In the digital age, where screens dominate our lives however, the attraction of tangible printed products hasn't decreased. Be it for educational use such as creative projects or simply to add an extra personal touch to your area, First Time Homebuyers Tax Deduction have become a valuable source. We'll take a dive to the depths of "First Time Homebuyers Tax Deduction," exploring their purpose, where they are, and how they can improve various aspects of your daily life.

Get Latest First Time Homebuyers Tax Deduction Below

First Time Homebuyers Tax Deduction

First Time Homebuyers Tax Deduction -

The tax credit can range from 10 to 50 of the mortgage interest paid annually on a primary residence MCCs are subject to income limits and other

First time Homebuyers Exemption From Transfer Tax First time home buyers are no longer exempt from transfer tax as of 1 Jan 2024 See Finnish Tax

First Time Homebuyers Tax Deduction encompass a wide assortment of printable, downloadable content that can be downloaded from the internet at no cost. They are available in a variety of kinds, including worksheets coloring pages, templates and more. The value of First Time Homebuyers Tax Deduction is in their versatility and accessibility.

More of First Time Homebuyers Tax Deduction

Incentives For First Time Homebuyers

Incentives For First Time Homebuyers

Go to our First Time Homebuyer Credit Account Look up to receive Balance of your First Time Homebuyer Credit Amount you paid back to date Total amount of the credit you

First time homebuyers may be eligible for certain tax breaks including mortgage interest deductions origination fee deductions and property tax deductions If you re ready to

First Time Homebuyers Tax Deduction have risen to immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Customization: You can tailor print-ready templates to your specific requirements when it comes to designing invitations, organizing your schedule, or decorating your home.

-

Education Value These First Time Homebuyers Tax Deduction can be used by students of all ages. This makes them an invaluable instrument for parents and teachers.

-

Convenience: Quick access to many designs and templates can save you time and energy.

Where to Find more First Time Homebuyers Tax Deduction

Rebates What First Time Homebuyers Should Know My Rebate

Rebates What First Time Homebuyers Should Know My Rebate

The First Time Homebuyer Credit Account Look up IRS gov HomeBuyer tool provides information on your repayments and account balance The Sales Tax Deduction

First time homebuyers can withdraw IRA funds for housing related costs penalty free Like all homebuyers first timers can take advantage of tax deductions on mortgage interest and energy

If we've already piqued your interest in First Time Homebuyers Tax Deduction and other printables, let's discover where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety with First Time Homebuyers Tax Deduction for all purposes.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free including flashcards, learning tools.

- Ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a wide range of topics, all the way from DIY projects to party planning.

Maximizing First Time Homebuyers Tax Deduction

Here are some unique ways ensure you get the very most use of First Time Homebuyers Tax Deduction:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home as well as in the class.

3. Event Planning

- Make invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

First Time Homebuyers Tax Deduction are an abundance of innovative and useful resources that cater to various needs and passions. Their access and versatility makes they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast collection of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes you can! You can download and print these tools for free.

-

Can I download free printables for commercial use?

- It depends on the specific terms of use. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Do you have any copyright issues when you download First Time Homebuyers Tax Deduction?

- Some printables may have restrictions regarding their use. Make sure to read the terms and condition of use as provided by the author.

-

How do I print First Time Homebuyers Tax Deduction?

- Print them at home using printing equipment or visit a local print shop to purchase the highest quality prints.

-

What program must I use to open printables that are free?

- Many printables are offered in PDF format. These is open with no cost software, such as Adobe Reader.

Everything You Need To Know About The First Time Homebuyers Tax Credit

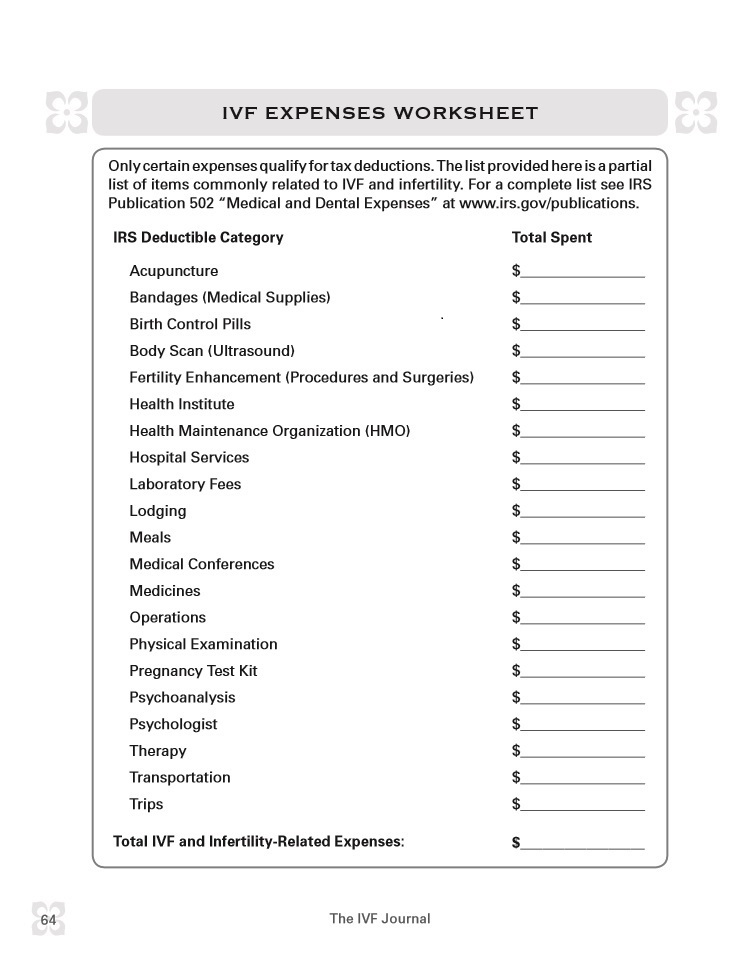

8 Tax Itemized Deduction Worksheet Worksheeto

Check more sample of First Time Homebuyers Tax Deduction below

5 Tax Breaks For First Time Homebuyers Part Time Money

Budget 2023 Expectations Rs 5 Lakh Income Tax Deduction On Home Loan

Tax Breaks For First Time Homebuyers

Assistance For First Time Homebuyers Moreira Team Mortgage

First Time Homebuyers Tax Credit

First Time Homebuyers Got Billions In Tax Credits September October 2012

https://www.expat-finland.com/housing/tax...

First time Homebuyers Exemption From Transfer Tax First time home buyers are no longer exempt from transfer tax as of 1 Jan 2024 See Finnish Tax

https://www.cnn.com/cnn-underscored/money/first...

The bill is designed to provide a tax credit for first time buyers worth up to 15 000 or 10 of a home s purchase price whichever is less The bill also known as the Biden first

First time Homebuyers Exemption From Transfer Tax First time home buyers are no longer exempt from transfer tax as of 1 Jan 2024 See Finnish Tax

The bill is designed to provide a tax credit for first time buyers worth up to 15 000 or 10 of a home s purchase price whichever is less The bill also known as the Biden first

Assistance For First Time Homebuyers Moreira Team Mortgage

Budget 2023 Expectations Rs 5 Lakh Income Tax Deduction On Home Loan

First Time Homebuyers Tax Credit

First Time Homebuyers Got Billions In Tax Credits September October 2012

Save Up To Rs7 Lakh On Tax Deductions On Home Loans Bangalore

5 Itemized Tax Deduction Worksheet Worksheeto

5 Itemized Tax Deduction Worksheet Worksheeto

/GettyImages-697534409-5b3e6fe746e0fb0037e5e7d3.jpg)

How To Take A Tax Deduction For Financial Advisor Fees