In this day and age where screens have become the dominant feature of our lives yet the appeal of tangible printed products hasn't decreased. If it's to aid in education as well as creative projects or just adding some personal flair to your home, printables for free are now an essential resource. Here, we'll dive into the sphere of "How Much Is Lottery Tax In Pa," exploring the different types of printables, where to find them and ways they can help you improve many aspects of your life.

Get Latest How Much Is Lottery Tax In Pa Below

How Much Is Lottery Tax In Pa

How Much Is Lottery Tax In Pa -

Gambling and lottery winnings is a separate class of income under Pennsylvania personal income tax law See 72 PA C S 7303 a 7 Between July 21 1983 and Dec 31 2015 all prizes of the Pennsylvania Lottery were excluded from this class of income As a result of Act 84 of 2016 cash prizes of the Pennsylvania Lottery that are paid on

Lottery Winnings Under Act 84 of 2016 the Pennsylvania personal income tax of 3 07 percent now applies to Pennsylvania Lottery cash prizes paid after January 1 2016 As a result winners who receive a cash prize or an annuity payment after January 1 2016 must report those payments as taxable income on a PA Schedule T when filing a

How Much Is Lottery Tax In Pa include a broad assortment of printable, downloadable material that is available online at no cost. These printables come in different types, such as worksheets templates, coloring pages and more. One of the advantages of How Much Is Lottery Tax In Pa lies in their versatility as well as accessibility.

More of How Much Is Lottery Tax In Pa

How Much Is Lottery Taxed In Germany YouTube

How Much Is Lottery Taxed In Germany YouTube

If your gross prize for lump sum payout is 1 000 000 you need to pay 334 072 in total tax 240 000 federal withholding plus the remaining 94 072 for single filing status in 2021 In addition you need to pay state tax as well depending on where you bought the lottery and where you live

At a glance Lottery winnings are considered taxable income for both federal and state taxes Federal tax rates vary based on your tax bracket with rates up to 37 Winning the lottery can bump you into a higher tax bracket Lottery winnings don t count as earned income for Social Security benefits

How Much Is Lottery Tax In Pa have gained a lot of popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Flexible: The Customization feature lets you tailor the templates to meet your individual needs in designing invitations or arranging your schedule or even decorating your home.

-

Educational Worth: The free educational worksheets are designed to appeal to students of all ages, which makes them a useful tool for parents and educators.

-

The convenience of Fast access a variety of designs and templates will save you time and effort.

Where to Find more How Much Is Lottery Tax In Pa

1 8 64

1 8 64

The Pennsylvania Lottery automatically withholds taxes for winnings that exceed 5 000 Multi state lottery games like Mega Millions and Powerball give winners 60 days from the date a claim is

Effective for taxable years beginning after December 31 2017 the withholding rate under Section 3402 q applicable to winnings of 5 000 or more from sweepstakes wagering pools certain parimutuel pools

Now that we've piqued your curiosity about How Much Is Lottery Tax In Pa Let's find out where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of How Much Is Lottery Tax In Pa suitable for many goals.

- Explore categories such as interior decor, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs are a vast range of interests, all the way from DIY projects to party planning.

Maximizing How Much Is Lottery Tax In Pa

Here are some fresh ways to make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use these printable worksheets free of charge for teaching at-home for the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

How Much Is Lottery Tax In Pa are a treasure trove filled with creative and practical information that satisfy a wide range of requirements and hobbies. Their availability and versatility make they a beneficial addition to the professional and personal lives of both. Explore the vast world of How Much Is Lottery Tax In Pa right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes they are! You can download and print these documents for free.

-

Can I use the free printables for commercial use?

- It's based on specific usage guidelines. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Some printables may come with restrictions in their usage. Make sure to read the terms and conditions provided by the designer.

-

How do I print How Much Is Lottery Tax In Pa?

- You can print them at home with printing equipment or visit any local print store for superior prints.

-

What software do I require to view printables at no cost?

- Most printables come with PDF formats, which can be opened using free software, such as Adobe Reader.

How Much Lottery Tax You Need To Pay In India

Is Lottery Tax Free In Finland YouTube

Check more sample of How Much Is Lottery Tax In Pa below

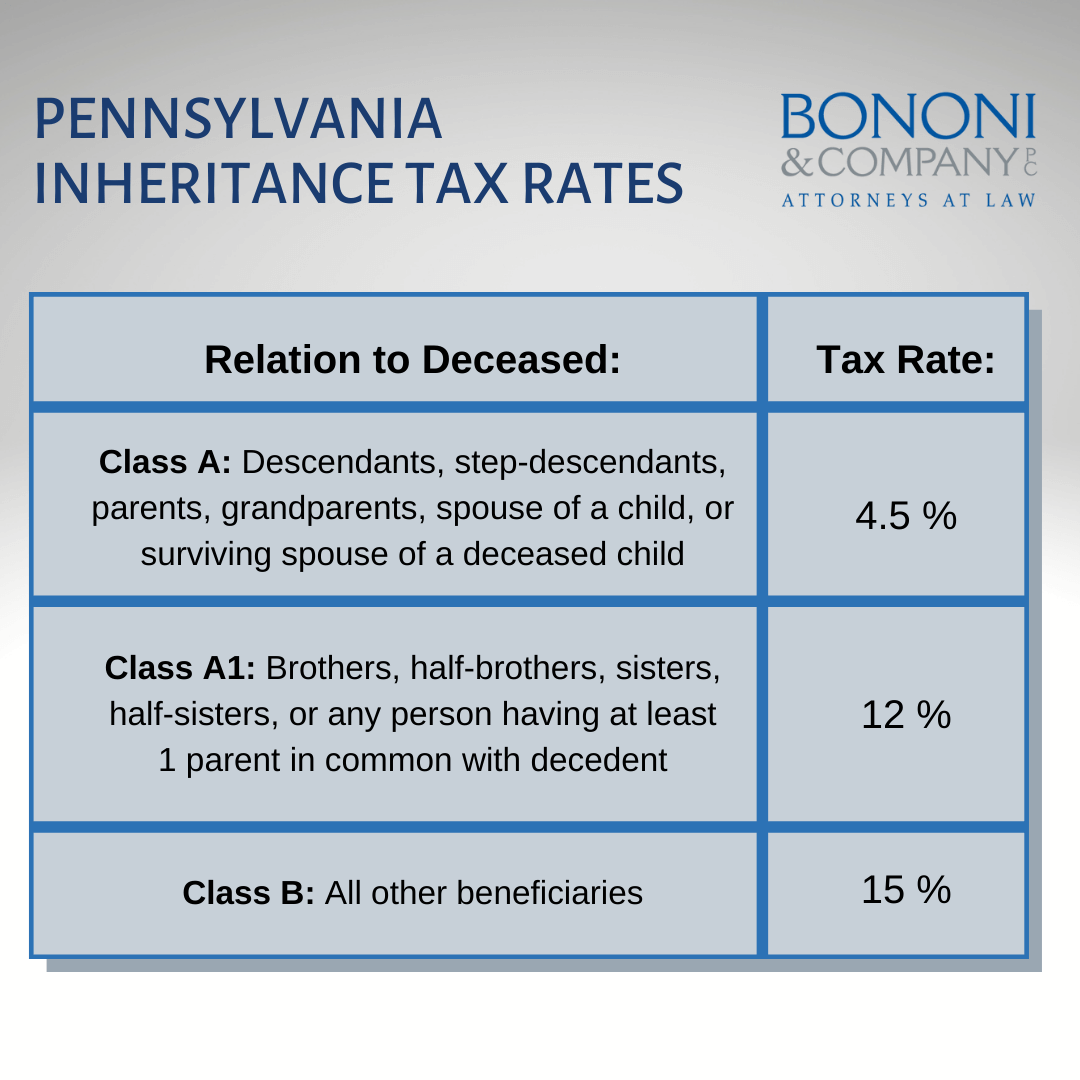

How To Avoid Pennsylvania Inheritance Tax Bononi And Company PC

How Much Is Lottery Tax Pandoratop blog

What Percentage Of Lottery Winnings Would Be Withheld In Your State

Lottery Tax Calculator Here s Everything You Need To Know BleBur

Not All SC Lawmakers On Board With 50 Lottery Tax Refund Check YouTube

Lottery Tax Facts Cansoup

https://www. revenue.pa.gov /TaxTypes/PIT/Pages/...

Lottery Winnings Under Act 84 of 2016 the Pennsylvania personal income tax of 3 07 percent now applies to Pennsylvania Lottery cash prizes paid after January 1 2016 As a result winners who receive a cash prize or an annuity payment after January 1 2016 must report those payments as taxable income on a PA Schedule T when filing a

https:// lottolibrary.com /lottery-tax-calculator/USA/Pennsylvania

Total tax to pay 280 700 00 Breakdown Federal tax 25 250 000 00 State tax in Pennsylvania 3 0700000000000003 30 700 00 Total tax deductions 280 700 00 You get to keep 719 300 00 Do You Always Have To Pay Taxes on Lottery Winnings Smaller prizes are tax free You don t have to pay federal taxes for winnings under 600

Lottery Winnings Under Act 84 of 2016 the Pennsylvania personal income tax of 3 07 percent now applies to Pennsylvania Lottery cash prizes paid after January 1 2016 As a result winners who receive a cash prize or an annuity payment after January 1 2016 must report those payments as taxable income on a PA Schedule T when filing a

Total tax to pay 280 700 00 Breakdown Federal tax 25 250 000 00 State tax in Pennsylvania 3 0700000000000003 30 700 00 Total tax deductions 280 700 00 You get to keep 719 300 00 Do You Always Have To Pay Taxes on Lottery Winnings Smaller prizes are tax free You don t have to pay federal taxes for winnings under 600

Lottery Tax Calculator Here s Everything You Need To Know BleBur

How Much Is Lottery Tax Pandoratop blog

Not All SC Lawmakers On Board With 50 Lottery Tax Refund Check YouTube

Lottery Tax Facts Cansoup

TDS Dividend And Lottery Tax Deducted At Source Income Tax I CA I

Lottery Tax In Washington State DestinationPackwood

Lottery Tax In Washington State DestinationPackwood

Can A Tourist Win The Lottery In The United States