In the digital age, where screens dominate our lives The appeal of tangible printed items hasn't gone away. Be it for educational use in creative or artistic projects, or simply to add personal touches to your space, How Much Do You Get Back In Taxes For Child Care are now a vital resource. We'll dive into the world "How Much Do You Get Back In Taxes For Child Care," exploring the benefits of them, where they are, and how they can enrich various aspects of your lives.

Get Latest How Much Do You Get Back In Taxes For Child Care Below

How Much Do You Get Back In Taxes For Child Care

How Much Do You Get Back In Taxes For Child Care -

The most parents can receive from the tax credit is 8 000 which applies to families with two or more children The expanded tax break lets families claim a credit worth 50 of their child

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school

How Much Do You Get Back In Taxes For Child Care provide a diverse range of downloadable, printable materials that are accessible online for free cost. These printables come in different forms, like worksheets templates, coloring pages, and much more. The beauty of How Much Do You Get Back In Taxes For Child Care is in their variety and accessibility.

More of How Much Do You Get Back In Taxes For Child Care

How Much Do You Get Back In Taxes For A Child 2020 YouTube

How Much Do You Get Back In Taxes For A Child 2020 YouTube

Take advantage of the 2021 child care credit and receive a refundable tax credit of up to 8 000 This tax season an often overlooked tax credit could put up to 8 000 back in families

In brief for the 2021 tax year you could get up to 4 000 back for one child and 8 000 back for care of two or more In prior years the maximum return for the credit was 1 050 for one child

How Much Do You Get Back In Taxes For Child Care have garnered immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization The Customization feature lets you tailor printed materials to meet your requirements in designing invitations to organize your schedule or even decorating your house.

-

Education Value Printables for education that are free are designed to appeal to students of all ages, which makes them an invaluable instrument for parents and teachers.

-

It's easy: Fast access an array of designs and templates is time-saving and saves effort.

Where to Find more How Much Do You Get Back In Taxes For Child Care

2022 Date Correction Clipart

2022 Date Correction Clipart

If your daycare expenses don t qualify for the child care tax credit don t worry There are plenty of other child related deductions or credits that may help you save a little money or get a little more back from Uncle Sam The Child Tax Credit provides up to 2 000 per child under age 16

It s called the Child and Dependent Care Tax Credit CDCC and you might be able to get back some of the money you spent on these expenses by claiming it Learn more about this valuable tax credit and its nuances here How much is

Now that we've ignited your interest in printables for free, let's explore where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of How Much Do You Get Back In Taxes For Child Care designed for a variety motives.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing, flashcards, and learning materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- These blogs cover a broad selection of subjects, including DIY projects to planning a party.

Maximizing How Much Do You Get Back In Taxes For Child Care

Here are some ideas of making the most of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets to build your knowledge at home and in class.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

How Much Do You Get Back In Taxes For Child Care are a treasure trove of useful and creative resources that cater to various needs and pursuits. Their availability and versatility make they a beneficial addition to any professional or personal life. Explore the wide world of How Much Do You Get Back In Taxes For Child Care today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are How Much Do You Get Back In Taxes For Child Care really absolutely free?

- Yes they are! You can print and download these files for free.

-

Do I have the right to use free printouts for commercial usage?

- It's all dependent on the usage guidelines. Always read the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright issues in How Much Do You Get Back In Taxes For Child Care?

- Certain printables may be subject to restrictions on usage. Make sure you read the conditions and terms of use provided by the author.

-

How can I print How Much Do You Get Back In Taxes For Child Care?

- You can print them at home with any printer or head to a print shop in your area for higher quality prints.

-

What program do I require to view printables free of charge?

- The majority of PDF documents are provided in the format of PDF, which is open with no cost programs like Adobe Reader.

How Much Do You Get Back In Taxes For A Child In 2023

How Much Do You Get Back In Taxes For A Child 2021 Timechi

Check more sample of How Much Do You Get Back In Taxes For Child Care below

How Much Do You Get Back In Taxes For A Child 2023 Leia Aqui Will We

How Much Money Do You Get Back From Bail In Nevada

Tax Back Calculator VhairiMaizie

How Much Do Charitable Donations Reduce Taxes In Canada

How Much Should I Get Back In Taxes 2019

How Much Do You Get Back In Taxes For Two Dependents TAXIRIN

https://www.irs.gov/newsroom/child-and-dependent...

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school

https://turbotax.intuit.com/tax-tips/family/...

If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit on your 2023 or 2024 taxes of up to 35 of Up to 3 000 of qualifying expenses for a maximum credit of 1 050 for one child or dependent or

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school

If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit on your 2023 or 2024 taxes of up to 35 of Up to 3 000 of qualifying expenses for a maximum credit of 1 050 for one child or dependent or

How Much Do Charitable Donations Reduce Taxes In Canada

How Much Money Do You Get Back From Bail In Nevada

How Much Should I Get Back In Taxes 2019

How Much Do You Get Back In Taxes For Two Dependents TAXIRIN

How Much Is 2 Kids Worth On Taxes Leia Aqui How Much Do You Get Back

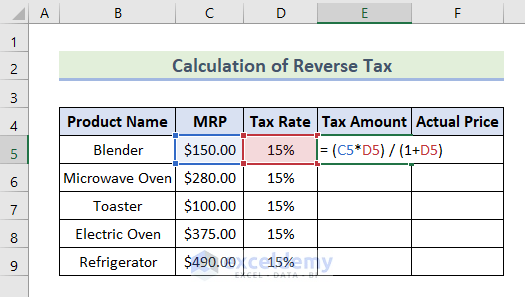

How To Calculate How Much Youll Get Back In Taxes Reverasite

How To Calculate How Much Youll Get Back In Taxes Reverasite

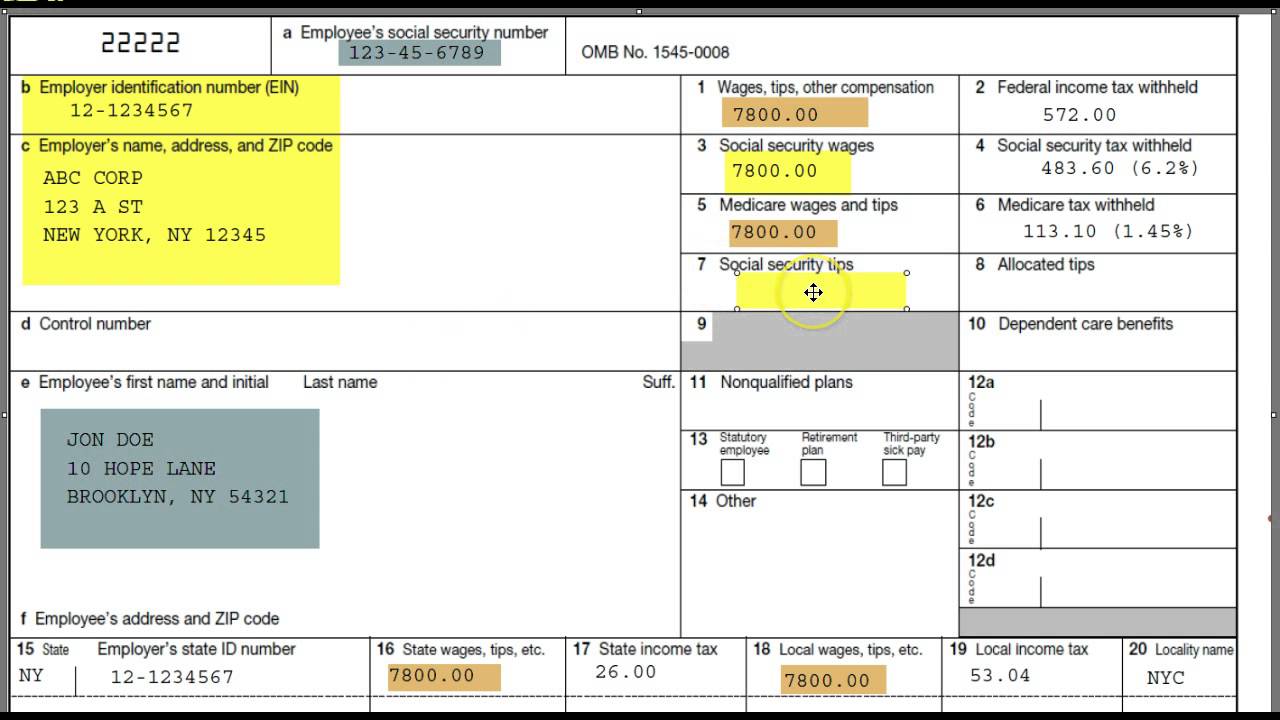

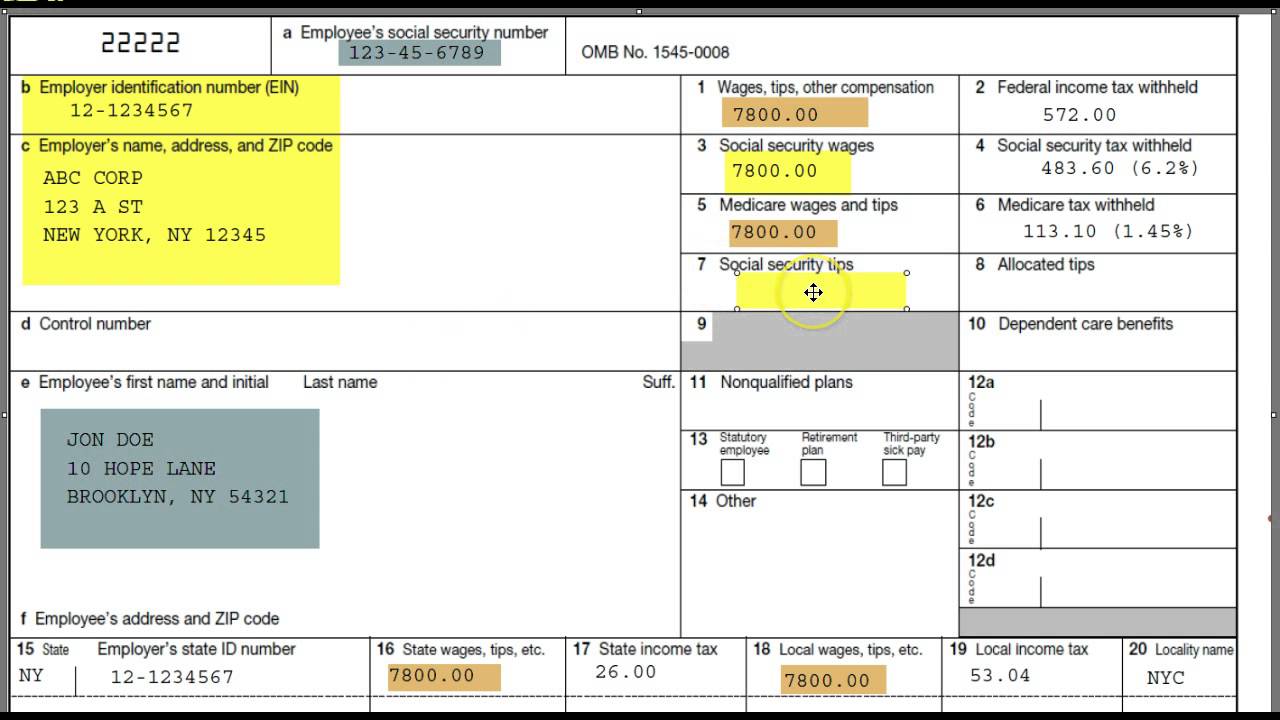

A Daycare Tax Statement Must Be Given To Parents At The End Of The Year