Today, when screens dominate our lives The appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses as well as creative projects or just adding a personal touch to your space, How Much Can You Claim For Moving Expenses On Your Taxes are now an essential source. This article will dive into the world "How Much Can You Claim For Moving Expenses On Your Taxes," exploring the benefits of them, where to find them, and the ways that they can benefit different aspects of your daily life.

Get Latest How Much Can You Claim For Moving Expenses On Your Taxes Below

How Much Can You Claim For Moving Expenses On Your Taxes

How Much Can You Claim For Moving Expenses On Your Taxes -

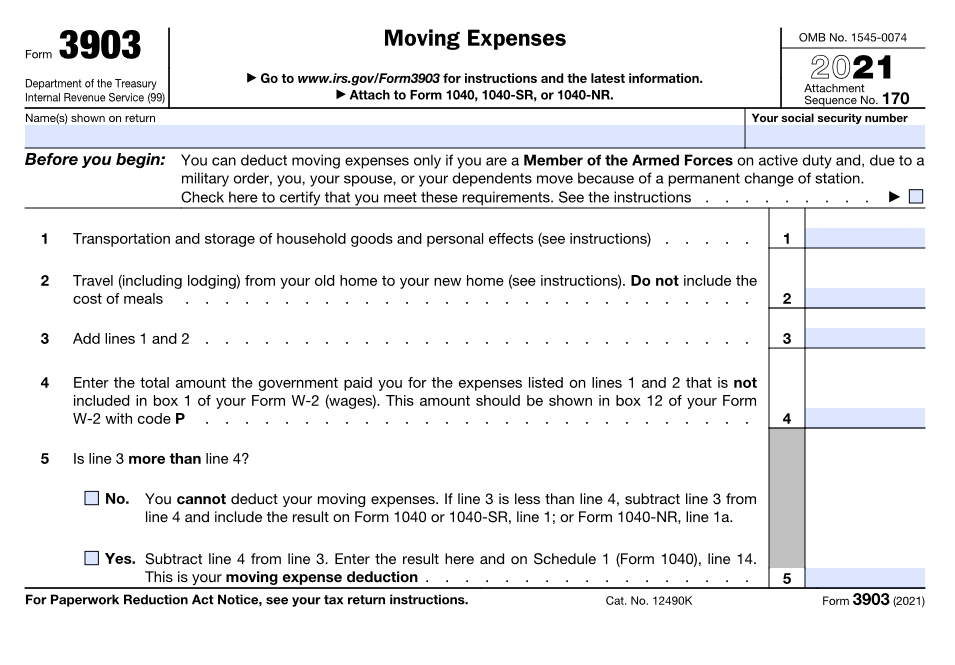

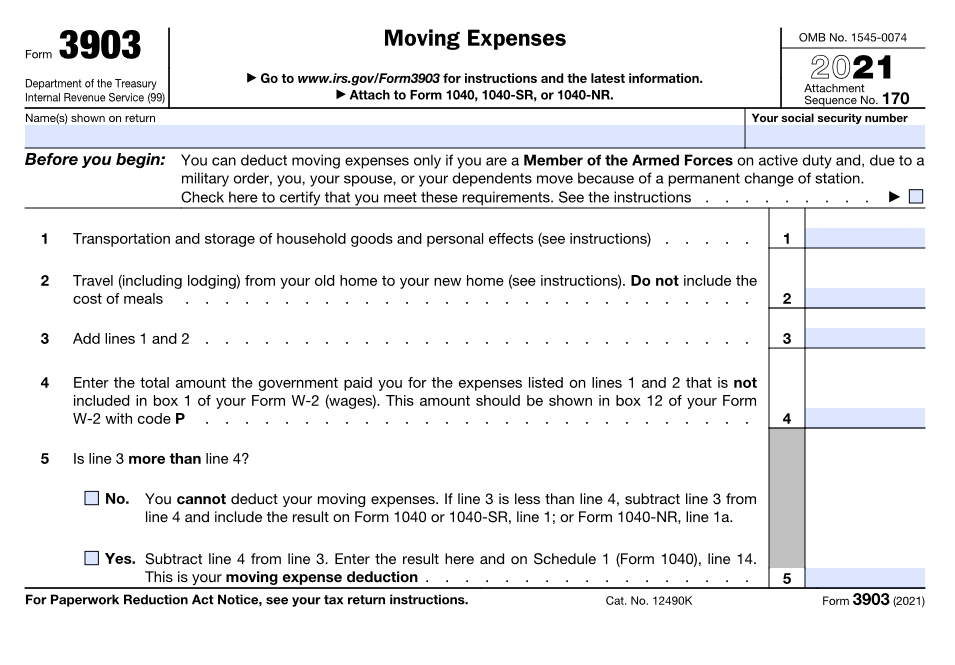

Standard mileage rate For 2023 the standard mileage rate for using your vehicle to move to a new home is 22 cents a mile Reminders Moving expense

You can deduct your unreimbursed moving expenses for you your spouse and your dependents You can t deduct expenses that are reimbursed or paid

Printables for free cover a broad assortment of printable materials that are accessible online for free cost. These printables come in different types, such as worksheets templates, coloring pages and much more. The value of How Much Can You Claim For Moving Expenses On Your Taxes is in their versatility and accessibility.

More of How Much Can You Claim For Moving Expenses On Your Taxes

Deduct Your Moving Expenses On Your Tax Return Master Movers

Deduct Your Moving Expenses On Your Tax Return Master Movers

Income tax Personal income tax Claiming deductions credits and expenses Line 21900 Moving expenses Eligible moving expenses You must first determine if you qualify

Did you move recently You could get a tax deduction for moving expenses To write off your relocation costs you must meet three tests Your move

How Much Can You Claim For Moving Expenses On Your Taxes have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Personalization We can customize print-ready templates to your specific requirements be it designing invitations making your schedule, or even decorating your home.

-

Educational Impact: Education-related printables at no charge provide for students of all ages, which makes these printables a powerful device for teachers and parents.

-

Affordability: The instant accessibility to a plethora of designs and templates is time-saving and saves effort.

Where to Find more How Much Can You Claim For Moving Expenses On Your Taxes

Are Moving Expenses Tax Deductible FShad CPA

Are Moving Expenses Tax Deductible FShad CPA

The IRS says you can claim a deduction for reasonable expenses related to moving your household belongings and personal effects and expenses related to traveling to your new home Eligible

A1 Yes if the employee moved in 2017 and would have been able to deduct the expenses for the move if paid by the employee in 2017 the payment of those expenses by the

In the event that we've stirred your curiosity about How Much Can You Claim For Moving Expenses On Your Taxes Let's take a look at where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection and How Much Can You Claim For Moving Expenses On Your Taxes for a variety needs.

- Explore categories like the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets including flashcards, learning materials.

- This is a great resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- These blogs cover a wide variety of topics, everything from DIY projects to party planning.

Maximizing How Much Can You Claim For Moving Expenses On Your Taxes

Here are some innovative ways that you can make use of How Much Can You Claim For Moving Expenses On Your Taxes:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

How Much Can You Claim For Moving Expenses On Your Taxes are a treasure trove with useful and creative ideas catering to different needs and pursuits. Their accessibility and versatility make these printables a useful addition to the professional and personal lives of both. Explore the vast world of How Much Can You Claim For Moving Expenses On Your Taxes today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes you can! You can download and print these materials for free.

-

Can I utilize free templates for commercial use?

- It's contingent upon the specific terms of use. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright rights issues with How Much Can You Claim For Moving Expenses On Your Taxes?

- Some printables could have limitations on use. Make sure to read the terms and conditions offered by the author.

-

How can I print printables for free?

- You can print them at home using the printer, or go to a local print shop to purchase better quality prints.

-

What program do I require to open printables for free?

- Many printables are offered in PDF format, which is open with no cost software such as Adobe Reader.

The Ins And Outs Of Claiming Moving Expenses On Your Tax Return

Claim Moving Expenses On Your Taxes The Move Out Bin

Check more sample of How Much Can You Claim For Moving Expenses On Your Taxes below

Did You Know Moving Expenses Can Be Tax Deductible Find Out If Your

New Tax Twists And Turns For Moving Expense Deductions

Can You Claim For Asbestosis After Death

RAF Loss Of Support Claims When And How Much Can You Claim

How To Pay For Moving Expenses With No Money Moving Expenses Moving

Can You Claim For Asbestos Exposure

https://turbotax.intuit.com/tax-tips/jobs-and...

You can deduct your unreimbursed moving expenses for you your spouse and your dependents You can t deduct expenses that are reimbursed or paid

https://www.canada.ca/en/revenue-agency/services/...

You are eligible to claim a deduction for moving expenses Complete Form T1 M Moving Expenses Deduction to calculate the moving expenses deduction that you are eligible

You can deduct your unreimbursed moving expenses for you your spouse and your dependents You can t deduct expenses that are reimbursed or paid

You are eligible to claim a deduction for moving expenses Complete Form T1 M Moving Expenses Deduction to calculate the moving expenses deduction that you are eligible

RAF Loss Of Support Claims When And How Much Can You Claim

New Tax Twists And Turns For Moving Expense Deductions

How To Pay For Moving Expenses With No Money Moving Expenses Moving

Can You Claim For Asbestos Exposure

When Can You Claim Moving Expenses As A Tax Deduction UNITS Moving

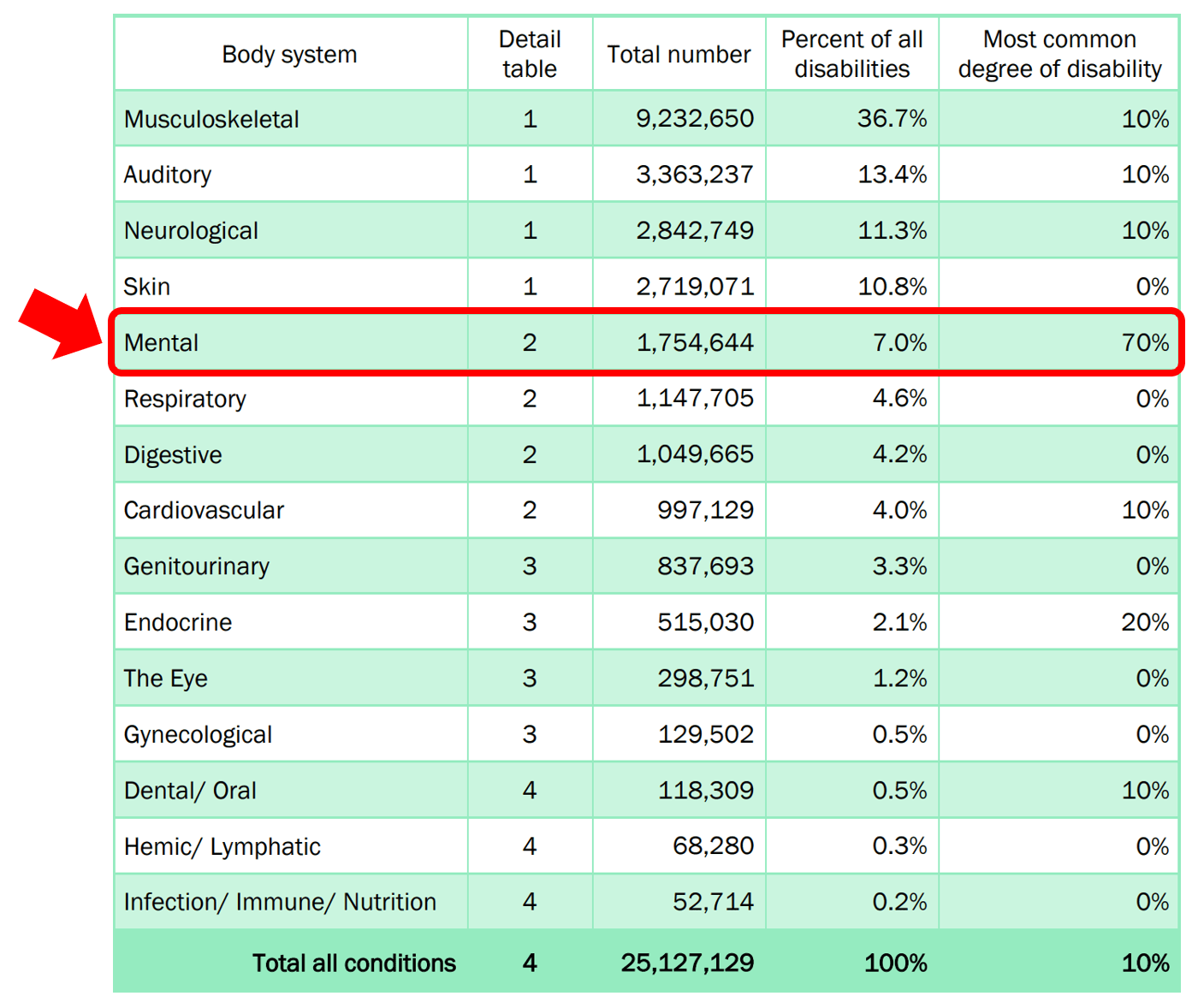

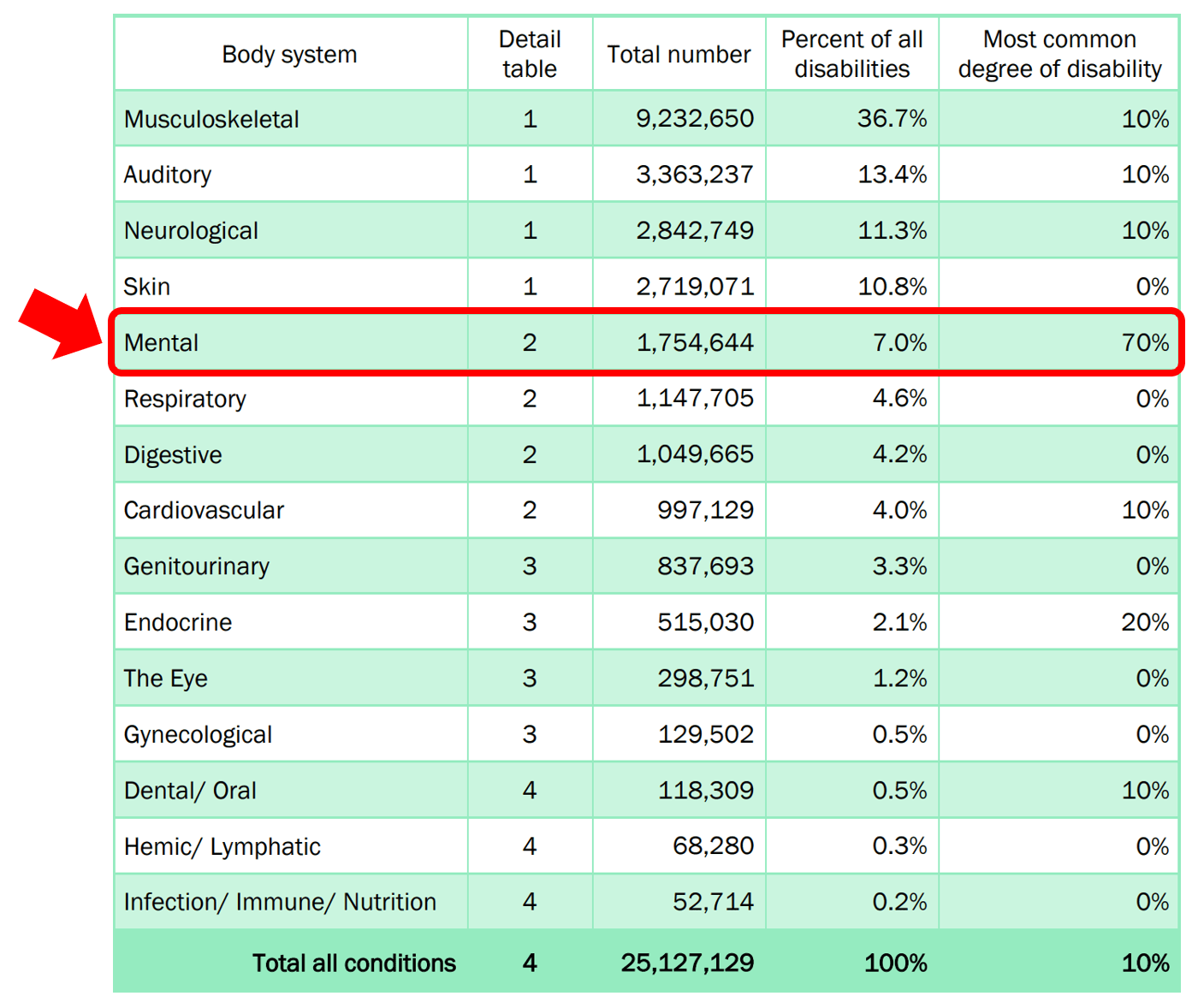

VA List Of Disabilities VA Disability Rates 2021

VA List Of Disabilities VA Disability Rates 2021

On The Move Claiming Moving Expenses Chartered Accountant Firms