In the age of digital, when screens dominate our lives but the value of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons for creative projects, simply adding an individual touch to the space, How Much Is The Irs Child Tax Credit have become a valuable source. This article will take a dive into the world of "How Much Is The Irs Child Tax Credit," exploring what they are, where to find them, and ways they can help you improve many aspects of your life.

Get Latest How Much Is The Irs Child Tax Credit Below

How Much Is The Irs Child Tax Credit

How Much Is The Irs Child Tax Credit -

It s just 50 Learn more Advertiser disclosure Child Tax Credit 2024 Requirements Who Qualifies The child tax credit is a 2 000 benefit available to those with dependent children under

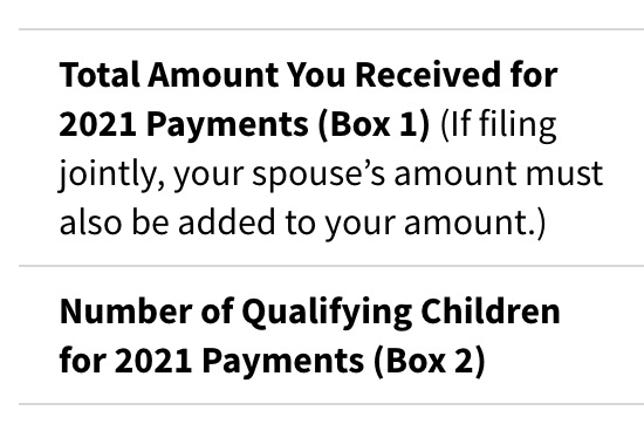

What is the amount of the Child Tax Credit for 2021 added January 31 2022 Q A3 How much of the Child Tax Credit can I claim on my 2021 tax return added January 31 2022 Q A4 How did the IRS determine the amount of my advance Child Tax Credit payments added January 31 2022 Q A5

Printables for free cover a broad array of printable materials available online at no cost. The resources are offered in a variety types, such as worksheets coloring pages, templates and much more. The value of How Much Is The Irs Child Tax Credit is their versatility and accessibility.

More of How Much Is The Irs Child Tax Credit

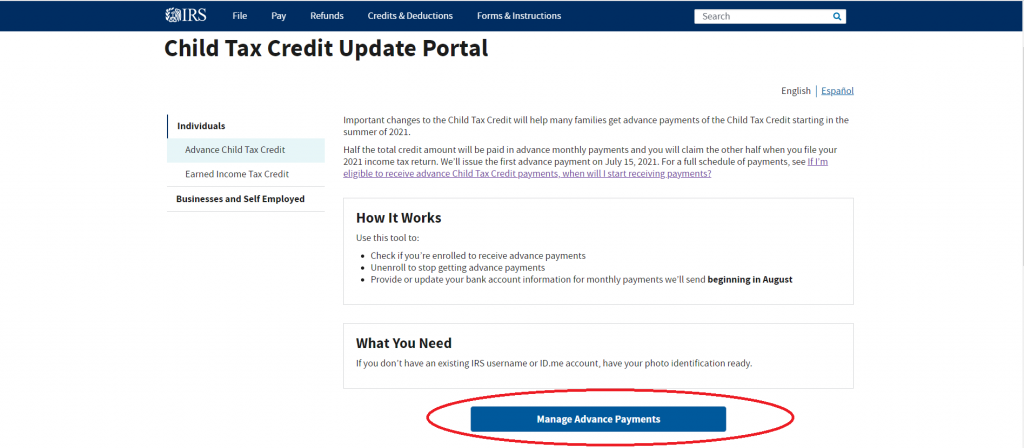

The IRS Child Tax Credit Opt Out Tool Spiegel Accountancy

The IRS Child Tax Credit Opt Out Tool Spiegel Accountancy

For the refundable portion of the credit or the additional child tax credit you may receive up to 1 600 per qualifying child Are you missing important tax dates Here are tax milestone

Right now unless Congress makes last minute changes the 2023 child tax credit is worth up to 2 000 per qualifying child However the credit is not fully refundable which means that you

How Much Is The Irs Child Tax Credit have gained a lot of appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization The Customization feature lets you tailor printables to fit your particular needs, whether it's designing invitations, organizing your schedule, or decorating your home.

-

Educational Use: The free educational worksheets are designed to appeal to students from all ages, making them an essential tool for parents and educators.

-

It's easy: instant access numerous designs and templates reduces time and effort.

Where to Find more How Much Is The Irs Child Tax Credit

Child Tax Credit 2022 How Much Can You Get Shared Economy Tax

Child Tax Credit 2022 How Much Can You Get Shared Economy Tax

For 2023 taxes for returns filed in 2024 the Child Tax Credit is worth 2 000 for each qualifying child You can claim this full amount if your income is at or below the modified adjusted gross income threshold see the income phase out information below The refundable Additional Child Tax Credit is worth up to 1 600

To get the full enhanced CTC which amounts to 3 600 for children under 6 years old and 3 000 for kids ages 6 to 17 years old single taxpayers must earn less than 75 000 and joint filers

Now that we've piqued your interest in printables for free Let's see where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in How Much Is The Irs Child Tax Credit for different uses.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free including flashcards, learning tools.

- The perfect resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a wide selection of subjects, all the way from DIY projects to planning a party.

Maximizing How Much Is The Irs Child Tax Credit

Here are some fresh ways ensure you get the very most use of How Much Is The Irs Child Tax Credit:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities to enhance learning at home for the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars with to-do lists, planners, and meal planners.

Conclusion

How Much Is The Irs Child Tax Credit are an abundance filled with creative and practical information which cater to a wide range of needs and interests. Their access and versatility makes they a beneficial addition to both professional and personal lives. Explore the endless world of How Much Is The Irs Child Tax Credit today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes they are! You can download and print these items for free.

-

Does it allow me to use free printouts for commercial usage?

- It's all dependent on the usage guidelines. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables could have limitations on their use. Make sure you read the conditions and terms of use provided by the author.

-

How can I print printables for free?

- Print them at home with the printer, or go to the local print shop for the highest quality prints.

-

What software do I require to open How Much Is The Irs Child Tax Credit?

- Many printables are offered in the PDF format, and can be opened with free software like Adobe Reader.

What Is The Irs Child Tax Credit

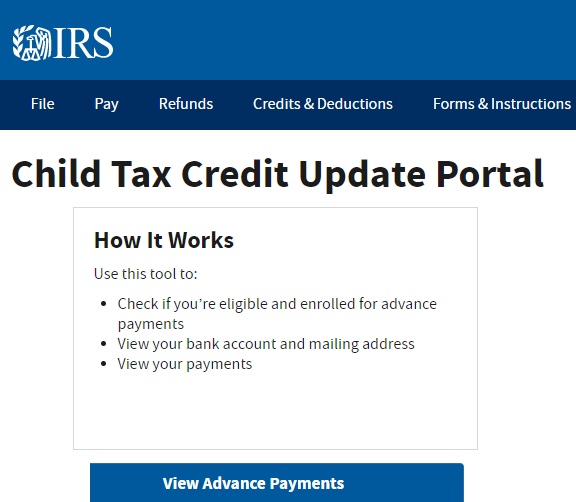

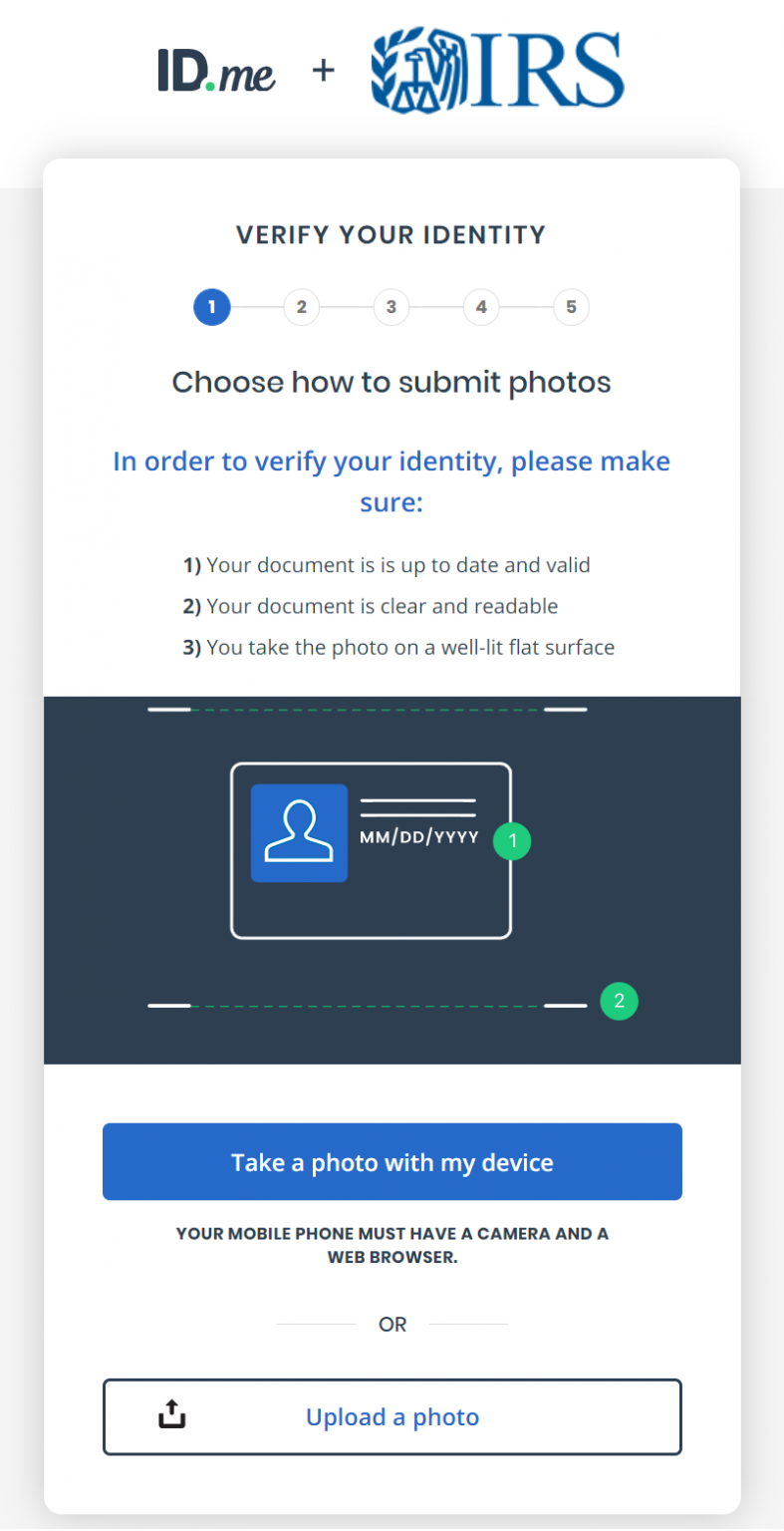

How To Use The IRS Child Tax Credit Update Portal CTC UP Get It Back

Check more sample of How Much Is The Irs Child Tax Credit below

IRS Reopens Registration For Economic Impact Payment VA News

IRS Child Tax Credit Deadline For Congress To Extend 300 Payments Into

IRS Child Tax Credit Portal 2023 Login Advance Update Bank Information

2022 Child Tax Credit Dates Latest News Update

Who s Eligible For The Child Tax Credit And What It Means This Tax

Child Tax Credit And Advance Child Tax Credit Payments CrossLink

https://www.irs.gov/credits-deductions/tax-year...

What is the amount of the Child Tax Credit for 2021 added January 31 2022 Q A3 How much of the Child Tax Credit can I claim on my 2021 tax return added January 31 2022 Q A4 How did the IRS determine the amount of my advance Child Tax Credit payments added January 31 2022 Q A5

https://www.irs.gov/credits-deductions/2021-child...

What is the amount of the Child Tax Credit for 2021 updated March 8 2022 Q C2 Can my Child Tax Credit amount be reduced based on the amount of my 2021 income added June 14 2021 Q C3 What is my modified AGI added June 14 2021 Q C4 How does the first phaseout reduce the 2021 Child Tax Credit to 2 000

What is the amount of the Child Tax Credit for 2021 added January 31 2022 Q A3 How much of the Child Tax Credit can I claim on my 2021 tax return added January 31 2022 Q A4 How did the IRS determine the amount of my advance Child Tax Credit payments added January 31 2022 Q A5

What is the amount of the Child Tax Credit for 2021 updated March 8 2022 Q C2 Can my Child Tax Credit amount be reduced based on the amount of my 2021 income added June 14 2021 Q C3 What is my modified AGI added June 14 2021 Q C4 How does the first phaseout reduce the 2021 Child Tax Credit to 2 000

2022 Child Tax Credit Dates Latest News Update

IRS Child Tax Credit Deadline For Congress To Extend 300 Payments Into

Who s Eligible For The Child Tax Credit And What It Means This Tax

Child Tax Credit And Advance Child Tax Credit Payments CrossLink

IRS Child Tax Credit Payments Information Summary Update 2021 YouTube

The IRS Is Shutting Down Its Child Tax Credit Portal For Now Best Life

The IRS Is Shutting Down Its Child Tax Credit Portal For Now Best Life

How To Use The IRS Child Tax Credit Update Portal CTC UP Get It Back