Today, where screens have become the dominant feature of our lives but the value of tangible printed materials isn't diminishing. Whatever the reason, whether for education project ideas, artistic or simply to add some personal flair to your space, Home Mortgage Interest Deduction Limit have become a valuable source. We'll dive into the sphere of "Home Mortgage Interest Deduction Limit," exploring the benefits of them, where they are, and how they can be used to enhance different aspects of your lives.

Get Latest Home Mortgage Interest Deduction Limit Below

Home Mortgage Interest Deduction Limit

Home Mortgage Interest Deduction Limit -

Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms Publication 936 explains the general rules for deducting home mortgage interest including points It also explains how the deductible amount of home mortgage interest may be limited

If you got an 800 000 mortgage to buy a house in 2017 and you pay 25 000 in interest on that loan during 2024 you probably can deduct all 25 000 of that mortgage interest on your 2024

Home Mortgage Interest Deduction Limit include a broad range of printable, free material that is available online at no cost. They are available in numerous designs, including worksheets templates, coloring pages and more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Home Mortgage Interest Deduction Limit

The Modified Home Mortgage Interest Deduction

The Modified Home Mortgage Interest Deduction

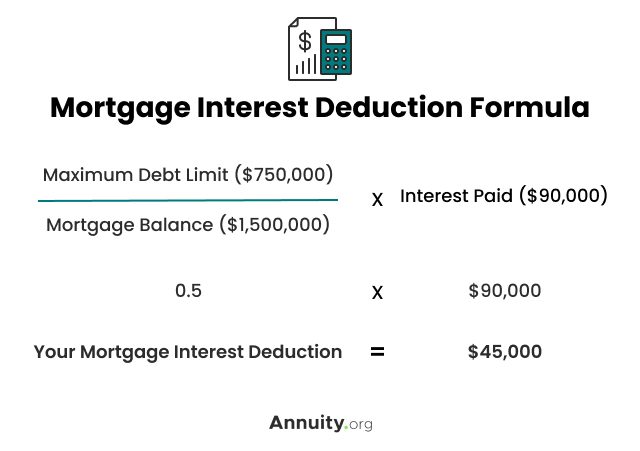

Before the TCJA the mortgage interest deduction limit was on loans up to 1 million Now the loan limit is 750 000 For the 2024 tax year married couples filing jointly single filers and heads of households can deduct up to 750 000 Married taxpayers filing separately can deduct up to 375 000 each

The Tax Cuts and Jobs Act TCJA of 2017 reduced the maximum mortgage principal eligible for the interest deduction to 750 000 from 1 million Some homeowners under legacy clauses

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization It is possible to tailor designs to suit your personal needs for invitations, whether that's creating them, organizing your schedule, or even decorating your home.

-

Educational Value Free educational printables cater to learners of all ages, making them a vital aid for parents as well as educators.

-

Easy to use: The instant accessibility to a variety of designs and templates is time-saving and saves effort.

Where to Find more Home Mortgage Interest Deduction Limit

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

If you re questioning How much mortgage interest can I deduct on my taxes you can fully deduct the home mortgage interest you pay on acquisition debt as long as the debt isn t more than the following amounts within a tax year 750 000 of mortgage debt if the loan was finalized after Dec 15 2017

For home loan taken out after October 13 1987 and before December 16 2017 homeowners can deduct interest on mortgage debt up to 1 million or 500 000 if married and filing

After we've peaked your interest in Home Mortgage Interest Deduction Limit Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection in Home Mortgage Interest Deduction Limit for different purposes.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free for flashcards, lessons, and worksheets. materials.

- The perfect resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- These blogs cover a wide variety of topics, including DIY projects to party planning.

Maximizing Home Mortgage Interest Deduction Limit

Here are some ideas to make the most of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets to build your knowledge at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Home Mortgage Interest Deduction Limit are an abundance with useful and creative ideas designed to meet a range of needs and passions. Their availability and versatility make them a wonderful addition to both professional and personal life. Explore the vast world of Home Mortgage Interest Deduction Limit to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes, they are! You can print and download these materials for free.

-

Can I use free printables for commercial use?

- It's based on the terms of use. Always read the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables might have limitations on use. Make sure to read these terms and conditions as set out by the creator.

-

How can I print Home Mortgage Interest Deduction Limit?

- You can print them at home using either a printer at home or in a local print shop to purchase better quality prints.

-

What program do I require to open printables that are free?

- The majority of printed documents are in the format of PDF, which can be opened with free software such as Adobe Reader.

Home Mortgage Interest Deduction Guide GreatRates co

High Rates And Mortgage Interest Deduction Limits 2023

Check more sample of Home Mortgage Interest Deduction Limit below

Calculate Mortgage Interest Deduction Limit

Home Mortgage Interest Deduction

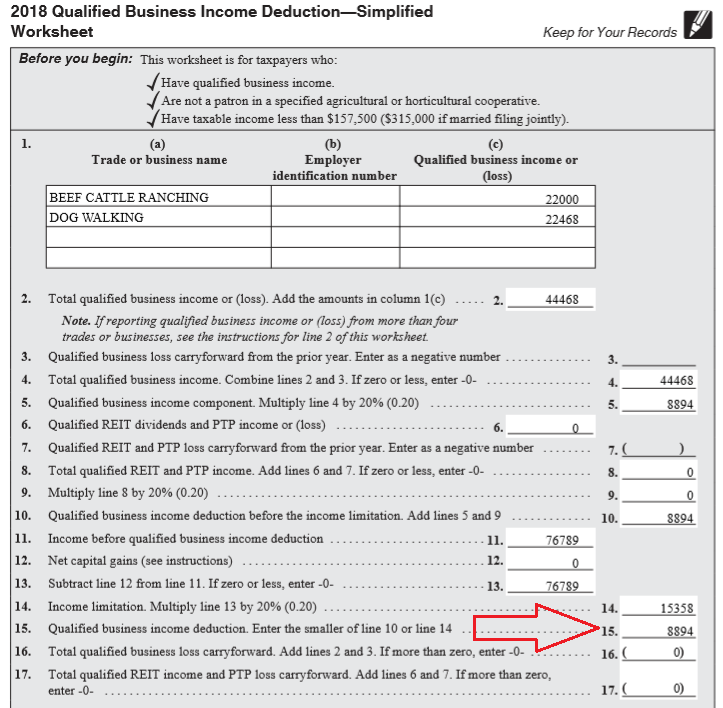

Qualified Business Income Deduction Worksheet Pdf TUTORE ORG Master

It s Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Home Mortgage Interest Deduction Boco Real Estate

Is Mortgage Interest Deductible Everything You Need To Know About

https://www.nerdwallet.com/article/taxes/mortgage...

If you got an 800 000 mortgage to buy a house in 2017 and you pay 25 000 in interest on that loan during 2024 you probably can deduct all 25 000 of that mortgage interest on your 2024

https://www.kiplinger.com/taxes/mortgage-interest-deduction

Head of household filers have a standard deduction of 20 800 for the 2023 tax year If you are married and filing jointly or file as a qualifying widow er your 2023 standard deduction jumps

If you got an 800 000 mortgage to buy a house in 2017 and you pay 25 000 in interest on that loan during 2024 you probably can deduct all 25 000 of that mortgage interest on your 2024

Head of household filers have a standard deduction of 20 800 for the 2023 tax year If you are married and filing jointly or file as a qualifying widow er your 2023 standard deduction jumps

It s Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Home Mortgage Interest Deduction

Home Mortgage Interest Deduction Boco Real Estate

Is Mortgage Interest Deductible Everything You Need To Know About

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018

California Deduction Limit Home Mortgage

California Deduction Limit Home Mortgage

PPT Mortgage Interest Deduction PowerPoint Presentation Free