Today, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. For educational purposes such as creative projects or simply adding personal touches to your area, Hi Tax Deduction are now an essential source. We'll dive into the world of "Hi Tax Deduction," exploring the different types of printables, where to find them, and how they can enrich various aspects of your life.

Get Latest Hi Tax Deduction Below

Hi Tax Deduction

Hi Tax Deduction -

Hawaii provides a standard Personal Exemption tax deduction of 1 144 00 in 2024 per qualifying filer and 1 144 00 per qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2024 Hawaii Single Filer Standard Deduction The standard deduction for a Single Filer in Hawaii for 2024 is 2 200 00

How does this affect my tax assessment The deduction for earned income is made from your net taxable earned income in both state taxation and municipal taxation How much can be deducted In 2024 and 2023 the maximum deduction is 3 570

The Hi Tax Deduction are a huge range of printable, free materials online, at no cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and more. The beauty of Hi Tax Deduction is their flexibility and accessibility.

More of Hi Tax Deduction

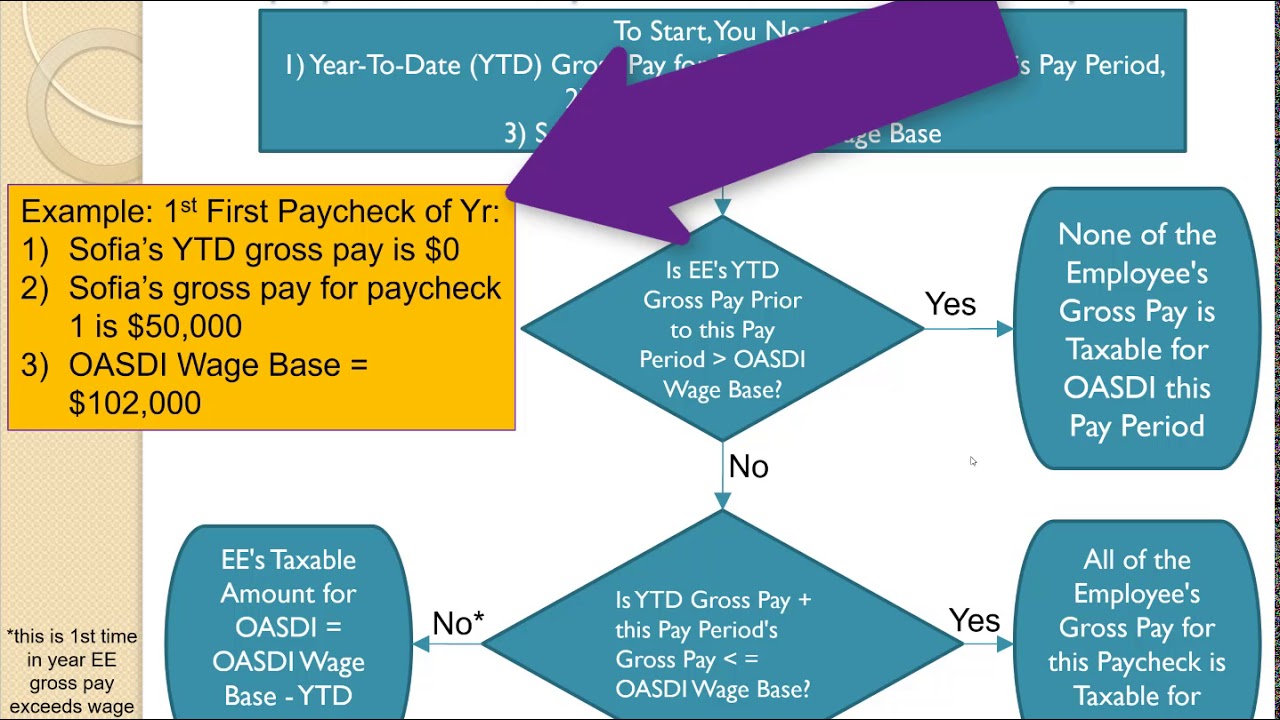

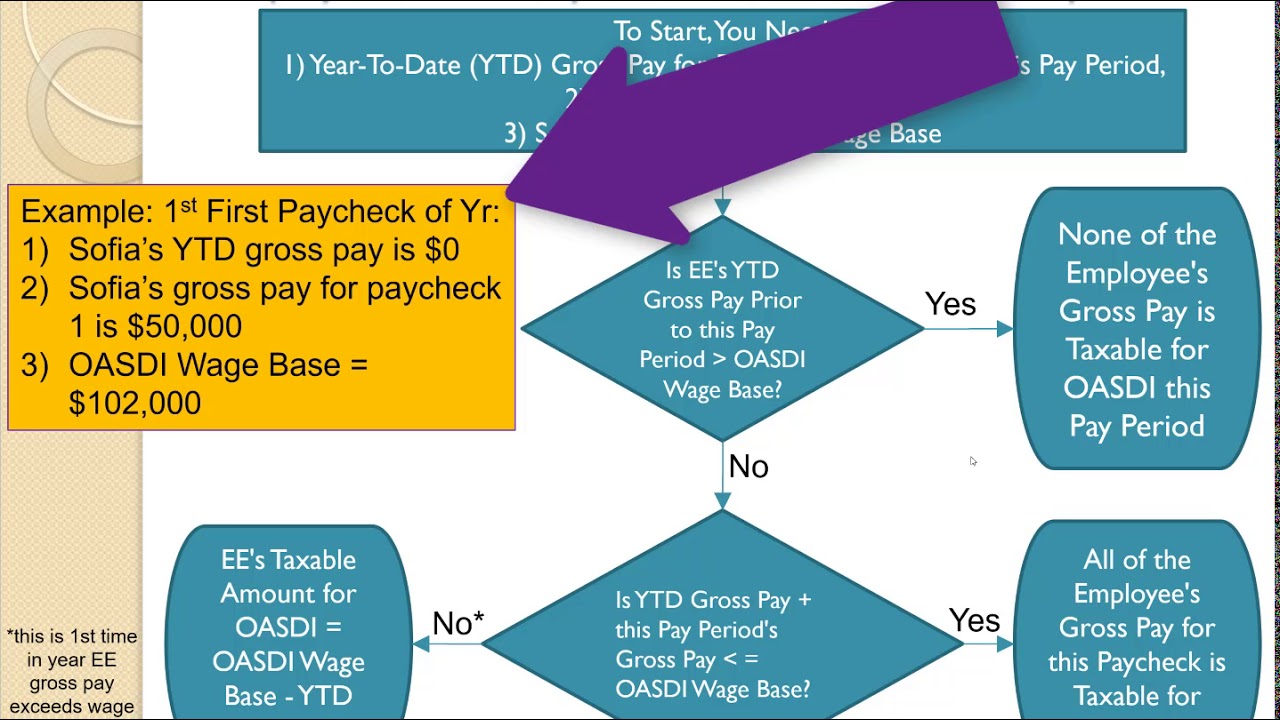

Calculating OASDI Social Security Deduction Medicare Deduction

Calculating OASDI Social Security Deduction Medicare Deduction

FICA HI The HI in FICA HI stands for hospital insurance and refers to a type of trust fund The U S Treasury maintains accounts for the deposit of payroll taxes and funds received from several sources including FICA and the Self Employment contributions Act or SECA Employees the self employed and employers contribute to the HI trust fund

Hawaii Tax Online currently supports General Excise Transient Accommodations Withholding Use Only Seller s Collection Corporate income Franchise Rental Motor Vehicle County Surcharge and Public Service Company taxes

Hi Tax Deduction have risen to immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

The ability to customize: Your HTML0 customization options allow you to customize printed materials to meet your requirements such as designing invitations making your schedule, or even decorating your home.

-

Educational value: These Hi Tax Deduction cater to learners from all ages, making these printables a powerful tool for parents and educators.

-

It's easy: Instant access to various designs and templates will save you time and effort.

Where to Find more Hi Tax Deduction

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Credits Save You More Than Deductions Here Are The Best Ones

Act 13 SLH 2020 Hawaii adopted the federal provision that allows a reduction in taxable income for taxpayers who do not itemize their deductions on their federal return The adjustment reduces the federal AGI by up to 300 for quali ed cash gifts to

The standard deduction for a Single Filer in Hawaii for 2023 is 2 200 00 Hawaii Single Filer Tax Tables Hawaii Married Joint Filer Standard Deduction The standard deduction for a Married Joint Filer in Hawaii for 2023 is 4 400 00 Hawaii Married Joint Filer Tax Tables Hawaii Married separate Filer Standard Deduction

After we've peaked your interest in printables for free Let's find out where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Hi Tax Deduction to suit a variety of objectives.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free, flashcards, and learning tools.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- The blogs are a vast spectrum of interests, from DIY projects to planning a party.

Maximizing Hi Tax Deduction

Here are some fresh ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Utilize free printable worksheets for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Hi Tax Deduction are an abundance with useful and creative ideas for a variety of needs and pursuits. Their availability and versatility make them an essential part of each day life. Explore the world of Hi Tax Deduction and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Hi Tax Deduction truly completely free?

- Yes, they are! You can download and print the resources for free.

-

Can I download free printables for commercial use?

- It's based on the usage guidelines. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright violations with Hi Tax Deduction?

- Some printables may contain restrictions in use. Be sure to read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- Print them at home with your printer or visit an area print shop for high-quality prints.

-

What software do I require to view printables for free?

- A majority of printed materials are in the format PDF. This can be opened using free software like Adobe Reader.

Comfortable Luxury In Remod 2br 2ba 2 Lanai Condo Apartments For Rent

The Message Of You The Power Humor Of Your Story Turn Your Life

Check more sample of Hi Tax Deduction below

Franks Almost Agrees With Walkup That Valley Hi Tax Should Be Abolished

Skillicorn Formally Kicking Off Campaign Thursday McHenry County Blog

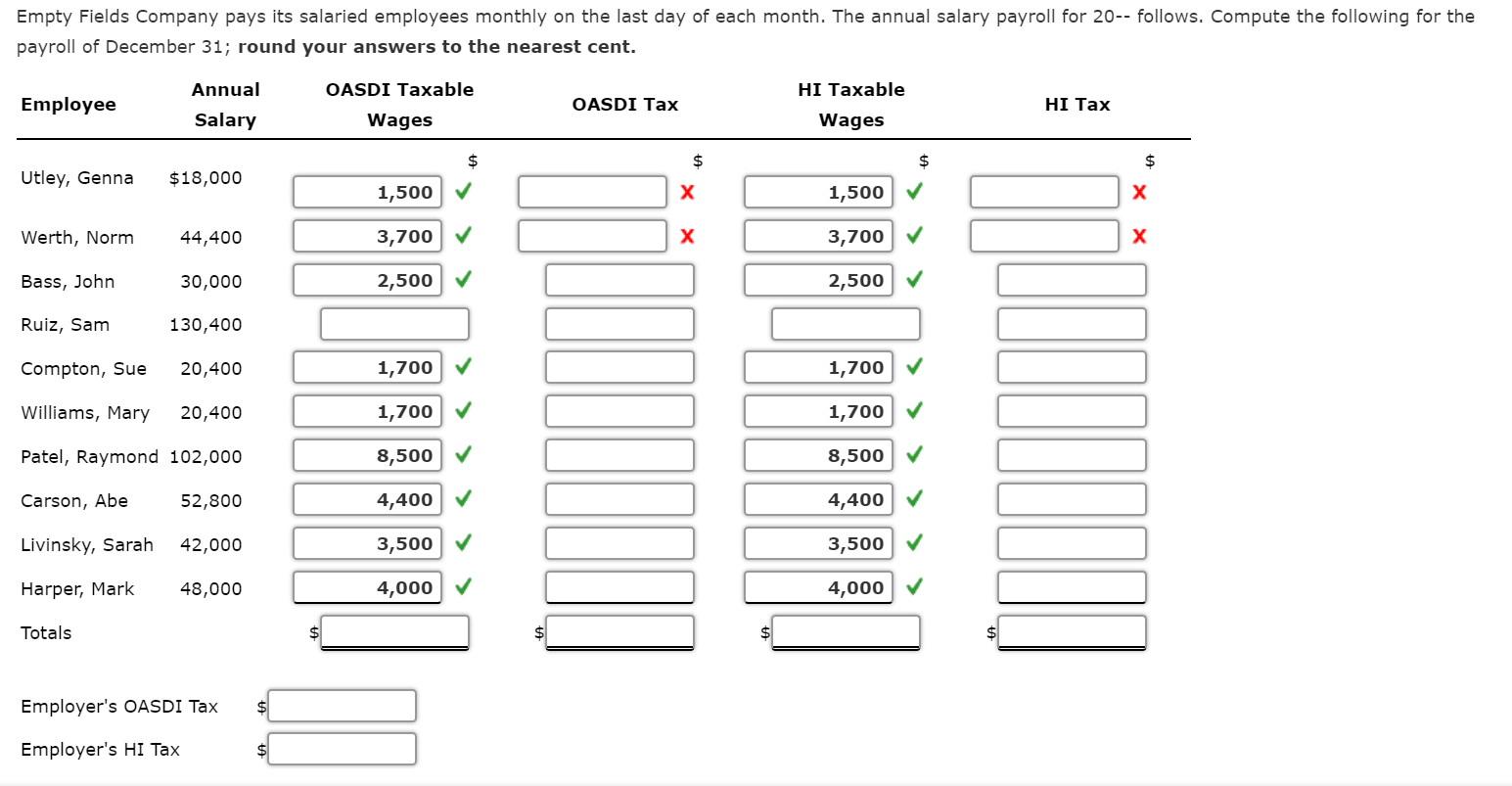

Hello I Could Use Some Help Filling In The Blanks Chegg

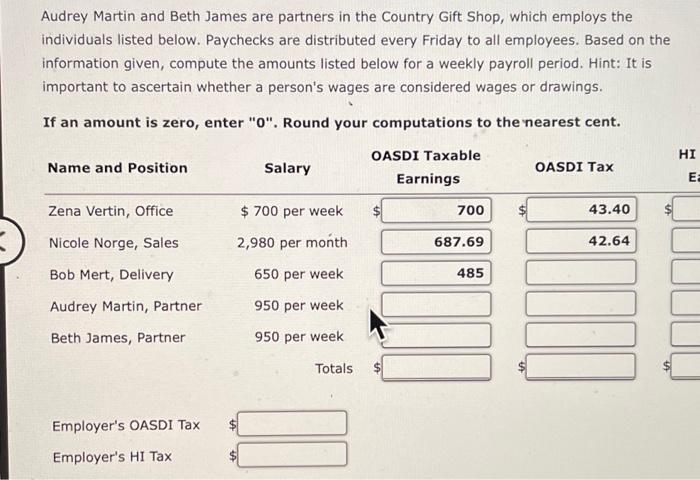

Solved Audrey Martin And Beth James Are Partners In The Chegg

Social Security Tax Definition How It Works Exemptions And Tax Limits

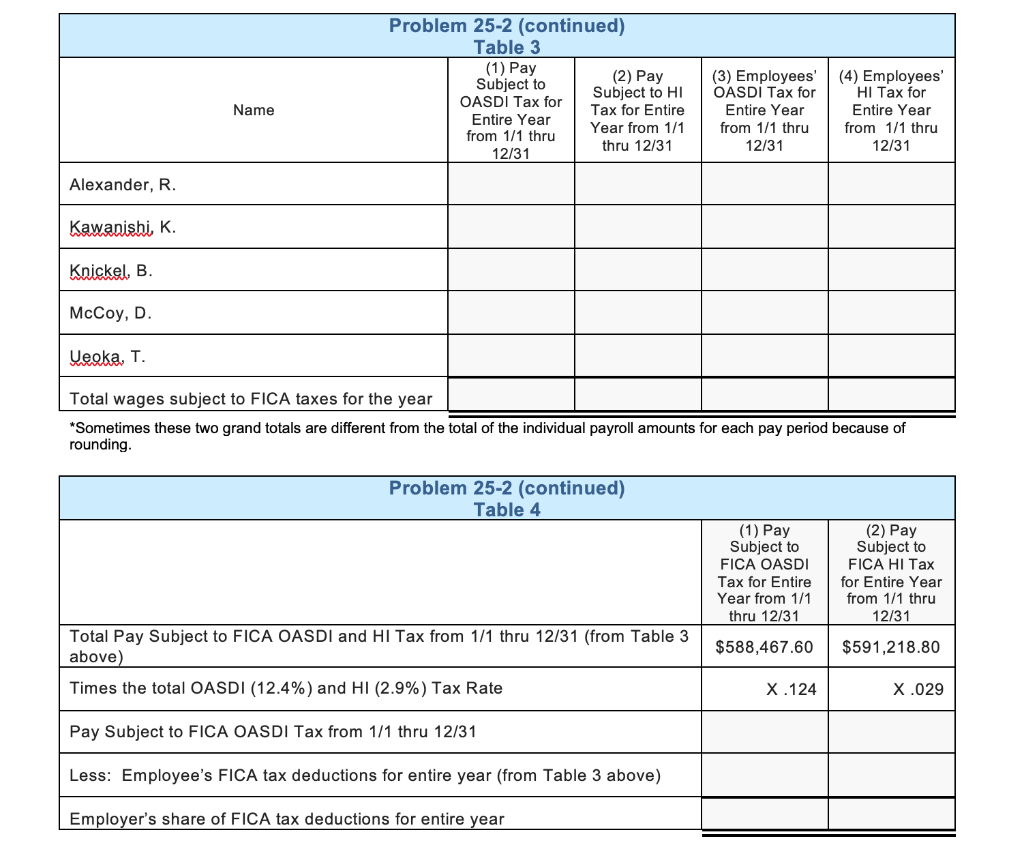

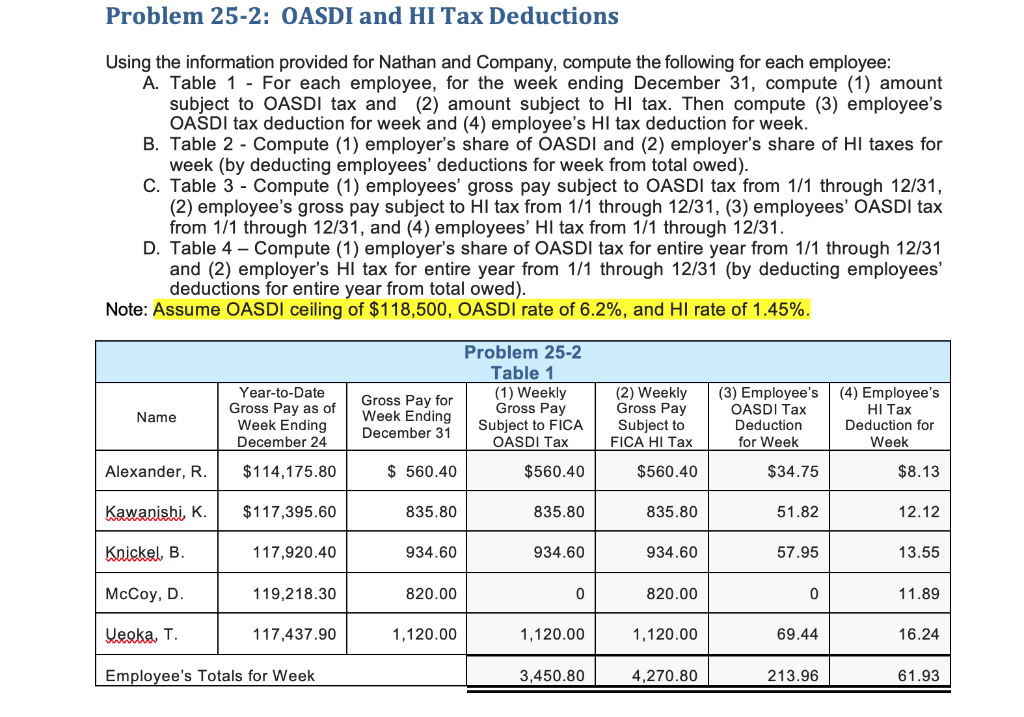

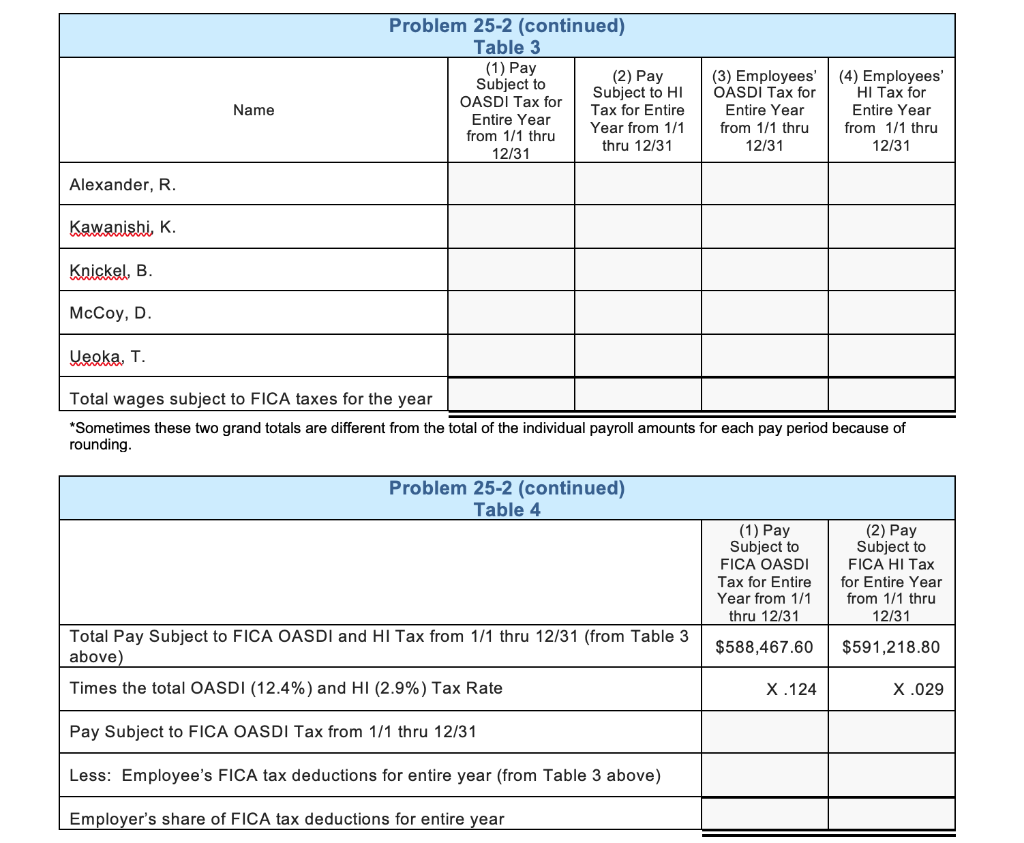

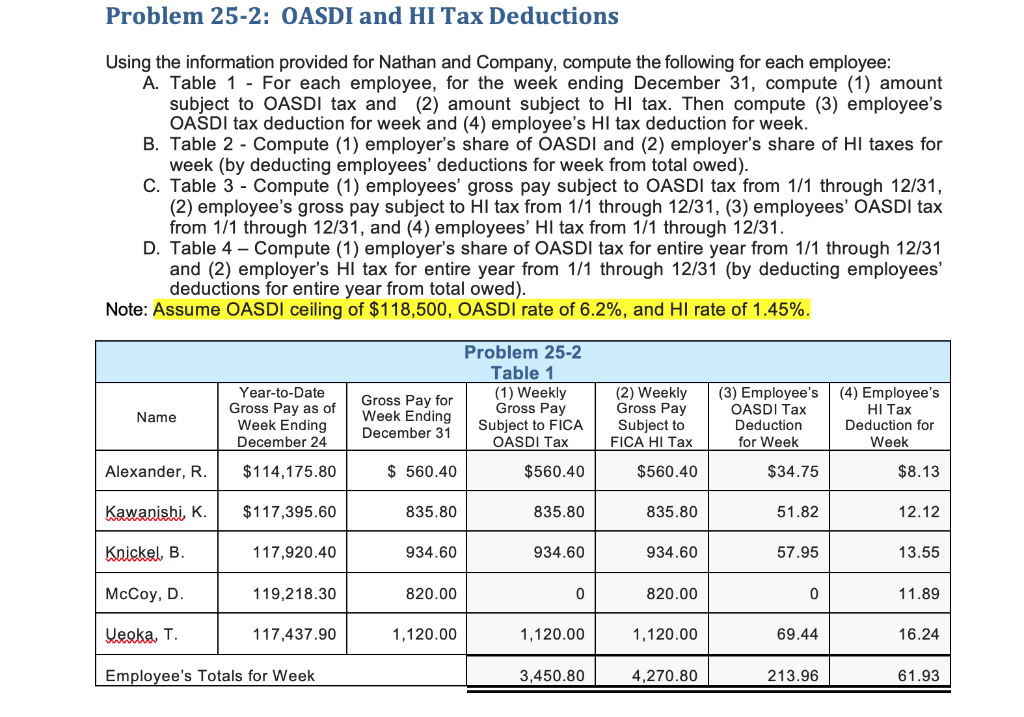

Solved Problem 25 2 OASDI And HI Tax Deductions Using The Chegg

https://www.vero.fi/.../deductions/tax-deductions

How does this affect my tax assessment The deduction for earned income is made from your net taxable earned income in both state taxation and municipal taxation How much can be deducted In 2024 and 2023 the maximum deduction is 3 570

https://www.forbes.com/advisor/income-tax-calculator/hawaii

Your tax is 0 if your income is less than the 2023 2024 standard deduction determined by your filing status and whether you re age 65 or older and or blind Income Filing Status State More

How does this affect my tax assessment The deduction for earned income is made from your net taxable earned income in both state taxation and municipal taxation How much can be deducted In 2024 and 2023 the maximum deduction is 3 570

Your tax is 0 if your income is less than the 2023 2024 standard deduction determined by your filing status and whether you re age 65 or older and or blind Income Filing Status State More

Solved Audrey Martin And Beth James Are Partners In The Chegg

Skillicorn Formally Kicking Off Campaign Thursday McHenry County Blog

Social Security Tax Definition How It Works Exemptions And Tax Limits

Solved Problem 25 2 OASDI And HI Tax Deductions Using The Chegg

Printable N11 Form Printable Word Searches

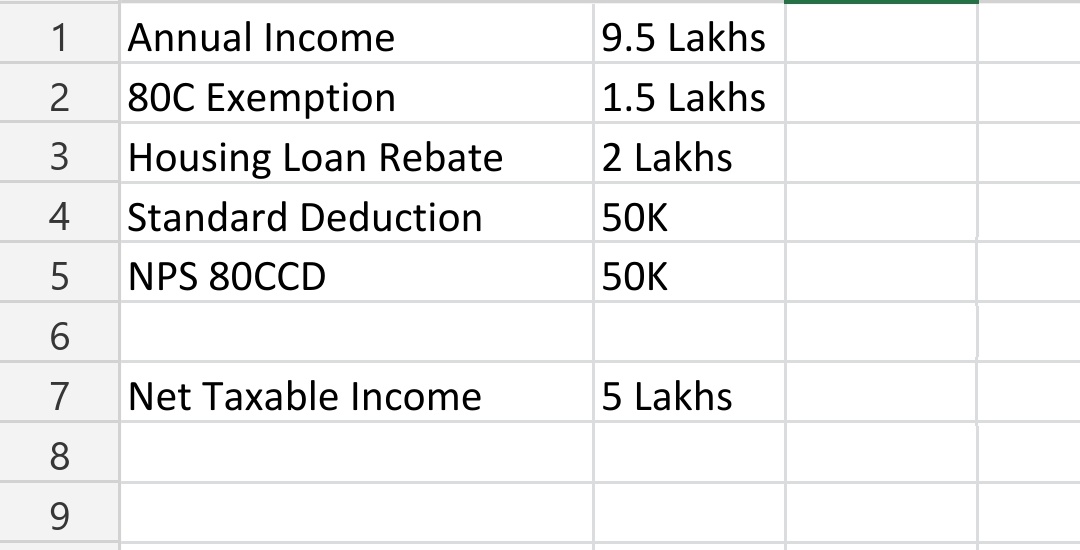

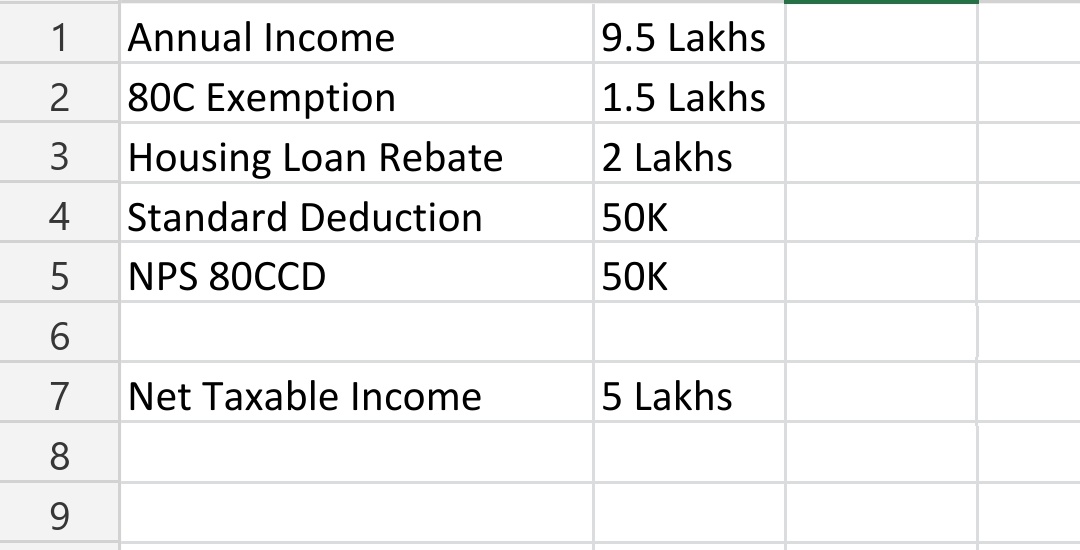

Pranav Joshi On Twitter Kisi Middle Class Aadmi Oe Itne Kharche Hi Na

Pranav Joshi On Twitter Kisi Middle Class Aadmi Oe Itne Kharche Hi Na

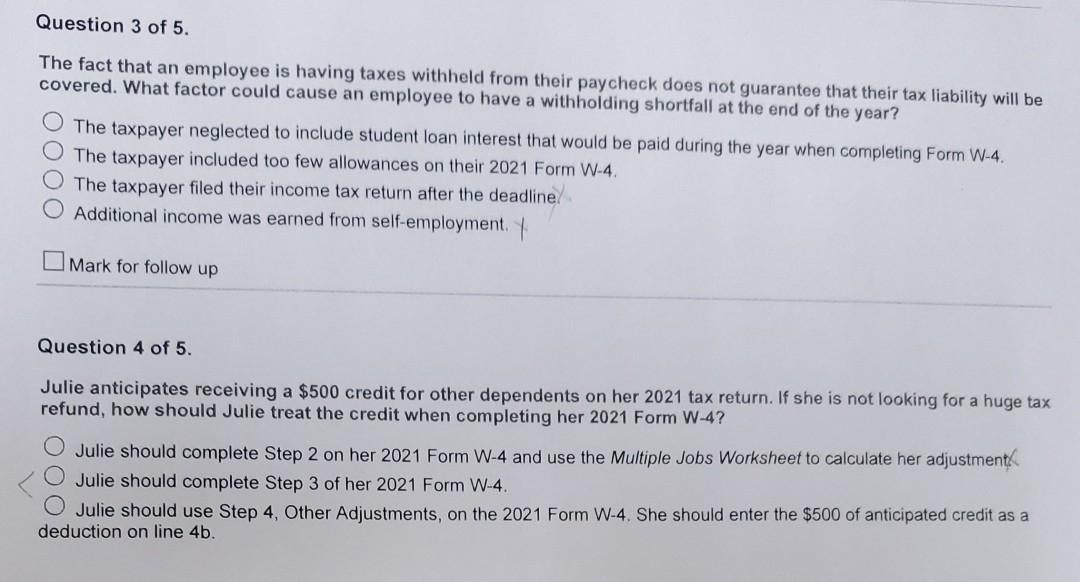

Solved Question 3 Of 5 The Fact That An Employee Is Having Chegg