In a world where screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. In the case of educational materials project ideas, artistic or simply to add the personal touch to your space, House Rent Tax Benefit Under Section have become a valuable resource. Here, we'll dive deeper into "House Rent Tax Benefit Under Section," exploring what they are, where to find them and how they can be used to enhance different aspects of your daily life.

Get Latest House Rent Tax Benefit Under Section Below

House Rent Tax Benefit Under Section

House Rent Tax Benefit Under Section -

Your salary package may include different allowances like House Rent Allowance HRA conveyance transport allowance medical reimbursement etc Additionally some of these allowances are exempt up to a certain limit under section 10 of the Income Tax Act

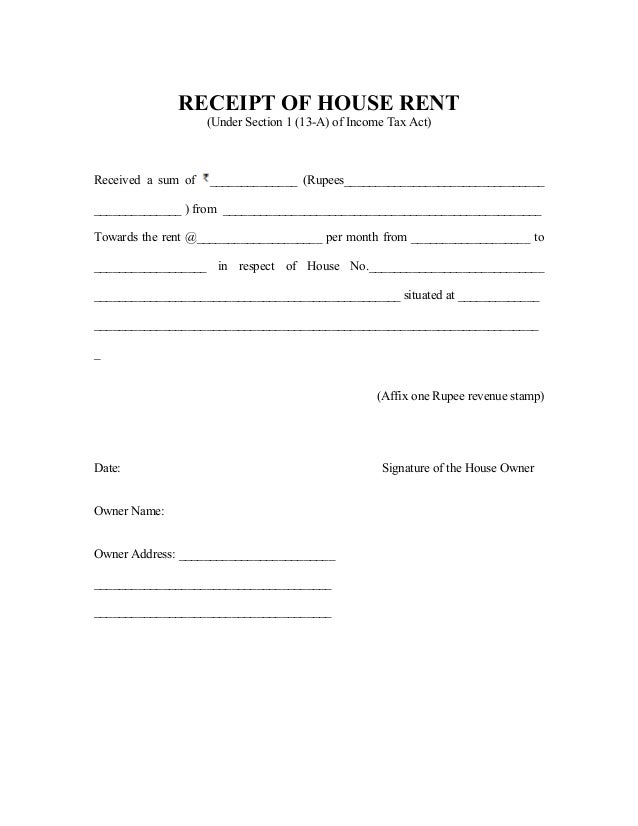

Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961 Amount of HRA tax exemption is deductible from the total salary income before arriving at a gross taxable

House Rent Tax Benefit Under Section include a broad collection of printable items that are available online at no cost. These resources come in various forms, like worksheets coloring pages, templates and much more. The benefit of House Rent Tax Benefit Under Section is their flexibility and accessibility.

More of House Rent Tax Benefit Under Section

NPS Tax Benefit Under Sec 80CCD 1b Of Rs 50 000 Business HimSky

-50000.jpg)

NPS Tax Benefit Under Sec 80CCD 1b Of Rs 50 000 Business HimSky

House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the employee However Income Tax Act provides a deduction of hra under section 10 13A subject to certain limits

Since housing is a basic need and the rental income eats into the income of an individual the Income Tax Act 1961 introduced the concept of House Rent Allowance HRA wherein you can claim tax benefits for the rental expense that you incur on accommodation Let s have a look at what HRA is all about What is House Rent Allowance

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Personalization There is the possibility of tailoring designs to suit your personal needs whether it's making invitations to organize your schedule or decorating your home.

-

Educational Worth: Free educational printables offer a wide range of educational content for learners of all ages, which makes them a vital resource for educators and parents.

-

Affordability: Quick access to many designs and templates reduces time and effort.

Where to Find more House Rent Tax Benefit Under Section

House Rental Tax In Nepal Corporate Lawyer Nepal

House Rental Tax In Nepal Corporate Lawyer Nepal

However in such a situation one can tax deduction on house rent paid under Section 80GG of the I T Act As per this section a taxpayer can claim lowest of the following three as deduction towards house rent payment Rs 5 000 per month 25 of adjusted total income Actual rent paid minus 10 of income

HRA Calculator Calculate House Rent Allowance Online Please Note You can now claim up to Rs 60 000 deduction under Section 80GG even if you do not receive HRA Calculate Your HRA Exemption The calculation is done by taking the salary as Basic Pay D A if considered for retirement benefits Actual HRA received Rent paid less 10 of Salary

We hope we've stimulated your interest in House Rent Tax Benefit Under Section Let's find out where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of uses.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets as well as flashcards and other learning tools.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs are a vast range of topics, all the way from DIY projects to planning a party.

Maximizing House Rent Tax Benefit Under Section

Here are some ways ensure you get the very most use of House Rent Tax Benefit Under Section:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print worksheets that are free for teaching at-home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

House Rent Tax Benefit Under Section are an abundance filled with creative and practical information designed to meet a range of needs and preferences. Their access and versatility makes them a fantastic addition to both professional and personal life. Explore the vast world that is House Rent Tax Benefit Under Section today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes you can! You can print and download these tools for free.

-

Can I utilize free printables in commercial projects?

- It's all dependent on the terms of use. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with House Rent Tax Benefit Under Section?

- Certain printables could be restricted in their usage. Make sure you read the conditions and terms of use provided by the author.

-

How can I print printables for free?

- Print them at home using either a printer or go to a local print shop for top quality prints.

-

What software do I need to run printables for free?

- The majority of PDF documents are provided in the format PDF. This is open with no cost software like Adobe Reader.

PPF Account For Minors E filing Of Income Tax Return

Section 80CCF Infrastructure Bonds FAQ OneMint

Check more sample of House Rent Tax Benefit Under Section below

Login System

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

Preventive Check Up 80d Wkcn

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

pancardapplyonline Hashtag On Twitter

HRCIN

https://economictimes.indiatimes.com/wealth/tax/...

Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961 Amount of HRA tax exemption is deductible from the total salary income before arriving at a gross taxable

-50000.jpg?w=186)

https://tax2win.in/guide/hra-house-rent-allowance

HRA is subject to full or partial tax deductions An employee has to submit Form 12BB to the employer to claim the exemptions like HRA LTA etc and Income Tax deductions under Chapter VI A It should be noted that self employed individuals can also claim tax exemption for the rent paid under Section 80GG of the Income Tax Act

Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961 Amount of HRA tax exemption is deductible from the total salary income before arriving at a gross taxable

HRA is subject to full or partial tax deductions An employee has to submit Form 12BB to the employer to claim the exemptions like HRA LTA etc and Income Tax deductions under Chapter VI A It should be noted that self employed individuals can also claim tax exemption for the rent paid under Section 80GG of the Income Tax Act

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

pancardapplyonline Hashtag On Twitter

HRCIN

Some Of The Lesser Known Income Tax Deductions That Help You Save Money

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Abc