In the digital age, where screens dominate our lives and the appeal of physical printed materials hasn't faded away. No matter whether it's for educational uses or creative projects, or simply to add an element of personalization to your space, Fuel Tax Credit Eligible Activities are now a vital resource. We'll dive into the sphere of "Fuel Tax Credit Eligible Activities," exploring what they are, how you can find them, and how they can enrich various aspects of your life.

Get Latest Fuel Tax Credit Eligible Activities Below

Fuel Tax Credit Eligible Activities

Fuel Tax Credit Eligible Activities -

Fuel tax credit rates You need to use the rate that applies on the date you acquired the fuel You can also use the fuel tax credit calculator to work out the

1 Check if you re eligible for fuel tax credits Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their

Fuel Tax Credit Eligible Activities include a broad range of printable, free content that can be downloaded from the internet at no cost. They are available in numerous kinds, including worksheets templates, coloring pages, and more. The value of Fuel Tax Credit Eligible Activities is in their versatility and accessibility.

More of Fuel Tax Credit Eligible Activities

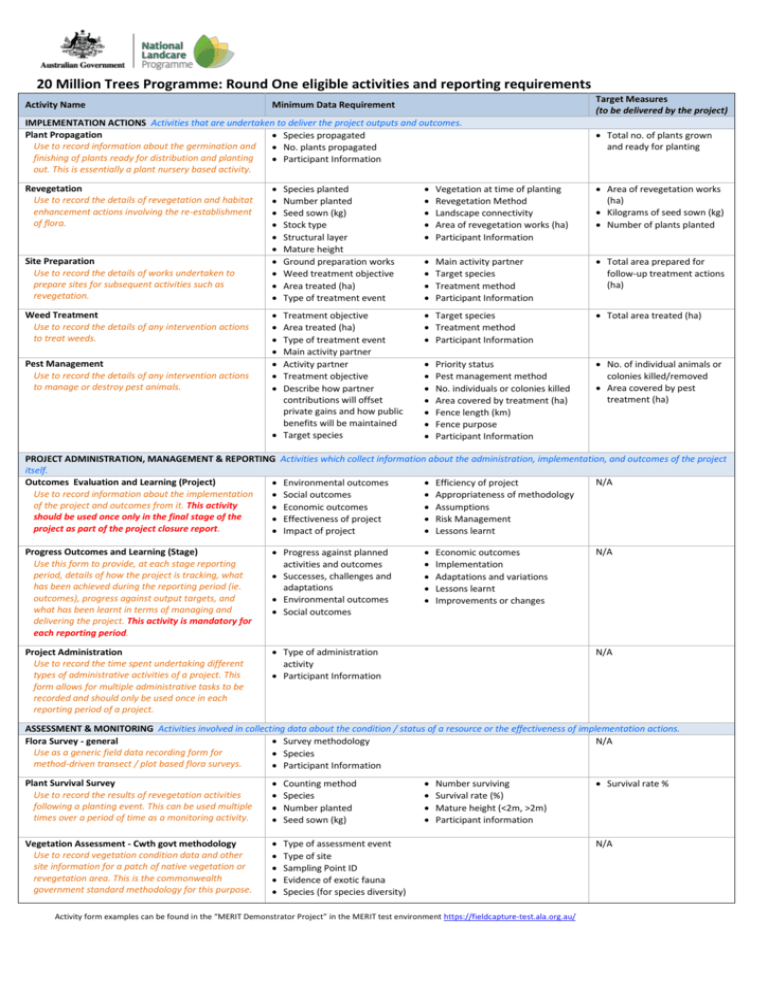

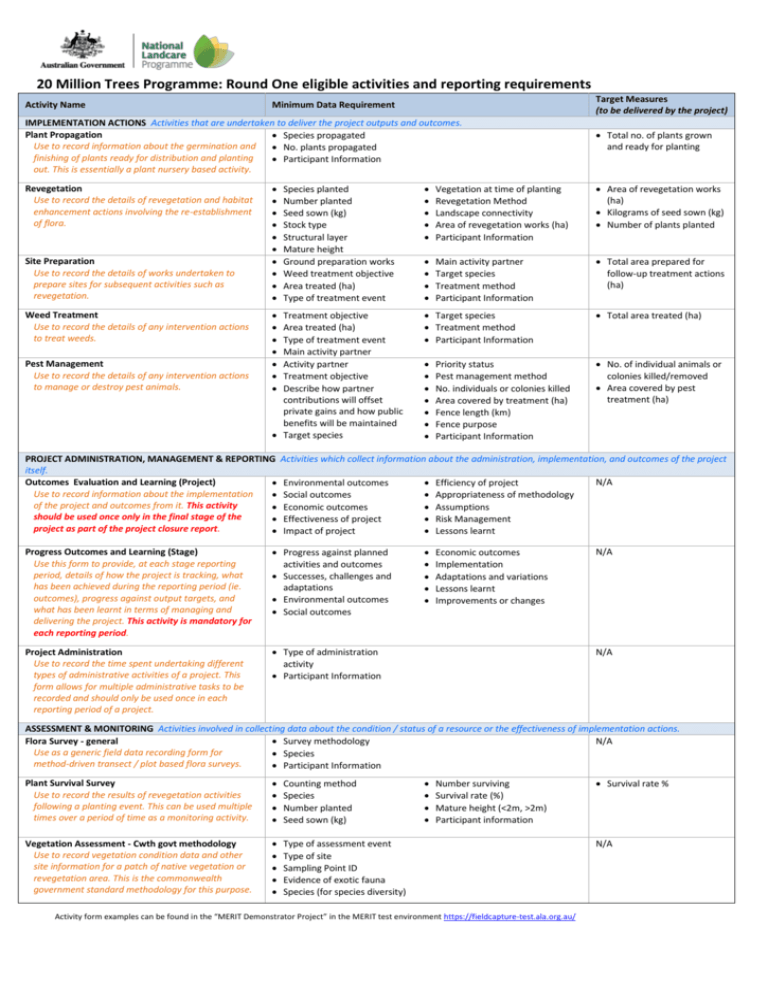

Round One Eligible Activities And Reporting Requirements

Round One Eligible Activities And Reporting Requirements

Eligible Business Activities Your business can claim fuel tax credits if it uses fuel in machinery heavy vehicles which weigh over 4 5 tonnes light vehicles travelling on private roads not on public

On this page How to register for fuel tax credits How to cancel your registration for fuel tax credits You can claim credits for the fuel tax excise or

Fuel Tax Credit Eligible Activities have garnered immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Flexible: They can make printed materials to meet your requirements whether it's making invitations to organize your schedule or decorating your home.

-

Educational Value Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, making them a useful resource for educators and parents.

-

Affordability: instant access an array of designs and templates will save you time and effort.

Where to Find more Fuel Tax Credit Eligible Activities

Fuel Tax Credit Eligibility Form 4136 How To Claim

Fuel Tax Credit Eligibility Form 4136 How To Claim

Activities eligible for fuel tax credits The activities for which you might be able to claim fuel tax credits are Road transport All other business uses Packaging or supplying

Fuel tax credits can only be claimed for fuel used in eligible business activities such as operating machinery vehicles equipment or generators for

Now that we've piqued your interest in Fuel Tax Credit Eligible Activities Let's look into where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Fuel Tax Credit Eligible Activities to suit a variety of motives.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- The blogs covered cover a wide variety of topics, including DIY projects to party planning.

Maximizing Fuel Tax Credit Eligible Activities

Here are some unique ways of making the most use of Fuel Tax Credit Eligible Activities:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Fuel Tax Credit Eligible Activities are an abundance of practical and innovative resources designed to meet a range of needs and interests. Their accessibility and flexibility make them an essential part of both professional and personal life. Explore the plethora of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes they are! You can download and print these materials for free.

-

Are there any free templates for commercial use?

- It is contingent on the specific rules of usage. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables could have limitations on use. Be sure to review these terms and conditions as set out by the author.

-

How do I print printables for free?

- Print them at home using any printer or head to an in-store print shop to get higher quality prints.

-

What software must I use to open Fuel Tax Credit Eligible Activities?

- The majority of printables are in PDF format. These is open with no cost software like Adobe Reader.

Coastal Farm Ranch Current Weekly Ad 10 13 10 19 2021 12

Categories Of Eligible Activities

Check more sample of Fuel Tax Credit Eligible Activities below

Fuel Tax Credit Are You Getting The Your FTC Tax Benefits

2022 Child Tax Credit Who Is Eligible For 2 000 Payments

Am I Eligible For Fuel Tax Credits Fuel Tax Assist

Add A New Fuel Tax Rate Agrimaster

Input Tax Credit Eligible For Canteen Services Provided By An Entity

Restoring The Fuel Tax Credit Survey

https:// business.gov.au /finance/taxation/claim-fuel-tax-credits

1 Check if you re eligible for fuel tax credits Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their

https:// business.gov.au /Grants-and-Programs/Fuel-Tax-Credits

This includes fuel used in business activities such as machinery plant equipment heavy vehicles light vehicles travelling off public roads or on private roads

1 Check if you re eligible for fuel tax credits Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their

This includes fuel used in business activities such as machinery plant equipment heavy vehicles light vehicles travelling off public roads or on private roads

Add A New Fuel Tax Rate Agrimaster

2022 Child Tax Credit Who Is Eligible For 2 000 Payments

.JPG)

Input Tax Credit Eligible For Canteen Services Provided By An Entity

Restoring The Fuel Tax Credit Survey

Fuel Tax Credit Calculation

The Treasury s EV Tax Credit Guidance Is Here Includes An 18 Day

The Treasury s EV Tax Credit Guidance Is Here Includes An 18 Day

Our Services R D