In this day and age where screens dominate our lives however, the attraction of tangible printed items hasn't gone away. Whether it's for educational purposes as well as creative projects or just adding an individual touch to the home, printables for free have become a valuable source. This article will dive into the world of "How Much Tax Credit For A Car Donation," exploring the different types of printables, where to locate them, and what they can do to improve different aspects of your lives.

Get Latest How Much Tax Credit For A Car Donation Below

How Much Tax Credit For A Car Donation

How Much Tax Credit For A Car Donation -

Car Donation Tax Deduction IRS Rules Basics Understanding a few fundamentals before donating your car for tax deductions is important You can claim a deduction if you donate to a qualified charity but the amount depends on what the charity does with the vehicle Let s examine these points in more detail Qualified Charitable

How Much of a Tax Break Can You Get for Donating a Car Your tax deduction depends on the vehicle s worth and how the charity intends to use it If the car is worth less than 500 you can

How Much Tax Credit For A Car Donation encompass a wide collection of printable materials online, at no cost. The resources are offered in a variety types, such as worksheets templates, coloring pages and many more. One of the advantages of How Much Tax Credit For A Car Donation is in their versatility and accessibility.

More of How Much Tax Credit For A Car Donation

BMW Electric Plug in Hybrid Vehicle Tax Credit Update For 2023

BMW Electric Plug in Hybrid Vehicle Tax Credit Update For 2023

Home 2024 Car Donation Tax Deduction How To Get The Maximum Tax Benefit Out Of Your Vehicle Donation Donating your car or vehicle to charity can be a great way to get a 2024 federal tax deduction state income tax deductibility depends on state law and Wheels For Wishes makes it easy

One snag in estimating your itemized deductions is you won t necessarily know the tax benefit until after you donate the car The amount you can deduct for a vehicle contribution depends upon what the charity does with the vehicle

The How Much Tax Credit For A Car Donation have gained huge recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Personalization You can tailor printables to fit your particular needs in designing invitations and schedules, or decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, making them a valuable source for educators and parents.

-

It's easy: Fast access a plethora of designs and templates is time-saving and saves effort.

Where to Find more How Much Tax Credit For A Car Donation

How To Claim The 3 600 Child Tax Credit For A Baby Born In 2021 YouTube

How To Claim The 3 600 Child Tax Credit For A Baby Born In 2021 YouTube

If you are looking for a car donation tax credit of over 500 but less than 5 000 you ll have to fill out a 1098 c form or a 8283 IRS Form for a non cash charitable contribution A tax deduction for a donated car is a simple step within the document in section A of the 8283

The 11 000 amount is the sum of your current and carryover contributions to 50 limit organizations 6 000 5 000 The deduction for your 5 000 carryover is subject to the special 30 limit for contributions of capital gain property This means it is limited to the smaller of 7 200 your 30 limit or

Since we've got your interest in How Much Tax Credit For A Car Donation Let's find out where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection and How Much Tax Credit For A Car Donation for a variety reasons.

- Explore categories like decorations for the home, education and the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free or flashcards as well as learning materials.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- The blogs are a vast selection of subjects, that includes DIY projects to planning a party.

Maximizing How Much Tax Credit For A Car Donation

Here are some inventive ways that you can make use use of How Much Tax Credit For A Car Donation:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living areas.

2. Education

- Print free worksheets to build your knowledge at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

How Much Tax Credit For A Car Donation are a treasure trove of fun and practical tools that cater to various needs and pursuits. Their accessibility and versatility make these printables a useful addition to both personal and professional life. Explore the wide world of How Much Tax Credit For A Car Donation today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes you can! You can print and download these materials for free.

-

Does it allow me to use free printables in commercial projects?

- It's all dependent on the rules of usage. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using How Much Tax Credit For A Car Donation?

- Some printables may have restrictions on usage. Check the terms of service and conditions provided by the author.

-

How can I print How Much Tax Credit For A Car Donation?

- You can print them at home using either a printer at home or in the local print shop for top quality prints.

-

What program do I need in order to open printables for free?

- A majority of printed materials are as PDF files, which is open with no cost software such as Adobe Reader.

How Much Do You Need To Donate For Tax Deduction

Is There A Tax Cut For A Used Electric Car OsVehicle

Check more sample of How Much Tax Credit For A Car Donation below

Tax Credits Save You More Than Deductions Here Are The Best Ones

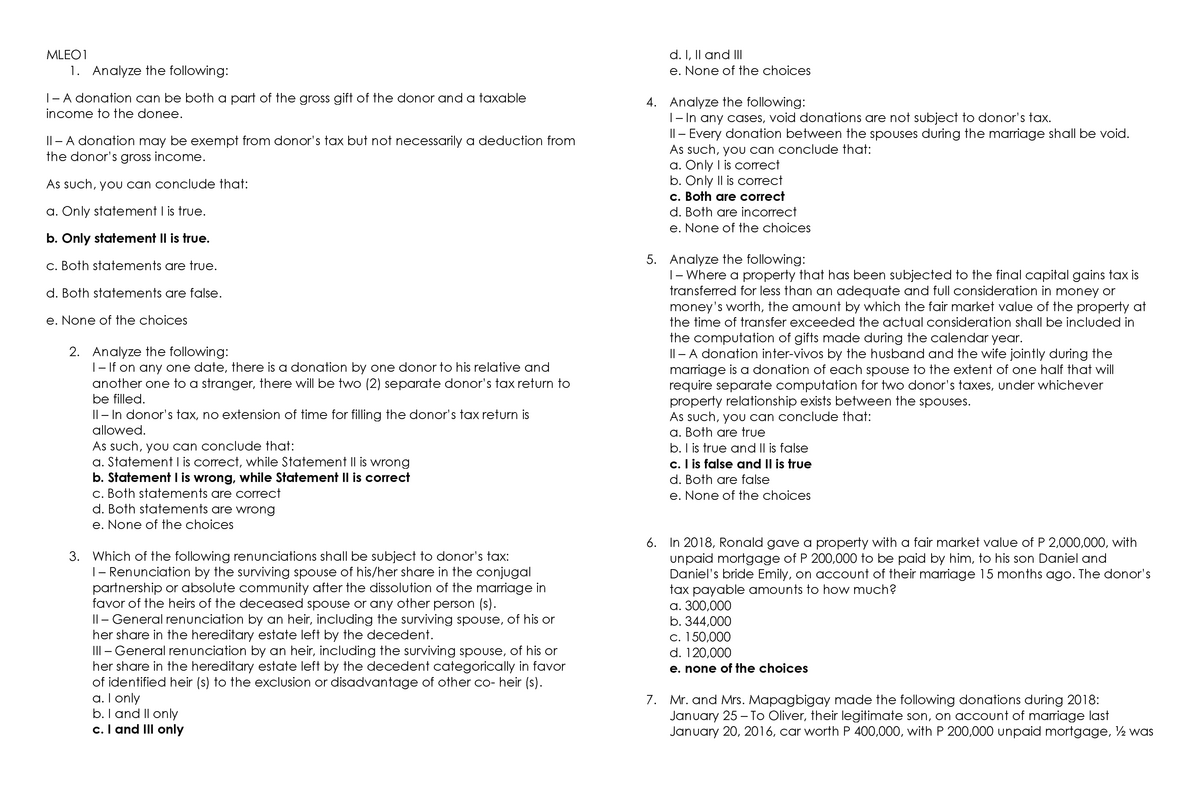

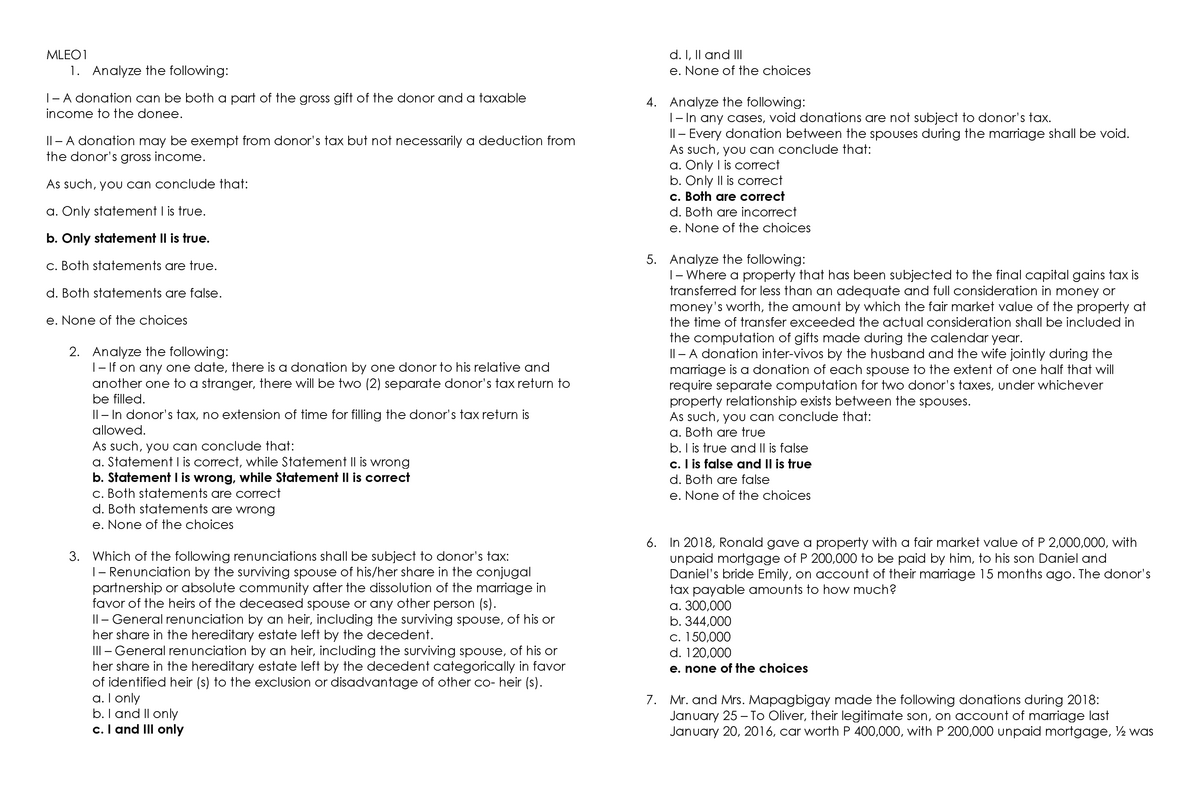

Exam 2020 Questions And Answers MLEO Analyze The Following I A

Explained The Updated EV Tax Credit Rules Elektriken

How To Refinance Your Car Loan

PDF TRANSFER TAXES IN GENERAL Aljanna Macog Academia edu

Why Choose Paul Sherry Car N Credit Car N Credit Buy Here Pay Here

https://www. forbes.com /advisor/taxes/donate-your-car

How Much of a Tax Break Can You Get for Donating a Car Your tax deduction depends on the vehicle s worth and how the charity intends to use it If the car is worth less than 500 you can

https://www. aarp.org /money/taxes/info-2022/car...

You ll need to report your deduction on Schedule A of your federal income tax return If your car donation is more than 500 you must also fill out IRS Form 8283 If your deduction for the car is between 501 and 5 000 fill out Part A of the form

How Much of a Tax Break Can You Get for Donating a Car Your tax deduction depends on the vehicle s worth and how the charity intends to use it If the car is worth less than 500 you can

You ll need to report your deduction on Schedule A of your federal income tax return If your car donation is more than 500 you must also fill out IRS Form 8283 If your deduction for the car is between 501 and 5 000 fill out Part A of the form

How To Refinance Your Car Loan

Exam 2020 Questions And Answers MLEO Analyze The Following I A

PDF TRANSFER TAXES IN GENERAL Aljanna Macog Academia edu

Why Choose Paul Sherry Car N Credit Car N Credit Buy Here Pay Here

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Gatelink

Gatelink

CHILDCTC The Child Tax Credit The White House