Today, where screens rule our lives, the charm of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons, creative projects, or just adding personal touches to your area, Housing Loan Interest Income Tax Exemption 2019 20 have become a valuable resource. The following article is a take a dive in the world of "Housing Loan Interest Income Tax Exemption 2019 20," exploring what they are, how to find them and what they can do to improve different aspects of your lives.

Get Latest Housing Loan Interest Income Tax Exemption 2019 20 Below

Housing Loan Interest Income Tax Exemption 2019 20

Housing Loan Interest Income Tax Exemption 2019 20 -

The Union Budget 2019 has introduced a new Section 80EEA to extend the tax benefits of the interest deduction up to Rs 1 50 000 for housing loans taken for affordable housing during the period 1 April 2019 to 31 March 2022 The individual taxpayer should be a first home buyer and should not be entitled to a deduction under

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

Housing Loan Interest Income Tax Exemption 2019 20 cover a large collection of printable content that can be downloaded from the internet at no cost. These printables come in different formats, such as worksheets, coloring pages, templates and much more. The beauty of Housing Loan Interest Income Tax Exemption 2019 20 is their flexibility and accessibility.

More of Housing Loan Interest Income Tax Exemption 2019 20

How To Show Interest On A Home Loan In An Income Tax Return

How To Show Interest On A Home Loan In An Income Tax Return

80EEA 1 5 Lakh The stamp value of the property is under INR 45 lakh Taxpayers not eligible to claim deduction under section 80EE Get to know the tax benefits on home loan interest for the F Y 2023 24 Also we have included tax benefits on principal repaid interest Paid etc

A new Section 80EEA has been inserted by government to allow for an interest deduction from AY 2020 21 FY 2019 20 The existing provisions of Section 80EE allow a deduction up to Rs 50 000 for interest paid by first time home buyers for loan sanctioned from a financial institution between 1 April 2016 and 31 March 2017 Amount

Housing Loan Interest Income Tax Exemption 2019 20 have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

The ability to customize: The Customization feature lets you tailor printables to fit your particular needs be it designing invitations making your schedule, or even decorating your house.

-

Educational Benefits: The free educational worksheets provide for students from all ages, making them an invaluable device for teachers and parents.

-

Accessibility: Access to a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Housing Loan Interest Income Tax Exemption 2019 20

Home Loan Tax Benefit Calculator Income Tax Home Loan Benefits

Home Loan Tax Benefit Calculator Income Tax Home Loan Benefits

Tax deduction under Section 80EE of the Income Tax Act 1961 can be claimed by first time home buyers for the amount they pay as interest on a home loan and the loan must be sanctioned between 01 04 2016 to 31 03 2017 The maximum deduction that can be claimed under this section is Rs 50 000 during a financial year

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Note that home loan borrowers opting for new tax regime cannot claim deductions under Sections 80C or 24 b

Now that we've ignited your interest in printables for free and other printables, let's discover where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Housing Loan Interest Income Tax Exemption 2019 20 to suit a variety of motives.

- Explore categories like decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Housing Loan Interest Income Tax Exemption 2019 20

Here are some unique ways to make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Housing Loan Interest Income Tax Exemption 2019 20 are an abundance of creative and practical resources for a variety of needs and interest. Their accessibility and flexibility make them a great addition to any professional or personal life. Explore the wide world of Housing Loan Interest Income Tax Exemption 2019 20 right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes they are! You can download and print these resources at no cost.

-

Does it allow me to use free printables for commercial purposes?

- It's based on the conditions of use. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright issues in Housing Loan Interest Income Tax Exemption 2019 20?

- Some printables may contain restrictions regarding usage. Always read these terms and conditions as set out by the designer.

-

How can I print Housing Loan Interest Income Tax Exemption 2019 20?

- You can print them at home with an printer, or go to an area print shop for premium prints.

-

What program do I require to open printables free of charge?

- The majority are printed in the PDF format, and is open with no cost software, such as Adobe Reader.

Housing Loan Interest Income Tax Exemption 2019 20 LOAKANS

Income Tax Exemption U s 80EEA Interest On Affordable Housing Loan

Check more sample of Housing Loan Interest Income Tax Exemption 2019 20 below

Tax Benefits On Home Loan Know More At Taxhelpdesk

Interim Budget 2019 Income Tax Exemption Limit Hiked To Rs 5 Lakh

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

Income Tax Exemption Limit Raised To Rs 5 Lakh Higher Standard

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

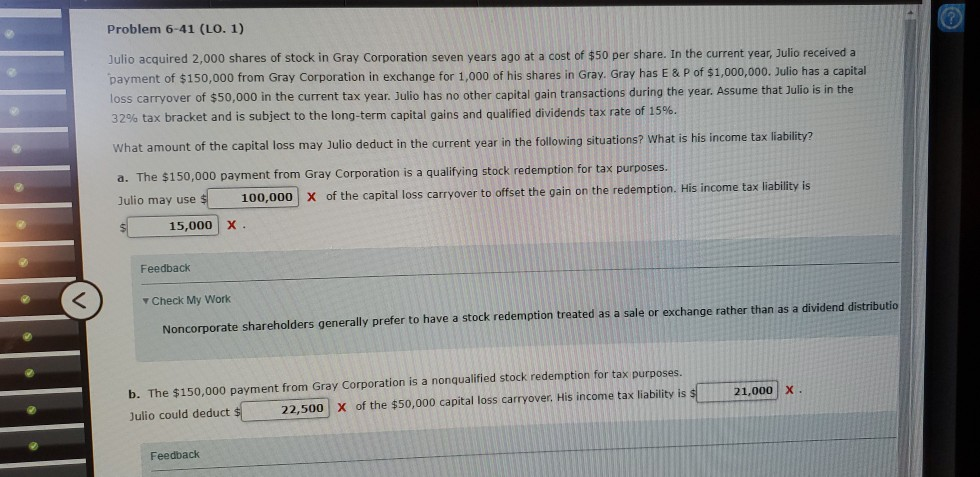

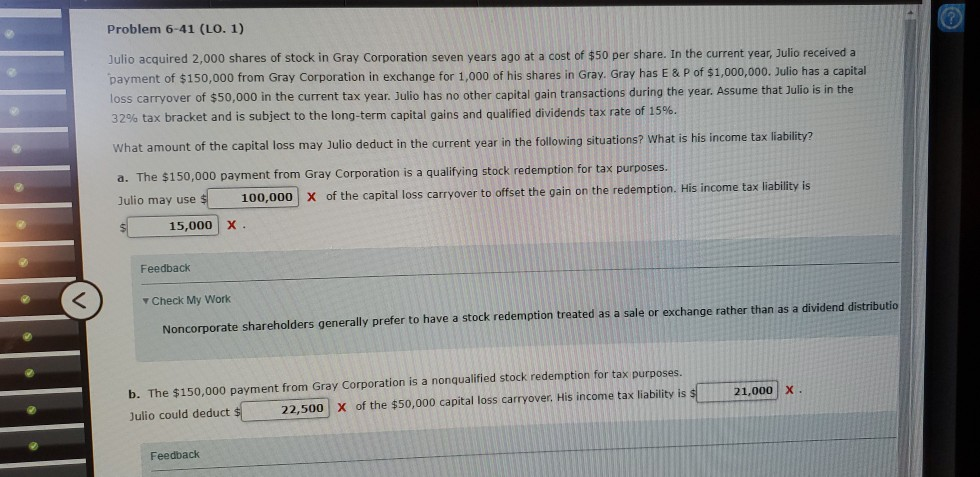

Solved Problem 6 41 LO 1 Julio Acquired 2 000 Shares Of Chegg

https://cleartax.in/s/home-loan-tax-benefits

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

https://taxguru.in/income-tax/faq-on-housing-loan...

In case you are living in the house for which home loan is taken both of you shall be entitled to deduction in the ratio 3 1 on account of interest on borrowed money up to a maximum of Rs 2 lakh individually Rs 1 50 Lakh up to A Y 2014 15

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

In case you are living in the house for which home loan is taken both of you shall be entitled to deduction in the ratio 3 1 on account of interest on borrowed money up to a maximum of Rs 2 lakh individually Rs 1 50 Lakh up to A Y 2014 15

Income Tax Exemption Limit Raised To Rs 5 Lakh Higher Standard

Interim Budget 2019 Income Tax Exemption Limit Hiked To Rs 5 Lakh

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

Solved Problem 6 41 LO 1 Julio Acquired 2 000 Shares Of Chegg

Stamp Duty Exemption 2019 Warren Churchill

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Section 24 Of Income Tax Act Deduction For Home Loan Interest