In a world when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. In the case of educational materials or creative projects, or simply to add a personal touch to your home, printables for free are now an essential source. Here, we'll dive into the world "Home Energy Tax Credits 2022," exploring what they are, where to get them, as well as how they can add value to various aspects of your lives.

Get Latest Home Energy Tax Credits 2022 Below

Home Energy Tax Credits 2022

Home Energy Tax Credits 2022 -

Home Energy Audits N A 10 of cost N A Updated Tax Credit Available for 2023 2032 Tax Years 30 of cost up to 2 000 per year 30 of cost up to 600 30 of cost up to 500 for doors up to 250 each 30 of cost up to 150 Frequently Asked Questions Q Who is eligible for tax credits

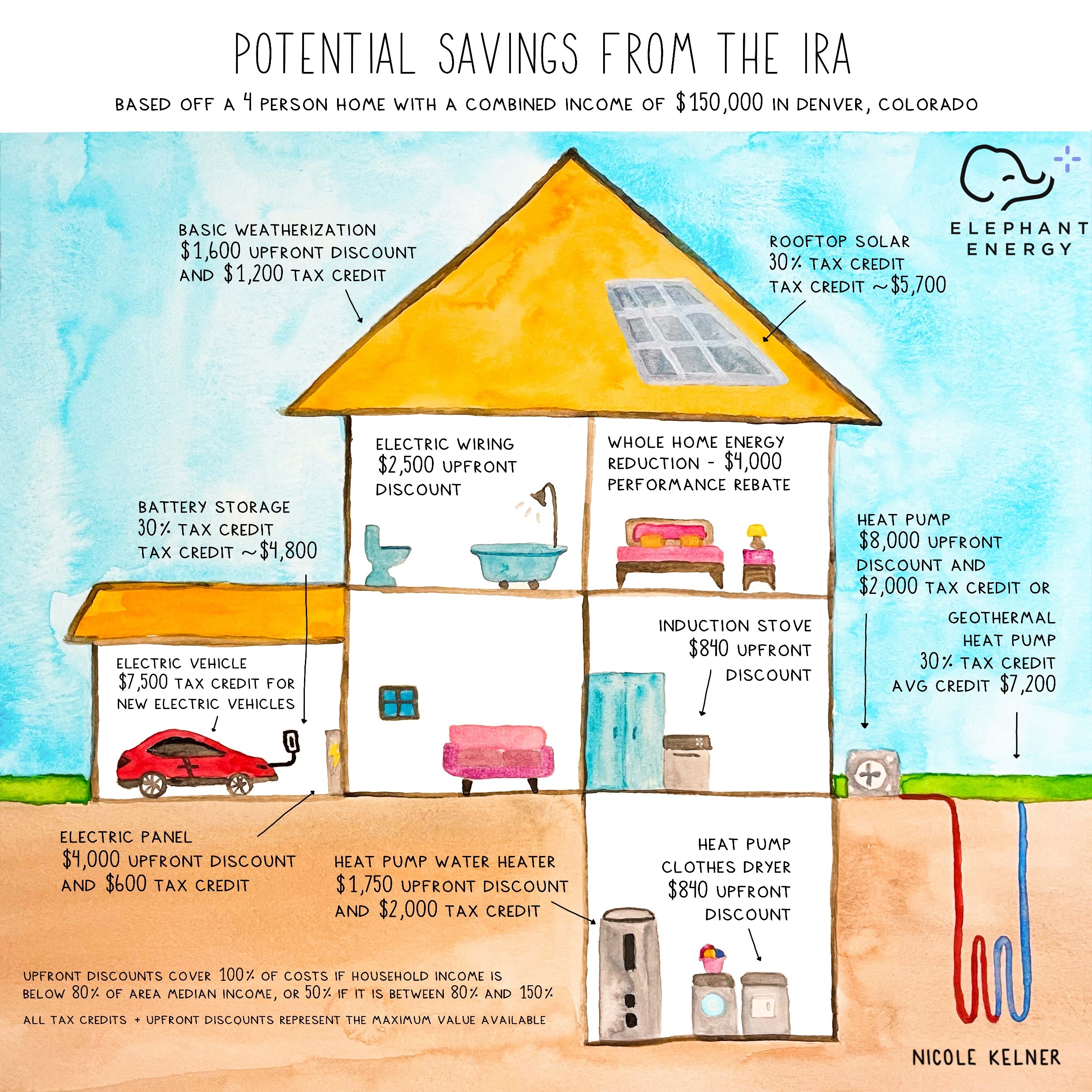

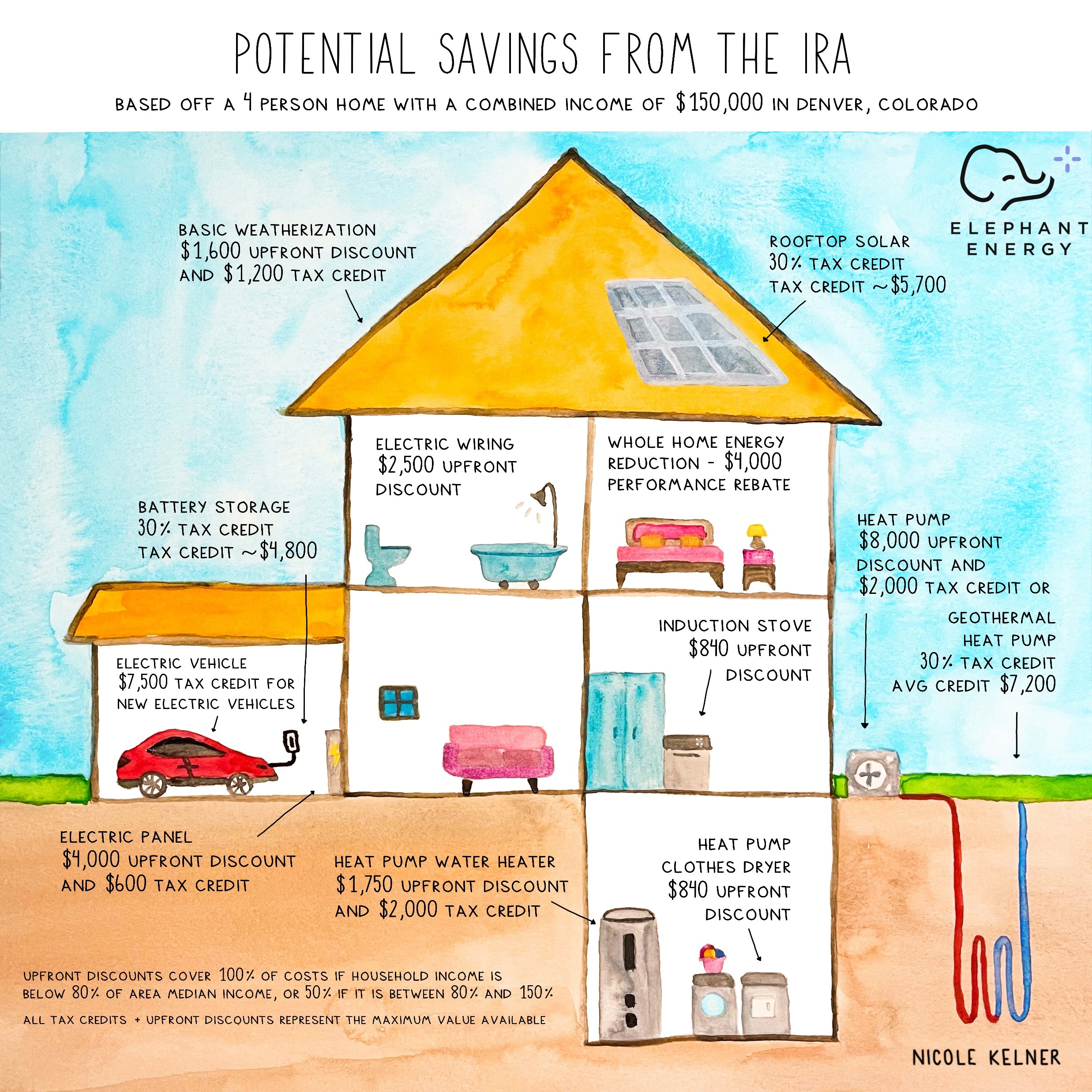

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Home Energy Tax Credits 2022 cover a large range of printable, free documents that can be downloaded online at no cost. They come in many formats, such as worksheets, coloring pages, templates and many more. One of the advantages of Home Energy Tax Credits 2022 lies in their versatility as well as accessibility.

More of Home Energy Tax Credits 2022

Energy Tax Credits Armanino

Energy Tax Credits Armanino

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades SEE TAX

New Inflation Reduction Act Provision Broadens Access and Boosts Return on Clean Energy Tax Credits Washington D C As part of the Biden Harris Administration s Investing in America agenda the U S Department of the Treasury and the Internal Revenue Service IRS today released final rules on transferability a key

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Customization: They can make the design to meet your needs be it designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Value: The free educational worksheets provide for students of all ages, which makes them a great source for educators and parents.

-

Simple: Access to a variety of designs and templates saves time and effort.

Where to Find more Home Energy Tax Credits 2022

4 Home Improvement Projects That Qualify For Energy Tax Credits RWC

4 Home Improvement Projects That Qualify For Energy Tax Credits RWC

Claiming energy tax credits for 2022 and 2023 4 min read Share Making energy efficient updates to your home is a great move for our environment But you might feel the pinch in your household budget The good news is that there are a couple of tax credits that can help out your pocketbook

2022 Tax Credit Information Information updated 12 30 2022 The Non Business Energy Property Tax Credits outlined below apply retroactively through 12 31 2022 Tax Credit 10 of cost up to 500 or a specific amount from 50 300 Expires December 31 2022

We hope we've stimulated your interest in Home Energy Tax Credits 2022 Let's see where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Home Energy Tax Credits 2022 designed for a variety purposes.

- Explore categories such as interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets as well as flashcards and other learning materials.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a broad variety of topics, that range from DIY projects to party planning.

Maximizing Home Energy Tax Credits 2022

Here are some innovative ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets for free to enhance learning at home and in class.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Home Energy Tax Credits 2022 are an abundance of innovative and useful resources that cater to various needs and interest. Their availability and versatility make these printables a useful addition to each day life. Explore the many options of Home Energy Tax Credits 2022 right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes you can! You can download and print these free resources for no cost.

-

Do I have the right to use free printables in commercial projects?

- It depends on the specific rules of usage. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download Home Energy Tax Credits 2022?

- Certain printables could be restricted regarding their use. Be sure to review the terms of service and conditions provided by the author.

-

How do I print Home Energy Tax Credits 2022?

- Print them at home with the printer, or go to the local print shop for more high-quality prints.

-

What software do I need to open printables that are free?

- Many printables are offered with PDF formats, which can be opened using free software, such as Adobe Reader.

Home Energy Tax Credits Help Save On Bills And Taxes Taxing Subjects

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Check more sample of Home Energy Tax Credits 2022 below

5 Ways To Save In 2023 With Home Energy Tax Credits Department Of Energy

Ways To Save In 2023 With Home Energy Tax Credits The Collective Group

Home Energy Tax Credits Inflation Reduction Act Phoenix Arizona

5 Ways To Save In 2023 With Home Energy Tax Credits Advanced Primitive

Installing Solar Panels Or Making Other Home Improvements May Qualify

For 346PRODUCTION Www directingactors

https://www.irs.gov/newsroom/irs-releases-frequently-asked...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

https://www.irs.gov/credits-deductions/energy-efficient-home...

For improvements installed in 2022 or earlier Use previous versions of Form 5695 Beginning Jan 1 2023 the credit equals 30 of certain qualified expenses including Qualified energy efficiency improvements installed during the year Residential energy property expenses Home energy audits

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

For improvements installed in 2022 or earlier Use previous versions of Form 5695 Beginning Jan 1 2023 the credit equals 30 of certain qualified expenses including Qualified energy efficiency improvements installed during the year Residential energy property expenses Home energy audits

5 Ways To Save In 2023 With Home Energy Tax Credits Advanced Primitive

Ways To Save In 2023 With Home Energy Tax Credits The Collective Group

Installing Solar Panels Or Making Other Home Improvements May Qualify

For 346PRODUCTION Www directingactors

Energy Tax Credits Expire At The End Of 2016 Lahrmer Company

Going Green At Home Use This Guide To Claiming Your Inflation

Going Green At Home Use This Guide To Claiming Your Inflation

Faulk Winkler LLC