In the digital age, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons for creative projects, simply to add an individual touch to your home, printables for free are now a vital source. In this article, we'll dive through the vast world of "Health Care Costs Tax Credit," exploring what they are, where to find them and how they can add value to various aspects of your life.

Get Latest Health Care Costs Tax Credit Below

Health Care Costs Tax Credit

Health Care Costs Tax Credit -

The Premium Tax Credit PTC makes health insurance more affordable by helping eligible individuals and their families pay premiums for coverage purchased through the Health Insurance Marketplace also referred to as the Marketplace or Exchange There are two ways to get the credit

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC

Health Care Costs Tax Credit include a broad assortment of printable resources available online for download at no cost. The resources are offered in a variety forms, including worksheets, templates, coloring pages, and much more. The benefit of Health Care Costs Tax Credit is their flexibility and accessibility.

More of Health Care Costs Tax Credit

Building Health Care Costs Into Retirement Planning Lifetime Paradigm

Building Health Care Costs Into Retirement Planning Lifetime Paradigm

Everything You Need to Know About The Health Care Tax Credit Need to get health insurance through an Affordable Care Act exchange You may be eligible for help

The premium tax credit PTC is a refundable tax credit designed to help you pay for health plans purchased through the federal or state exchanges Eligibility for the PTC for an exchange

Health Care Costs Tax Credit have gained a lot of popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: You can tailor printed materials to meet your requirements such as designing invitations to organize your schedule or even decorating your home.

-

Educational value: Printing educational materials for no cost offer a wide range of educational content for learners of all ages, which makes them a valuable source for educators and parents.

-

Affordability: Fast access many designs and templates cuts down on time and efforts.

Where to Find more Health Care Costs Tax Credit

Jessica Livingston On LinkedIn Empire State Development Recently

Jessica Livingston On LinkedIn Empire State Development Recently

You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 This section will explain the types of expenses that qualify

The premium tax credit is a refundable tax credit that helps cover the cost of health insurance premiums It s available to taxpayers who have purchased a health insurance plan from the

We hope we've stimulated your curiosity about Health Care Costs Tax Credit Let's look into where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Health Care Costs Tax Credit to suit a variety of goals.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free with flashcards and other teaching materials.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs covered cover a wide selection of subjects, that includes DIY projects to planning a party.

Maximizing Health Care Costs Tax Credit

Here are some inventive ways for you to get the best of Health Care Costs Tax Credit:

1. Home Decor

- Print and frame stunning artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Health Care Costs Tax Credit are an abundance of innovative and useful resources that cater to various needs and needs and. Their access and versatility makes them a fantastic addition to each day life. Explore the plethora of Health Care Costs Tax Credit to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes they are! You can print and download the resources for free.

-

Do I have the right to use free printables in commercial projects?

- It's based on the rules of usage. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright issues in Health Care Costs Tax Credit?

- Certain printables may be subject to restrictions on use. Be sure to review the terms and conditions offered by the author.

-

How can I print printables for free?

- You can print them at home with a printer or visit an in-store print shop to get better quality prints.

-

What software do I require to open Health Care Costs Tax Credit?

- Many printables are offered as PDF files, which can be opened using free software like Adobe Reader.

2023 Medicare Premiums And Open Enrollment

Wondering About The Health Care Tax Credit C D

Check more sample of Health Care Costs Tax Credit below

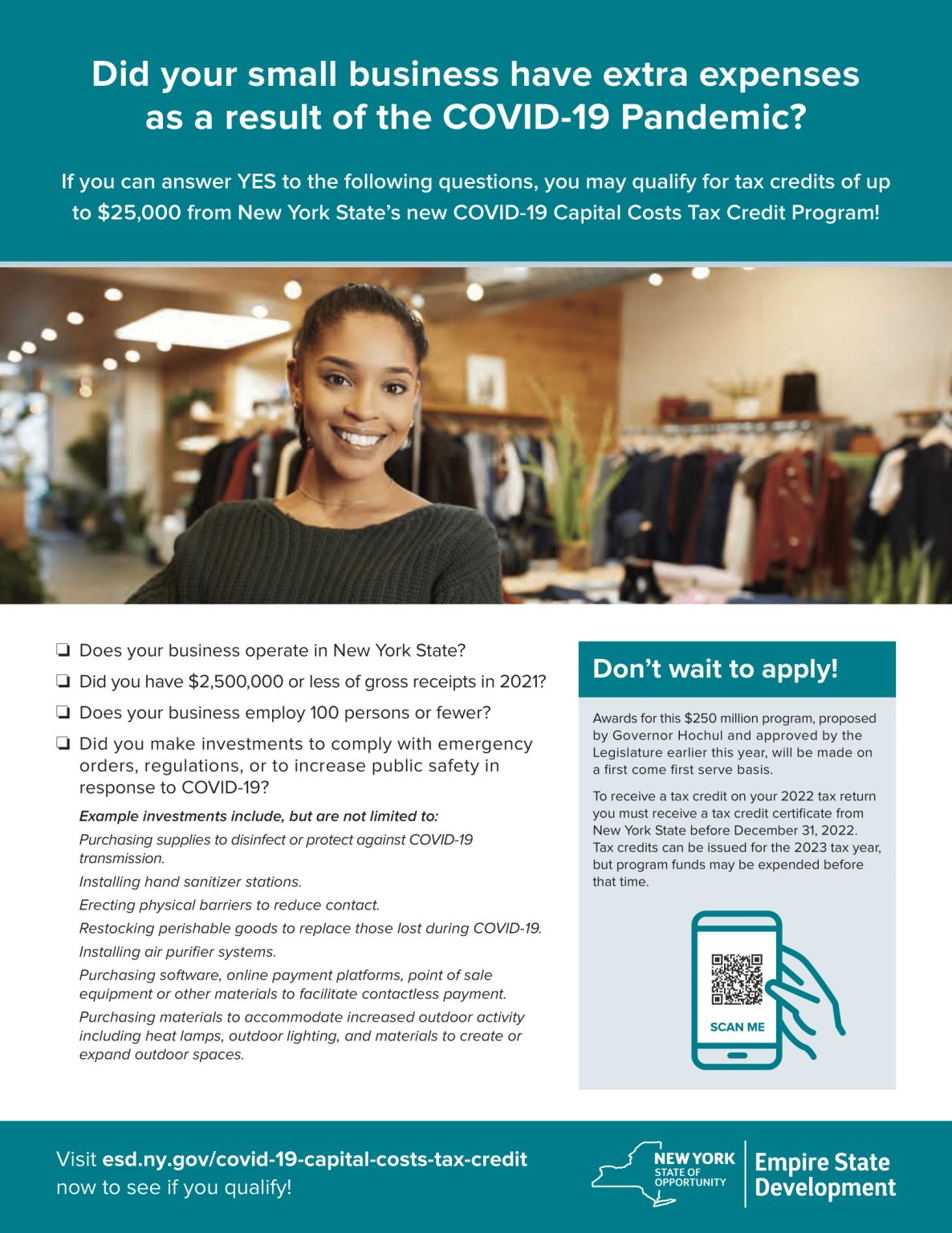

Apply Now NYS COVID 19 Small Business Relief Programs CMP

.jpg)

Warning Labels On Soda Bottles Restaurant Menus Could Reduce Obesity

Metabolik Hastal klarda Beslenme Diyetisyen ahadet AYDIN

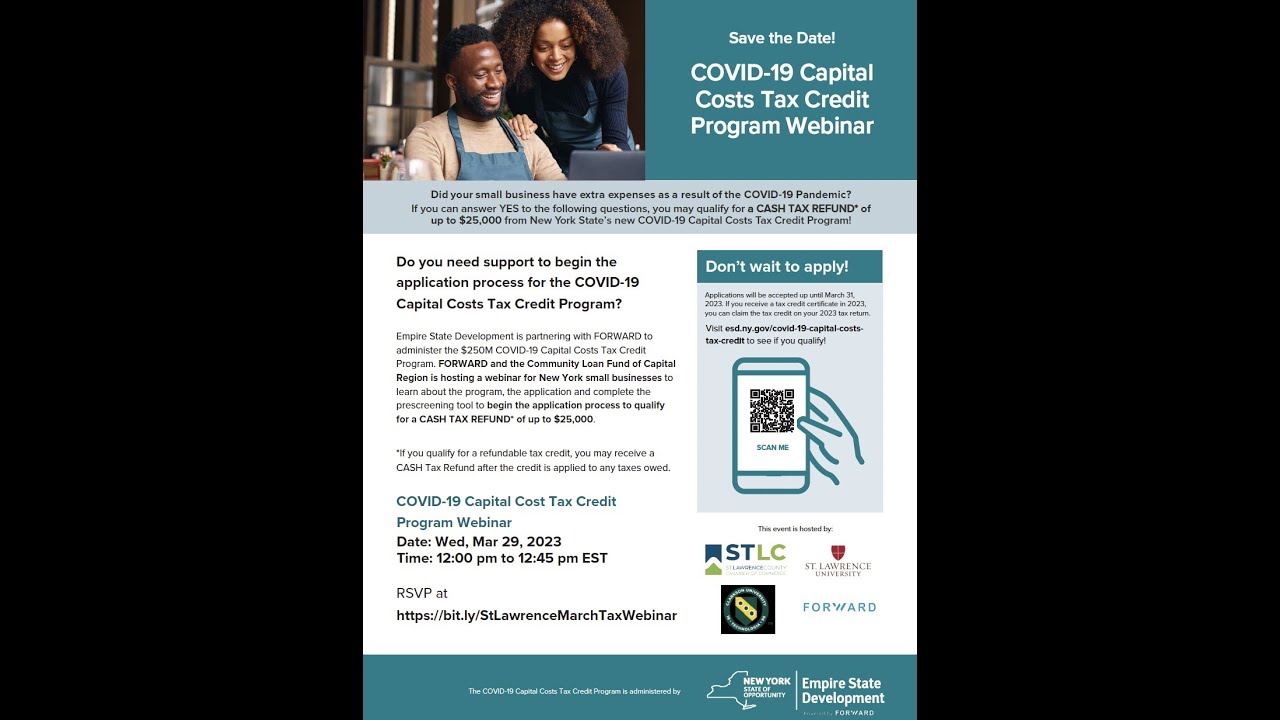

New York State COVID 19 Capital Costs Tax Credit Program STLC Chamber

Satisfying Retirement Health Care Costs Is Next Year Going To Be Bad

NYS COVID 19 Capital Costs Tax Credit Program Cerini Associates LLP

https://www.irs.gov/affordable-care-act/...

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC

https://www.irs.gov/affordable-care-act/...

You may be allowed a premium tax credit if You or a tax family member enrolled in health insurance coverage through the Marketplace for at least one month of a calendar year in which the enrolled individual was not eligible for affordable coverage through an eligible employer sponsored plan that provides minimum value or eligible to

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC

You may be allowed a premium tax credit if You or a tax family member enrolled in health insurance coverage through the Marketplace for at least one month of a calendar year in which the enrolled individual was not eligible for affordable coverage through an eligible employer sponsored plan that provides minimum value or eligible to

New York State COVID 19 Capital Costs Tax Credit Program STLC Chamber

Warning Labels On Soda Bottles Restaurant Menus Could Reduce Obesity

Satisfying Retirement Health Care Costs Is Next Year Going To Be Bad

NYS COVID 19 Capital Costs Tax Credit Program Cerini Associates LLP

Health Care Tax Credit

Q A Addressing High Costs And Greed In Health Care Chatsaudicam

Q A Addressing High Costs And Greed In Health Care Chatsaudicam

How Did US Healthcare Become So Expensive And When It Happened