In this age of electronic devices, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. Be it for educational use in creative or artistic projects, or simply to add an individual touch to the area, Home Loan Interest Exemption Under Income Tax can be an excellent resource. In this article, we'll dive in the world of "Home Loan Interest Exemption Under Income Tax," exploring the benefits of them, where you can find them, and how they can add value to various aspects of your life.

Get Latest Home Loan Interest Exemption Under Income Tax Below

Home Loan Interest Exemption Under Income Tax

Home Loan Interest Exemption Under Income Tax -

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

Section 80EE provides tax benefits on interest portion of home loan from financial institution up to Rs 50 000 year Criteria include property value Rs 50 lakh loan amount Rs 35 lakh sanctioned between 01 04 2016 to 31 03 2017 and no other property owned when loan sanctioned

Home Loan Interest Exemption Under Income Tax include a broad selection of printable and downloadable material that is available online at no cost. These materials come in a variety of kinds, including worksheets templates, coloring pages, and many more. The beauty of Home Loan Interest Exemption Under Income Tax lies in their versatility as well as accessibility.

More of Home Loan Interest Exemption Under Income Tax

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross income annually provided the construction acquisition of the house is completed within 5 years

You can get home loan tax benefit under different sections like Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home loan tax benefits are available over and above the existing exemption of Rs 2 lakh under Section 24 b

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Customization: Your HTML0 customization options allow you to customize printing templates to your own specific requirements in designing invitations making your schedule, or decorating your home.

-

Educational Use: These Home Loan Interest Exemption Under Income Tax are designed to appeal to students from all ages, making them a vital aid for parents as well as educators.

-

Affordability: Fast access numerous designs and templates saves time and effort.

Where to Find more Home Loan Interest Exemption Under Income Tax

What Is A Portfolio Interest Exemption EPGD Business Law

What Is A Portfolio Interest Exemption EPGD Business Law

Yes you can claim income tax exemption if you are a co applicant in a housing loan as long as you are also the owner or co owner of the property in question If you are only person repaying the loan you can claim the entire tax benefit for yourself provided you are an owner or co owner

Presently under Section 24 a home loan borrower who pays interest on the loan may deduct that interest from his or her gross annual income up to a maximum of Rs 2 lakh The deduction of Rs 50 000 introduced in Budget 2016 is

Now that we've ignited your curiosity about Home Loan Interest Exemption Under Income Tax Let's take a look at where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Home Loan Interest Exemption Under Income Tax suitable for many purposes.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets along with flashcards, as well as other learning tools.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs are a vast variety of topics, from DIY projects to party planning.

Maximizing Home Loan Interest Exemption Under Income Tax

Here are some inventive ways that you can make use use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets from the internet to reinforce learning at home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Home Loan Interest Exemption Under Income Tax are a treasure trove of fun and practical tools that cater to various needs and desires. Their accessibility and versatility make them a valuable addition to your professional and personal life. Explore the plethora of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can download and print these tools for free.

-

Can I use free templates for commercial use?

- It is contingent on the specific rules of usage. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Do you have any copyright concerns with Home Loan Interest Exemption Under Income Tax?

- Certain printables may be subject to restrictions regarding their use. Make sure to read the terms and conditions set forth by the creator.

-

How do I print printables for free?

- You can print them at home using the printer, or go to a local print shop to purchase superior prints.

-

What software must I use to open printables for free?

- The majority are printed as PDF files, which is open with no cost software such as Adobe Reader.

Tax Benefits On Home Loan Know More At Taxhelpdesk

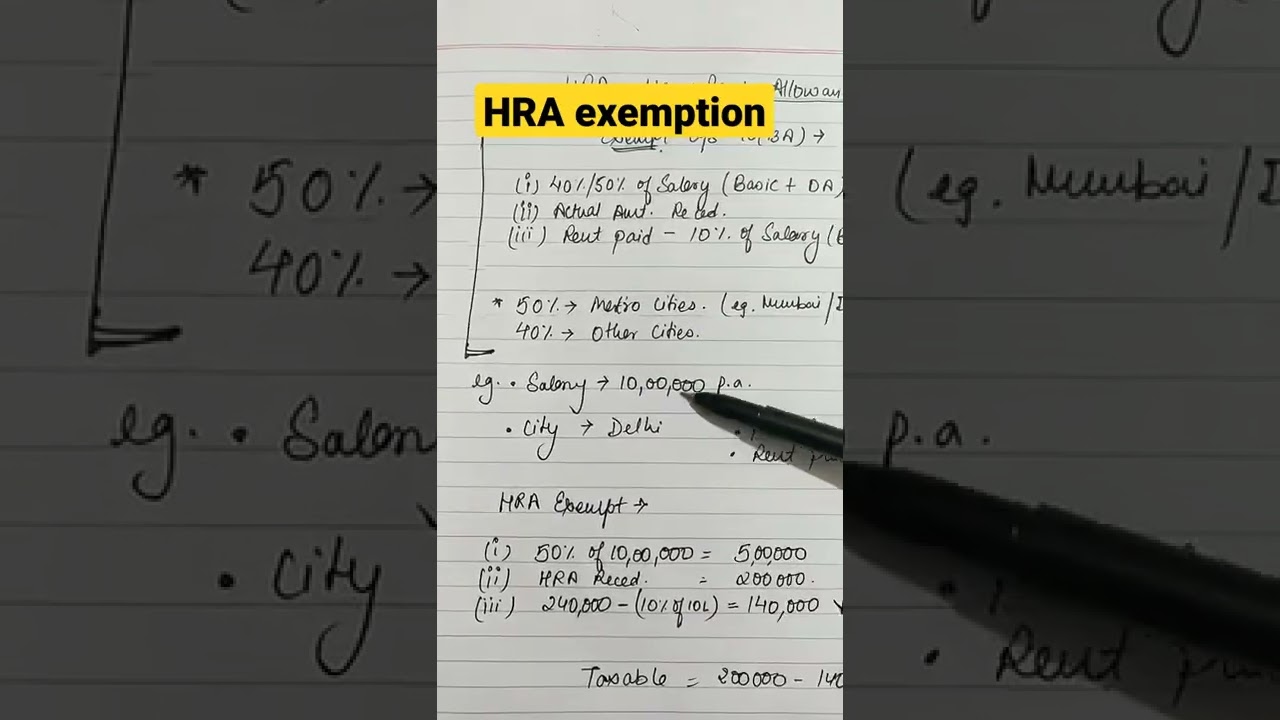

SEC 10 AA EXEMPTION Under Income Tax SEC 10AA EXEMPTION CA INTER

Check more sample of Home Loan Interest Exemption Under Income Tax below

Group Insurance Scheme Exemption Under Income Tax The Enterprise World

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

HRA Exemption Under Income Tax HRA Calculation Sec 10 13A Itr For

Income Tax Slab For FY 2022 23 What You Need To Know

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Home Loan Interest Exemption Limit Home Sweet Home Modern Livingroom

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE provides tax benefits on interest portion of home loan from financial institution up to Rs 50 000 year Criteria include property value Rs 50 lakh loan amount Rs 35 lakh sanctioned between 01 04 2016 to 31 03 2017 and no other property owned when loan sanctioned

https://cleartax.in/s/section-80eea-deduction-affordable-housing

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Rs 50 000 if eligible Further Section 24 also provides deduction from interest paid on housing loan upto Rs 2 00 000

Section 80EE provides tax benefits on interest portion of home loan from financial institution up to Rs 50 000 year Criteria include property value Rs 50 lakh loan amount Rs 35 lakh sanctioned between 01 04 2016 to 31 03 2017 and no other property owned when loan sanctioned

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Rs 50 000 if eligible Further Section 24 also provides deduction from interest paid on housing loan upto Rs 2 00 000

Income Tax Slab For FY 2022 23 What You Need To Know

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Home Loan Interest Exemption Limit Home Sweet Home Modern Livingroom

A Guide To Group Insurance Scheme Exemption Under Income Tax

Income Tax Exemption On Interest Of Education Loan YouTube

Income Tax Exemption On Interest Of Education Loan YouTube

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar