In this day and age with screens dominating our lives yet the appeal of tangible printed products hasn't decreased. In the case of educational materials in creative or artistic projects, or simply to add the personal touch to your space, How Much Government Revenue Does The Gasoline Tax Generate have proven to be a valuable source. With this guide, you'll take a dive deep into the realm of "How Much Government Revenue Does The Gasoline Tax Generate," exploring their purpose, where they can be found, and how they can enhance various aspects of your lives.

Get Latest How Much Government Revenue Does The Gasoline Tax Generate Below

How Much Government Revenue Does The Gasoline Tax Generate

How Much Government Revenue Does The Gasoline Tax Generate -

On average as of April 2019 state and local taxes and fees add 34 24 cents to gasoline and 35 89 cents to diesel for a total US volume weighted average fuel tax of 52 64 cents per gallon for gas and 60 29 cents per gallon for diesel

They represent a significant source of revenue for government In 2023 24 we expect fuel duties to raise 24 7 billion That would represent 2 2 per cent of all receipts and is equivalent to 850 per household and 0 9 per cent of national income

Printables for free include a vast range of downloadable, printable documents that can be downloaded online at no cost. They are available in numerous designs, including worksheets templates, coloring pages and more. The attraction of printables that are free is in their variety and accessibility.

More of How Much Government Revenue Does The Gasoline Tax Generate

Since suspended State Gasoline Tax Propped Up August Revenue Report

Since suspended State Gasoline Tax Propped Up August Revenue Report

Total state taxes added 31 0 cents to the price of a gallon of gasoline on average compared with the federal excise tax of 18 4 cents At current price levels the federal tax comprises about 3 7 of the retail price

The Congressional Budget Office CBO estimates that Highway Trust Fund tax revenue will total 43 billion in fiscal year 2023 figure 1 Revenue from the federal excise tax on gasoline 25 0 billion and diesel fuel 10 8 billion accounts for 83 percent of the total

How Much Government Revenue Does The Gasoline Tax Generate have garnered immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

customization They can make printed materials to meet your requirements in designing invitations making your schedule, or decorating your home.

-

Educational Value Educational printables that can be downloaded for free provide for students of all ages. This makes them a vital resource for educators and parents.

-

The convenience of You have instant access the vast array of design and templates will save you time and effort.

Where to Find more How Much Government Revenue Does The Gasoline Tax Generate

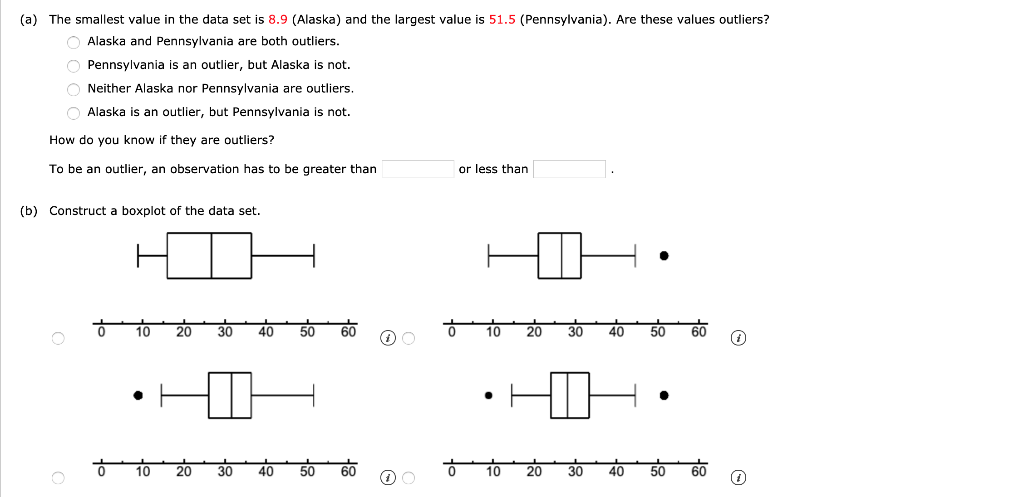

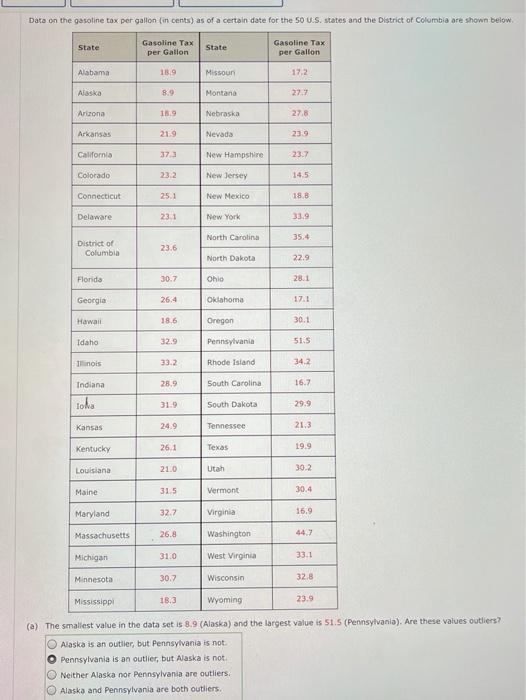

Solved Data On The Gasoline Tax Per Gallon in Cents As Of Chegg

Solved Data On The Gasoline Tax Per Gallon in Cents As Of Chegg

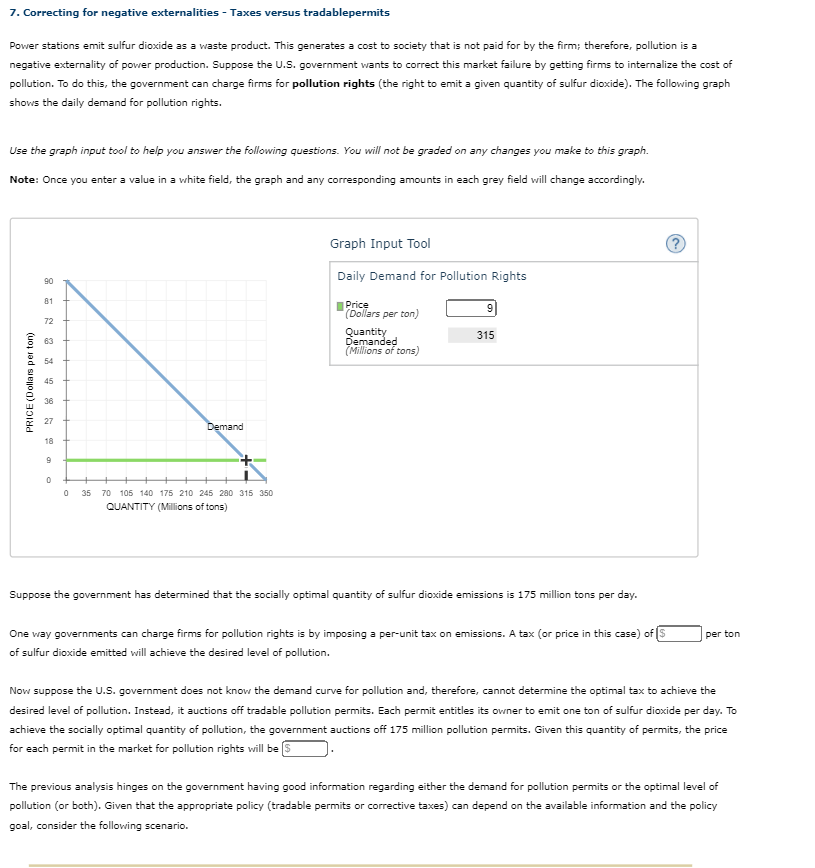

How much government revenue does the gasoline tax generate Enter a numeric response using a real number rounded to two decimal places The gasoline tax is inefficient in that the tax revenue is less than the excess burden

Under the Chamber of Commerce proposal the tax increase would have phased in at 0 05 per year until it reaches 0 25 per gallon Assuming a similar proposal starting in 2021 the tax increase would create 50 billion in government revenue per year by 2025 and about 1 1 trillion through 2050

After we've peaked your curiosity about How Much Government Revenue Does The Gasoline Tax Generate Let's find out where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection in How Much Government Revenue Does The Gasoline Tax Generate for different purposes.

- Explore categories such as the home, decor, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free with flashcards and other teaching tools.

- Great for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs are a vast spectrum of interests, including DIY projects to party planning.

Maximizing How Much Government Revenue Does The Gasoline Tax Generate

Here are some creative ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet to build your knowledge at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

How Much Government Revenue Does The Gasoline Tax Generate are an abundance of fun and practical tools that can meet the needs of a variety of people and pursuits. Their access and versatility makes them an essential part of the professional and personal lives of both. Explore the world that is How Much Government Revenue Does The Gasoline Tax Generate today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes, they are! You can print and download these files for free.

-

Can I use the free printables for commercial uses?

- It is contingent on the specific conditions of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables could be restricted on use. Be sure to check these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home with an printer, or go to an in-store print shop to get better quality prints.

-

What software must I use to open printables for free?

- The majority of printables are as PDF files, which can be opened using free programs like Adobe Reader.

Solved Data On The Gasoline Tax Per Gallon in Cents As Of Chegg

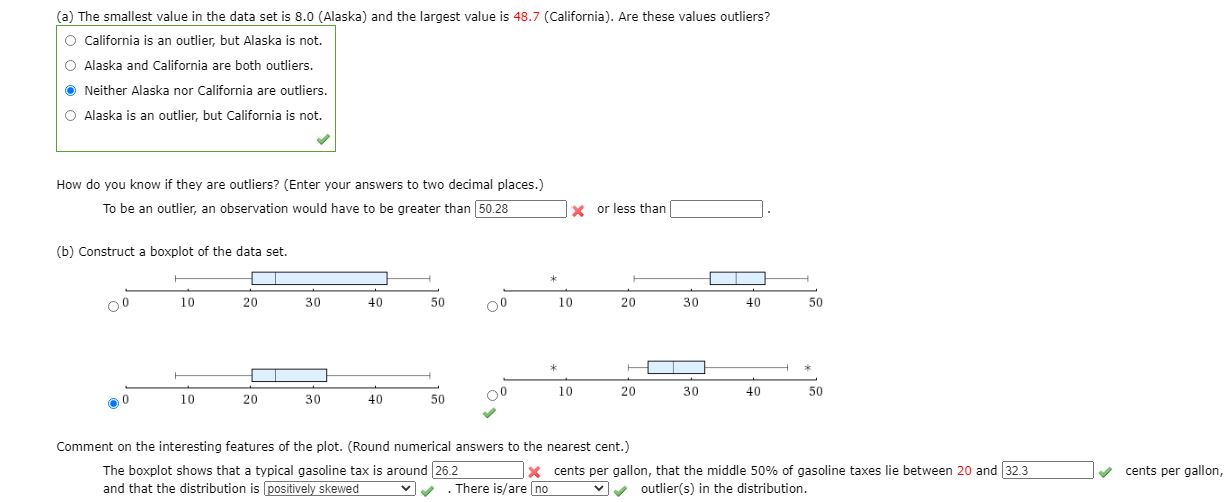

Suppose The Government Decides To Raise The Gasoli Chegg

Check more sample of How Much Government Revenue Does The Gasoline Tax Generate below

State Gasoline Tax Rates In 2016 Tax Foundation

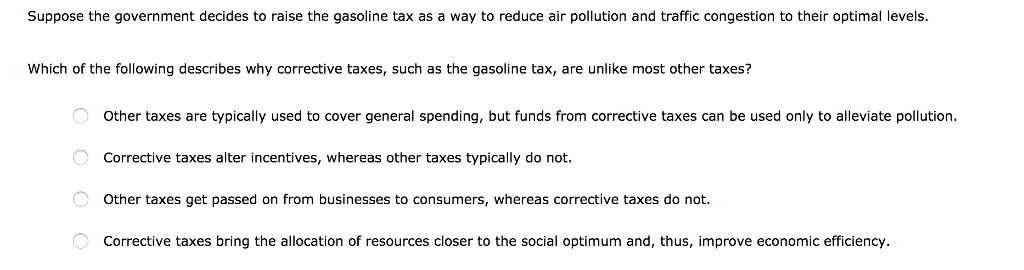

Public Finance And Public Choice Public Economics

Solved Data On The Gasoline Tax Per Gallon in Cents As Of Chegg

Solved 6 Achieving Lower Pollution Suppose The Government Chegg

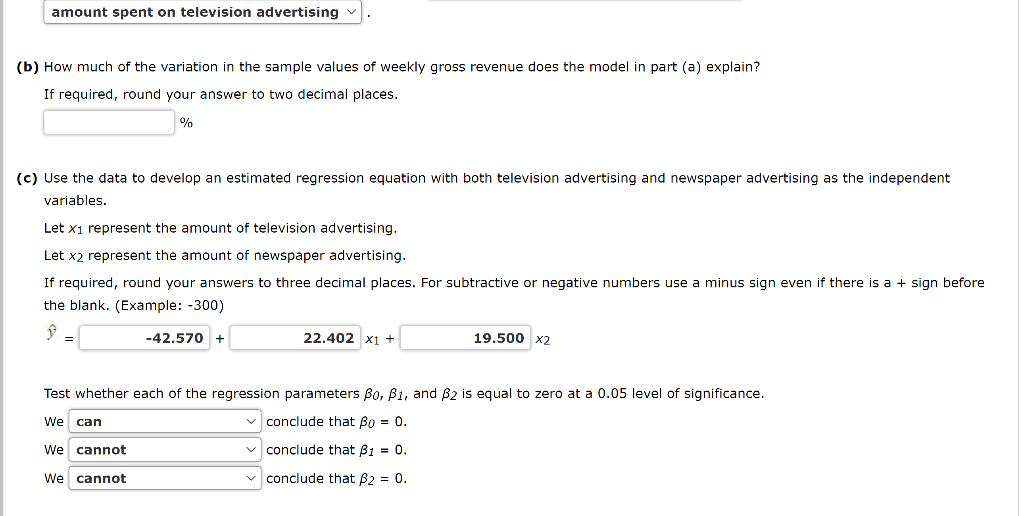

Solved Dixie Showtime Movie Theaters Inc Owns And Chegg

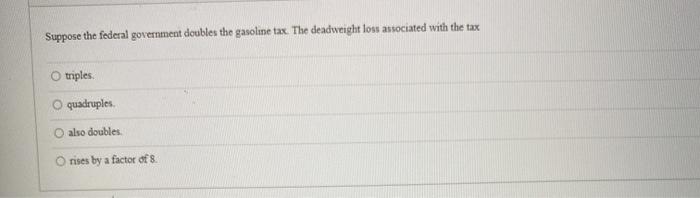

Solved Suppose The Federal Government Doubles The Gasoline Chegg

https://obr.uk/forecasts-in-depth/tax-by-tax-spend-by-spend/fuel-duties

They represent a significant source of revenue for government In 2023 24 we expect fuel duties to raise 24 7 billion That would represent 2 2 per cent of all receipts and is equivalent to 850 per household and 0 9 per cent of national income

https://www.pgpf.org/blog/2021/09/how-do-we-tax...

The Congressional Budget Office estimates that the federal government will collect 23 8 billion in revenues from the taxes on gasoline and 10 3 billion from taxes on diesel in fiscal year 2021 Revenues from the gas

They represent a significant source of revenue for government In 2023 24 we expect fuel duties to raise 24 7 billion That would represent 2 2 per cent of all receipts and is equivalent to 850 per household and 0 9 per cent of national income

The Congressional Budget Office estimates that the federal government will collect 23 8 billion in revenues from the taxes on gasoline and 10 3 billion from taxes on diesel in fiscal year 2021 Revenues from the gas

Solved 6 Achieving Lower Pollution Suppose The Government Chegg

Public Finance And Public Choice Public Economics

Solved Dixie Showtime Movie Theaters Inc Owns And Chegg

Solved Suppose The Federal Government Doubles The Gasoline Chegg

Solved Data On The Gasoline Tax Per Gallon in Cents As Of Chegg

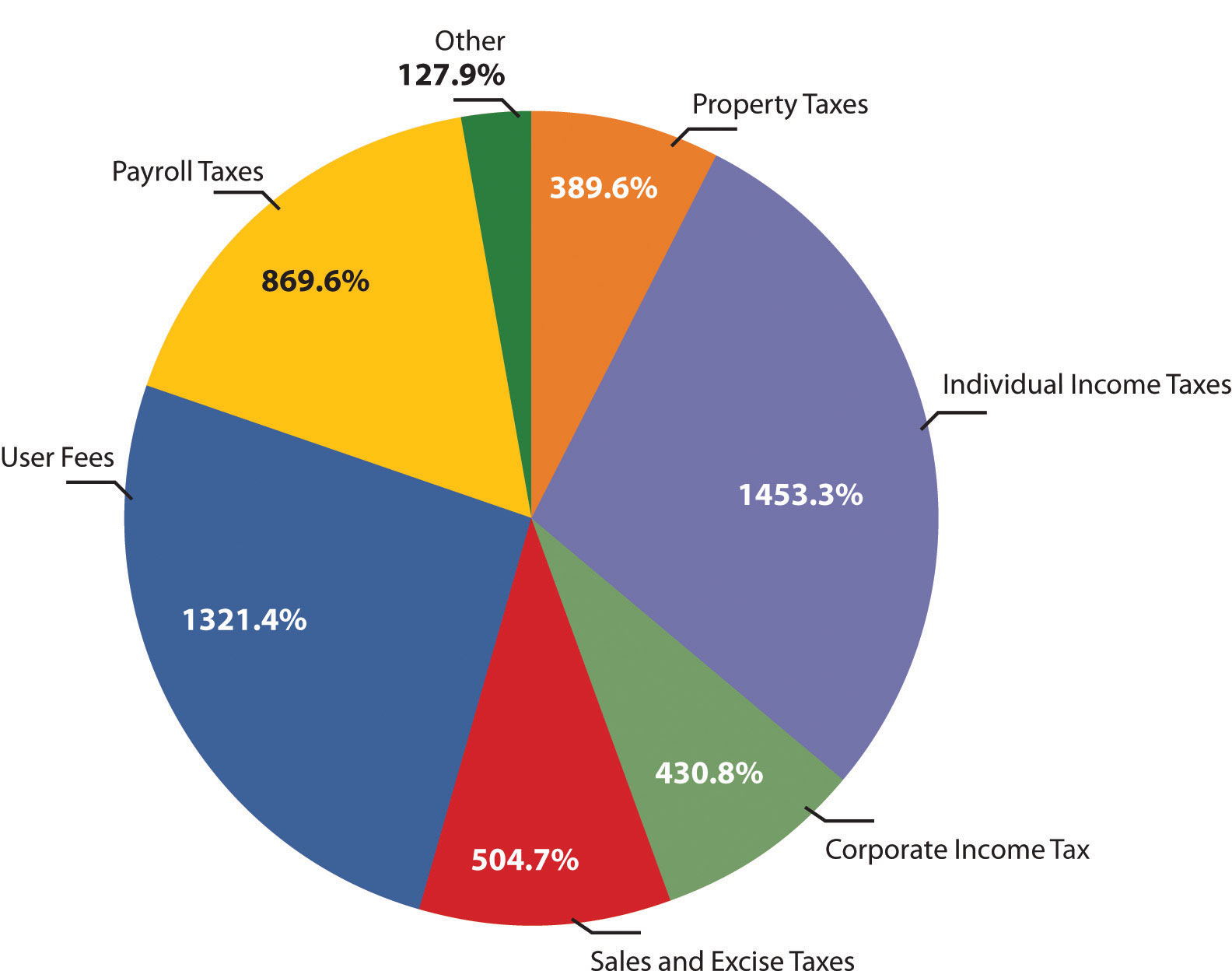

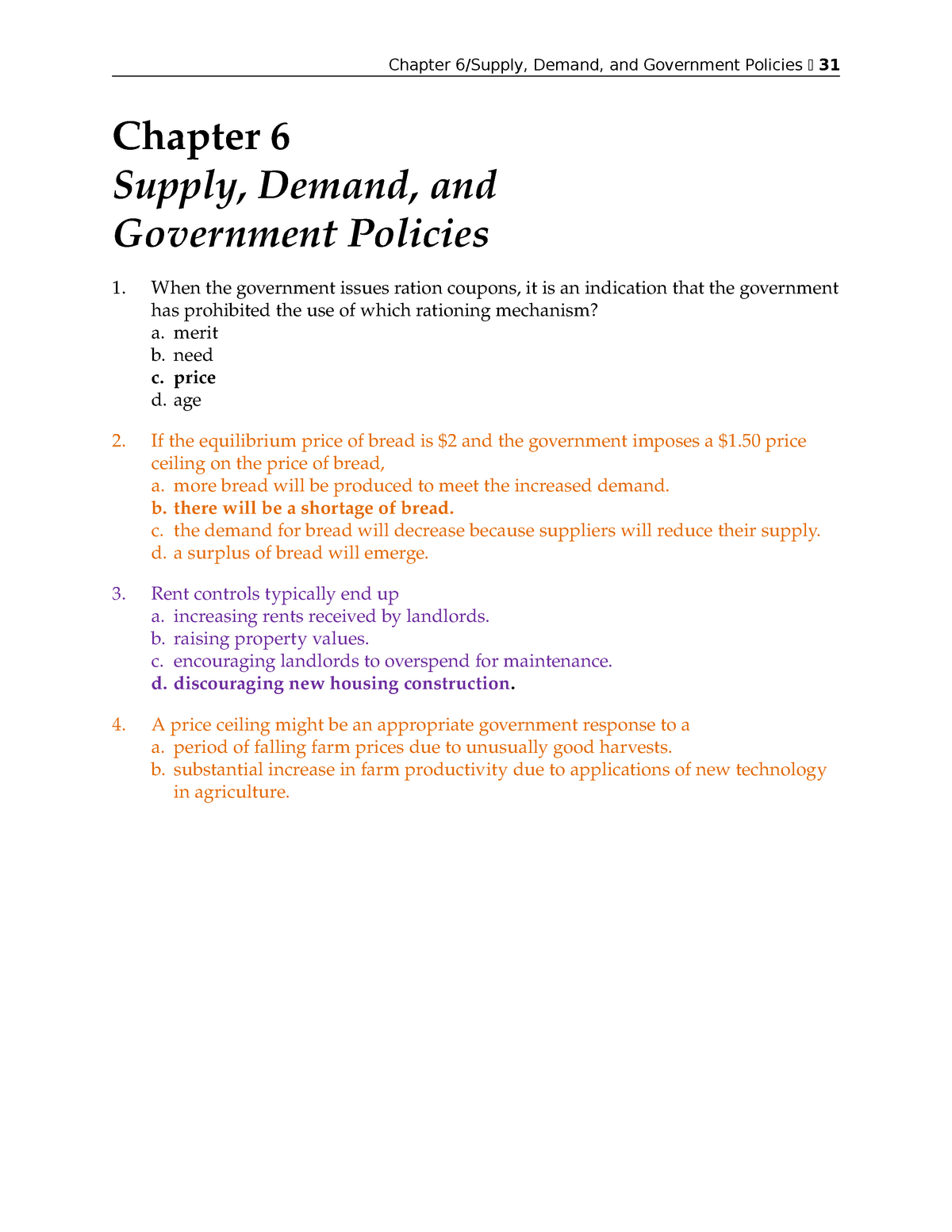

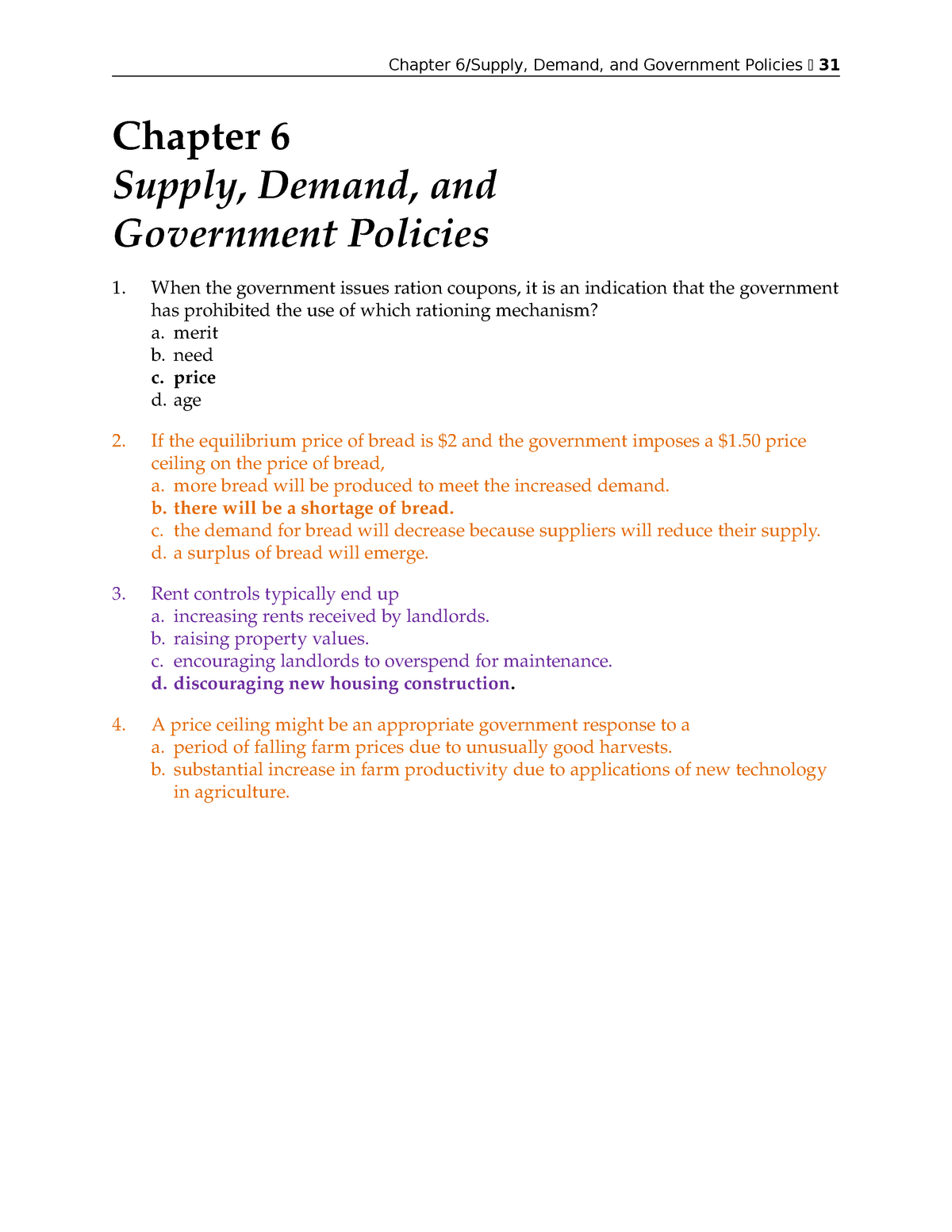

Exam 17 November 2017 Questions And Answers Chapter 6 Supply Demand

Exam 17 November 2017 Questions And Answers Chapter 6 Supply Demand

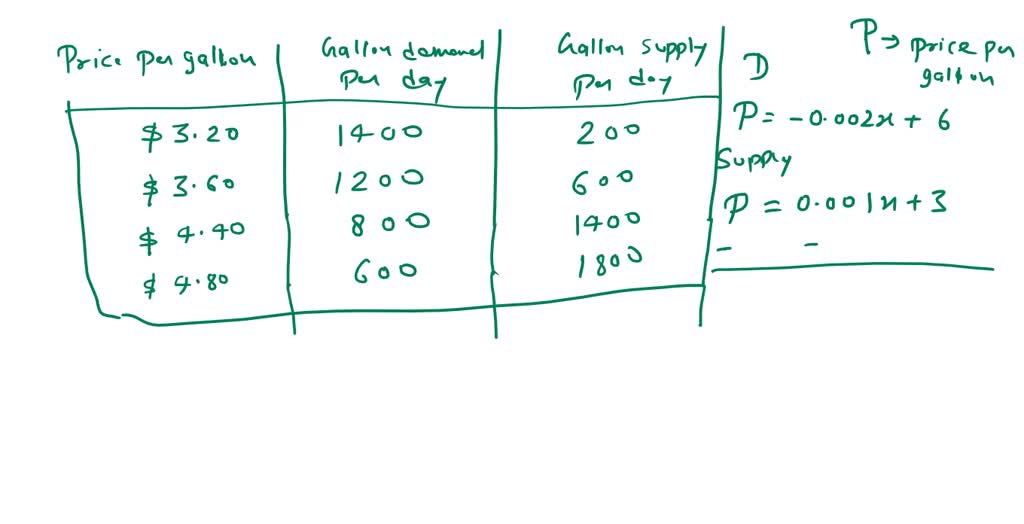

SOLVED The Table Shows The Price Of A Gallon Of Unleaded Premium