Today, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education project ideas, artistic or just adding some personal flair to your area, Homestead Tax Exemption Mn have become an invaluable resource. In this article, we'll dive to the depths of "Homestead Tax Exemption Mn," exploring what they are, how to find them, and how they can enrich various aspects of your daily life.

Get Latest Homestead Tax Exemption Mn Below

Homestead Tax Exemption Mn

Homestead Tax Exemption Mn -

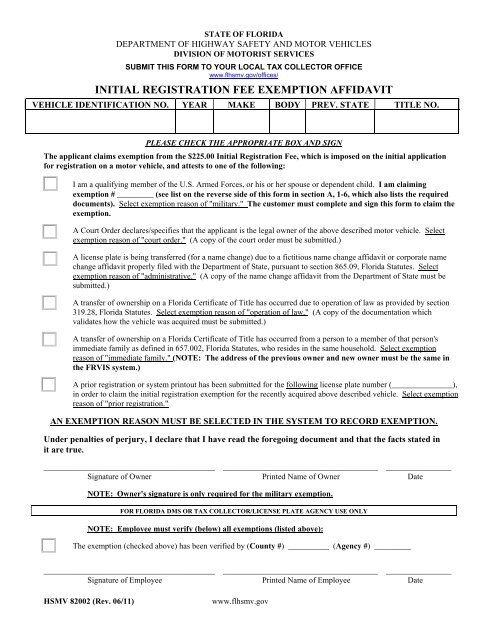

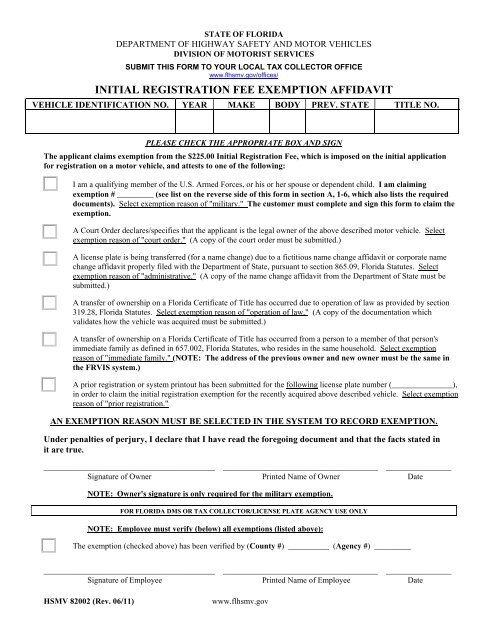

Minneapolis Assessing Department 350 Fifth St S Room 100 Minneapolis MN 55415 1323 Office hours 8 a m 4 30 p m Monday Friday See list of City holidays Last updated on March 2 2023 Apply for homestead status by Dec 31 to get benefits on next year s taxes

The Market Value Exclusion reduces the taxable market value for property classified as homestead if it is valued below 517 200 By decreasing the taxable market value net property taxes are also decreased Note Properties valued below 517 200 may qualify for this benefit for 2025 property taxes

Printables for free cover a broad assortment of printable items that are available online at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages and much more. The value of Homestead Tax Exemption Mn is in their variety and accessibility.

More of Homestead Tax Exemption Mn

Texas Homestead Tax Exemption Cedar Park Texas Living

Texas Homestead Tax Exemption Cedar Park Texas Living

Homestead and related programs Homestead status can save you money on your property taxes Individual taxpayer identification numbers now qualify property owners for homestead exclusion You may qualify for homestead status if You or one of your relatives lives in the home

Subdivision 1 Exemption The homestead may include any quantity of land not exceeding 160 acres The exemption per homestead whether the exemption is claimed by one or more debtors may not exceed 480 000 or if the homestead is used primarily for agricultural purposes 1 200 000 exclusive of the

Homestead Tax Exemption Mn have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

customization This allows you to modify printables to your specific needs, whether it's designing invitations, organizing your schedule, or even decorating your home.

-

Educational Value: Free educational printables can be used by students of all ages, which makes them a vital instrument for parents and teachers.

-

Simple: instant access a plethora of designs and templates reduces time and effort.

Where to Find more Homestead Tax Exemption Mn

Minnesota Revenue Form ST3 for Tax Exempt Orders

Minnesota Revenue Form ST3 for Tax Exempt Orders

What is the Homestead Exclusion Homestead is a program to reduce property taxes for owners or relatives of owners who also occupy their homes CR H 2023 Homestead Application Application to Remove Homestead Who is eligible for the Homestead Exclusion You can qualify for this tax reduction if

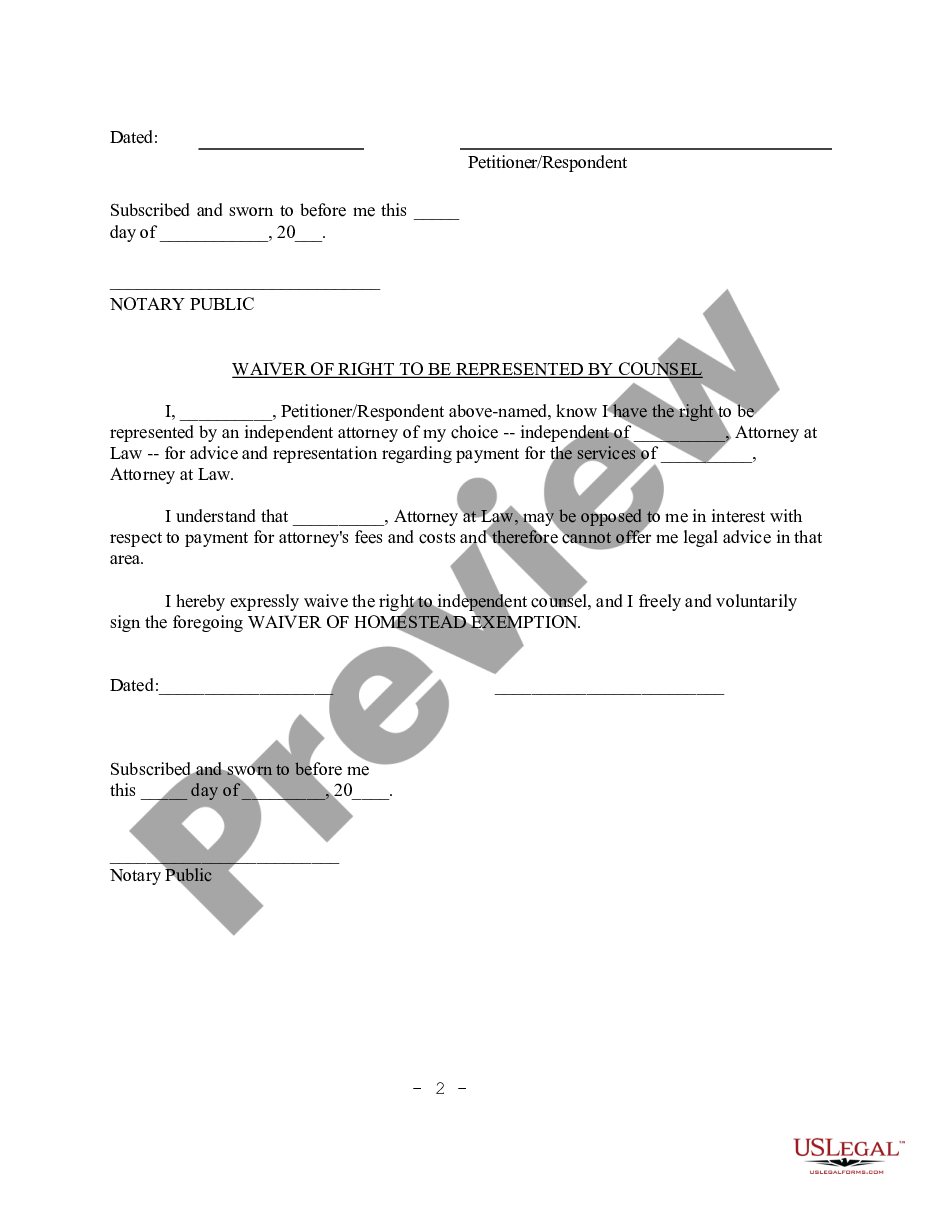

The homestead exemption is a product of the strong social policy of securing the home against the uncertainties and misfortunes of life 3 The homestead exemption is found in the constitutions or laws of every state except New Jersey and Pennsylvania 4 The Minnesota homestead exemption is rooted in the Minnesota

We hope we've stimulated your curiosity about Homestead Tax Exemption Mn Let's take a look at where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in Homestead Tax Exemption Mn for different motives.

- Explore categories like home decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets including flashcards, learning materials.

- Great for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a wide variety of topics, from DIY projects to planning a party.

Maximizing Homestead Tax Exemption Mn

Here are some new ways to make the most use of Homestead Tax Exemption Mn:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home and in class.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Homestead Tax Exemption Mn are a treasure trove of creative and practical resources designed to meet a range of needs and interest. Their accessibility and flexibility make they a beneficial addition to your professional and personal life. Explore the endless world of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes, they are! You can print and download these files for free.

-

Does it allow me to use free templates for commercial use?

- It's based on the usage guidelines. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may come with restrictions on their use. Check the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- You can print them at home with printing equipment or visit the local print shops for better quality prints.

-

What program must I use to open Homestead Tax Exemption Mn?

- Most PDF-based printables are available in PDF format. They can be opened with free software like Adobe Reader.

Homestead Tax Exemption For Seniors Adams County Iowa

Homestead Tax Exemption

Check more sample of Homestead Tax Exemption Mn below

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

How Do I Register For Florida Homestead Tax Exemption

Form Residence Homestead Exemption Application Fill Out And Sign Www

Homestead Tax Exemption And Your Home

Osceola County Homestead Tax Exemption Form ExemptForm

Minnesota Homestead

https://www.revenue.state.mn.us/homestead

The Market Value Exclusion reduces the taxable market value for property classified as homestead if it is valued below 517 200 By decreasing the taxable market value net property taxes are also decreased Note Properties valued below 517 200 may qualify for this benefit for 2025 property taxes

https://aaronhall.com/applying-for-the-homestead...

A homestead classification qualifies your property for a classification rate of 1 00 on up to 500 000 in taxable market value Homesteads are also eligible for a market value exclusion which may reduce the property s taxable market value Homestead properties also qualify for other programs such as the disabled veterans market value

The Market Value Exclusion reduces the taxable market value for property classified as homestead if it is valued below 517 200 By decreasing the taxable market value net property taxes are also decreased Note Properties valued below 517 200 may qualify for this benefit for 2025 property taxes

A homestead classification qualifies your property for a classification rate of 1 00 on up to 500 000 in taxable market value Homesteads are also eligible for a market value exclusion which may reduce the property s taxable market value Homestead properties also qualify for other programs such as the disabled veterans market value

Homestead Tax Exemption And Your Home

How Do I Register For Florida Homestead Tax Exemption

Osceola County Homestead Tax Exemption Form ExemptForm

Minnesota Homestead

How Do I Register For Florida Homestead Tax Exemption

Palestine Real Estate Palestine TX Homes For Sale BuyPalestine

Palestine Real Estate Palestine TX Homes For Sale BuyPalestine

Osceola County Homestead Tax Exemption Form ExemptForm