In this age of electronic devices, where screens have become the dominant feature of our lives The appeal of tangible, printed materials hasn't diminished. In the case of educational materials and creative work, or just adding some personal flair to your space, House Rent Deduction In Income Tax Section India are now a useful resource. The following article is a dive in the world of "House Rent Deduction In Income Tax Section India," exploring what they are, how to find them and how they can enhance various aspects of your lives.

Get Latest House Rent Deduction In Income Tax Section India Below

House Rent Deduction In Income Tax Section India

House Rent Deduction In Income Tax Section India -

In India 30 of your rental income is taxable under the head income from house property as a standard deduction The applicant must be the legal owner of a property for this standard deduction rate to apply to

HRA is a part of your salary income and therefore it is initially considered as your taxable income However if you live in a

House Rent Deduction In Income Tax Section India encompass a wide assortment of printable, downloadable items that are available online at no cost. They are available in numerous designs, including worksheets templates, coloring pages and more. The benefit of House Rent Deduction In Income Tax Section India is their flexibility and accessibility.

More of House Rent Deduction In Income Tax Section India

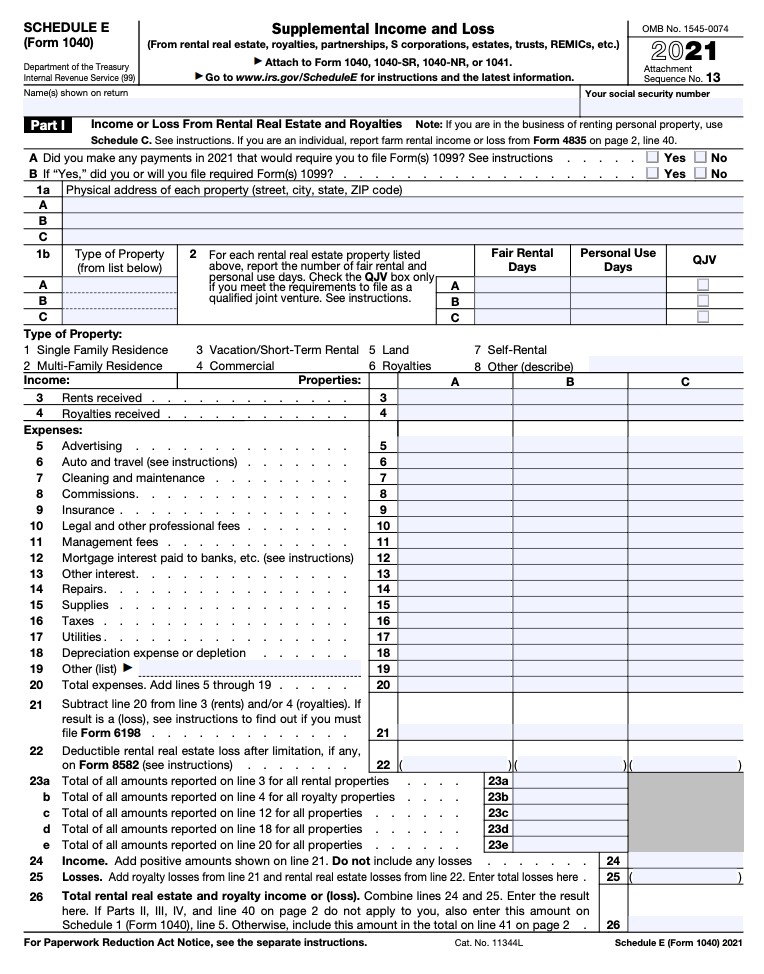

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

If you don t receive HRA you can now claim upto Rs 60 000 deduction under Section 80GG Click here to calculate your tax as per Budget 2024 If you receive HRA you can use this calculator File your Income Tax

Salaried individuals who live in a rented house can claim tax exemption on HRA under Section 10 13A of the Income Tax Act HRA is subject to full or partial tax deductions An employee has to submit Form

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Personalization We can customize printables to fit your particular needs when it comes to designing invitations making your schedule, or even decorating your house.

-

Educational Benefits: The free educational worksheets cater to learners from all ages, making them a valuable source for educators and parents.

-

It's easy: instant access various designs and templates reduces time and effort.

Where to Find more House Rent Deduction In Income Tax Section India

Section 24 Deduction Income From House Property

Section 24 Deduction Income From House Property

Salaried individuals who live in a rented house can claim House Rent Allowance or HRA to lower taxes This can be partially or completely exempt from taxes The allowance is for

The deduction amount under Section 80GG is calculated by deducting 10 of your total income from the minimum rent OR 5 000 per month OR 25 of your

Now that we've ignited your interest in printables for free Let's look into where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of House Rent Deduction In Income Tax Section India to suit a variety of goals.

- Explore categories like home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs covered cover a wide array of topics, ranging from DIY projects to party planning.

Maximizing House Rent Deduction In Income Tax Section India

Here are some fresh ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print free worksheets to aid in learning at your home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

House Rent Deduction In Income Tax Section India are an abundance of practical and innovative resources catering to different needs and interest. Their access and versatility makes them a fantastic addition to both personal and professional life. Explore the vast array of House Rent Deduction In Income Tax Section India and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes you can! You can print and download these tools for free.

-

Can I use free printables to make commercial products?

- It's dependent on the particular conditions of use. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Are there any copyright issues with House Rent Deduction In Income Tax Section India?

- Certain printables might have limitations in use. Make sure you read these terms and conditions as set out by the designer.

-

How do I print House Rent Deduction In Income Tax Section India?

- Print them at home with any printer or head to an area print shop for high-quality prints.

-

What program do I need to open printables that are free?

- A majority of printed materials are in the format PDF. This can be opened using free programs like Adobe Reader.

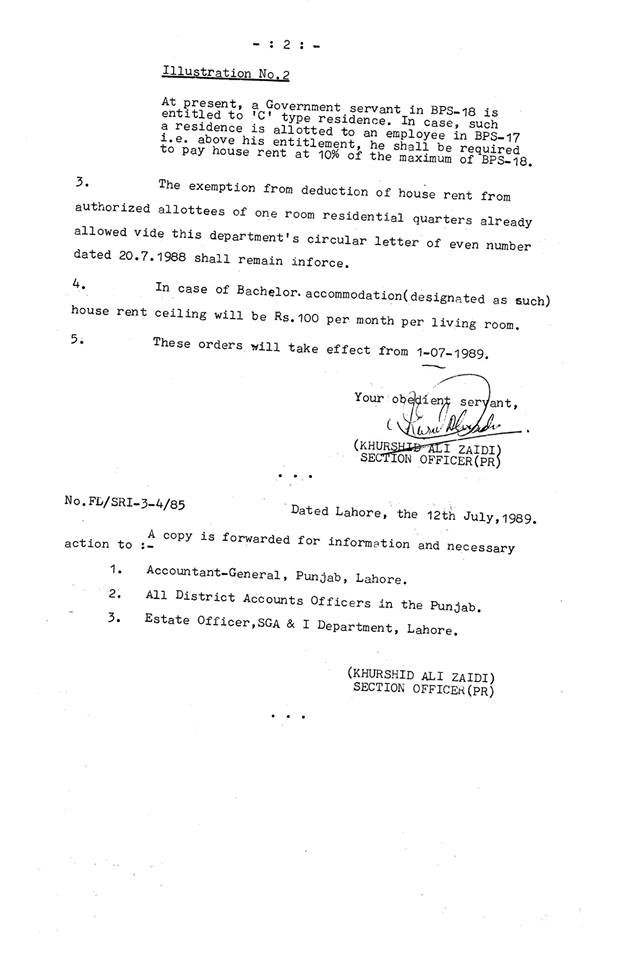

Material Requirement Form House Rent Deduction In Income Tax Section

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

Check more sample of House Rent Deduction In Income Tax Section India below

House Rent Deduction Raised From Rs 24 000 To Rs 60 000 Hindustan Times

Section 80GG Of Income Tax Act House Rent Deduction In Income Tax

House Rent Deduction HRA

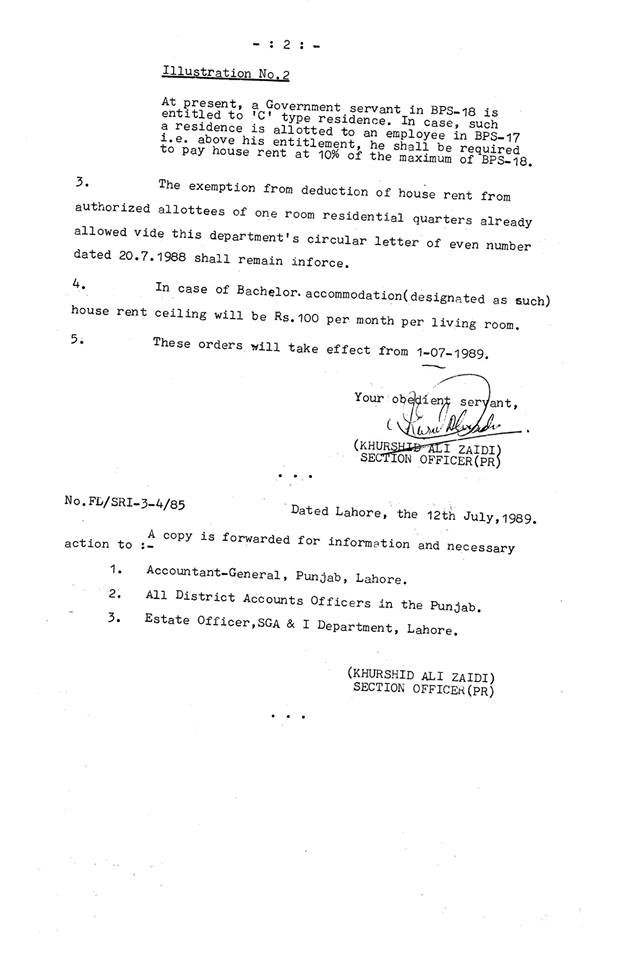

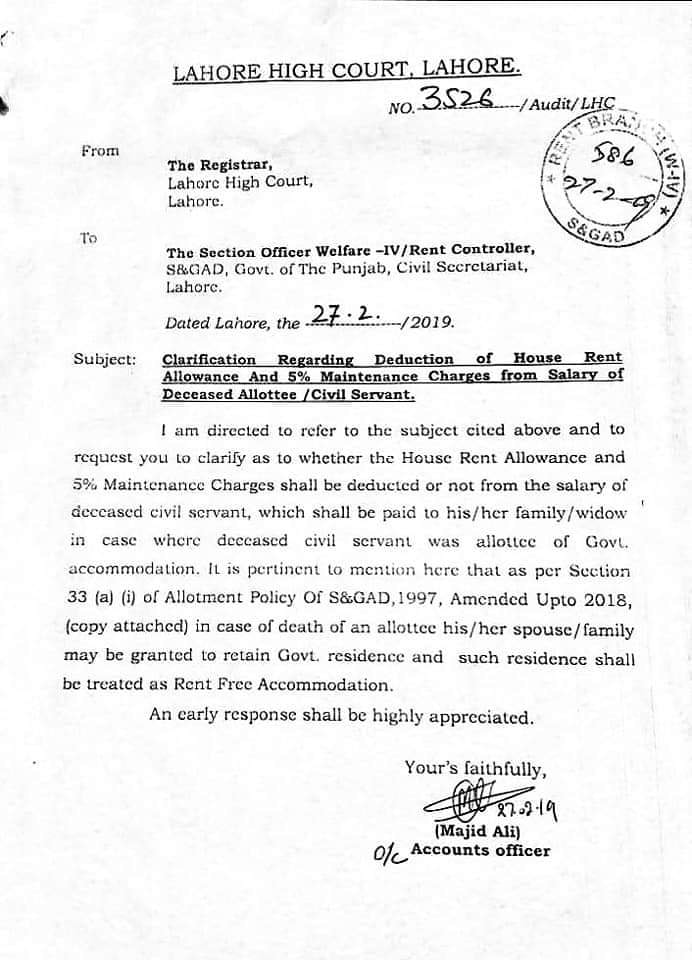

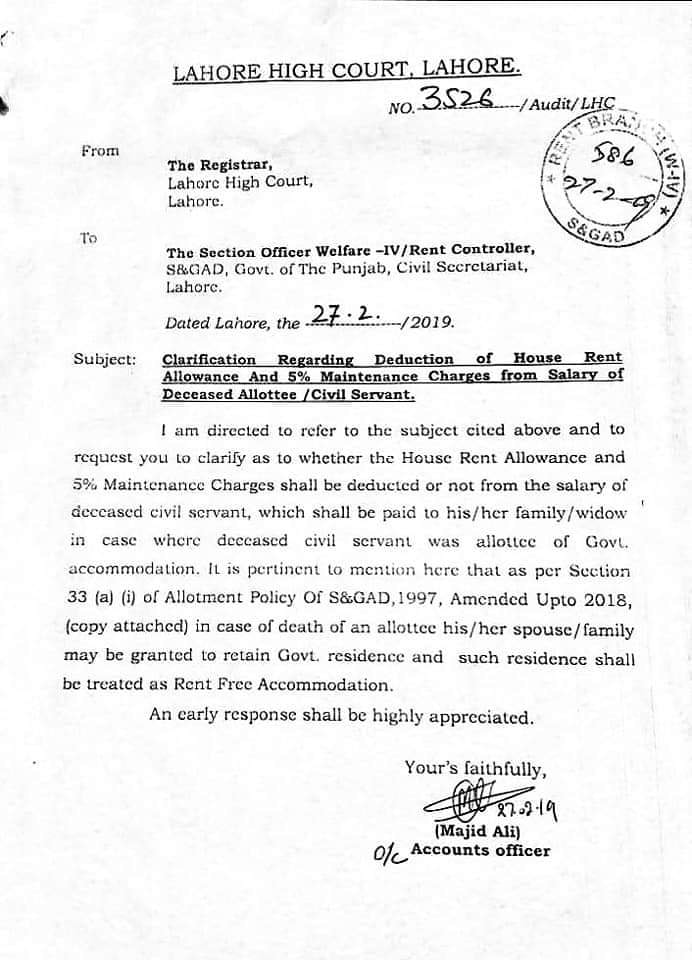

House Rent Deduction Letters Dated 12 7 1999 19 04 2013 27 2 2019

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

House Rent Deduction Letters Dated 12 7 1999 19 04 2013 27 2 2019

https://cleartax.in/s/hra-house-rent-allo…

HRA is a part of your salary income and therefore it is initially considered as your taxable income However if you live in a

https://taxguru.in/income-tax/house-re…

Rent paid exceeds 10 of Salary HRA is a part of Salary Can be seen in Form 16 B Sr no 2 e Not paying rent to spouse 2 HOW MUCH DEDUCTION CAN BE TAKEN Deduction

HRA is a part of your salary income and therefore it is initially considered as your taxable income However if you live in a

Rent paid exceeds 10 of Salary HRA is a part of Salary Can be seen in Form 16 B Sr no 2 e Not paying rent to spouse 2 HOW MUCH DEDUCTION CAN BE TAKEN Deduction

House Rent Deduction Letters Dated 12 7 1999 19 04 2013 27 2 2019

Section 80GG Of Income Tax Act House Rent Deduction In Income Tax

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

House Rent Deduction Letters Dated 12 7 1999 19 04 2013 27 2 2019

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

Section 80GG Of Income Tax Act Tax Deduction On Rent Paid

Section 80GG Of Income Tax Act Tax Deduction On Rent Paid

House Rent Receipt Format PDF Download