In this age of technology, where screens rule our lives, the charm of tangible printed items hasn't gone away. Be it for educational use as well as creative projects or simply to add an individual touch to the home, printables for free are now a useful source. Through this post, we'll dive deeper into "How Much Tax Deduction In Ontario," exploring what they are, how to find them, and the ways that they can benefit different aspects of your life.

Get Latest How Much Tax Deduction In Ontario Below

How Much Tax Deduction In Ontario

How Much Tax Deduction In Ontario -

In Ontario tax brackets are based on net income for income tax purposes There are five tax brackets First 49 231 or less Second over 49 231 up to 98 463 Third over 98 463 up to 150 000 Fourth over 150 000 up to 220 000 Fifth over 220 000 Each tax bracket has a different rate of tax associated with it

Federal income tax rates in 2023 range from 15 to 33 Ontario income tax rates in 2023 range from 5 05 to 13 16 The amount of income tax that was deducted from your paycheque appears in Box 22 of your T4 slip Learn more about income tax withholding

Printables for free include a vast assortment of printable, downloadable materials that are accessible online for free cost. They are available in a variety of types, like worksheets, templates, coloring pages, and more. The attraction of printables that are free is in their versatility and accessibility.

More of How Much Tax Deduction In Ontario

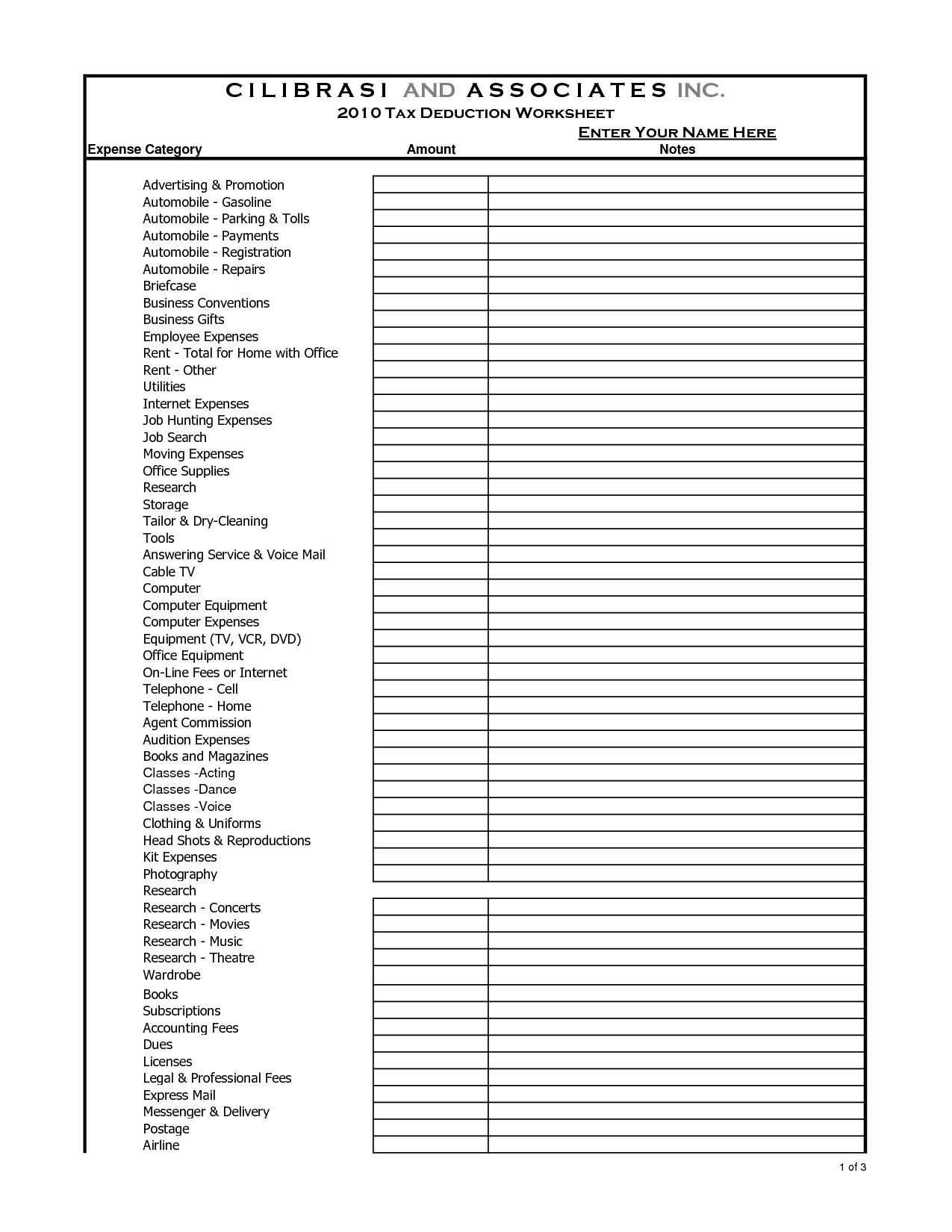

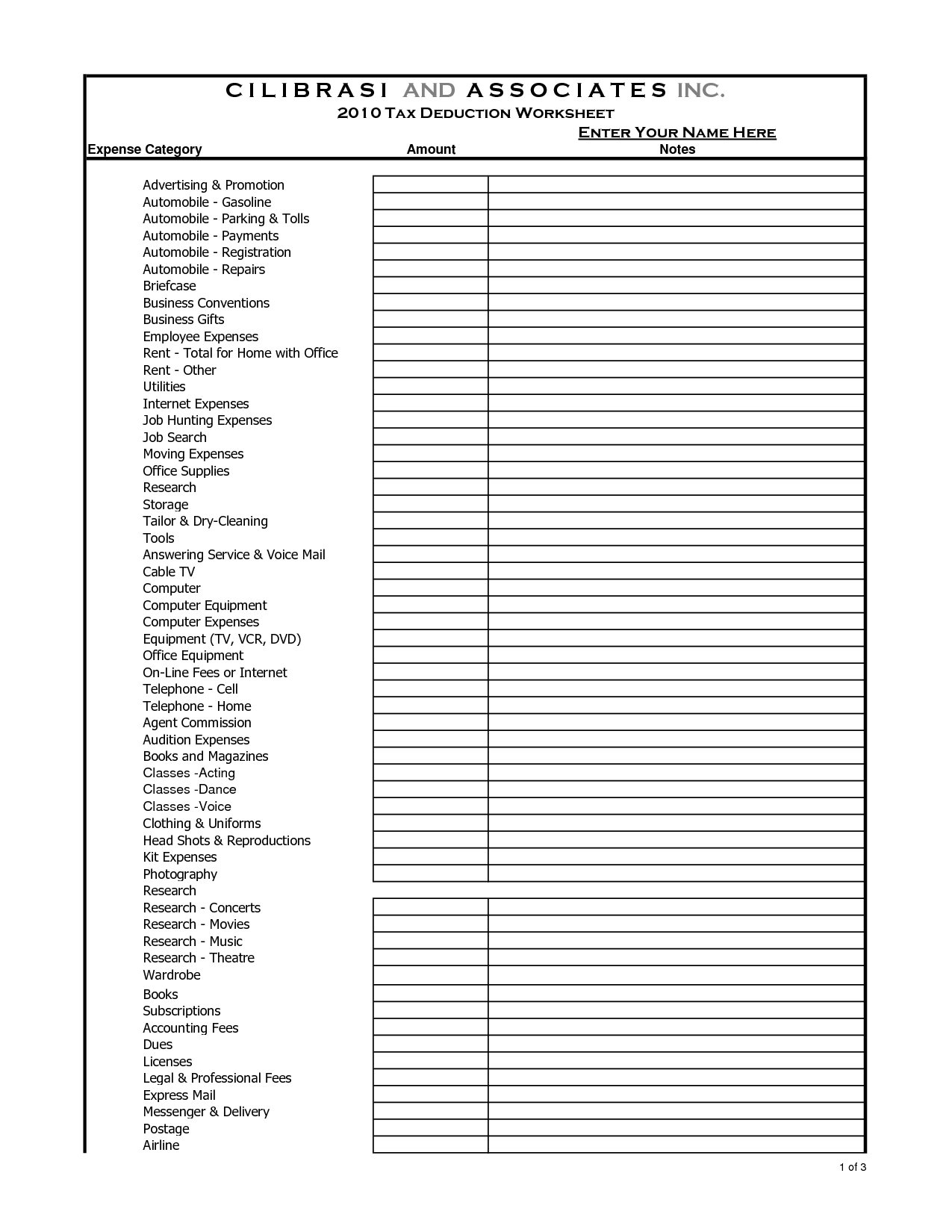

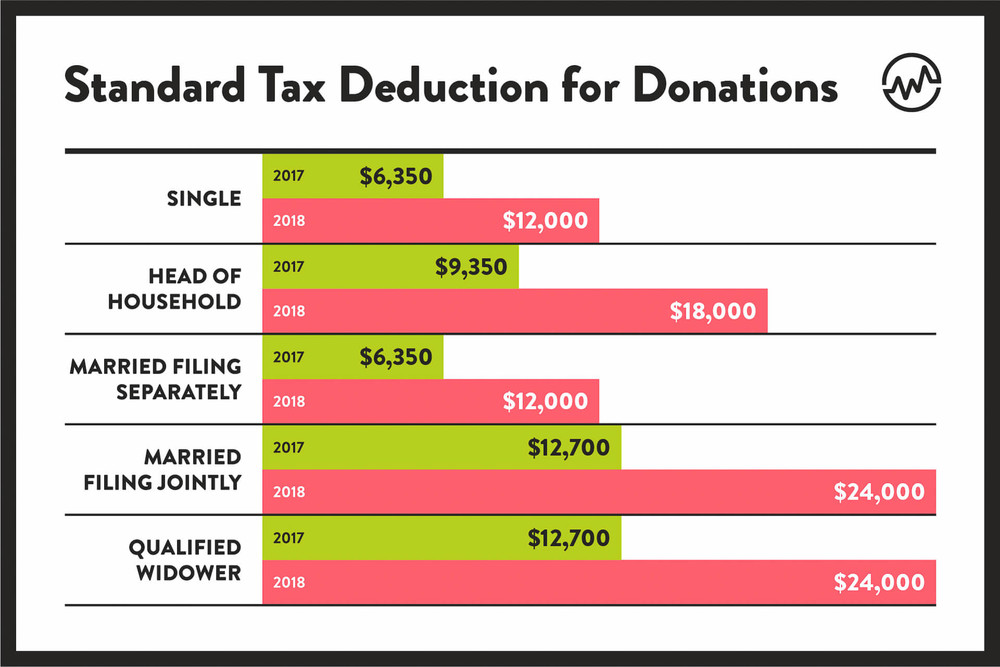

How Much Do You Need To Donate For Tax Deduction

How Much Do You Need To Donate For Tax Deduction

2022 Income Tax Calculator Ontario 2023 Ontario Income Tax Calculator Plug in a few numbers and we ll give you visibility into your tax bracket marginal tax rate average tax rate and payroll tax deductions along with an estimate of your tax refunds and taxes owed in 2023 File your tax return today Your maximum refund is guaranteed Get started

2023 01 24 Find out which deductions credits and expenses you can claim to reduce the amount of tax you need to pay

How Much Tax Deduction In Ontario have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Flexible: The Customization feature lets you tailor the templates to meet your individual needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value: The free educational worksheets can be used by students of all ages. This makes them a valuable tool for parents and educators.

-

Accessibility: Access to various designs and templates is time-saving and saves effort.

Where to Find more How Much Tax Deduction In Ontario

Federal Income Tax Brackets 2021 Vs 2022 Orangerilo

Federal Income Tax Brackets 2021 Vs 2022 Orangerilo

Curious about how much income tax you ll owe this year Forbes Advisor Canada has a tool to help you figure it out If you make 60 000 a year living in Ontario you will be taxed 11 847

Ontario Tax Calculator 2024 25 The Ontario Tax Calculator below is for the 2024 tax year the calculator allows you to calculate income tax and payroll taxes and deductions in Ontario This includes calculations for Employees in Ontario to calculate their annual salary after tax

We've now piqued your interest in printables for free we'll explore the places you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of How Much Tax Deduction In Ontario suitable for many applications.

- Explore categories such as decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning materials.

- Ideal for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- The blogs covered cover a wide selection of subjects, from DIY projects to party planning.

Maximizing How Much Tax Deduction In Ontario

Here are some new ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to build your knowledge at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

How Much Tax Deduction In Ontario are an abundance of practical and imaginative resources which cater to a wide range of needs and interests. Their accessibility and flexibility make them a valuable addition to the professional and personal lives of both. Explore the endless world of How Much Tax Deduction In Ontario to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes you can! You can print and download the resources for free.

-

Can I use free printables in commercial projects?

- It's determined by the specific usage guidelines. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns with How Much Tax Deduction In Ontario?

- Some printables may have restrictions regarding usage. Be sure to read the terms and conditions offered by the creator.

-

How do I print printables for free?

- You can print them at home with either a printer or go to a local print shop for superior prints.

-

What software will I need to access printables for free?

- Many printables are offered in the PDF format, and is open with no cost software, such as Adobe Reader.

How Much Indiana Homeschool Tax Deduction

ITR Filing How Much Deduction Can You Get For Stamp Duty And Property

Check more sample of How Much Tax Deduction In Ontario below

How To Find Average Income Tax Rate Parks Anderem66

2022 Tax Tables Married Filing Jointly Printable Form Templates And

How Much Tax Deduction In Germany TAXP

20 Paycheck Calculator New Mexico JanMacailean

Taxes Payable By Individuals At Various Income Levels Ontario 2018

How Much Tax Deduction In Germany TAXP

https://turbotax.intuit.ca/tax-resources/ontario-income-tax-calculator.jsp

Federal income tax rates in 2023 range from 15 to 33 Ontario income tax rates in 2023 range from 5 05 to 13 16 The amount of income tax that was deducted from your paycheque appears in Box 22 of your T4 slip Learn more about income tax withholding

https://ca.talent.com/tax-calculator/Ontario

Summary If you make 52 000 a year living in the region of Ontario Canada you will be taxed 14 043 That means that your net pay will be 37 957 per year or 3 163 per month Your average tax rate is 27 0 and your marginal tax rate is 35 3

Federal income tax rates in 2023 range from 15 to 33 Ontario income tax rates in 2023 range from 5 05 to 13 16 The amount of income tax that was deducted from your paycheque appears in Box 22 of your T4 slip Learn more about income tax withholding

Summary If you make 52 000 a year living in the region of Ontario Canada you will be taxed 14 043 That means that your net pay will be 37 957 per year or 3 163 per month Your average tax rate is 27 0 and your marginal tax rate is 35 3

20 Paycheck Calculator New Mexico JanMacailean

2022 Tax Tables Married Filing Jointly Printable Form Templates And

Taxes Payable By Individuals At Various Income Levels Ontario 2018

How Much Tax Deduction In Germany TAXP

Pay Stub Worksheet

Indiana Paycheck Taxes

Indiana Paycheck Taxes

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com