In the digital age, with screens dominating our lives it's no wonder that the appeal of tangible printed objects hasn't waned. Whether it's for educational purposes such as creative projects or simply adding an individual touch to your home, printables for free have become an invaluable resource. With this guide, you'll take a dive in the world of "Gst Rebate For Registered Charities," exploring what they are, where to get them, as well as ways they can help you improve many aspects of your daily life.

Get Latest Gst Rebate For Registered Charities Below

Gst Rebate For Registered Charities

Gst Rebate For Registered Charities -

Registered charities can claim GST refunds on the goods and services they buy or import Applying for charity tax exemption Qualifying purchases and expenses Charities must pay GST on their purchases and business expenses at the time of purchase but can claim refunds Purchases and expenses qualifying for a GST refund must

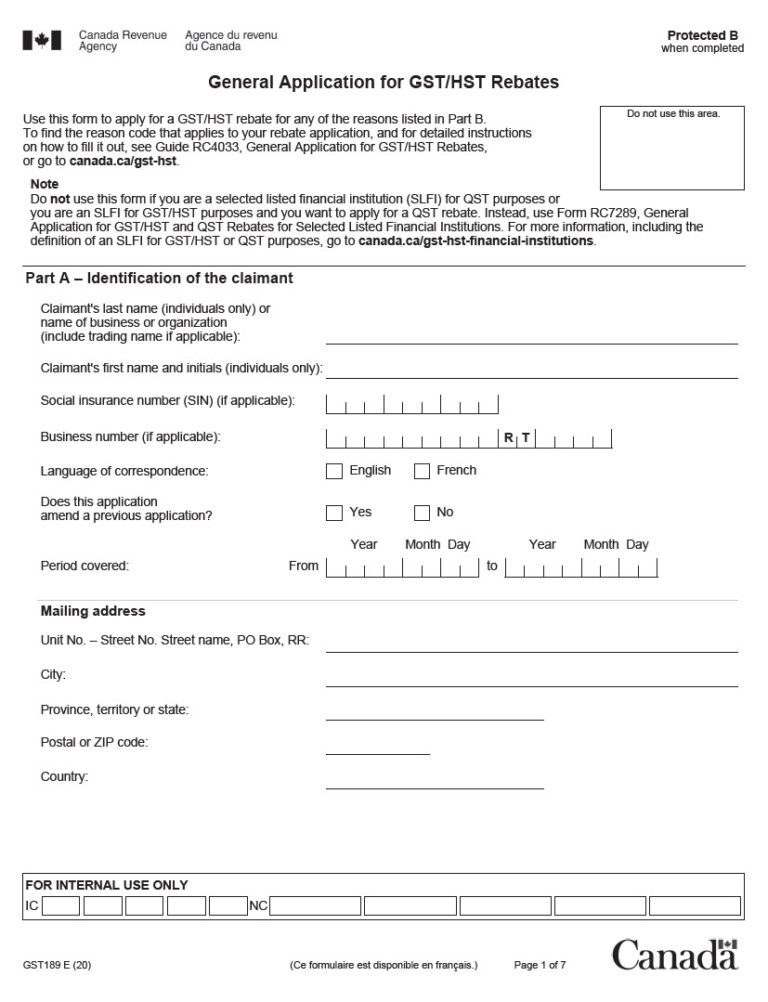

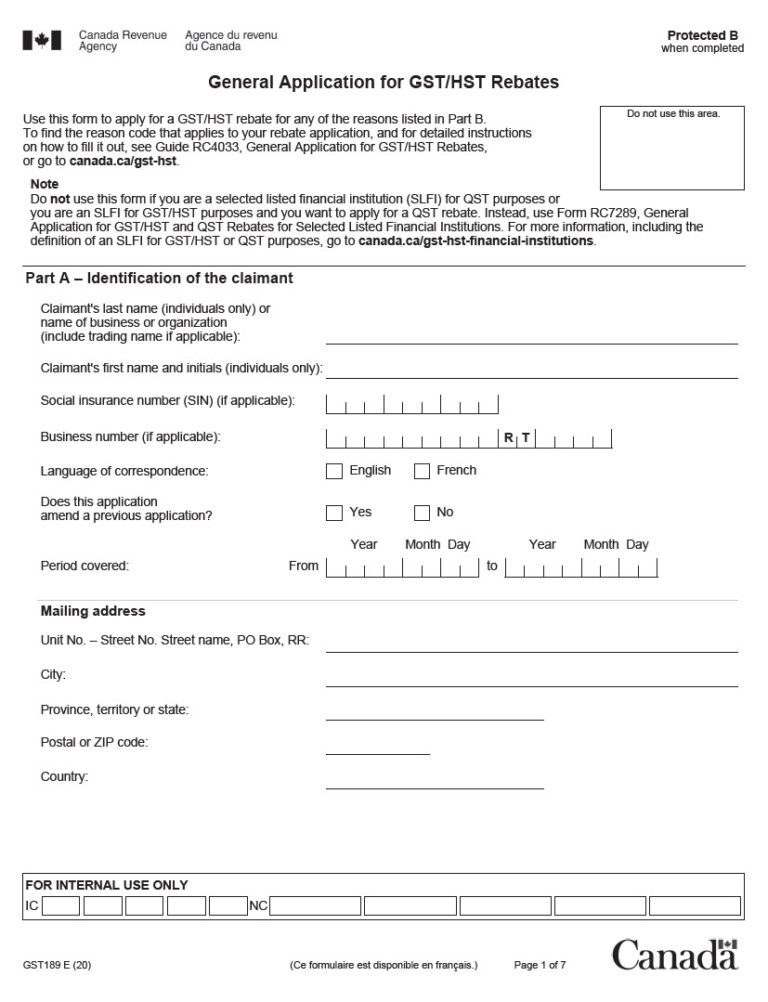

The result is the charity s net tax The amount should be entered on line 109 of the charity s GST HST return Line 111 Offset of GST HST rebate A charity that is a registrant can offset the net tax it owes on its GST HST return or increase any refund with certain GST HST rebates to which it is entitled

Printables for free include a vast selection of printable and downloadable items that are available online at no cost. These resources come in many designs, including worksheets templates, coloring pages and many more. The great thing about Gst Rebate For Registered Charities lies in their versatility and accessibility.

More of Gst Rebate For Registered Charities

Canadians Begin To Receive Temporary Boost To GST Rebate Today

Canadians Begin To Receive Temporary Boost To GST Rebate Today

Date modified 2023 09 22 Use this form to claim the Public Service Bodies rebate or the Self government refund

GST HST registrants cannot claim input tax credits ITCs to recover the GST HST paid or payable on expenses related to making such supplies However a charity may be eligible to claim a public service bodies PSB rebate for such expenses Participating province means a province that has harmonized its provincial sales tax with the GST to

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Modifications: You can tailor printing templates to your own specific requirements for invitations, whether that's creating them as well as organizing your calendar, or decorating your home.

-

Educational Value Educational printables that can be downloaded for free provide for students from all ages, making them a valuable tool for parents and teachers.

-

Easy to use: The instant accessibility to the vast array of design and templates is time-saving and saves effort.

Where to Find more Gst Rebate For Registered Charities

Feds Temporary Boost To GST Rebate Will Help During High Inflation

Feds Temporary Boost To GST Rebate Will Help During High Inflation

1 Tax Incentives for Charitable Donations Structure of charitable donation tax incentives Charitable giving in Canada 2 Income Tax Act Requirements for Registered Charities Categories of charities and qualified donees Regulatory rules for charities Recent regulatory and legislative changes Tax Incentives for Charitable Donations

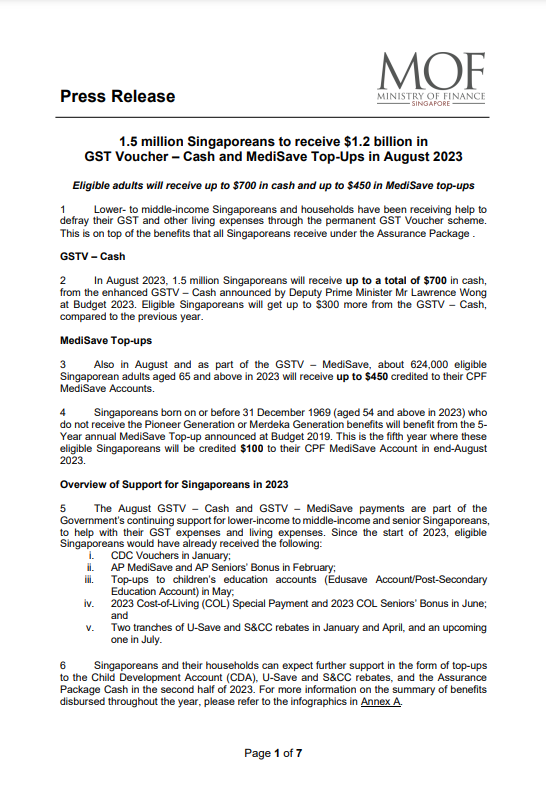

GST is a broad based tax of 10 per cent on most goods and services sold or consumed in Australia All ACNC registered charities are entitled to the GST concession which helps reduce their GST liability Importantly the GST concession does not exempt ACNC registered charities from paying GST on goods or services

Now that we've piqued your curiosity about Gst Rebate For Registered Charities Let's look into where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of goals.

- Explore categories like the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free, flashcards, and learning tools.

- The perfect resource for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Gst Rebate For Registered Charities

Here are some creative ways create the maximum value use of Gst Rebate For Registered Charities:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use these printable worksheets free of charge for teaching at-home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Gst Rebate For Registered Charities are an abundance with useful and creative ideas designed to meet a range of needs and hobbies. Their access and versatility makes they a beneficial addition to both personal and professional life. Explore the endless world of Gst Rebate For Registered Charities today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually are they free?

- Yes they are! You can download and print these tools for free.

-

Can I use free printables for commercial uses?

- It's based on specific usage guidelines. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright issues with Gst Rebate For Registered Charities?

- Certain printables might have limitations concerning their use. Always read these terms and conditions as set out by the designer.

-

How can I print Gst Rebate For Registered Charities?

- Print them at home using an printer, or go to the local print shops for better quality prints.

-

What program do I need in order to open printables free of charge?

- A majority of printed materials are in the PDF format, and can be opened using free programs like Adobe Reader.

Temporary Boost To GST Rebate Appropriate Amid High Inflation

Budget 2023 An Ironic GST Rebate And A Happy NDP Policy Magazine

Check more sample of Gst Rebate For Registered Charities below

The Federal Grocery Rebate Is Available This Week Who Is Eligible And

Charities And Unincorporated Associations NPG

MPs Unanimously Vote To Temporarily Double GST Rebate For Lower income

New Home HST GST Rebate By Nadene Milnes Issuu

GST Refund Form Rfd 01 Printable Rebate Form

Temporary Boost To GST Rebate Appropriate Amid High Inflation Economists

https://www.canada.ca/en/revenue-agency/services/...

The result is the charity s net tax The amount should be entered on line 109 of the charity s GST HST return Line 111 Offset of GST HST rebate A charity that is a registrant can offset the net tax it owes on its GST HST return or increase any refund with certain GST HST rebates to which it is entitled

https://www.ato.gov.au/businesses-and...

If an endorsed charity gift deductible entity or government school reimburses an individual person for an expense they have incurred that is directly related to their activities as a volunteer of that organisation the organisation can claim a GST credit for the GST included in the price of the item purchased if the organisation is registered

The result is the charity s net tax The amount should be entered on line 109 of the charity s GST HST return Line 111 Offset of GST HST rebate A charity that is a registrant can offset the net tax it owes on its GST HST return or increase any refund with certain GST HST rebates to which it is entitled

If an endorsed charity gift deductible entity or government school reimburses an individual person for an expense they have incurred that is directly related to their activities as a volunteer of that organisation the organisation can claim a GST credit for the GST included in the price of the item purchased if the organisation is registered

New Home HST GST Rebate By Nadene Milnes Issuu

Charities And Unincorporated Associations NPG

GST Refund Form Rfd 01 Printable Rebate Form

Temporary Boost To GST Rebate Appropriate Amid High Inflation Economists

Customers To Fully Understand GST Rebate Method On Prepaid Top ups

New Gst Rebate 2023 PrintableRebateForm

New Gst Rebate 2023 PrintableRebateForm

Registered Charity Tick Women Lawyers Association Of NSW