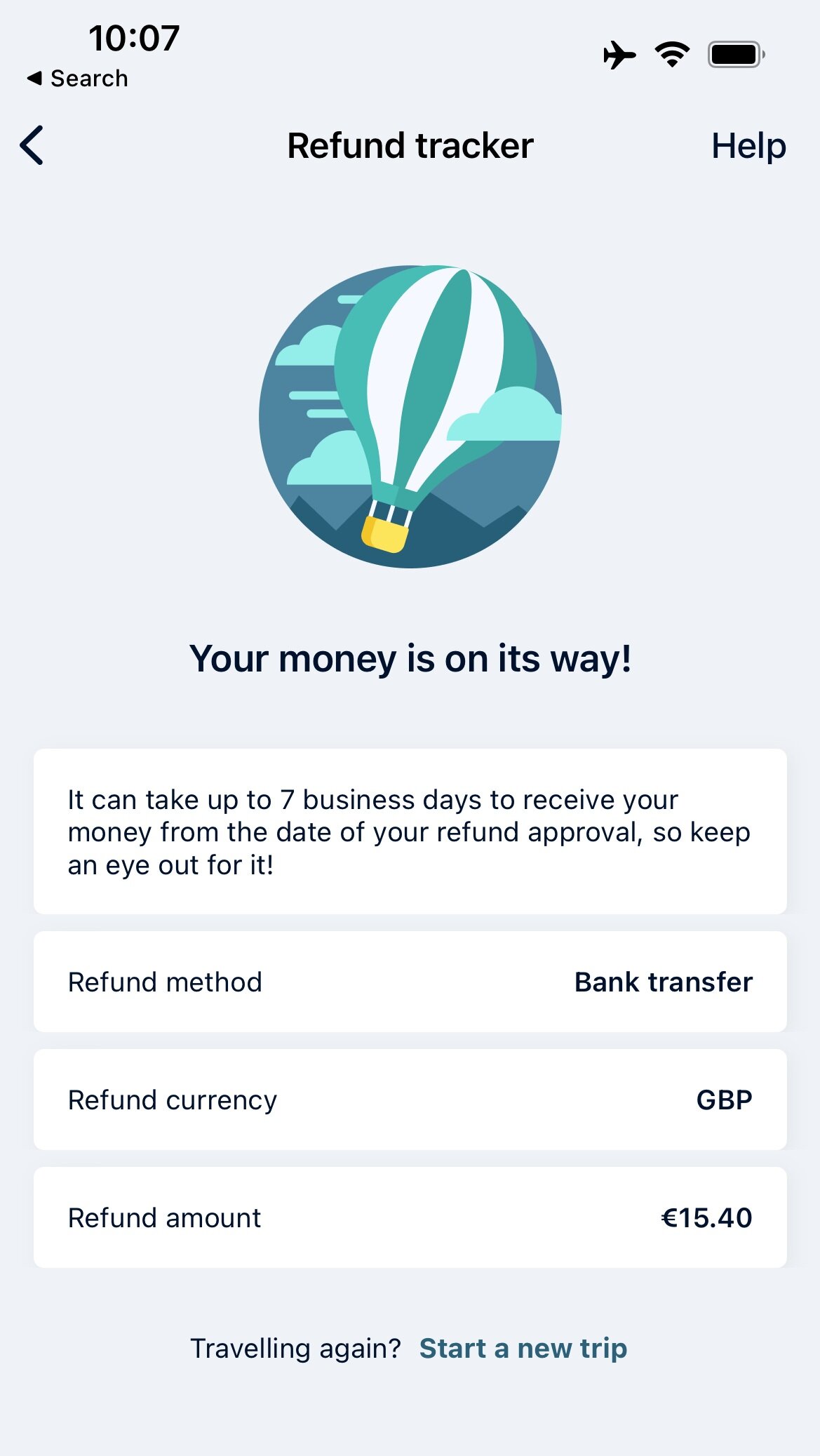

You can find out exactly how much you will save by using our refund calculator tool within the Airvat app Note that tax free shopping rules are changing in the UK from 1 January 2021 so you may also need to consider additional shipping costs and your home country import costs

As the rate of VAT in the UK is 20 per cent on most goods this could be a significant sum This situation has now changed and this option was cancelled with effect from January 1 2021 a date when many changes took place as it was the first day that the UK was fully out of the EU after a transition period

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization: You can tailor printed materials to meet your requirements when it comes to designing invitations or arranging your schedule or even decorating your home.

-

Educational Worth: Downloads of educational content for free can be used by students of all ages, making them a valuable device for teachers and parents.

-

Convenience: Access to many designs and templates is time-saving and saves effort.

Where to Find more How Much Vat Refund In Uk

How Tourists Can Get VAT Refund In UAE Saif Chartered Accountants UAE

How Tourists Can Get VAT Refund In UAE Saif Chartered Accountants UAE

Travel to more countries Try our global calculator Save up to 25 in United Kingdom Book your business trips with TravelPerk to make it easy to get up to 25 of your spend back The VAT reclaim process has never been quicker or easier Book more VAT recoverable trips TravelPerk offers the world s largest range of business travel options

How much is VAT refund in the UK VAT is charged as a percentage rate of the net price which is the price before the tax is applied In the UK VAT is 20 of the net price which is equal to 16 67 of the gross price i e the price actually paid by you in

In the event that we've stirred your interest in How Much Vat Refund In Uk Let's take a look at where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of How Much Vat Refund In Uk for various needs.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free with flashcards and other teaching materials.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a broad array of topics, ranging all the way from DIY projects to party planning.

Maximizing How Much Vat Refund In Uk

Here are some creative ways of making the most use of How Much Vat Refund In Uk:

1. Home Decor

- Print and frame stunning artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use these printable worksheets free of charge for teaching at-home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

How Much Vat Refund In Uk are an abundance of creative and practical resources which cater to a wide range of needs and passions. Their accessibility and flexibility make them a fantastic addition to both professional and personal lives. Explore the vast collection of How Much Vat Refund In Uk today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes, they are! You can download and print these materials for free.

-

Can I download free printables for commercial purposes?

- It's based on specific terms of use. Always review the terms of use for the creator before using any printables on commercial projects.

-

Do you have any copyright rights issues with How Much Vat Refund In Uk?

- Some printables could have limitations in their usage. Be sure to read the terms and regulations provided by the creator.

-

How can I print How Much Vat Refund In Uk?

- You can print them at home using either a printer or go to the local print shops for premium prints.

-

What software is required to open printables free of charge?

- Most PDF-based printables are available in PDF format, which can be opened using free software like Adobe Reader.

REAL ESTATE MARBELLA WOHNEN How Much VAT Is Paid When Buying A

How To Get A VAT Refund In The UK With An App

Check more sample of How Much Vat Refund In Uk below

VAT Refund For Tourists In Dubai What You Need To Know

Hmrc Vat Registration Foreign Company

VAT Calculator Calculate How Much VAT You Pay Company Bug

How Much VAT Is My Business Paying On Energy AI Global Media Ltd

How Much VAT Lies Hidden In Your Company T E Budget YouTube

How To Apply For The EU VAT Refund In France France Travel Tips

http://www.essentialtravelguide.com/travel-articles/uk...

Currently the standard VAT rate is 20 that means 20 is the amount added to the price in purchases and the amount that can be reclaimed by those that are eligible to apply The current 20 rate came in to effect on 4th January 2011

https://www.gov.uk/vat-repayments

Total amount of VAT paid Box 4 You re due a repayment if the figure in Box 3 is less than the figure in Box 4 How much you re repaid is the figure shown in Box 5 of your VAT Return

Currently the standard VAT rate is 20 that means 20 is the amount added to the price in purchases and the amount that can be reclaimed by those that are eligible to apply The current 20 rate came in to effect on 4th January 2011

Total amount of VAT paid Box 4 You re due a repayment if the figure in Box 3 is less than the figure in Box 4 How much you re repaid is the figure shown in Box 5 of your VAT Return

How Much VAT Is My Business Paying On Energy AI Global Media Ltd

Hmrc Vat Registration Foreign Company

How Much VAT Lies Hidden In Your Company T E Budget YouTube

How To Apply For The EU VAT Refund In France France Travel Tips

How To Get Your VAT Refund In Paris Charles De Gaulle Airport France

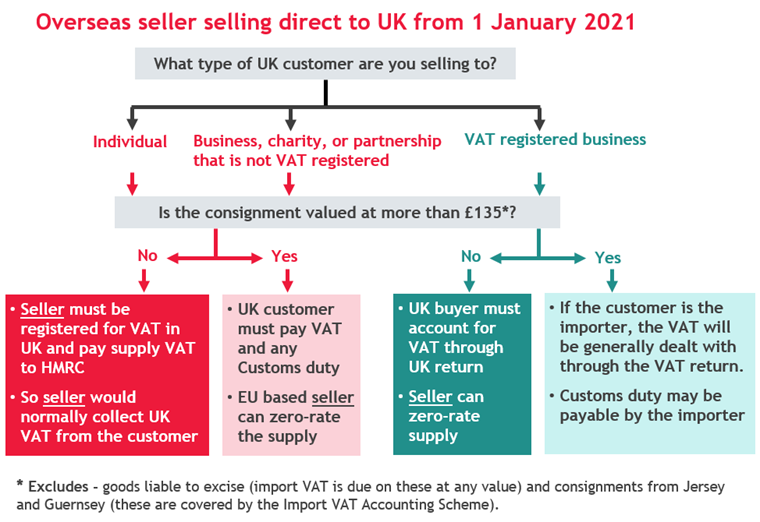

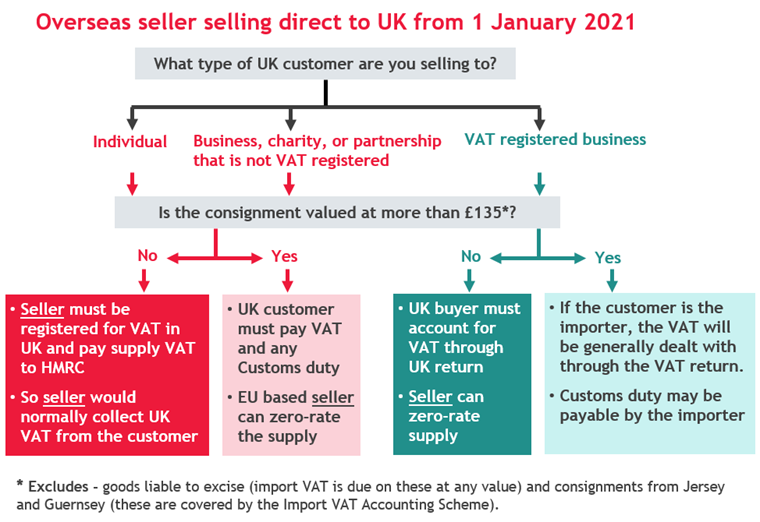

How Much VAT Do You Pay On Imported Goods Tax Navigator London

How Much VAT Do You Pay On Imported Goods Tax Navigator London

Hecht Group Does Pennymac Pay Property Taxes