In this digital age, in which screens are the norm, the charm of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply to add personal touches to your area, Home Energy Tax Credits 2023 Income Limits have become a valuable source. Through this post, we'll take a dive through the vast world of "Home Energy Tax Credits 2023 Income Limits," exploring what they are, where they are available, and how they can improve various aspects of your lives.

Get Latest Home Energy Tax Credits 2023 Income Limits Below

.jpg#keepProtocol)

Home Energy Tax Credits 2023 Income Limits

Home Energy Tax Credits 2023 Income Limits -

Verkko Updated Tax Credit Available for 2023 2032 Tax Years 30 of cost 30 of cost 30 of cost up to 2 000 per year 30 of cost 30 of cost up to 600 30 of cost up to 600 30 of cost up to 600 Subject to cap of 1 200 year

Verkko 22 jouluk 2022 nbsp 0183 32 There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made

Home Energy Tax Credits 2023 Income Limits offer a wide range of printable, free documents that can be downloaded online at no cost. These printables come in different styles, from worksheets to templates, coloring pages, and much more. The appealingness of Home Energy Tax Credits 2023 Income Limits is their versatility and accessibility.

More of Home Energy Tax Credits 2023 Income Limits

Home Energy Tax Credits Help Save On Bills And Taxes Taxing Subjects

Home Energy Tax Credits Help Save On Bills And Taxes Taxing Subjects

Verkko 2023 through 2032 30 up to a maximum of 1 200 water heaters heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit For 2022 biomass stoves and boilers are treated as a Residential Clean Energy Credit with no lifetime

Verkko 21 marrask 2022 nbsp 0183 32 Residential Energy Tax Credits Changes in 2023 November 21 2022 P L 117 169 commonly referred to as the Inflation Reduction Act of 2022 IRA expanded and extended two nonrefundable tax credits meant to encourage individuals to invest in energy efficiency improvements or clean energy in their homes

Home Energy Tax Credits 2023 Income Limits have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Flexible: They can make printed materials to meet your requirements whether you're designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Worth: Educational printables that can be downloaded for free provide for students of all ages, making them an essential tool for parents and teachers.

-

Simple: Access to a myriad of designs as well as templates reduces time and effort.

Where to Find more Home Energy Tax Credits 2023 Income Limits

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Verkko 28 elok 2023 nbsp 0183 32 The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

Verkko March 1 2023 Individual Income Taxation Credits The Inflation Reduction Act of 2022 P L 117 169 expanded and renamed the nonbusiness energy property credit as the energy efficient home improvement credit

In the event that we've stirred your interest in Home Energy Tax Credits 2023 Income Limits we'll explore the places the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Home Energy Tax Credits 2023 Income Limits to suit a variety of applications.

- Explore categories like furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free with flashcards and other teaching materials.

- Ideal for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a broad selection of subjects, starting from DIY projects to planning a party.

Maximizing Home Energy Tax Credits 2023 Income Limits

Here are some ways that you can make use of Home Energy Tax Credits 2023 Income Limits:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use free printable worksheets to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Home Energy Tax Credits 2023 Income Limits are an abundance of useful and creative resources for a variety of needs and needs and. Their availability and versatility make them a fantastic addition to the professional and personal lives of both. Explore the world of Home Energy Tax Credits 2023 Income Limits today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes, they are! You can print and download these tools for free.

-

Are there any free printables for commercial purposes?

- It's contingent upon the specific usage guidelines. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables might have limitations in their usage. Always read the terms and conditions offered by the creator.

-

How do I print Home Energy Tax Credits 2023 Income Limits?

- You can print them at home with any printer or head to the local print shop for superior prints.

-

What software will I need to access printables that are free?

- The majority of PDF documents are provided in the PDF format, and is open with no cost software like Adobe Reader.

Installing Solar Panels Or Making Other Home Improvements May Qualify

Home Energy Tax Credits Inflation Reduction Act Phoenix Arizona

Check more sample of Home Energy Tax Credits 2023 Income Limits below

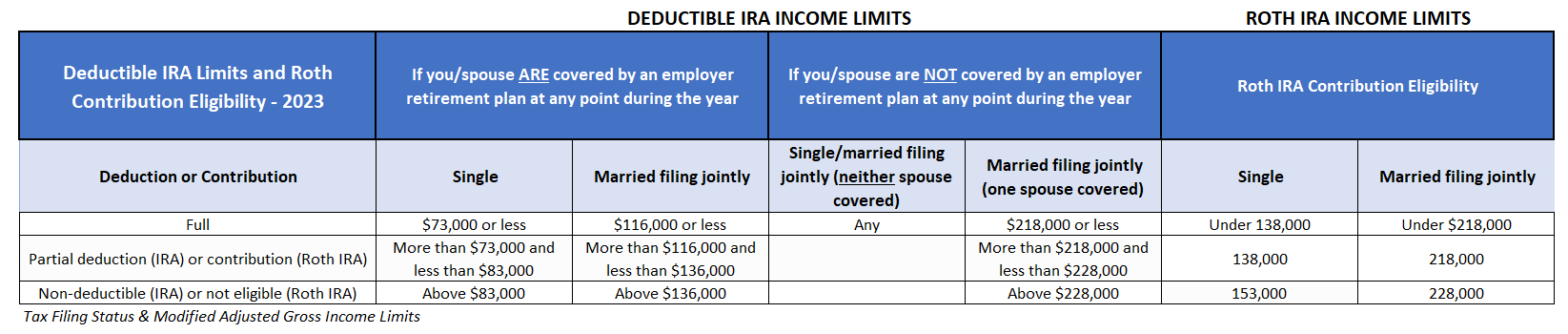

2023 IRS Contribution Limits And Tax Rates By Kristin McKenna Harvest

Receive Your Tax Credits

Clean Energy Tax Credits Can t Do The Work Of A Carbon Tax Tax Policy

The Inflation Reduction Act pumps Up Heat Pumps Hvac

2023 IRS Contribution Limits And Tax Rates By Kristin McKenna Harvest

Energy Tax Credits Expire At The End Of 2016 Lahrmer Company

.jpg#keepProtocol?w=186)

https://www.irs.gov/credits-deductions/frequently-asked-questions...

Verkko 22 jouluk 2022 nbsp 0183 32 There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made

https://www.irs.gov/newsroom/irs-going-green-could-help-taxpayers...

Verkko IR 2023 97 May 4 2023 WASHINGTON The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy tax credits The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Verkko 22 jouluk 2022 nbsp 0183 32 There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made

Verkko IR 2023 97 May 4 2023 WASHINGTON The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy tax credits The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

The Inflation Reduction Act pumps Up Heat Pumps Hvac

Receive Your Tax Credits

2023 IRS Contribution Limits And Tax Rates By Kristin McKenna Harvest

Energy Tax Credits Expire At The End Of 2016 Lahrmer Company

Faulk Winkler LLC

5 Ways To Save In 2023 With Home Energy Tax Credits Department Of Energy

5 Ways To Save In 2023 With Home Energy Tax Credits Department Of Energy

Ways To Save In 2023 With Home Energy Tax Credits The Collective Group