In the age of digital, with screens dominating our lives The appeal of tangible, printed materials hasn't diminished. For educational purposes such as creative projects or simply adding personal touches to your area, Homestead Property Tax Credit Maryland have become a valuable source. For this piece, we'll dive into the world "Homestead Property Tax Credit Maryland," exploring what they are, where they are available, and how they can enrich various aspects of your daily life.

Get Latest Homestead Property Tax Credit Maryland Below

Homestead Property Tax Credit Maryland

Homestead Property Tax Credit Maryland -

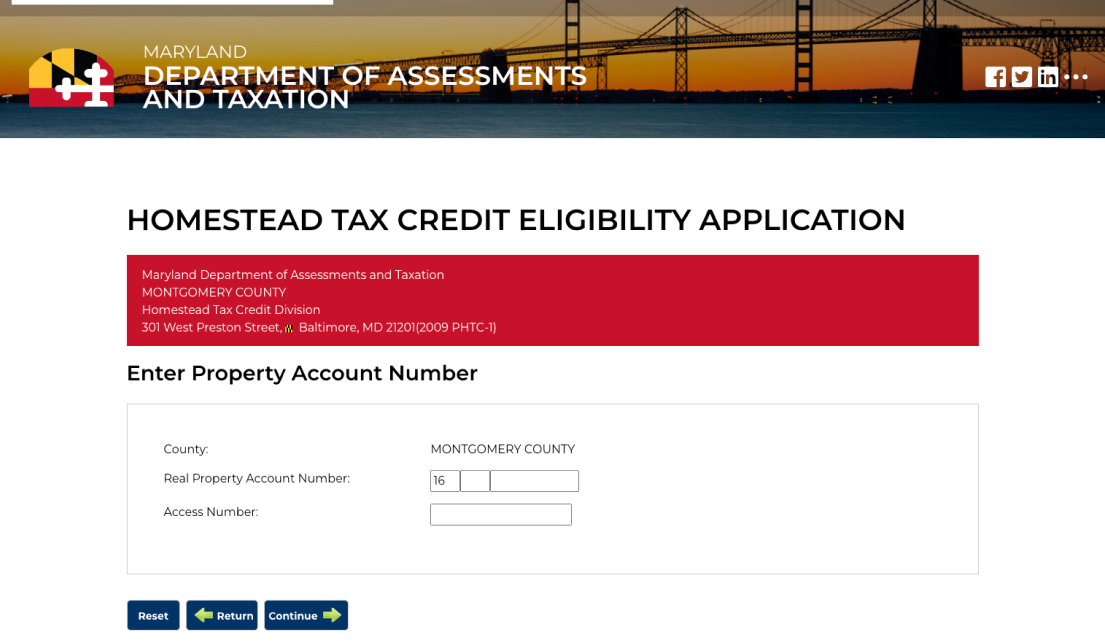

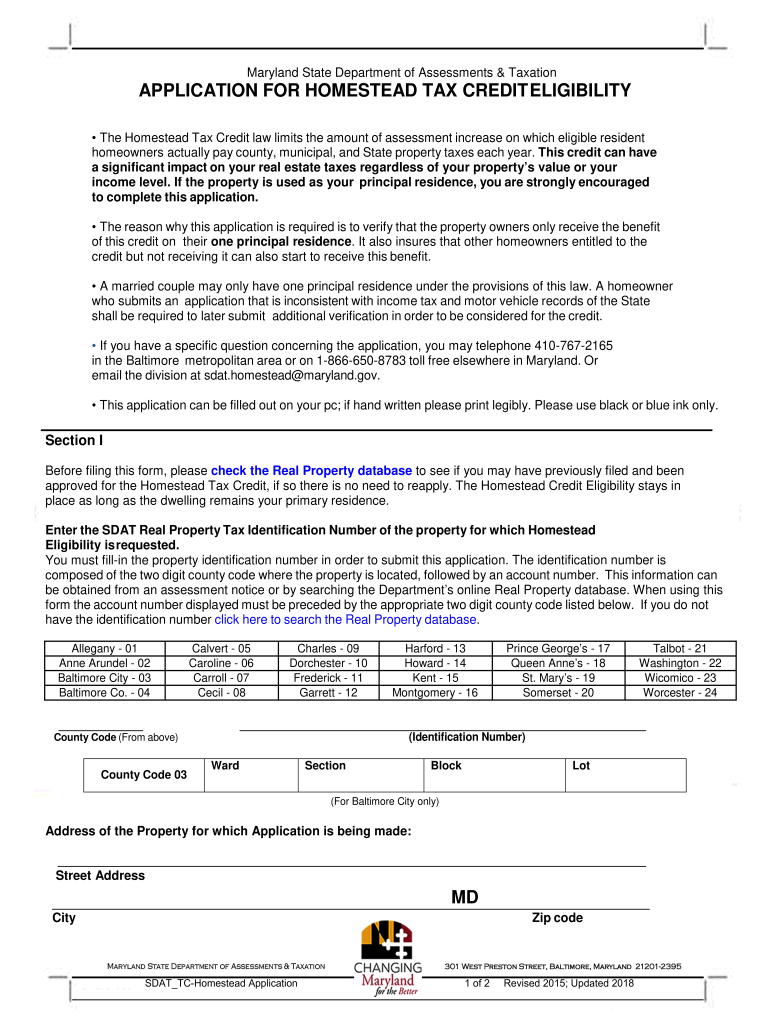

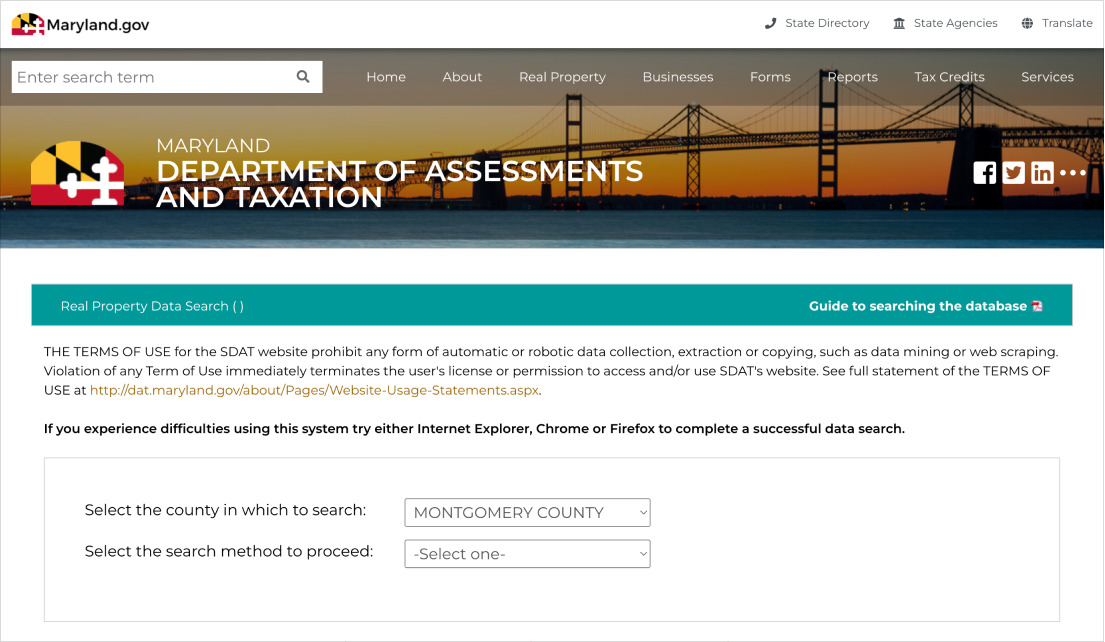

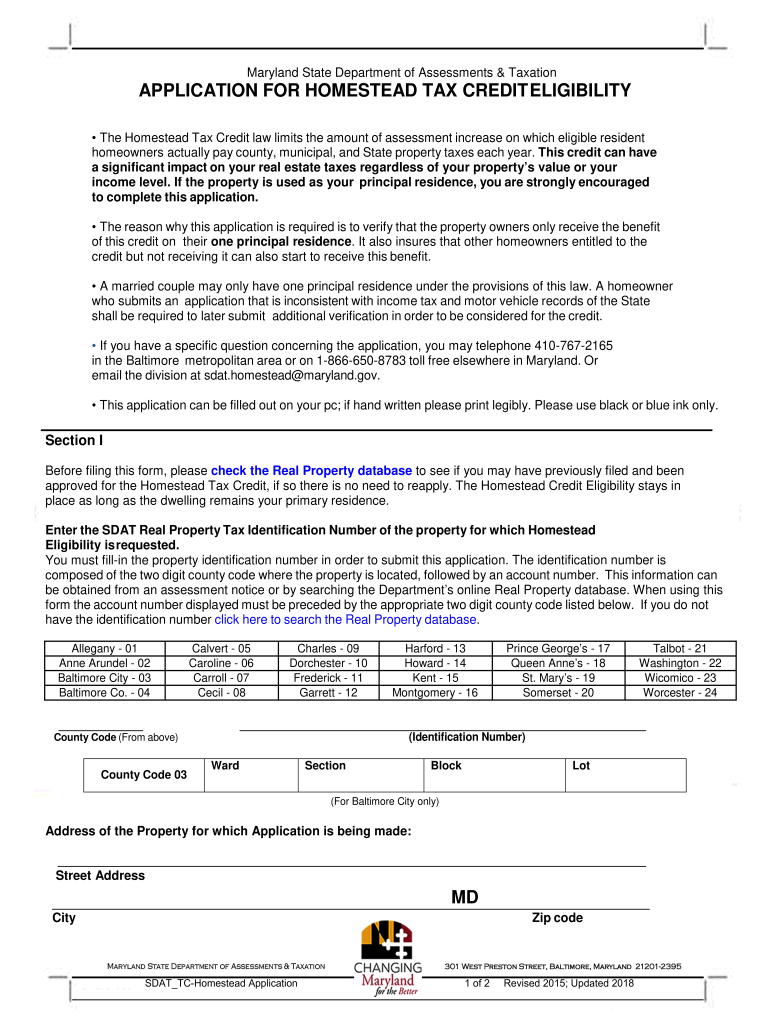

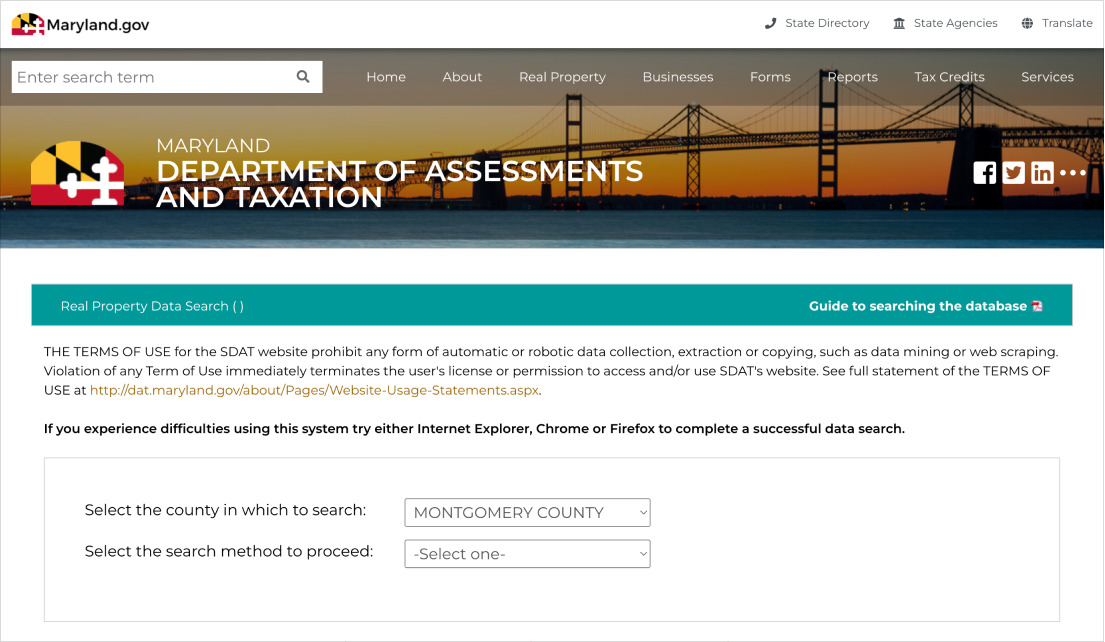

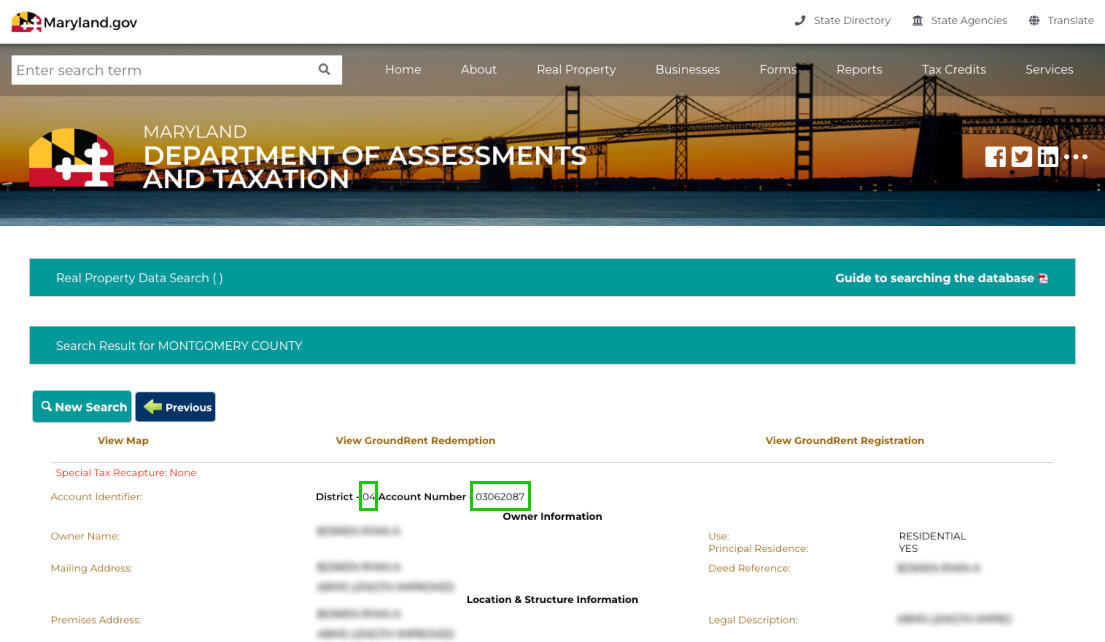

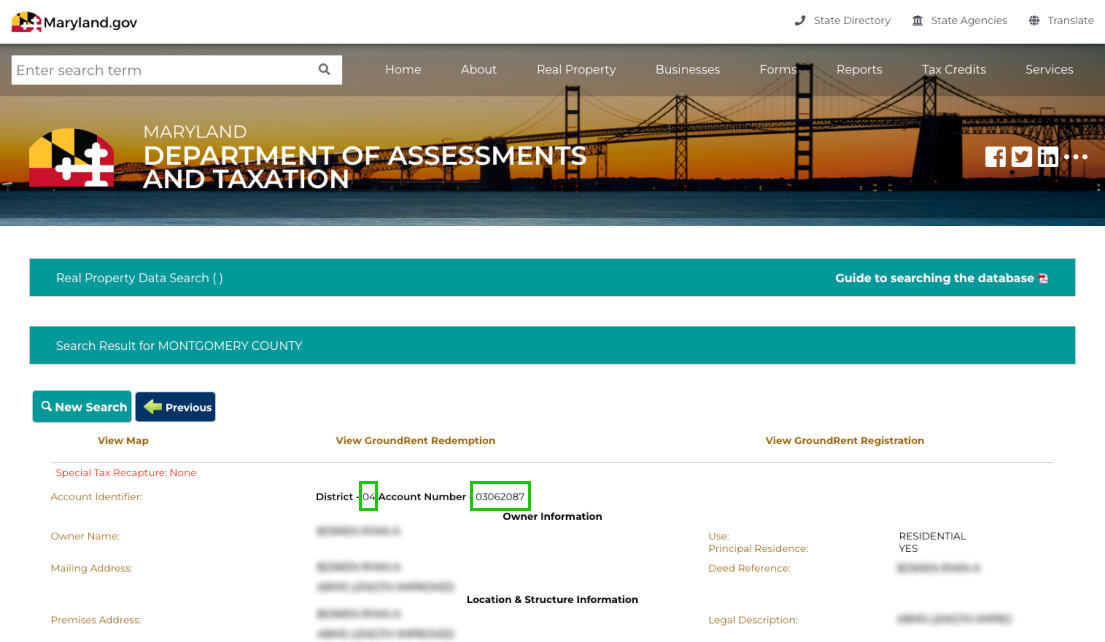

The Homestead Tax Credit Eligibility Application is needed to ensure that homeowners receive the Homestead credit only on their principal residence You can find out if you have already filed an application by looking up

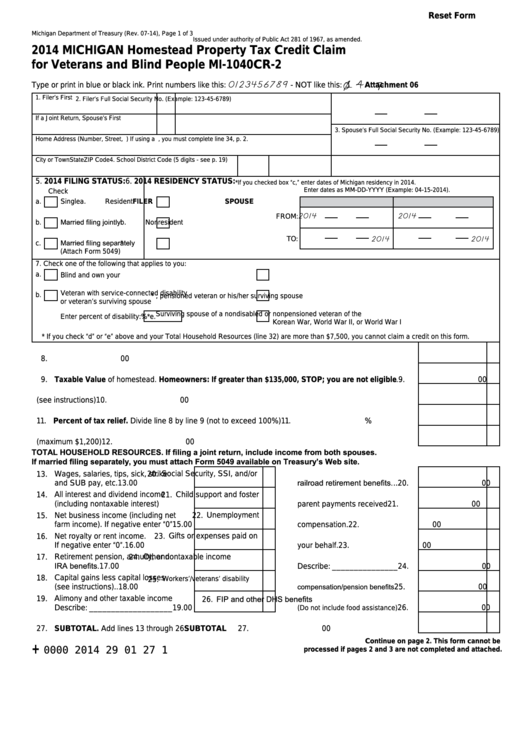

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula 0 of the first 8 000 of the combined household income 4 of the next 4 000 of income 6 5 of the next 4 000 of income and 9 of all income above 16 000

Printables for free cover a broad assortment of printable, downloadable materials online, at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and more. The beauty of Homestead Property Tax Credit Maryland lies in their versatility and accessibility.

More of Homestead Property Tax Credit Maryland

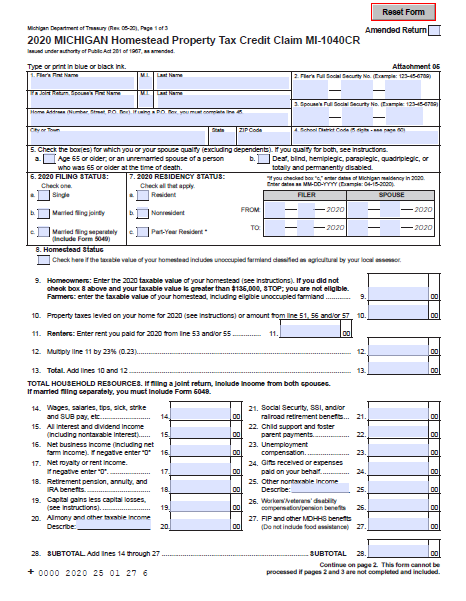

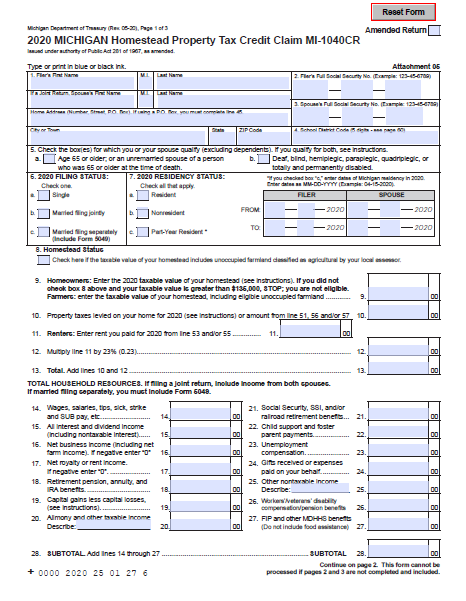

2020 Homestead Property Tax Credit Michigan s Support For Older

2020 Homestead Property Tax Credit Michigan s Support For Older

The Homestead Credit limits the increase in taxable assessments each year to a fixed percentage Every county and municipality in Maryland is required to limit taxable assessment increases to 10 or less each year View a listing of homestead caps for each local government

The Homeowners Property Tax Credit Program provides tax relief for eligible homeowners by setting a limit on the amount of property taxes owed based on their income Applications received and approved by April

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Customization: They can make designs to suit your personal needs for invitations, whether that's creating them or arranging your schedule or decorating your home.

-

Educational Worth: Downloads of educational content for free provide for students of all ages, making them an invaluable device for teachers and parents.

-

It's easy: You have instant access a myriad of designs as well as templates can save you time and energy.

Where to Find more Homestead Property Tax Credit Maryland

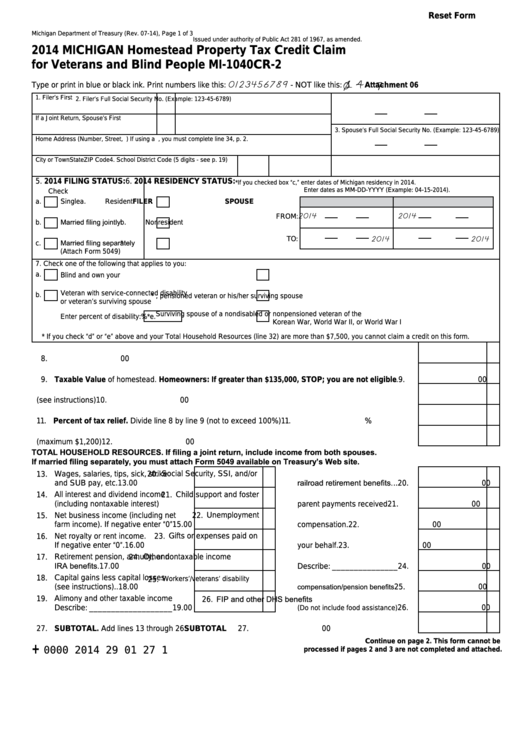

What Is The Michigan Homestead Property Tax Credit

What Is The Michigan Homestead Property Tax Credit

County and Municipal Homestead Credit Percentages Effective July 1 2023 Subdivision Percentage Limit State of Maryland 10 Maryland Department of Assessments and Taxation Last Updated July 1 2023 Maryland Department of Assessments and Taxation Last Updated July 1 2023 County and Municipal Homestead Credit

The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income A new application must be filed every year if the applicant wishes to be considered for a tax credit

Since we've got your interest in Homestead Property Tax Credit Maryland We'll take a look around to see where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Homestead Property Tax Credit Maryland suitable for many needs.

- Explore categories such as decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free as well as flashcards and other learning materials.

- It is ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- These blogs cover a wide variety of topics, that range from DIY projects to planning a party.

Maximizing Homestead Property Tax Credit Maryland

Here are some unique ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Utilize free printable worksheets to enhance learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Homestead Property Tax Credit Maryland are an abundance of innovative and useful resources which cater to a wide range of needs and desires. Their accessibility and flexibility make them a great addition to every aspect of your life, both professional and personal. Explore the vast collection of Homestead Property Tax Credit Maryland today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Homestead Property Tax Credit Maryland really free?

- Yes they are! You can download and print these resources at no cost.

-

Can I use the free printables to make commercial products?

- It's determined by the specific conditions of use. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables could be restricted concerning their use. You should read the terms and regulations provided by the author.

-

How can I print printables for free?

- Print them at home with either a printer at home or in an in-store print shop to get top quality prints.

-

What program do I need to open printables that are free?

- The majority of PDF documents are provided in the PDF format, and can be opened using free programs like Adobe Reader.

The Michigan Homestead Property Tax Credit Is Often Overlooked But Can

Homestead Tax Credit

Check more sample of Homestead Property Tax Credit Maryland below

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit YouTube

Homestead Tax Credit Maryland Form Fill Out And Sign Printable PDF

Michigan Non Homestead Property Tax PROPERTY HJE

Homestead Tax Credit Great News For Maryland Homeowner s

Homestead Tax Credit

Free Printable Homestead Tax Form Printable Forms Free Online

https://dat.maryland.gov/realproperty/Pages/...

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula 0 of the first 8 000 of the combined household income 4 of the next 4 000 of income 6 5 of the next 4 000 of income and 9 of all income above 16 000

https://dat.maryland.gov/realproperty/Pages/FAQ...

The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used as the owner s principal residence See Section 9 105 Tax Property Article of the Maryland Annotated Code

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula 0 of the first 8 000 of the combined household income 4 of the next 4 000 of income 6 5 of the next 4 000 of income and 9 of all income above 16 000

The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used as the owner s principal residence See Section 9 105 Tax Property Article of the Maryland Annotated Code

Homestead Tax Credit Great News For Maryland Homeowner s

Homestead Tax Credit Maryland Form Fill Out And Sign Printable PDF

Homestead Tax Credit

Free Printable Homestead Tax Form Printable Forms Free Online

Understanding The Michigan Homestead Property Tax Credit Action Economics

Homestead Tax Credit

Homestead Tax Credit

Homestead Tax Credit Great News For Maryland Homeowner s